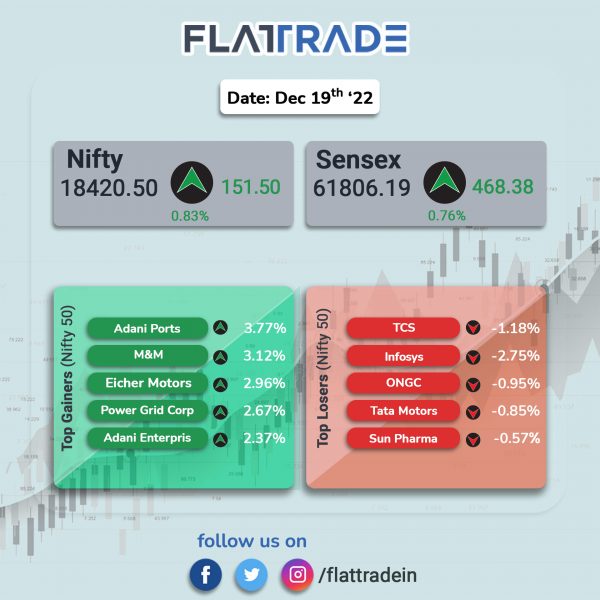

Benchmark stock indices registered a strong gain, helped by investors buying beaten-down stocks. The Sensex rose 0.76% and the Nifty 50 index advanced 0.83%.

In broader markets, Nifty Midcap 100 index was up 0.55% and the BSE Smallcap gained 0.29%.

Top gainers among nifty sectoral indices were Auto [1.59%], FMCG [1.46%], Metal [1.27%], Energy [1.05%] and Financial Services [0.87%]. Top losers were IT [-0.51%] and PSU Bank [-0.12%].

Indian rupee gained 17 paise to 82.71 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The company has signed an agreement to divest its 51% stake in L&T Infrastructure Development Projects (L&T IDPL) to a portfolio company of Infrastructure Yield Plus II, an infrastructure fund managed by Edelweiss Alternatives. With this, L&T will divest its entire stake in the concession subsidiary, L&T IDPL. This is in line with L&T’s strategy of reducing its exposure to the non-core asset heavy developmental projects portfolio. L&T IDPL is a joint venture between Larsen & Toubro and Canada Pension Plan Investment Board (CPP Investments) holding 51% and 49% shares respectively.

UTI Asset Management Company: In an exchange filing, the company said that it “is not part of any such negotiation”. The company also said that it has not taken any decision on the transaction as mentioned in the news item. Earlier, Economic Times reported that Tata Group is in final negotiations to buy a majority stake in UTI AMC from four state-owned financial entities, citing people close to the development.

UPL: The company announced the completion of investment of Rs 2,474 crore ($300 million) for 13.33% stake in Advanta Enterprises by KKR. This is a part of the larger corporate realignment exercise announced in October 2022 to create four distinct business platforms — Global Crop Protection (ex-India), India Agtech, Global Seeds, and Manufacturing & Specialty Chemicals to unleash growth potential of each of these platforms and unlock value for UPL shareholders by facilitating ‘fair value recognition’ of each platform.

KEC International: The company has secured new orders of Rs. 1,313 crore across its various businesses such as Transmission & Distribution (T&D) and Solar. The T&D business has secured orders for T&D projects in India, East Asia Pacific and SAARC: 220 kV GIS Substation for a refinery project in India 500 kV Transmission line in Thailand 132 kV Transmission line and associated substations in Nepal. The solar business has secured a large order for a 500 MW Solar PV project in India.

Public Sector Banks: India’s public sector banks have recovered an aggregate amount of more than Rs 1.3 lakh crore from the written-off loans during the last five financial years. During the Lok Sabha during the Question Hour, Finance Minister Nirmala Sitharaman said that the borrowers of written-off loans continue to be liable for repayment. The process of recovery of dues from the borrower in written-off loan accounts continues, she added.

Sugar Companies: Shares of sugar companies rallied after PTI news reported that the government may consider increasing sugar export quota for the current 2022-23 marketing year after evaluating the domestic production in January. In a separate news, the Goods and Services Tax (GST) Council recommended on Saturday reducing GST from 18% to 5% on ethyl alcohol supplied to refineries for blending with petrol.

Dilip Buildcon: Shares of the company rose nearly 6% in intraday trade after the construction company received multiple orders from the National Highways Authority of lndia for new HAM (Hybrid Annuity Mode) projects in the state of Karnataka, Chhattisgarh and Telangana. According to the exchange filings, the company received an order worth Rs 1,955 crore for construction of four lane Urga-Pathalgaon section of NH-130A under Bharatmala Pariyojana in Chhattisgarh. It received another order worth Rs 1,589 crore for the development of six-lane Maradgi S Andola to Baswantpur (Package -III of Akkalkot-KNT/TS Border) in the state of Karnataka. The company also received new order worth Rs 1,647 crore for four-laning of Karimnagar Warangal Section of NH-563 in Telangana.

Hariom Pipe Industries: The company announced that HDFC Bank sanctioned credit facilities worth Rs 197.43 crore. The credit facilities of Rs 197.43 crore includes cash credit limit of Rs 140 crore and term loan limit of Rs 57.43 crore. The company added it will utilise the credit facilities for growth and expansion plans. The company is a premium manufacturer of iron and steel products with a diverse product portfolio consisting of Mild Steel (MS) Billets, Pipes and Tubes, Hot Rolled (HR) Coils and Scaffolding Systems.

3i Infotech: The company said that a consortium of 3i Infotech, Forensics Intelligence Surveillance and Security Technologies (FISST), and Yellow Inc, have been awarded Wi-Fi Monetisation Project by RailTel Corporation of India, with 3i Infotech being the lead bidder. The WiFi Monetisation project will monetise one of the biggest captive free public wi-fi network in the world, covering more than 6102 railways stations across India with per day current user base of 11 lakhs.

Marathon Nextgen Realty: Shares of the company jumped 17.7% in intraday trade after CDSL purchased office space at Marathon Futurex, Lower Parel in a deal worth Rs 163 crore. The Mumbai-based real estate developer said it has sold commercial space worth over Rs 400 crore this year alone at its flagship commercial project in Lower Parel – Marathon Futurex. CDSL has acquired an office space measuring over 46,000 sqft carpet area on the 34th and 35th floors of the tower.

Marine Electricals: The company secued a contract worth Rs 35 crore from AdaniConnex and the contract is for supply & installation of LV panel and skid at AdaniConnex’s Hyderabad site. The delivery of the said goods will be made over a period of six months.

Information Technology Companies: Shares of a few IT companies declined after US-based IT firm Accenture kept its FY 2023 guidance unchanged, reportedly hinting towards a possible pullback in client spending. Accenture reported financial results for the first quarter of fiscal 2023, ended November 30, 2022, with revenues of $15.7 billion, an increase of 5% in U.S. dollars and 15% in local currency over the same period last year. Coforge was the biggest loser among IT companies as its shares slid 1.44%.

Mahindra CIE Automotive: The company said it has acquired another 2,40,000 equity shares The company held 8,72,813 equity shares of Sunbarn. The shareholding of the company after the allotment of current subscription will be 11,12,813 equity shares, which will constitute 26.12% of the post issue paid-up capital of Sunbarn. With this, Sunbarn will become associate company of Mahindra CIE of Sunbarn Renewables for sourcing green energy on captive basis.

Mastek: The company announced that it has made a strategic investment in VolteoEdge, which is a Software as a service (or SaaS) company with an enterprise-ready Edge Intelligence Platform that enables secure IoT workflows and makes business workflows smarter. VolteoEdge, in collaboration with Intel and ServiceNow, delivers Edge-as-a-Service or Edge-to-Service (E2S) to its customers across manufacturing, oil & gas, healthcare, retail, and infrastructure industries.

Shilpa Medicare: The drug maker said that it has introduced Capecitabine (Capebel) dispersible tablet (DT) with technology of faster dispersion within 90 seconds to treat colorectal and metastatic breast cancer. With this, patients will be required to just drop the Capecitabine tablets in 100 ml water and allow the tablets to dissolve and then drink dissolved solution. Hence from 7 to 8 tablets a day, patients just need to drink 100 ml water twice daily with dissolved tablets in it.

The product is backed by required scientific proof and comparative bioequivalence studies and is approved by Central Drugs Standard Control Organisation (CDSCO). The company is further looking to introduce Capebel 1 gm DT in various international markets through its partners and clients.

Bharti Airtel: The telecom company announced the launch of its cutting edge 5G services in Shimla. Airtel 5G Plus services will be available to customers in a phased manner as the company continues to construct its network and complete the roll out.

Spandana Sphoorty Financials: The company said that its board will consider and approve the issue and offer of non-convertible debentures on Wednesday, (21 December). The company said that this issue will be done on a private placement basis. As on 30 September 2022, the promoter and promoter group held 63.03% stake in the company.

Alembic Pharmaceuticals: The USFDA has issued five procedural observations after an inspection of the company’s solid oral formulation facility located at Jarod in Gujarat. The company will prepare and submit the response to the observation within stipulated period.

Bajaj Consumer Care: The company announced in an exchanges filing that they have commenced the plan to buy back 33.7 lakh shares at a price of up to Rs 240 each aggregating up to Rs 80.89 crore.