Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.21 per cent higher at 18,243.50, signalling that Dalal Street was headed for a positive start on Tuesday.

Japanese shares were trading higher as Nikkie 225 index was up 0.87% and the Topix index jumped 1.2%. Chinese markets were trading lower on fears over fresh Covid-19 curbs. Hang Seng was down 0.84% and the CSI 300 index fell 0.13%.

Indian rupee depreciated by 5 paise to close at 81.79 against the US dollar on Monday.

Kaynes Technology will make its stock market debut today. The issue price has been fixed at Rs 587 per share.

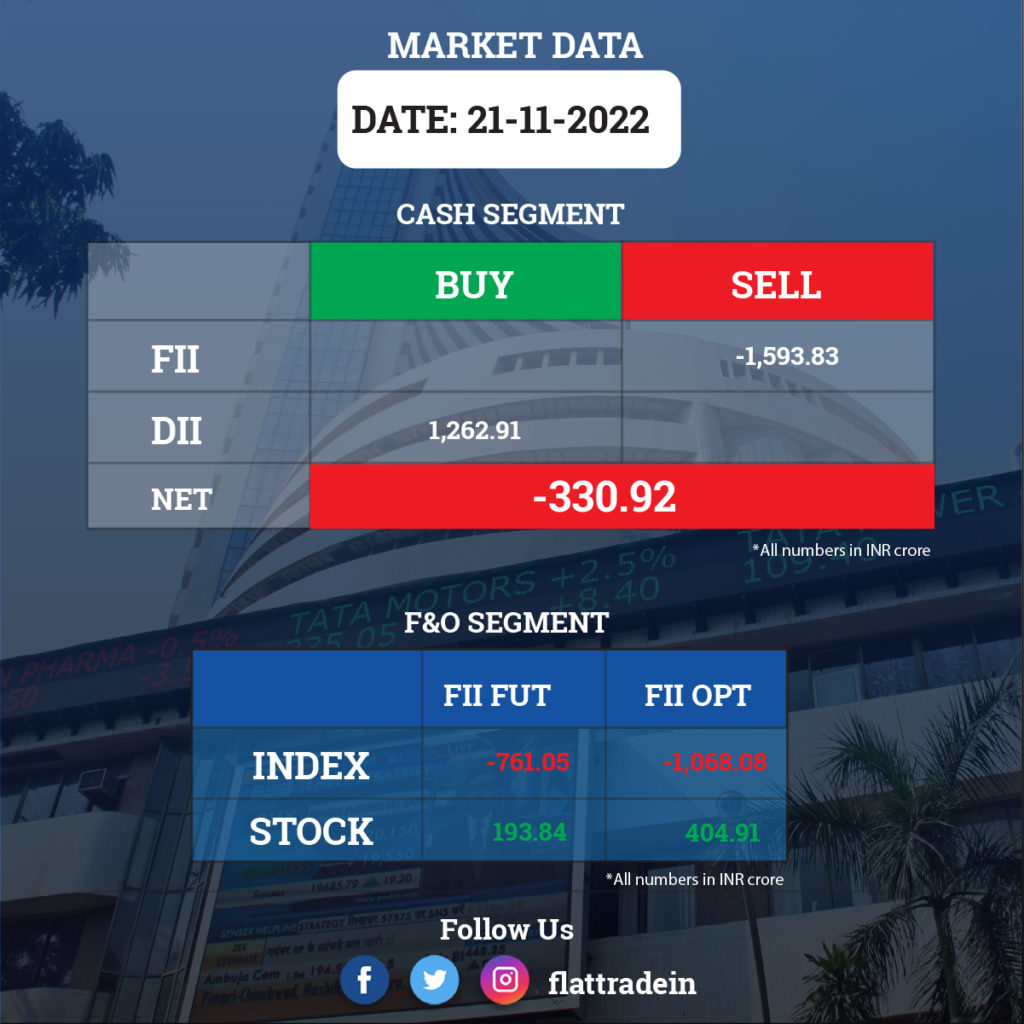

FII/DII Trading Data

Stocks in News Today

Reliance Jio: The telco has secured National Company Law Tribunal (NCLT) nod to acquire Reliance Infratel after months of delay and litigation. On Monday, the Mumbai Bench of NCLT allowed Jio’s application to deposit the resolution amount of Rs 3,720 crore in a State Bank of India (SBI) account.

New Delhi Television (NDTV): Adani Group’s open offer to buy an additional 26 per cent stake in NDTV from the market will start from November 22, and close on December 5. The price band for offer has been fixed at Rs 294 per share. Earlier this month, the market regulator, Sebi, granted its approval to the proposed open offer.

FSN E-Commerce Ventures (Nykaa): Private equity firm Lighthouse India will sell stake worth Rs 320 crore in FSN E-Commerce Ventures, via a block deal, CNBC Awaaz reported. The shares would be offered at a price of around Rs 180-183.5 apiece. A total of around 1.8 crore shares or 0.65 per cent of Nykaa’s overall stake would be offloaded by Lighthouse through the block trade.

Jindal Steel & Power Ltd (JSPL): Botswana has picked the company as the preferred bidder in a tender to build a 300 megawatt (MW) coal-fired power plant, a notice from its energy ministry showed on Monday.

Punjab National Bank: The state-owned bank appointed Binod Kumar and M Paramasivam as executive directors on its board.

JK Paper: The paper and packaging board company entered into an agreement for the acquisition of 85 per cent shares of Horizon Packs (HPPL) and Securipax Packaging (SPPL). The balance 15 per cent stake will be bought within a period of 3 years.

Power Finance Corporation (PFC): The company has incorporated two special purpose vehicles for the development of independent transmission projects. Both will be wholly owned subsidiaries of PFC Consulting, a wholly owned subsidiary of Power Finance Corporation.

CreditAccess Grameen: The company has raised Rs 240 crore from by issuance of 2,400 unlisted, senior, secured, redeemable, transferable, non-convertible debentures, with a door-to-door tenure of four years.

Biocon: Biocon Biologics Limited (“BBL”), subsidiary of Biocon Limited, and its subsidiaries have executed a debt facility agreement, which is classified as a Sustainability linked Loan (SLL) amounting to $1.2 billion, the proceeds of which shall be used for funding the acquisition of Viatris Inc.’s biosimilars business and acquisition related expenses.

Blue Star: Kotak Mahindra Mutual Fund bought additional 63,179 equity shares in the company via open market transactions on November 17. With this, Kotak AMC increased its stake in the company to 5.045 per cent, from 4.979 per cent earlier.

Lupin: The pharmaceutical company’s subsidiary Lupin Human Welfare and Research Foundation has signed MoU with the Government of Rajasthan to strengthen healthcare system. It will address the prevalence of cardiovascular disease (CVD) and chronic obstructive pulmonary disease (COPD) in Alwar district.

Sadbhav Engineering: The Chief Executive Officer (CEO) of the company, Vasistha C Patel, has resigned with immediate effect. Nitin R Patil also resigned as Executive Director and Chief Financial Officer of the company.

JK Paper: The paper & packaging board company entered into Share Purchase and Shareholders’ Agreements (SPSHAs) for the acquisition of 85 percent shares of Horizon Packs (HPPL) and Securipax Packaging (SPPL). The balance 15 percent stake will be bought within a period of 3 years as per the respective SPSHAs. HPPL and SPPL together are India’s largest corrugated packaging manufacturers with seven plants across the country.