Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.31% lower at 15,785.50, indicating that Dalal Street was headed for a negative start on Tuesday.

Most Asian shares fell in on Tuesday after investors took their cue from a volatile Wall Street session overnight amid rising oil prices. Japan’s Nikkei fell 0.15%, while Topix rose 0.18%. China’s Hang Seng slumped 0.92% and CSI 300 index lost 0.29%.

Indian rupee was flat at at 78.35 against the US dollar on Monday.

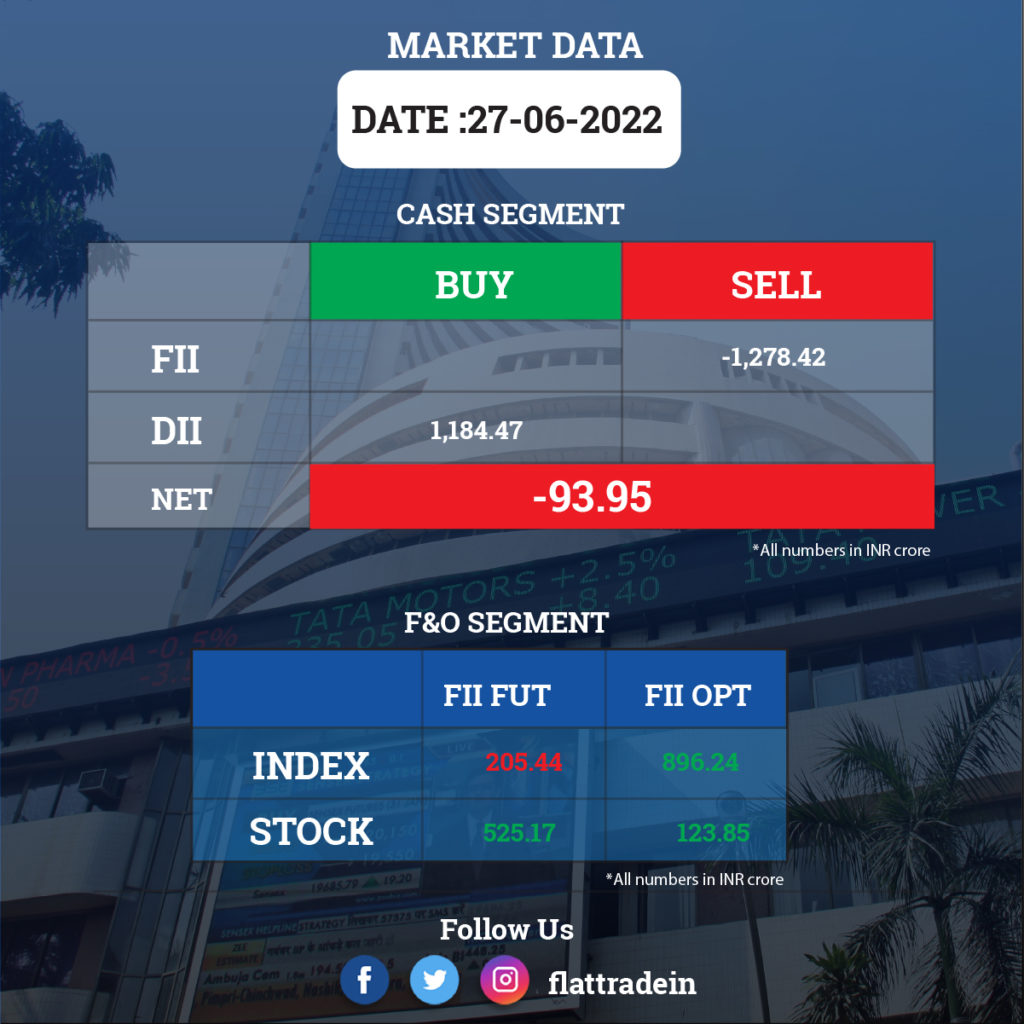

FII/DII Trading Data

Stocks in News Today

Tata Steel: Rating agency Moody’s changed Tata Steel’s outlook to ‘positive’ from ‘stable’, reflecting its track record of delivering a solid operating performance while maintaining conservative financial policies. There is a likelihood that an upward rating thrust will build over the next 12 months if recent performance and credit metrics improvements are sustained.

TVS Motor: The company’s managing director, Sudarshan Venu, said that the two-wheeler manufacturer was going to invest heavily on electric vehicles. It plans to focus on electric vehicles (EVs) and will come up with different products in its two and three-wheeler segments under the 5 to 25 kilowatt range. They will also design digital applications for service and will book for digital appointments.

GAIL (India) Ltd: Fitch Ratings has affirmed a ‘BBB-‘ rating to gas utility GAIL (India) Ltd, with a stable outlook, on tha back of the company’s financial profile will continue to be strong. Its rating is capped by the Indian sovereign rating of ‘BBB-‘. The Indian government owned 51.52% in GAIL.

Mahindra & Mahindra (M&M): The company has unveiled new car model name Scorpio-N and its prices start from Rs 11.9 lakh. The bookings for the SUV will open on July 30, 2022.

Star Health and Allied Insurance: The health insurance company has signed a corporate agency agreement with IDFC FIRST Bank, for distribution of its health insurance solutions to the bank’s customers.

Cipla: The company will invest Rs 25.9 crore in associate firm GoApptiv that will increase its stake to 22.02%. The investment will enable wider reach of the Cipla’s key brands in Tier-3+ towns through GoApptiv’s solutions.

Bank of Baroda: The state-run lender has announced plans to raise long term bonds worth Rs 5,000 crore in FY23.

Capri Global Capital: APV Tradesol Pvt Ltd and PACs sold 2.055 percent stake in the company via open market transactions. With this, their shareholding in the company stands reduced to 6.102 percent, down from 8.156 percent earlier.

Brigade Enterprises: The company has signed an agreement for joint development of 2.1 million square feet of residential apartments in Chennai. Brigade targets revenue of Rs 6,000 crore from its residential business over the next 5 years in the city.

Future Retail Ltd (FRL): The National Company Law Tribunal (NCLT) reserved its order on the petition filed by Amazon opposing Bank of India’s plea to initiate insolvency resolution proceedings against debt-ridden company. The tribunal directed the e-retailer to submit its written response to the lender’s submission by Thursday.