Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.26% lower at 19,751, signalling that Dalal Street was headed for negative start on Wednesday.

Asia shares were trading lower as investors’ sentiments were dampened after Fitch Ratings downgraded the US sovereign rating. The Nikkei 225 index tanked 1.84% and the Topix dropped 1%. The Hang Seng plummeted 1.44% and teh CSI 300 index was down by 0.3%.

The Indian rupee ended flat at 82.26 against the US dollar on Tuesday.

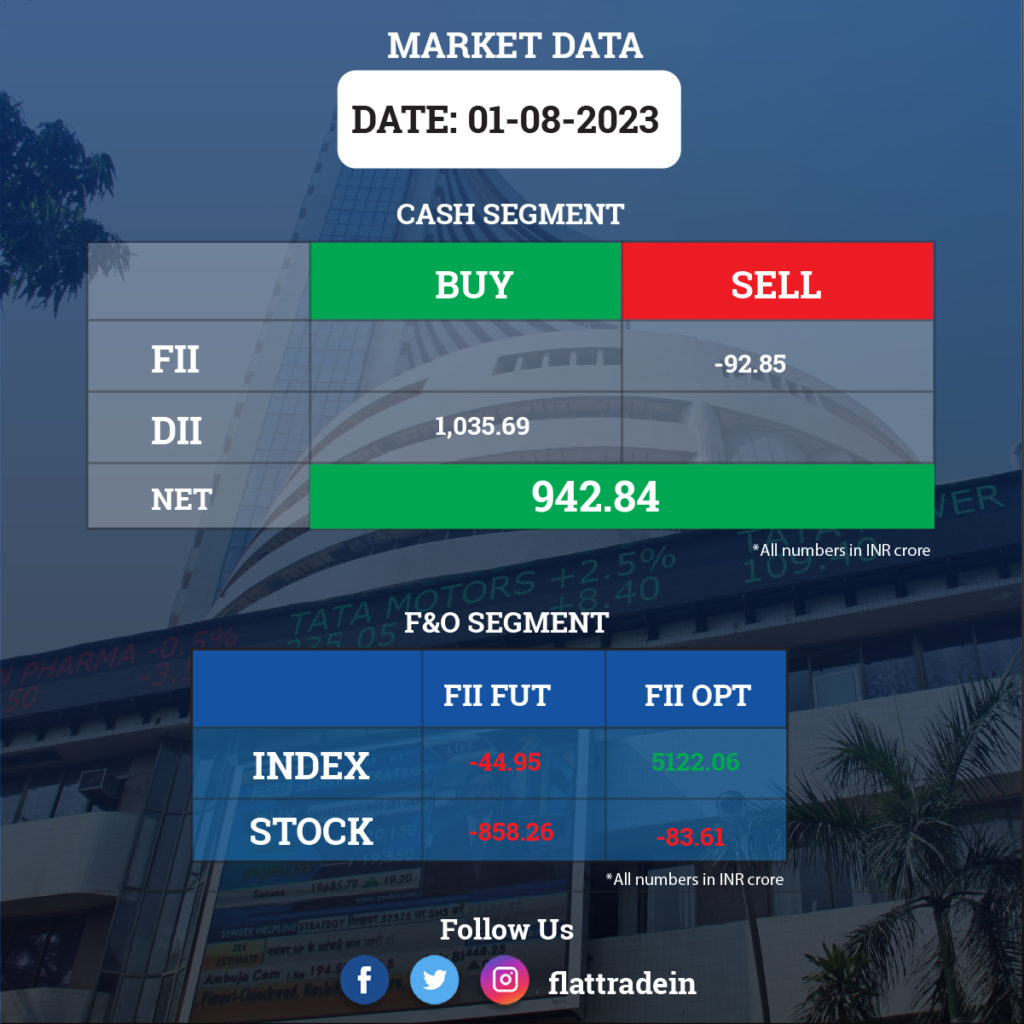

FII/DII Trading Data

Stocks in News Today

Maruti Suzuki India: The automaker reported a 3% increase in total sales at 1,81,630 units in July, riding on the back of demand for its utility vehicle range. The company had dispatched a total of 1,75,916 units to its dealers in the same month last year. Total domestic passenger vehicle sales were at 1,52,126 units as compared to 1,42,850 units in the year-ago month, a growth of 6%. The company said its exports last month stood at 22,199 units over 20,311 units in the same month last year.

Power Grid Corporation of India: The state-owned electric services company has received board approval for the implementation of an 85 MW solar PV power project at Nagda in Madhya Pradesh. The estimated cost of the project is Rs 554.91 crore.

Hero MotoCorp: The company said its total sales fell 12% YoY to 3.91 lakh units in July 2023. Domestic sales fell 14% to 3.71 lakh units compared to the year-ago period. Exports rose 35% to 20,106 units compared to the same period last year.

Grasim Industries: The company has approved allotting 1,00,000 (7.35%) fully paid, unsecured, listed, rated, redeemable, non-convertible debentures, aggregating to Rs 1,000 crore, on a private placement basis.

TVS Motor: The company said its total sales rose 4% YoY to 3.26 lakh units in July 2023. Two-wheeler sales rose 4% YoY to 3.12 lakh units in July 2023. Three-wheeler sales fell 8.8% YoY to 13,670 units. Exports fell 20% YoY to 89,213 units.

Ashok Leyland: The country’s second-largest commercial vehicle maker has announced sales of 15,068 units for July 2023, better than analysts’ estimates, rising 10.6% over the corresponding period last year. Medium and heavy commercial vehicle sales increased by 17% to 9,571 units, and light commercial vehicle sales rose by 0.4% to 5,497 units during the same period.

Eicher Motors: The automobile company has announced sales volume data of its Royal Enfield. Total sales grew by 32% year-on-year to 73,117 motorcycles, driven by domestic sales which surged 42% YoY to 66,062 units, but exports dropped 22% to 7,055 units during the same period. Sales of models with engine capacities up to 350 cc rose 39% to 64,398 units, while sales of models with engine capacities exceeding 350 cc fell 5% to 8,719 units.

Redington: The company’s consolidated revenue jumped 26% to Rs 21,187.18 crore in Q1FY24 as against Rs 16,803.14 crore in Q1FY23. Consolidated net profit declined 22% to Rs 255.2 crore in Q1FY24 from Rs 326.34 crore in Q1FY23. Ebitda was down 9% at Rs 419.18 crore in Q1FY24 as against Rs 461.82 crore in Q1FY23.

Dalmia Bharat Sugar And Industries: The company said its consolidated revenue fell 10% to Rs 833.89 crore in Q1FY24 from Rs 924.19 crore in Q1FY23. Consolidated net profit was up 24% to Rs 61.34 crore in Q1FY24 from Rs 49.27 crore in Q1FY23. Ebitda was up 9% YoY to Rs 118.48 crore in Q1FY24 as against Rs 109.02 crore in Q1FY23.

Metro Brands: The footwear retailer said its consolidated revenue was up 15% at Rs 582.52 crore in Q1FY24 from Rs 507.95 crore in Q1FY23. Consolidated net profit was down 12% YoY at Rs 93.5 crore in Q1FY24 as against Rs 105.78 crore in Q1FY23. Ebitda was up 2% at Rs 186.59 crore in Q1FY24 as against Rs 182.87 crore in Q1FY23.

Bikaji Foods: The company’s consolidated revenue was up 15% at Rs 482.05 crore in Q1FY24 as against Rs 419.15 crore in Q1FY23. Consolidated net profit was up 163.9% YoY at Rs 41.41 crore in Q1FY24 as against Rs 15.69 crore in Q1FY23. Ebitda jumped 114% at Rs 65.77 crore in Q1FY24 from Rs 30.72 crore in Q1FY23.

Thermax: The company’s consolidated revenues was up 16.8% YoY at Rs 1932.96 crore in Q1FY24 from Rs 1654.48 crore in Q1FY23. Consolidated net profit rose 1.69% to Rs 59.95 crore in Q1FY24 as against Rs 58.95 crore in Q1FY23. Ebitda was up 37.6% YoY at Rs 132.2 crore in Q1FY24 from Rs 96.03 crore in Q1FY23.

Sterling and Wilson Renewable Energy: The company has received a limited notice to proceed with an engineering, procurement and construction order worth Rs 360 crore for a project in India. This is in addition to the new order value of Rs 466 crore that the company reported in Q1 FY24.

Zee Entertainment: The company said IDBI Bank has challenged NCLT’s order before NCLAT. NCLT had dismissed an application filed under Section 7 of IBC, 2016, by IDBI Bank against the company on May 19, 2023.

GE Power Grid: The company received a contract worth over Rs 444 crore from Gujarat State Electricity Corporation for design, engineering, manufacturing, supply, shop testing, packing, installation, commissioning, and PG testing of the FGD System. The order will be executed within 30 months.

Shree Renuka Sugars: The company agreed to issue guarantees to RBL Bank to repay Harvest and Transport Operators loan of Rs 75 crore.

Genus Power Infrastructures: The company executed an engineering and procurement contract it signed with Hi-Print Infra and Gemstar Infra. The contract was for Advanced Metering Infrastructure Solutions services to be procured by Gemstar Infra and Hi-Print Infra.

Gujarat Ambuja Exports: The company approved a scheme of amalgamation between Mohit Agro Commodities Processing and Gujarat Ambuja Exports.

Syrma SGS Technology: The company’s revenue was up 54% YoY at Rs 601.31 crore in Q1FY24 from Rs 389.34 crore in Q1FY23. The company’s net profit was up 65% at Rs 28.33 crore in Q1FY24 as against Rs 17.15 crore in Q1FY23. Ebitda rose 10% YoY to Rs 36.93 crore in Q1FY24 from Rs 33.56 crore in Q1FY23. The company has approved the 51% acquisition of Johari Digital Healthcare for Rs 257.5 crore.

Axis Bank: The company announced its Independent Director Manoj Kohli has resigned. The resignation will take effect on Aug. 11.

Safari Industries (India): The company’s unit Safari Manufacturing has commenced commercial manufacturing of luggage on Aug. 1 from its increased capacity at its Gujarat factory. The effective production capacity has increased from 2,25,000 pieces per month to 3,50,000 pieces per month.

Sealmatic India: The company won an order to supply high-critical mechanical seals for demanding applications for 52 pumps in the FCCU, VBU, and BBU units at IOCL Mathura.

Ashiana Housing: The company has inked an investment framework agreement with the International Finance Corporation, which will invest Rs 112.5 crore and a maximum of Rs 225 crore. The proposal includes project-to-project investment by IFC, representing 40% of the capital required by a project. The remaining 60%, i.e., Rs 168.75 crore, will be contributed by Ashiana Housing.

Deep Industries: The company’s consolidated revenue was up 39% to Rs 101.32 crore in Q1FY24 as against Rs 73.15 crore in Q1FY23. Cosolidated net profit jumped 59% to Rs 31.01 crore in Q1FY24 as against Rs 19.51 crore in Q1FY23. Ebitda rose 45% to Rs 42.99 crore in Q1FY24 from Rs 29.60 crore in Q1FY23.

Sansera Engineering: The company’s consolidated revenue was up 24% at Rs 660.10 crore in Q1FY24 as against Rs 532.21 crore in Q1FY23. Consolidated net profit was up 30% at Rs 45.17 crore in Q1FY24 as against Rs 34.78 crore in Q1FY23. Ebitda was up 25% YoY at Rs 114.3 crore in Q1FY24 as against Rs 91.48 crore in Q1FY23.