Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.13% lower at 19,748.5, signalling that Dalal Street was headed for negative start on Monday.

Japanese markets were trading higher with investors shifting their focus to central bank meetings this week. The benchmark Nikkei 225 index was up 1.23% and the Topix index was up 0.83%. Chinese markets declined as investors were cautious and waited for signs of more government support to prop up the country’s economy.

Indian rupee gained 4 paise to 81.95 against the US dollar on Friday.

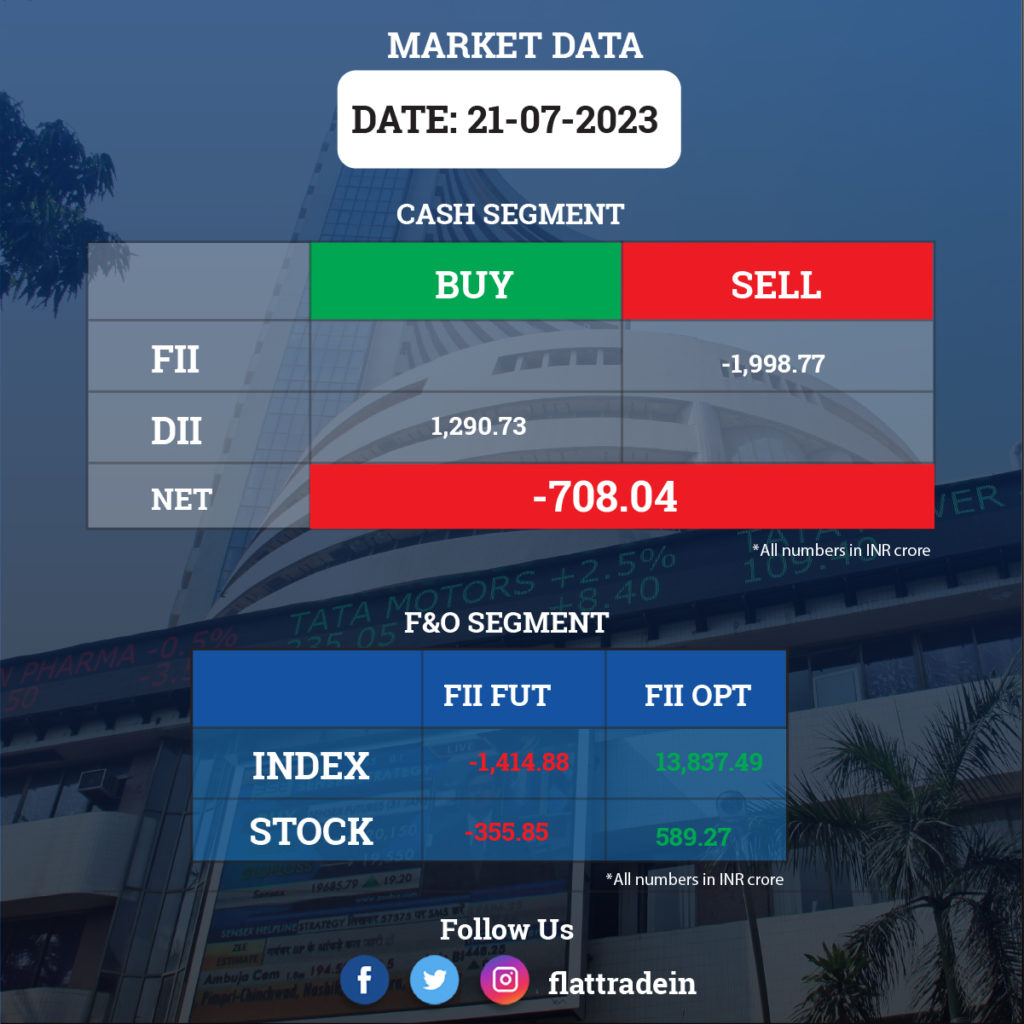

FII/DII Trading Data

Upcoming Results

Tata Steel, HDFC Asset Management Company, Canara Bank, PNB Housing Finance, TVS Motor Company, IDBI Bank, BASF India, Poonawalla Fincorp, Spandana Sphoorty Financial, Chennai Petroleum Corporation (CPCL), Craftsman Automation, Gravita India, IIFL Securities, Jammu & Kashmir Bank, JK Paper, Mahindra Logistics, Sharda Cropchem, Shoppers Stop, SRF, Tamilnad Mercantile Bank, DCM Shriram, Kalyani Steels, Maharashtra Scooters, Paisalo Digital, Relaxo Footwear, SRF, Thangamayil Jewellery, and Waaree Renewable will declare theri results today.

Stocks in News Today

Reliance Industries (RIL): The conglomerate reported a drop of 11% YoY in its consolidated net profit for the quarter ended June 2023 to Rs 16,011 crore. The consolidated revenue declined 5.3% YoY to Rs 2.11 lakh crore. The board has recommended dividend payout of Rs 9 a share, subject to approval of the shareholders.

The drop in revenue was primarily due to weak performance of the oil-to-chemicals (O2C) business. Revenue from this segment, which constituted 63% of RIL’s topline in the reporting quarter, plunged nearly 18% YoY to Rs 1.33 lakh crore. The consolidated revenue of the retail business increased about 20% YoY to Rs 69,962 crore, and the digital services revenue grew nearly 13% YoY to Rs 32,077 crore.

ICICI Bank: The private sector lender has reported a 39.7% on-year growth in standalone profit at Rs 9,648 crore for quarter ended June FY24. Provisions & contingencies icreased durignt he quarter. Net interest income increased by 38% on-year to Rs 18,227 crore with net interest margin expansion of 77 bps on-year at 4.78%, while loan growth was 18.1% and deposits grew by 17.9% YoY. Asset quality was stable with gross NPA falling 5 bps sequentially to 2.76% and net NPA flat at 0.48% for the quarter.

Kotak Mahindra Bank: The private sector bank has reported standalone profit at Rs 3,452.3 crore for quarter ended June FY24, growing 66.7% over a year-ago period, while operating profit surged 78% YoY to Rs 4,950 crore. Net interest income grew by 32.7% YoY to Rs 6,233.7 crore, with net interest margin at 5.57%, while advances increased by 19%. Gross NPA fell 1 basis point sequentially to 1.77%, and net NPA rose 3 bps to 0.40%.

Lupin: The pharma major has received tentative approval from the United States Food and Drug Administration (USFDA) under the US President’s Emergency Plan for AIDS Relief (PEPFAR) for its new drug application for Dolutegravir Lamivudine and Tenofovir Alafenamide tablets. This product would be manufactured at Lupin’s Nagpur facility in India.

One 97 Communications (Paytm): The company has narrowed its net loss for quarter ended June FY24 to Rs 357 crore, from Rs 644.4 crore in same period last year. Revenue grew by 39% on-year to Rs 2,342 crore led by increase in GMV, merchant subscription revenues, and growth of loans distributed through its platform.

DLF: The real estate major has reported a 12.2% YoY growth in consolidated profit at Rs 528 crore. Revenue declined 1.3% on-year to Rs 1,423.2 crore for the quarter. The realty firm’s new sales bookings stood at Rs 2,040 crore.

Power Finance Corporation: The state-owned company has inked several pacts worth Rs 2.37 lakh crore with 20 companies in clean energy space. The agreements are a part of the company’s plan to position itself as the focal funding agency for energy transition.

Vedanta: The company has recorded consolidated profit at Rs 2,640 crore for quarter ended June FY24, falling 40% compared to year-ago period on disappointing operating performance and lower topline. Revenue fell by 12.8% on-year to Rs 33,342 crore due to steep reduction in output commodity prices, partially offset by favourable movement in exchange rate. Sunil Duggal will be retired as WholeTime Director & CEO with effect from July 31. Arun Misra has been appointed as an Additional Director and also designated as an Executive Director of the company effective August 1.

AU Small Finance Bank: The lender has registered a massive 44% YoY growth in profit at Rs 387 crore for quarter ended June FY24 and 39% increase in pre-provision operating profit at Rs 546 crore. Net interest income rose 28% YoY to Rs 1,246 crore with net interest margin declining 20 bps to 5.7%. Total advances grew by 29% YoY to Rs 63,635 crore and deposits increased by 27% to Rs 69,315 crore. Gross NPA rising 10 bps QoQ to 1.76% and net NPA increasing 13 bps sequentially to 0.55% for the quarter ender June 2023.

Yes Bank: The private sector lender has recorded a net profit of Rs 343 crore for quarter ended June FY24, while operating profit grew 38.8% YoY to Rs 818 crore. Net interest income grew by 8.1% YoY to Rs 2,000 crore, with net interest margin rising 10 bps YoY to 2.5% for the quarter. Advances rose 7.4% yoY to Rs 2 lakh crore and deposits rose 13.5% YoY to Rs 2.19 lakh crore. On the asset quality front, gross NPA fell 20 bps QoQ to 2% and net NPA jumped 20 bps QoQ to 1% for the quarter, while slippages for the quarter stood at Rs 1,430 crore as against Rs 1,196 crore in previous quarter.

RBL Bank: The bank has reported a net profit of Rs 288 crore for June FY24 quarter, rising 43% over a year-ago period. Net interest income increased by 21% on-year to Rs 1,246 crore, with net interest margin expansion of 48 bps YoY at 4.84% for the quarter. Loan growth stood at 21% at Rs 73,087 crore and deposits rose by 8% YoY to Rs 85,636 crore in Q1FY24. Gross NPA fell 15 bps sequentially to 3.22% and net NPA declined 10 bps QoQ to 1% for the quarter.

Aurobindo Pharma: The United States Food and Drug Administration (USFDA) has inspected company’s Unit III, a formulation manufacturing facility in Telangana during July 14-21. The US health regulator issued a Form 483 with 3 observations. The observations are procedural in nature.

Biocon: The USFDA conducted two GMP inspections at Biocon’s insulins manufacturing facility in Malaysia during July 10-20. The US health regulator issued a Form 483 with 6 observations for drug substance, drug product units and quality control laboratories as well as 2 observations for the delivery devices unit. These observations primarily related to enhancing operational procedures and strengthening training programs. The inspections did not identify any data integrity breaches or systemic non-compliance.

Tejas Networks: The company’s consolidted revenue from operations gained 49% YoY to Rs 187.89 crore in Q1FY24 as against Rs 125.76 in Q1FY23. Consolidated net loss widened to Rs 26.29 crore in the reported quarter as against Rs 6.64 crore in the year-ago period. Ebitda loss stood at Rs 46.27 crore in Q1FY24 compared with Rs 7.32 crore in Q1FY23.

Zomato: The company’s subsidiary, Zomato Media Portugal, Unipessoal Lda, has initiated the process of liquidation on July 21. ZM Portugal is not a material subsidiary of the company and the dissolution of ZM Portugal will not affect the revenue of the company.

BEML: Shantanu Roy has been appointed as Chairman & Managing Director on the board of the company with effect from August 1, in place of Amit Banerjee, who will be retiring as Chairman & Managing Director with effect from July 31. Currently, Shantanu Roy is the Director (Mining & Construction Business) at BEML.

SJVN: The company said it has signed an MoU with REC for financing the projects of the company and its subsidiaries and joint ventures to the extent of Rs 50,000 crore. Further it has acquired additional stake in Cross Border Power Transmission Company for Rs 18.6 crore. The company through it wholly owned subsidiary SJVN Green Energy has received Letter of Intent from Punjab State Power Corporation for procurement of 1200 MW solar power.

Aarti Drugs: The pharma company has registered a 38% YoY growth in profit at Rs 48 crore for quarter ended June FY24 on healthy operating performance. Revenue for the quarter at Rs 661.7 crore, up 6% over the year-ago period. API business rose 9% and formulation segment grew 6%, while specialty chemicals division fell 18% YoY. Ebitda grew by 26% on-year to Rs 84 crore with margin expansion of 200 bps at 12.8% for the quarter.

Cyient DLM: The electronic manufacturing services and solutions provider has reported profit at Rs 5.4 crore for June FY24 quarter, falling 15.2% compared to year-ago period impacted by lower other income. Revenue grew by 27.6% year-on-year to Rs 217.15 crore for the quarter, with order backlog of Rs 2,499.7 crore.

PNB Gilts: The company’s interest income rose 33% to Rs 373.91 crore in Q1FY24 from Rs 281.39 crore in Q1FY23. Net interest income fell 79% YoY to Rs 19.68 crore in Q1FY24 from Rs 95.07 crore in theyear-ago period. Net profit stood at Rs 57.87 in the reported quarter from a net loss of Rs 88.94 in the corresponding quarter lst fiscal.

CreditAccess Grameen: The microfinance institution has recorded healthy growth in earnings for the quarter ended June FY24, with profit growing 151.5% year-on-year to Rs 348 crore and net interest income increasing 65.4% on-year to Rs 763.3 crore. The gross loan portfolio grew by 39.7% YoY to rs Rs 21,814 crore for the quarter, while pre-provision operating profit increased by 87.7% on-year to Rs 544 crore in Q1.

CMS Info Systems: The cash management company has reported a consolidated profit at Rs 84.3 crore for June FY24 quarter, rising 22% over year-ago period. Revenue from operations grew by 12.85% on-year to Rs 511.6 crore for the quarter.

Dodla Dairy: The dairy products manufacturer has posted a 40% year-on-year growth in profit at Rs 35 crore for the quarter ended June FY24. Ebitda rose 33.9% YoY to Rs 60.3 crore and margin expanded by 104 bps YoY to 7.3% due to lower raw material prices and other expenses. Operating revenues increased by 14.8% YoY to Rs 823.4 crore for the quarter, with domestic business rising 16.1% YoY to Rs 762.8 crore.