Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.18 percent lower at 15,716.50, indicating that Dalal Street was headed for a lower opening on Monday.

Asian shares were mixed as Japanese stocks rose and Chinese equities fell. Japan’s Nikkei 225 index was 0.58% higher and Topix rose 1.01%. China’s Hang Seng fell 1.08% and CSI 300 index lost 0.31%.

Indian rupee fell 5 paise to 79.05 against the US dollar on Friday.

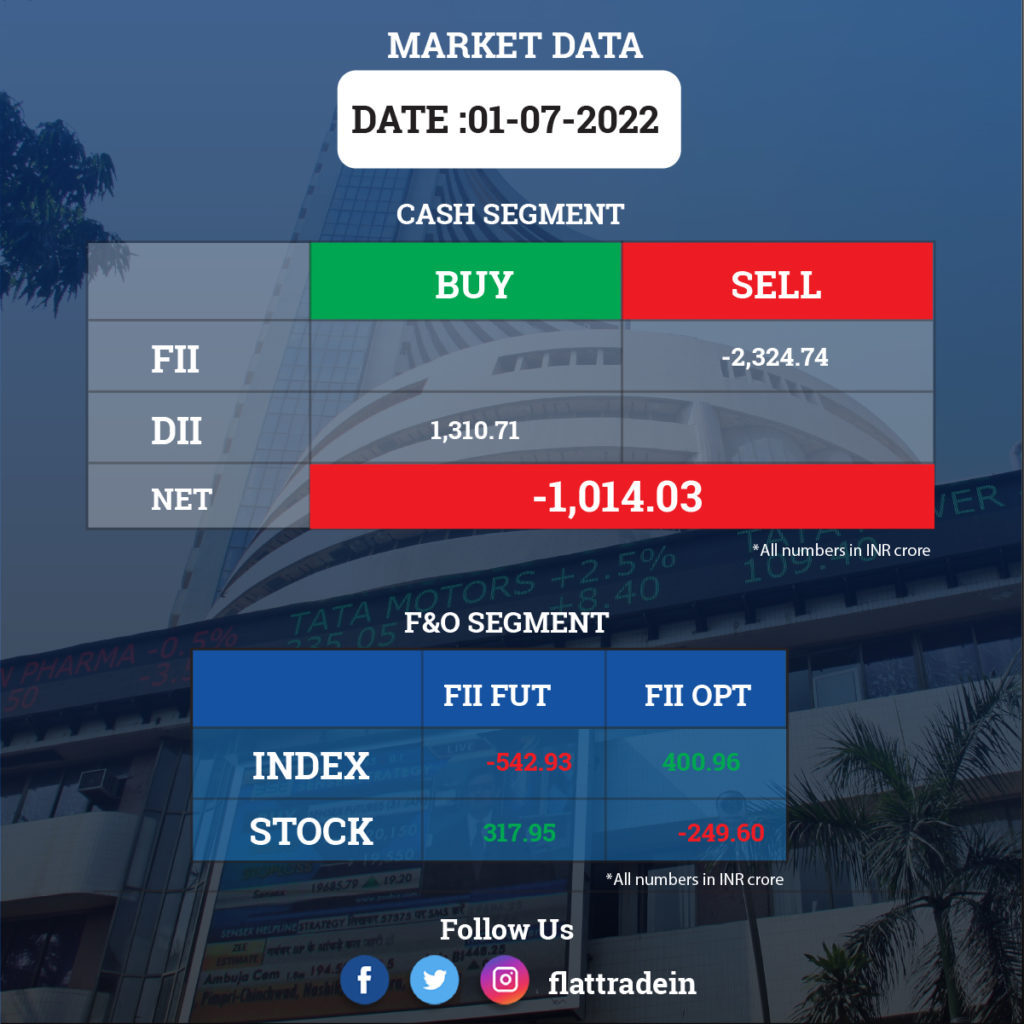

FII/DII Trading Data

Stocks in News Today

HDFC, HDFC Bank: The proposal of merger of HDFC with its banking subsidiary HDFC Bank, the biggest transaction in India’s corporate history, has got approval from stock exchanges. The merger still requires a series of approvals from financial sector regulators including RBI and CCI before it goes to NCLT and shareholders.

NTPC: The company informed BSE that its 100 megawatt (MW) floating solar photovoltaic project in Telangana was fully operational. The Floating Solar PV Project was at Ramagundam, Telangana. With this, standalone installed and commercial capacity of NTPC has become 54,769.20 MW, while group installed and commercial capacity of NTPC has become 69,134.20 MW.

Hero MotoCorp: The two-wheeler maker sold 4.85 lakh units of motorcycles and scooters in June 2022, a growth of 3.3% over 4.69 lakh units sold in the corresponding month of the previous fiscal. During the quarter ended June 2022, it sold 13.90 lakh units, a robust double-digit growth of 35.7 percent over 10.25 lakh units sold in same period last year.

Coal India (CIL): The state-owned company said its coal production increased 29 percent YoY to a record 159.8 MT in April-June this fiscal. CIL on an average supplied 1.684 MT of coal per day to the power sector in June 2022 quarter compared to a daily requirement of 1.650 MT.

TVS Motor Company: The company registered a growth of 22 percent in June 2022 with sales of 3,08,501 units as against 2,51,886 units in June 2021, including two-wheelers sales of 23 percent YoY at 2,93,715 units in June 2022. Total exports grew by 8 percent YoY to 1,14,449 units in June 2022.

Mahindra & Mahindra: The automotive company sold 54,096 vehicles in June 2022, a growth of 64 percent over 32,964 vehicles sold in same month last year, while exports for the month were at 2,777 vehicles, increasing by 7 percent YoY. In June 2022, it sold 41,848 tractors, a fall of 13 percent compared to 48,222 units sold in corresponding month last year.

IDFC First Bank: The company’s Q1FY23 business update showed that advances grew 6.7% QoQ & 21% YoY to Rs 1,37,685 crore. Retail business represents 65.7% of the overall funded assets as of June 30, 2022 and commercial business (CV, Business Banking etc.) constitutes 7.8% of the total funded assets. Mortgage business including home loans grew by 32% on a Y-o-Y basis and constituted 37.5% of the retail book.

Bharat Forge: The company has successfully completed the acquisition of Coimbatore-based JS Autocast Foundry India for an enterprise value Rs 489.63 crore.

Birlasoft: The company has fixed July 15 as the record date for the proposed buyback worth Rs 390 crore. The company’s board had approved buyback of up to 78 lakh shares at Rs 500 each.

Glenmark Pharmaceuticals: The US health regulator has issued Form 483 with one observation after an inspection at the company’s formulation manufacturing facility based out of Aurangabad, India between June 27 and July 1, 2022.

Eicher Motors: The company sold 61,407 units of Royal Enfield in June 2022, a growth of 43 percent over 43,048 units sold in same month last year, which included exports of 11,142 units that grew by 54% YoY. During the quarter, Eicher sold 1,87,205 units of Royal Enfield, up 51 percent over 1,23,640 units sold in same quarter previous year.

Ashoka Buildcon: The joint venture led by Ashoka Buildcon emerged as ‘the lowest bidder’ for construction and maintenance of Rajiv Gandhi Fintech Digital Institute, Jodhpur. The project cost is Rs 611 crore and construction period is 18 months from commencement date.

CSB Bank: The private sector lender recorded a 16.16% year-on-year growth in gross advances at Rs 16,332.8 crore for the quarter ended June 2022 and total deposits grew by 8.65% to Rs 20,266.8 crore during the same period. Advances against gold & gold jewellery at Rs 7,099.33 crore, which is 43% of total advances, increased by 26.37 percent YoY in Q1FY23.