Market Opening - An Overview

GIFT Nifty on the NSE IX was trading 0.08% at 20,134, signalling that Dalal Street may head for a positive start on Tuesday.

Asian shares were trading higher, after the US markets ended higher on Monday, aided by gains in technology-related stocks. The Nikkei 225 index jumped 0.61% and the Topix rose 0.36%. Meanwhile, the Hang Seng edged up 0.04% and the CSI 300 index marginally rose by 0.02%.

The Indian rupee fell 8 paise to 83.03 against the US dollar on Monday.

Meanwhile, India’s industrial production data for July and inflation rate for August will be declared today.

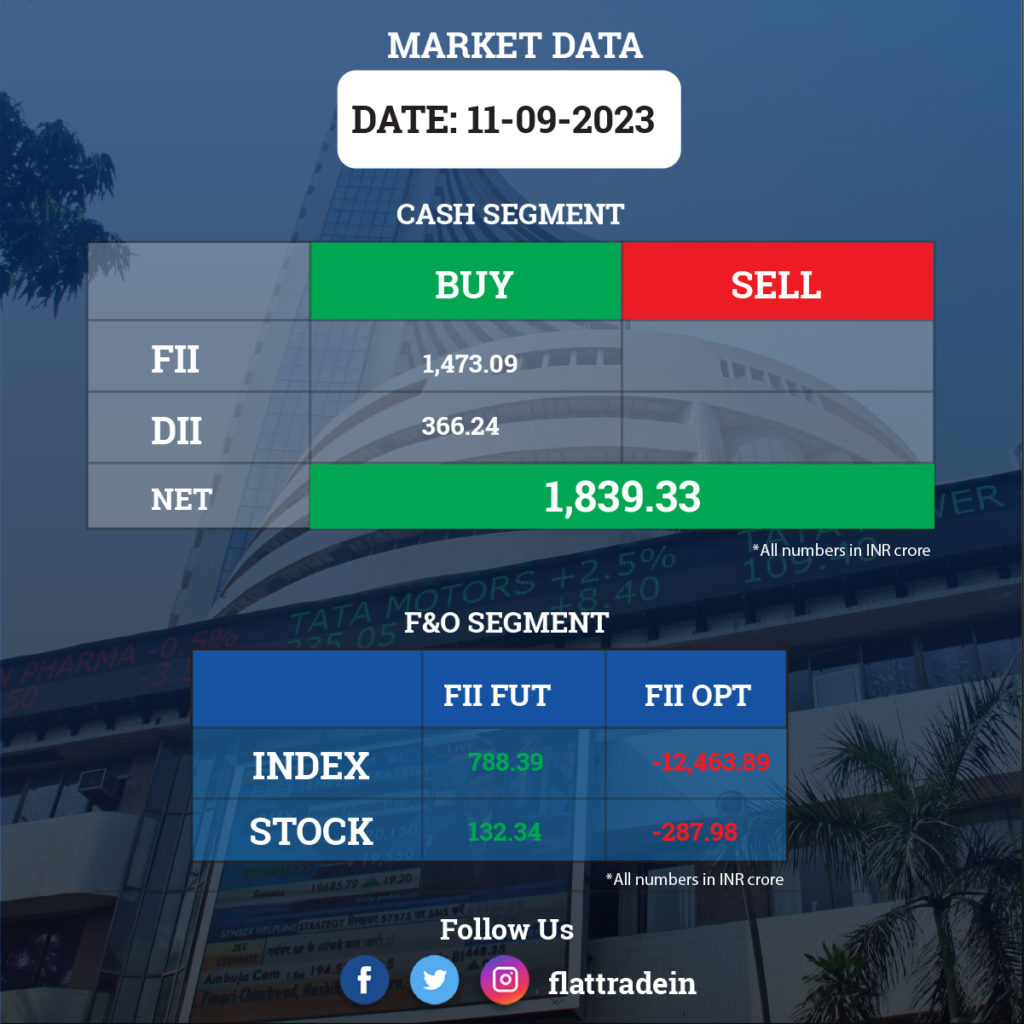

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): KKR will invest Rs 2,069.5 crore in the company’s subsidiary, Reliance Retail Ventures, increasing its stake to 1.42% from 1.17%, according to the company’s regulatory filing. The deal values the retail company at Rs 8.36 lakh crore.

ICICI Bank: The RBI has approved the reappointment of Sandeep Bakhshi as Managing Director & CEO of the bank with effect from October 4, 2023 till October 3, 2026. In August 2023, the shareholders had already approved the appointment of Bakhshi for the said period.

Larsen & Toubro (L&T): The infrastructure conglomerate has increased its buyback price to Rs 3,200 from Rs 3,000 apiece, while the number of shares has been reduced from 3.33 crore to 3.12 crore. With this revision in the buyback price, the company aims to enhance the return on equity (ROE) and thereby maximise shareholder value.

NTPC: The company’s subsidiary, NTPC Green Energy, signed an MoU with Nayara Energy to explore opportunities in the green hydrogen and green energy space for captive usage.

Power Grid Corporation of India: The state-owned utility company has been declared as the successful bidder to establish an inter-state transmission system project in Rajasthan. The project comprises establishment of a new 765/400kV substation along with STATCOM at Ramgarh, 765kV D/C Transmission Line and associated bays extension works at other existing substations in Rajasthan.

Lupin: In an exchange filing, the drugmaker said it plans to enter into a business transfer agreement with subsidiary Lupin Manufacturing Solutions to carve out two active pharmaceutical ingredient manufacturing sites at Dabhasa and Visakhapatnam and select R&D operations, including fermentation, at Lupin Research Park, Pune. The consideration expected to be received is Rs 750–850 crore, and the deal is likely to be entered into in October 2023.

Laurus Labs: The company has signed a share purchase agreement with a promoter and other shareholders of Laurus Bio for 37,641 equity shares through secondary purchase for Rs 71.6 crore. With this acquisition, the company’s shareholding in Laurus Bio will become 87.58% on a fully diluted basis.

TVS Supply Chain Solutions: The board has agreed to acquire equity shares of three of the company’s wholly owned subsidiaries: TVS Logistics Investments UK, TVS Logistics Investments Inc. USA, and TVS Supply Chain Solutions Pte. Ltd., Singapore, for an aggregate cost of Rs 450 crore. The transaction is expected to be completed by November 30. Further, it has reported consolidated revenue of Rs 2,342.43 crore, down 12.4% year-on-year, and a net loss of Rs 65.26 crore.

Gravita India: The Government of India has upgraded the status of the company from “Three Star Export House” to “Four Star Export House”. This recognition will help company in ease of doing businesses, easier facilitation of various export licensing norms, relaxation of business norms being issued by the government, various export-related benefits, and self-recognition among categories of export houses.

Shyam Metalics and Energy: In an exchange filing, the company said its promoters have opted to exercise the oversubscription option to the extent of 30.43 lakh equity shares, representing 1.19% of the share capital in addition to the 1.30 crore shares. The total offer size will be up to 1.61 crore shares, of which 16.09 lakh shares will be available as part of the offer for the retail category on T+1 day, i.e. September 12, 2023.

Sun Pharma Advanced Research Company: Dinesh Lahoti has resigned as Company Secretary and Compliance Officer, with effect from September 11. Lahoti said that career growth was the reason for his decision to leave the company in his resignation letter.

Rainbow Children’s Medicare: White Oak Capital Management Consultants LLP has sold 20,88,635 shares in the company and has reduced its stake to 5.74% from 7.8% earlier. The fund manager now holds a total of 58,24,215 shares in the healthcare company.

ION Exchange: Indraneel Dutt has been appointed CEO with immediate effect. He has about 28 years of experience in the Energy, Renewable, Water & Environmental sectors and has worked across the complete Energy value chain including Thermal Generation, Renewable Energy (Wind & Solar), Oil & Gas, Transmission & Distribution (T&D), Electrical, Instrumentation (E&I) & Automation and Water & Environmental segments.

Krishna Institute of Medical Sciences: The company has acquired an additional 13.24% stake in Kondapur Healthcare for Rs 20 crore. The total equity stake as of September 11, 2023 stands at 19.86%.

Mishtann Foods: The company will issue up to 7.4 crore convertible equity warrants with each warrant convertible into one fully paid-up equity share of the company. The warrants will be issued to non-promoters for 18 months at Rs 13.50 per warrant to raise Rs 99.9 crore. Besides, the company said it will also raise Rs 200 crore from promoters via convertible debt.

Gufic Biosciences: The company has received approval from the Therapeutic Group Administration (TGA), Australia and the National Health Surveillance Agency (ANVISA), Brazil for Parecoxib Sodium 40mg Lyophilized powder for injection, a selective COX-2 inhibitor. This will be used for short-term treatment of acute pain and post-operative pain in adult patients.