Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.26% higher at 18,366, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares were trading lower, after Wall Street dropped over fresh fears of a global economic slowdown. The Nikkei 225 index fell 1.11%, Topix index dropped 0.67%. The Hang Seng was down 0.41% and the CSI 300 index slumped 0.72%.

Indian rupee fell 11 paise to 82.87 against the US dollar on Friday.

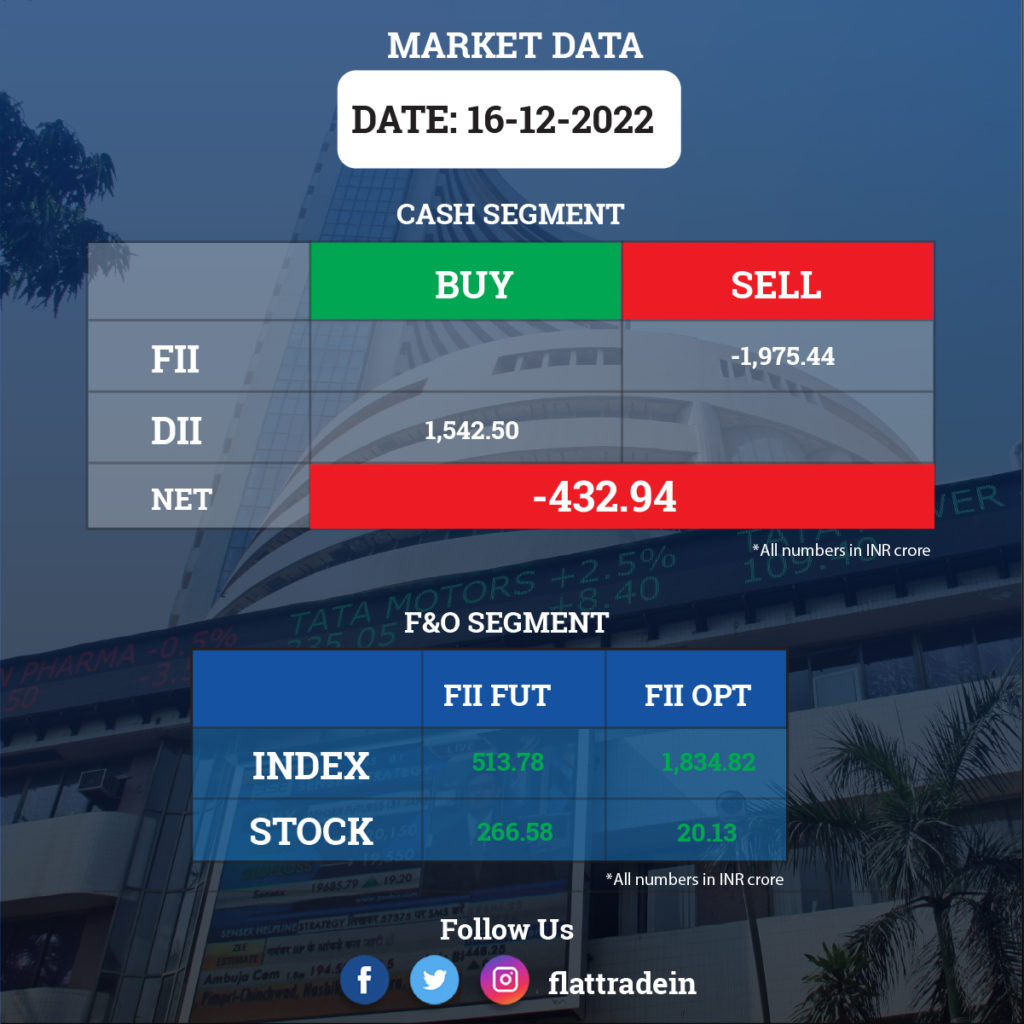

FII/DII Trading Data

Stocks in News Today

Tech Mahindra: The company has approved the sale of a 100% stake in wholly owned subsidiary Dynacommerce Holdings BV, to step-down subsidiary Comviva Netherlands BV. The transaction cost is 6.6 million euro and the expected date for transaction completion is the first week of January 2023.

Tata Motors: Bengaluru Metropolitan Transport Corporation has signed an agreement with the company’s subsidiary, TML Smart City Mobility Solutions, for the operation of electric buses in Bengaluru. As part of the agreement, TML Smart City Mobility Solutions will supply, operate and maintain 921 electric buses for a period of 12 years.

Adani Enterprises: The company plans to invest up to Rs 10,700 crore for the expansion of Lucknow airport, so that its annual passenger handling capacity zooms from 4 million passengers per annum (MPPA) to 39 MPPA.

Dr Reddy’s Laboratories: The company’s wholly-owned subsidiary Dr Reddy’s Research and Development BV (DRRDBV) has entered into an agreement to sell certain assets and liabilities of its Netherlands-based site. It has entered into an asset purchase agreement with Delpharm Development Leiden BV, part of France-based Delpharm Group.

Yes Bank: The private lender has concluded assignment of the Rs 48,000-crore stressed asset loan portfolio of the bank to JC Flowers Asset Reconstruction company. The bank had earlier declared JC Flowers Asset Reconstruction (JC Flowers ARC) as the winner of the Swiss Challenge process for sale of its identified portfolio of stressed assets.

UTI AMC: The Tata Group is in final negotiations to buy a majority stake in UTI AMC from four state-owned financial entities, Economic Times reported citing people close to the development. A final agreement is being sought on the deal valuation.

PNB Housing Finance: The company home financing player has opened ‘Roshni’ branches in various locations, including tier II and III cities, for deepening its customer base in the affordable housing segment. Through its affordable home loan scheme Roshni.

GMR Airports Infrastructure: The company’s subsidiary GMR Airports International BV received Rs 1,389.90 crore against the sale of shares in GMR Megawide Cebu Airport Corporation (a joint venture between GMR Airports International BV, and Megawide Construction Corporation) and the issuance of exchangeable notes to Aboitiz InfraCapital Inc (AIC).

Tilaknagar Industries: The company has received board approval for the allotment of 1.05 crore shares at a price of Rs 95 per share to foreign portfolio investor Think India Opportunities Master Fund LP on a preferential basis. Think India will invest nearly Rs 100 crore.

Phoenix Mills: The company completed the acquisition of 7.22 acres of land in Surat, Gujarat, for Rs 510 crore. The land was acquired through the subsidiary Thoth Mall and Commercial Real Estate. Thoth will develop a premium retail destination with a gross leasable area of approximately 1 million square feet and currently expects to complete the retail development by FY27.

Dilip Buildcon: The company has received a letter of acceptance for a new HAM project ‘4-Laning of Karimnagar Warangal section of NH-563’ in Telangana, from the National Highways Authority of India. The order is worth Rs 1,647 crore.

Sun Pharmaceutical Industries: The company has received a warning letter from USFDA for the Halol facility. The warning letter mentions violations with respect to current good manufacturing practice (cGMP) regulations. The Halol facility was placed under import alert by USFDA.

Ashoka Buildcon: The company’s subsidiaries Ashoka Concessions & Viva Highways have entered into a share purchase agreement with National Investment & Infrastructure Fund & Jaora Nayagaon Toll Road for sale of 100 per cent share capital of JTCL, from ACL & VHL to NIIF for a consideration of Rs 691 crore.

Jindal Steel and Power: The metal player will spend Rs 7,930 crore under the PLI scheme for specialty steel to manufacture eight types of high-end alloy in the country. JSPL is one of the qualifiers of the government’s production linked incentive (PLI) scheme.

JSW Energy: The utility firm’s arm JSW Energy (Barmer) has issued over 99 crore bonus shares worth Rs 995.90 crore. JSW Energy (Barmer), a wholly-owned subsidiary of the company, has completed a bonus issue of 99,59,09,996 fully paid-up equity shares of Rs 10 each amounting to Rs 995.90 crore.

GMM Pfaudler: The promoter of engineering firm divested 17.3% stake or 77,85,819 shares in the company in the range of Rs 1,700.14 – Rs 1,702.87 apiece for Rs 1,323.97 crore through open market transactions, according to bulk deal data available with the NSE and BSE.

Suryoday Small Finance Bank: The lender’s MD & CEO, Baskar Babu Ramachandran, has sold 50 lakh shares for Rs 55.44 crore to close a loan availed by him. With this transaction, the total promoter group holding would stand at 23.30% and Ramachandran’s individual holding would come down to 5.94%, according to the bank’s exchange filing.