Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading higher by 0.14% at 19,211, signalling that Dalal Street was headed for positive start on Thursday.

Asian shares were trading higher as investors were buoyed after the US central bank left the interest rates unchanged and signalled that the rate hike cycle may be over. The Federal Open Market Committee left its benchmark rate unchanged in Wednesday in the range of 5.25% to 5.5%, following a two-day monetary policy meeting. After the announcement, the 10-year US Treasury yield tumbled below 4.75%. The Nikkei 225 index jumped 1.12% and the the Topix rose 0.63%. The Hang Seng advanced 1.14% and the CSI 300 index was trading 0.07% higher.

The Indian rupee depreciated by 3 paise to 83.29 against the US dollar on Wednesday.

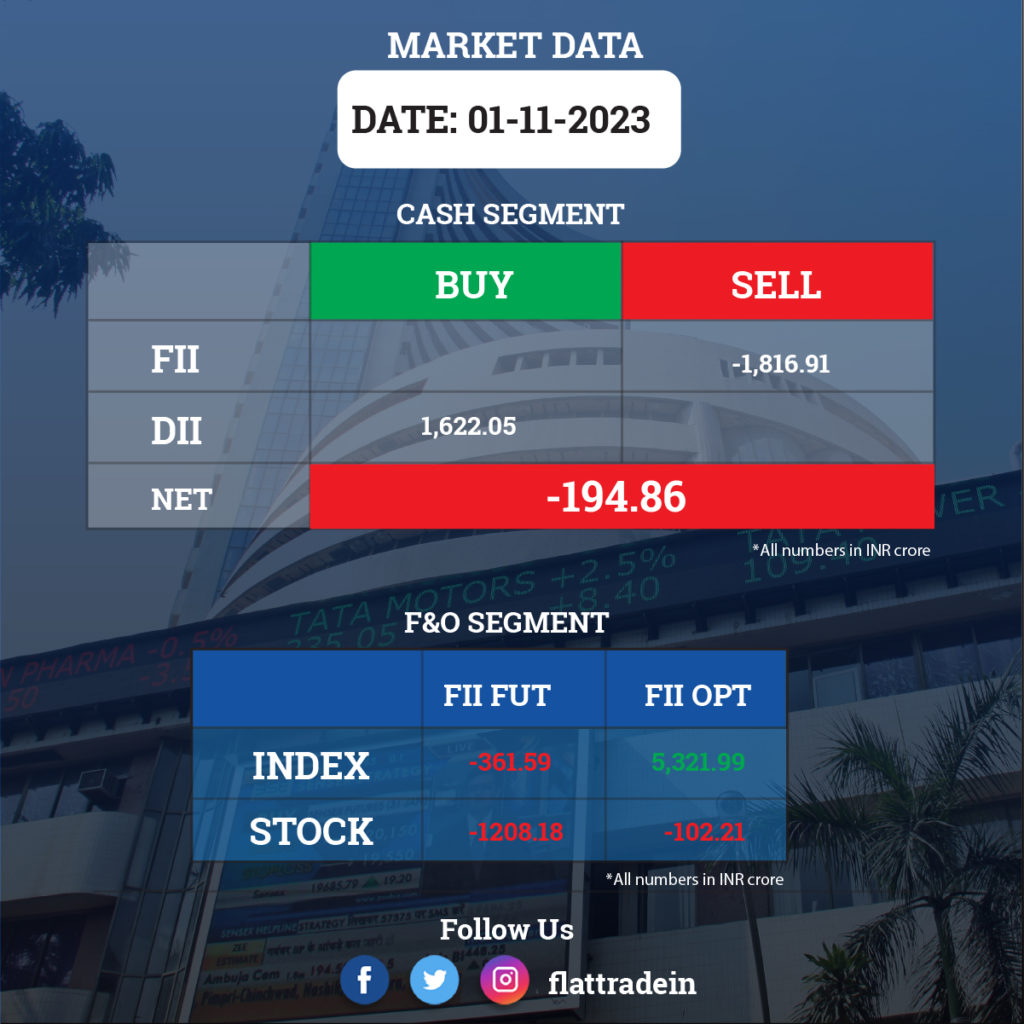

FII/DII Trading Data

Stocks in News Today

State Bank of India (SBI): India’s largest public sector bank has raised Rs 10,000 crore at a coupon rate of 7.81% through its first Basel III-compliant Tier 2 bond for the current financial year. The bonds are issued for a 15-year term, with the first call option after 10 years.

Hero MotoCorp: The two-wheeler manufacturer posted a standalone net profit of Rs 1,053.8 crore in Q2FY24, up 47.2% YoY. Revenue from operations for the quarter rose by 4% YoY to Rs 9,445.4 crore in the quarter under review. Its Ebitda grew 28% YoY to Rs 1,328 crore and margin expanded by 260 bps to 14.1%. Meanwhile, Pawan Munjal has volunteered to reduce his fixed salary by 20 percent.

Britannia Industries: The biscuit manufacturer reported a 19% YoY growth in consolidated net profit at Rs 588 crore in Q2FY24. Its Consolidated net revenue from operations grew by 1% YoY to Rs 4,433 crore in the quarter under review. Ebitda grew by nearly 23% YoY to Rs 872.42 crore and operating margin expanded by 343 basis points to 19.68%. Total expenses for the quarter stood at Rs 3,686 crore, compared to Rs 3,774 crore in the same period last fiscal. Raw material costs rose to Rs 2,283 crore in the quarter from Rs 2,246 crore a year ago.

Tata Steel: The company posted a net loss of Rs 6,196 crore for the quarter ended September 2023 as against a net profit of Rs 1,514 crore in the year-ago quarter. Revenue from operations during the second quarter fell 7% YoY to Rs 55,682 crore as against Rs 59,877 crore in the same quarter last fiscal. During the quarter, the company incurred an exceptional loss of Rs 6,898 crore that included an impairment charge of Rs 2,631 crore related to Tata Steel UK, a step-down subsidiary, and charge towards restructuring and other provisions of Rs 3,612 crore. The company’s Ebitda stood at Rs 4,315 crore in the reporting period, while margins were at Rs 8%. Crude steel production was around 5 million tons, up 5% on a YoY basis.

Further, the company will issue 67 shares of Tata Steel for every 10 shares held in Tata Steel Long Products following the amalgamation. It also approved the Scheme of Amalgamation of Bhubaneshwar Power, a wholly owned subsidiary, into and with its parent company.

Ultratech Cement: The company issued a corporate guarantee of $73.50 million in favour of Abu Dhabi Commercial Bank PJSC for credit facilities availed by its wholly-owned subsidiary in the UAE, UltraTech Cement Middle East Investments. The Corporate Guarantee is for a term up to 30th April, 2024 and will be considered as contingent liability of the company, it said in a regulatory filing.

Bajaj Finance: The NBFC said the board members have approved the issuance of 15.5 lakh warrants to the promoter Bajaj Finserv, at an issue price of Rs 7,670 per warrant, aggregating up to Rs 1,188.85 crore.

Godrej Consumer Products: The FMCG company has registered a 20.6% YoY growth in consolidated profit at Rs 432.8 crore in Q2FY24 as cost of raw materials declined. Consolidated revenue from operations rose 6.2% YoY to Rs 3,602 crore in Q2 FY24 and sales volume rose by 10% year-on-year. The company said its board has approved a dividend of Rs 5 per share as well as the incorporation of a new wholly owned subsidiary to manufacture, sell, and export personal and household care products.

GAIL (India): The state-owned company has signed an agreement with Bharat Petroleum Corporation for a 15-year supply of propane for its upcoming petrochemical plant in Usar, Maharashtra. Under the agreement, GAIL will procure 600 KTPA of propane from BPCL’s LPG import facility at Uran and the 15-year supply contract is estimated to have a value of over Rs 63,000 crore.

LIC Housing Finance: The company’s net profit jumped nearly four times to Rs 1188 crore for the September quarter from Rs 305 crore in the year-ago period. Total income for the mortgage lender rose 33% at Rs 6759 crore as compared with Rs 5092 crore in the corresponding quarter last fiscal. Its gross NPA ratio declined to 4.33% at the end of September from 4.91% a year back. Net NPA ratio was at 2.59% in Q2FY24 as against 2.83% in Q2FY23. Its board approved an upfront commitment of Rs 150 crore to the corpus fund LICHFL Real Estate Debt Opportunities Fund -1 of LICHFL Asset Management Company, it announced in a regulatory filing to stock exchanges.

Adani Enterprises: The company’s media arm, AMG Media Networks, has executed a share-purchase agreement for the acquisition of the remaining 51% stake in Quintillion Business Media.

JK Tyre and Industries: The company recorded 372% YoY growth in consolidated profit at Rs 242.1 crore in Q2FY24, helped by fall in input costs by 9.1% percent YoY to Rs 2,199.4 crore. Consolidated revenue from operations increased by 3.75% YoY to Rs 3,897.5 crore in the quarter under review. The company said its board has approved an investment of Rs 1,025 crore for the expansion of tyre manufacturing capacity.

Motilal Oswal Financial Services: The company reported a 24% year-on-year increase in consolidated revenue at Rs 1,639.2 crore in Q2FY24. The company reported a consolidated profit after tax of Rs 533.4 crore in Q2FY24 as against Rs 509 crore in the corresponding quarter last fiscal. Revenue from its fund distribution business stood Rs 273 crore and the capital market business revenue stood at Rs 242.4 crore.

Kansai Nerolac Paints: The company recorded 56% YoY growth in consolidated profit at Rs 177.2 crore in Q2FY24 due to decline in raw material costs. The company’s revenue from operations increased 1.3% YoY to Rs 1,957 crore during the quarter under review.

TV Today Network: The company reported a 64.4% decline in consolidated net profit to Rs 7.02 crore in Q2FY24. The company had reported a net profit of Rs 19.72 crore in the year-ago period. Its revenue from operations was marginally up 1.05% to Rs 213.86 crore during the period under review as against Rs 211.63 crore in the same period last fiscal. The company’s revenue from television and other media operations was Rs 211.68 crore, and from radio broadcasting at Rs 2.18 crore in the second quarter of FY2023-24.

Eicher Motors: The company said that Royal Enfield sales in October increased by 3% year-on-year to 84,435 motorcycles, but export sales dropped 39% YoY to 3,477 motorcycles.

Pfizer: The pharma company has entered into an agreement for transferring and assigning unexpired leasehold rights in the MIDC land in Turbhe, Thane, and the sale of structures and buildings having total built-up area of approx. 16,494.33 sq. mtrs. constructed thereon, to Zoetis Pharmaceutical Research for a lumpsum consideration of Rs 264.40 crore.

GR Infraprojects: The company’s wholly owned subsidiary, GR Devinagar Kasganj Highway, has executed a concession agreement with NHAI. The agreement is for four lanings of NH 530B from Devinagar Bypass in Uttar Pradesh at a cost of Rs 1,226.87 crore.