Market Opening - An Overview

Nifty futures on the Gift Nifty were trading 0.27% lower at 19,426, signalling a negative start for Dalal Street.

Asian shares were trading lower as investors’ sentiments were dented due to deepening crisis in China’s property sector. The Nikkei 225 index fell 0.96% and the Topix was down 0.75%. The Hang Seng index tanked 2.32% and the CSI 300 index slumped 1.32%.

The Indian rupee fell 14 paise to 82.84 against the US dollar on Friday.

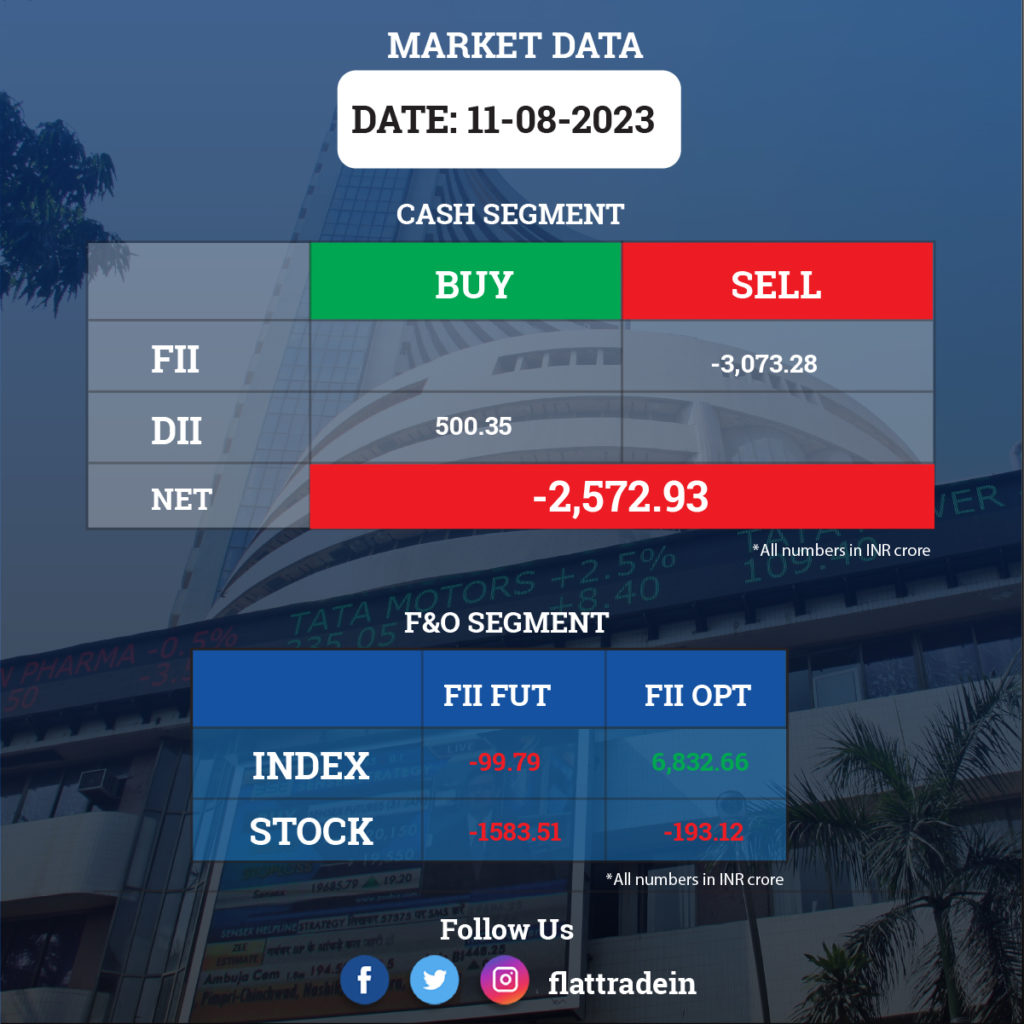

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The company finance arm, Jio Financial Services, said its 635,32,84,188 equity shares have been credited to the demat account of Reliance Industries’ shareholders on August 10. The said equity shares will remain frozen in the depository system until it is listed and trading permission is granted by BSE.

Oil and Natural Gas Corporation (ONGC): The state-owned quarterly profit fell 34% to Rs 10,015 crore from a year earlier due to a steep fall in crude oil prices. Revenue for the April-June quarter fell 20% YoY to Rs 33,814 crore. In rupee terms, the average oil price realization was 25% lower at Rs 6,288 per barrel and Oil price realization from joint venture fields fell 31% to Rs 5,808 per barrel during the reported quarter. The company witnessed a 10% year-on-year rise in the natural gas price at $6.71 per mmBtu during the quarter under review.

ITC: Shareholders of the company has approved the re-appointment of Sanjiv Puri as MD & Chairman of ITC for five years with effect from July 22, 2024. The company has also approved appointment of Hemant Malik as a wholetime director of the company, and Alka Marezban Bharucha as an independent director.

Biocon: The company plans to list its biosimilars business by the first half of 2025, Siddharth Mittal, CEO and Managing Director told Reuters. Biocon Biologics, a fully integrated subsidiary of Biocon, focuses on making biosimilars, and it is a significant contributor to the company’s total revenue. The subsidiary’s key revenue-generating markets are the United States and Europe.

Zydus Lifesciences: The company reported a net profit to Rs 1,087 crore in Q1FY24 led by strong sales in US and India. It had posted a net profit of Rs 518 crore during corresponding quarter of the previous year. Revenues rose 30% YoY to Rs 5,140 crore. EBITDA rose 81% YoY at Rs 1505 crores, while EBITDA margins stood at 29.3% as against 21% in corresponding previous quarter. Its US business grew by 57% YoY at Rs 2454 crore, while India formulations grew by 9.1% to Rs 1227 crore.

NHPC: The state-owned hydro power giant posted a 4% rise in its consolidated net profit at Rs 1,095.38 in Q1FY24 as against a consolidated net profit of Rs 1,053.76 crore in Q1FY23. The total income of the company increased to Rs 3,010.22 crore in Q1FY24 from Rs 2,886.95 crore in Q1FY23.

National Aluminium Company: The state-owned aluminium company has recorded consolidated profit at Rs 333.8 crore for quarter ended June FY24, a fall of 40.2% compared to year-ago period. Revenue dropped 16.3% YoY to Rs 3,178.4 crore during the quarter.

Vedanta: The National Company Law Tribunal (NCLT) has granted its approval for the Resolution Plan submitted by Vedanta for acquisition of Meenakshi Energy under Corporate Insolvency Resolution Process in accordance with the provisions of Insolvency and Bankruptcy Code (IBC), 2016.

FSN E-Commerce Ventures (Nykaa): The compnay has reported a 8% YoY growth in its consolidated net profit at Rs 5.4 crore for the quarter ended June 2023 as against Rs 5 crore in the year-ago period. Revenue from operations for the quarter stood at Rs 1,421.8 crore, rising 24% YoY. The company reported an EBITDA of Rs 73.5 crore in Q1FY24, a rise of 60% YoY, and its EBITDA margins grew by 116 basis points to 5.2%. The overall gross merchandise value (GMV) for the quarter rose 24% YoY to Rs 2,668 crore.

Aurobindo Pharma: The company said its consolidated net profit increased 10% to Rs 571 crore in the first quarter ended June 2023 as against a net profit of Rs 520.5 crore in the year-ago period. Revenue from operations rose to Rs 6,850.5 crore in Q1FY24 from Rs 6,236 crore in the year-ago period. US formulations revenue stood at Rs 3,304 (up 11% YoY) contributing to 48% of the total revenue. Europe formulation revenue stood at Rs 1,837 crore, (up 19%), accounting for 27% of the company’s revenue. Revenue from Active pharmaceutical ingredients grew 14% to Rs 1,033 crore.

Patanjali Foods: The company reported a net profit of Rs 878 crore, a fall of 64% YoY for the quarter ended June 2023. Revenue from operations rose 8% YoY to Rs 7,767 crore in Q1FY24. Total expenses for the quarter rose to Rs 7,691 crore from Rs 7,038 crore a year ago. EBITDA plunged 57% YoY to Rs 169 crore, and its EBITDA margin dropped 326 basis points to 2.17%. The company’s edible oils business reported 13% drop in revenue for the quarter at Rs 5,891 crore, while food and FMCG business registered 8.2% sales growth at Rs 1,952 crore.

Godrej Industries: The company has reported a 13% year-on-year (YoY) decline in its consolidated net profit at Rs 178 crore in the quarter ended June 2023 from Rs 204 crore in the year-ago period. Its total revenue for the reported quarter rose 15% to Rs 4,893 crore, from 4,242 crore in the corresponding period of the last financial year, helped by 10% YoY volume growth in constant currency. Its real estate business in Q1FY24 witnessed a total booking value of Rs 2,254 crore with 2.25 million square feet of area sold during the quarter.

Sterling and Wilson Renewable Energy: The renewable energy company has received a Letter of Intent (LoI) from Gujarat Industries Power Company (GIPCL), for its proposed 600 MWac (equivalent to 750 MWdc) solar PV project at Khavda. The total bid value, including operation and maintenance for 3 years would be Rs 1,130 crore.

Dredging Corporation of India Limited (DCI): The company has reported a net profit of Rs 15.15 crore in Q1FY24 as against a net loss of Rs 14.18 crore in the same quarter last fiscal. Total income during the quarter stood at Rs 205.19 crore in Q1FY24, down from Rs 337.76 crore in Q1FY23. Total expenditure during the quarter under reviewe stood at Rs 189.53 crore, down from Rs 351.57 crore in the comparable quarter a year ago.

Kirloskar Industries: The company reported a 9% YoY drop in its consolidated Profit After Tax (PAT) at Rs 94 crore in Q1FY24 compaed with a consolidated PAT of Rs 102.9 crore in Q1FY23. The company’s total income for the quarter under review stood at Rs 1,518.2 crore, compared with Rs 1,513.5 crore in Q1FY23.

Eveready Industries India: The battery manufacturer registered a 13.77% increase in its consolidated net profit at Rs 24.86 crore in Q1FY24 as against a net profit of Rs 21.85 crore in Q1FY23. Its revenue from operations was up 8.4% to Rs 363.57 crore during the quarter under review as against Rs 335.38 crore in the year-ago period.

PTC India: The company posted a 5.62% YoY rise in its consolidated net profit at Rs 142.70 crore in Q1FY24 as against a consolidated net profit of Rs 135.10 crore in Q1FY23. The company’s total income rose to Rs 4,863.46 crore in the quarter under review, from Rs 4,310.74 crore in the same period a year ago.

IRB Infrastructure Developers: The road construction company said it has made an upfront payment of Rs 7,380 crore to Hyderabad Metropolitan Development Authority (HMDA). With this payment, its special purpose vehicle, IRB Golconda Expressway Private Limited, has commenced toll collection on the Jawaharlal Nehru Outer Ring Road, Hyderabad, the company said in a statement.

Global Health (Medanta): The company reported a 74% YoY jump in net profit at Rs 102 in Q1FY24 due to higher bed capacity and in-patient footfalls. Revenue rose 27% YoY to Rs 795 crore. EBITDA rose 40.7% YoY to Rs 199 crore. Average revenue per occupied bed (ARPOB) grew by 7.1% YoY to Rs 63,148. In-patient volume increased by 19.4% YoY and out-patient volume increased by 17.5% YoY. Revenue from international patients increased by 45% YoY to Rs 48 crore driven by increased volume and realization.

Glenmark Pharma: The company posted a net profit of Rs 173 crore in Q1FY24, down 18% YoY due to an exceptional item of Rs 52 crore in the quarter that comprises remediation cost of manufacturing sites in India and Monroe (US). Revenue from operations rose 22.5% YoY to Rs 3402 crore in Q1FY24. EBITDA grew 46.2% YoY to Rs 631 crore, while the EBITDA margins expanded 310 basis points YoY to 18.6%. India business grew by 2.8% YoY to Rs 1064 crore, while North America business grew by 22% to Rs. 809 crore.

JK Cement: The company’s consolidated net profit fell 29.5% to Rs 114.7 crore in Q1FY24 from Rs 162.7 crore in the year-ago period. Consolidated revenue was up 21.6% YoY at Rs 2762.6 crore in Q1FY24 from Rs 2272.4 crore in Q1FY23.

Netweb Technologies: The company reported a profit after tax of Rs 5.1 crore in Q1FY24, a decline of 9.2% from Rs 5.6 crore in Q1FY23. It had posted a profit after tax of Rs 10.5 crore in Q4FY23. Its total income stood at Rs 60.2 crore in Q1FY24, down 13.2% YoY from Rs 64.9 crore in Q1FY23. The total income fell 51.7% from Rs 12.46 crore in Q4FY23. Meanwhile, its EBITDA declined by 4.6% to Rs 9 crore in Q1FY24 from Rs 9.5 crore in Q1FY23.