Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.51% lower at 18,101, signalling that Dalal Street was headed for a negative start on Thursday.

Asian share markets were trading lower as investors were cautious ahead of the important the US consumer inflation report. Japan’s Nikkei 225 index fell 1.17% an the Topix index dropped 0.865. The Hang Sneg index tanked 2.27% and the CSI 300 index was down 0.88%.

Indian rupee strengthened by 48 paise to 81.44 against the US dollar on Wednesday.

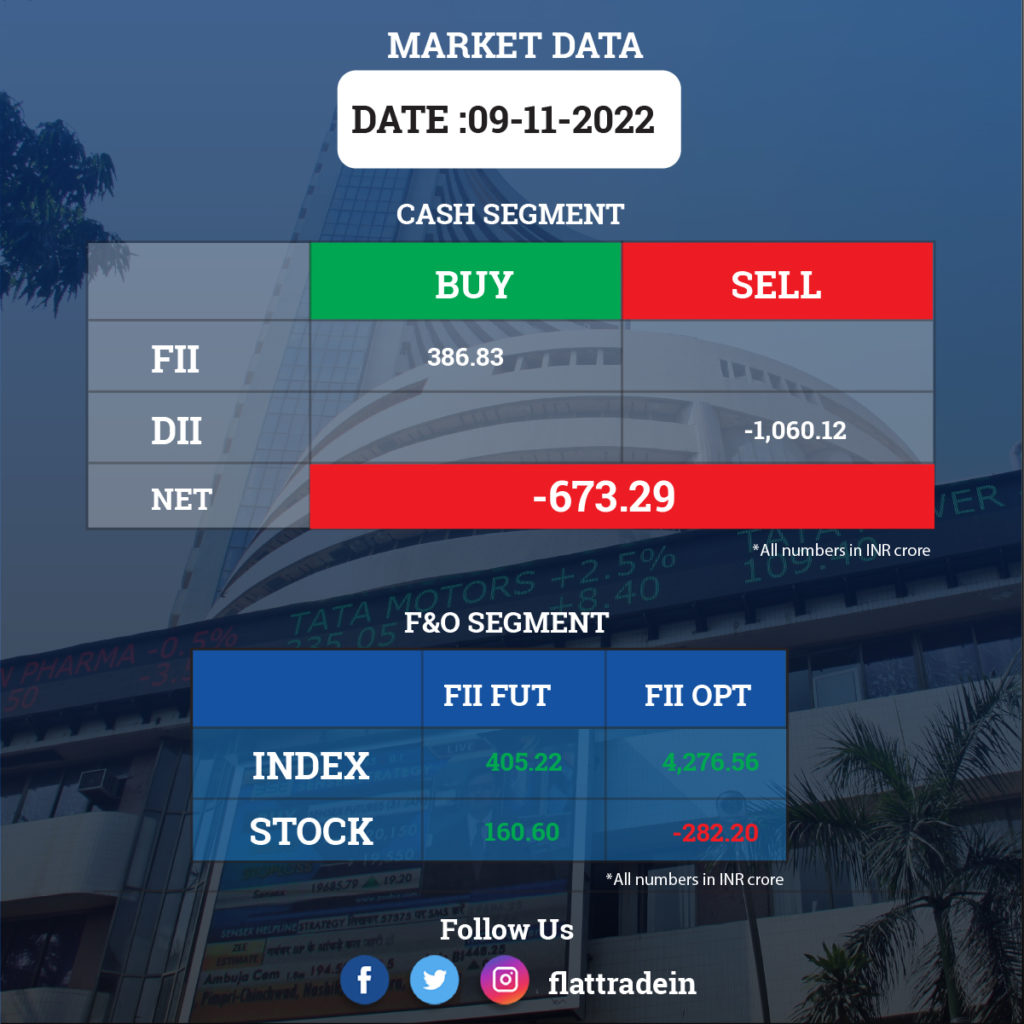

FII/DII Trading Data

Upcoming Results

Adani Green Energy, Ashok Leyland, Apollo Hospitals Enterprise, Eicher Motors, Indian Hotels, NHPC, Oil India, SAIL, Power Finance Corporation, Page Industries, Aster DM Healthcare, Bata India, Zomato, Mrs. Bectors Food Specialities, Berger Paints India, Campus Activewear, Container Corporation of India, Gujarat State Petronet, Gujarat Gas, Jindal Steel & Power, Kalpataru Power Transmission, Kalyan Jewellers India, Linde India, Mazagon Dock Shipbuilders, Muthoot Finance, RITES, Suzlon Energy, Torrent Power and Trent will report their quarterly earnings on November 10.

Stocks in News Today

Tata Motors: The passenger and commercial vehicle maker has posted net loss of Rs 944.6 crore for the quarter ended September FY23, compared to a loss of Rs 4,441 crore in same period last year. Revenue from operations grew 30% YoY to Rs 79,611 crore during the quarter and EBITDA increased by 35.4% to Rs 5,572 crore compared to same period last year. Jaguar Land Rover’s revenue at 5.3 billion pound grew by 36% YoY for the quarter. Tata Motors to delist its American Depositary shares from The New York Stock Exchange.

Axis Bank: The government-backed Specified Undertaking of the Unit Trust of India (SUUTI) plans to sell 4.65 crore shares representing 1.55% stake in Axis Bank, as per a regulatory filing. With the sale, the government would completely exit the private sector lender. The government, at the current market price, is expected to realise about Rs 4,000 crore from the share sale.

Adani Ports and Special Economic Zone Ltd (APSEZ): The company said that it has acquired 49.38% stake in Indian Oiltanking Ltd — developer and operator of liquid storage facilities — for Rs 1,050 crore. APSEZ will also acquire an additional 10% equity stake in IOT Utkal Energy Services Ltd, which is a 71.57% subsidiary of Indiain Oiltanking Ltd.

Lupin: The drug maker said that its consolidated net profit stood at Rs 130 crore for the second quarter ended September 2022. The company had reported a net loss of Rs 2,098 crore in the July-September period of the previous fiscal. Total revenue from operations rose to Rs 4,145 crore for the period under review as compared to Rs 4,091 crore in the year-ago period, it said in a regulatory filing. The pharma firm said that it paid Rs 1,878 crore towards litigation and settlement related expenses last year with respect to antitrust class action filed in the US in connection with the drug Glumetza.

Bharat Electronics Ltd (BEL): The state-owned defence company has signed a memorandum of understanding (MoU) with Aerosense Technologies Pvt Ltd for co-operation in the development and marketing of drones and soft kill aerial anti-drone. Besides, the two companies would explore marketing and sale of drone-based solutions for applications in defence and civilian domains for the domestic and export markets.

Tata Power Company: The company said its subsidiary Tata Power Renewable Energy has received the ‘Letter of Award’ from the Maharashtra State Electricity Distribution Corporation (MSEDCL) to set up 150MW solar project in Solapur, Maharashtra. The project will be commissioned within 18 months from the PPA execution date.

Happiest Minds Technologies: The company announced partnership with Singapore-based ESG (environmental, social and governance) solution provider CredQuant for BFSI (banking, financial services & insurance) customers. This collaboration with CredQuant will help BFSI customers in addressing ESG screening, ESG rating models, sustainability disclosures & reporting, impact reporting and carbon footprint.

Piramal Enterprises: The company posted consolidated loss of Rs 1,536.4 crore for the quarter ended September FY23, impacted by impairment on financial instruments, net loss on fair value changes, and higher other expenses. It had consolidated profit of Rs 426.5 crore in year-ago period. Revenue grew by 20.3% to Rs 1,893.7 crore compared to same period last year.

Pidilite Industries: The company recorded a 11.3 percent year-on-year decline in consolidated profit at Rs 332.4 crore for the quarter ended September FY23, dented by weak operating performance. Profit and operating income missed analysts’ estimates, while revenue was in line with estimates. Revenue at Rs 3,011.2 crore for the quarter increased by 14.6 percent compared to year-ago period. EBITDA fell 9.1 percent to Rs 500 crore and margin declined by 430 bps to 16.6 percent YoY in Q2FY23.

Narayana Hrudayalaya: The healthcare service provider has clocked a 70 percent year-on-year growth in consolidated profit at Rs 168.8 crore for the quarter ended September FY23, led by healthy operating performance and higher top line. Consolidated revenue from operations grew by 21.4 percent to Rs 1,141.5 crore and EBITDA at Rs 274.9 crore increased by 51.9 percent compared to year-ago period.

Gujarat Pipavav Port: The company has recorded a massive 58.5 percent year-on-year growth in consolidated profit at Rs 72.1 crore for the quarter ended FY23 with revenue for the quarter growing 16.7 percent to Rs 227.3 crore and EBIDTA increasing 11.2 percent to Rs 121 crore compared to year-ago period. However, margin fell 265 bps YoY to 53.23 percent in Q2FY23.

Prestige Estates Projects: The realty firm reported an 80% increase in its consolidated net profit at Rs 140.7 crore in the September quarter of this fiscal year. Its net profit stood at Rs 78.3 crore in the year-ago period. Total income rose to Rs 1,474.7 crore in the second quarter of this fiscal year from Rs 1,345.2 crore in the corresponding period of the previous year. The company’s sales bookings rose 66% year-on-year to Rs 3,511 crore in the second quarter of this fiscal on higher demand despite a rise in home loan interest rates.

Natco Pharma: The drug manufacturer said that it has launched the first generic version of Pomalyst capsules in the Australian market. The capsules have been launched in strengths of 1,2,3 and 4 mg. Pomalidomide is prescribed for treatment of Multiple Myeloma and Kaposi Sarcoma.

Indigo Paints: Sequoia Capital India has divested 3.28% or 15,60,000 equity shares in the paint manufacturer at an average price of Rs 1,343.82-Rs 1,343.65 apiece, taking the transaction value to Rs 209.62 crore, the bulk deal data showed.

Reliance Capital: Advent, the US-based private equity firm, has called off its plan to participate in the resolution process of debt-ridden company. Initially, Advent had shown interest in acquiring Reliance Capital’s subsidiary Reliance General Insurance by submitting a non-binding bid of Rs 7,000 crore.

Sundram Fasteners: The auto-components manufacturer reported a standalone profit of Rs 111.75 crore for the July-September 2022 quarter. Its standalone profit was Rs 120.16 crore during the corresponding quarter last year.

TeamLease Services: The Staffing company reported a consolidated net profit of Rs 31.62 crore in the quarter ended September. The company had posted a loss of Rs 49.47 crore in the year-ago period.

TD Power Systems: The electrical utilities company posted a nearly 24% rise in its consolidated net profit to Rs 19.90 crore in the September quarter mainly due to lower expenses. The consolidated net profit of the company was Rs 16.05 crore in the year-ago period.

New Delhi Television: The media firm reported an increase of 4.4 per cent in consolidated net profit to Rs 13.03 crore for the second quarter ended September. The company had posted a net profit of Rs 12.48 crore during the July-September quarter a year ago.

Dhanlaxmi Bank: The private lender reported a multi-fold rise in net profit at Rs 15.89 crore for September quarter 2022-23 on lower provisions for bad loans. The bank had clocked a net profit of Rs 3.66 crore in the year-ago period. In the previous June quarter, the bank incurred a net loss of Rs 26.43 crore.