Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.5% lower at 17,705.50, signalling that Dalal Street would open negatively on Wednesday.

Asian shares were trading lower after Wall Street ended lower on Tuesday ahead of the US Federal Reserve monetary policy meeting. Japan’s Nikkei 225 index dropped 1.39% and Topix was down 1.27%. Hang Seng lost 1.57% and CSI 300 index fell 0.93%.

The Indian rupee rose 2 paise to 79.75 against the US dollar on Tuesday.

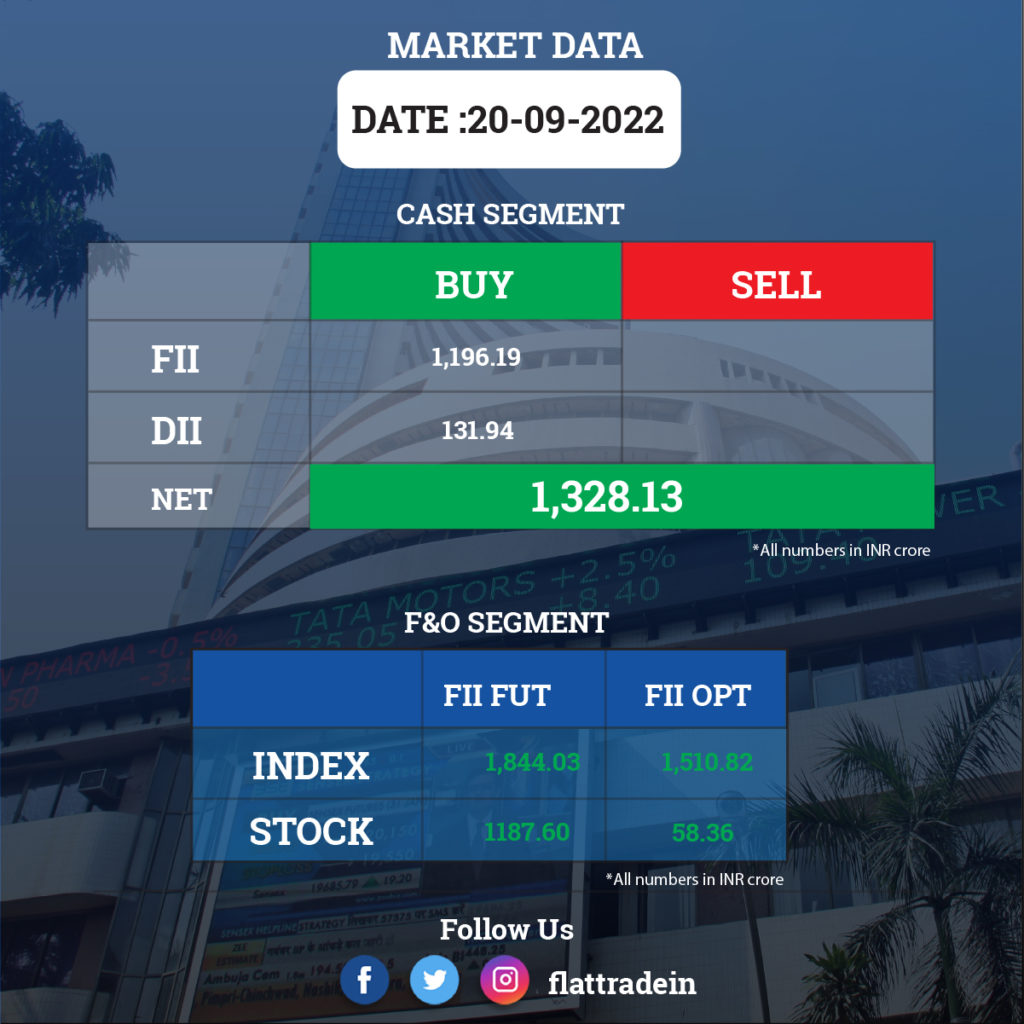

FII/DII Trading Data

Stocks in News Today

Ambuja Cements and ACC: Billionaire Gautam Adani pledged his entire stake in Ambuja Cements and ACC, worth about $12.5 billion, to foreign banks to fund his family’s $6.5 billion acquisition of the two cement makers. The family’s 63.15% stake in Ambuja Cements and 56.69% in ACC have been pledged by Adani Group, according to exchange filing made by Ambuja Cements.

Mahindra & Mahindra(M&M): The company said it will buy an additional 17.41% stake in Swaraj Engines Ltd from Kirloskar Industries Ltd (KIL) for Rs 296 crore. The acquisition will result in increasing the company’s stake in Swaraj Engines to 52.13% from 34.72%, according to the company’s regulatory filing. The company proposes to acquire 21,14,349 equity shares at Rs 1,400 per share, the company added. With this acquisition, SEL, which is currently an associate of the company, would become a subsidiary of M&M, the regulatory filing said.

Tata Steel: The company has raised Rs 2,000 crore through NCDs issue after the board of directors approved the allotment of 20,000 non-convertible debentures with face value Rs 10 lakh each to identified investors on private placement basis. The NCDs are proposed to be listed on the Wholesale Debt Market (WDM) segment of BSE.

Wipro: The IT services company, and UK-based Finastra announced a partnership in India to power digital transformation for corporate banks in India. This multi-year partnership makes Wipro the exclusive implementation and go-to-market partner for all banks in India for Finastra’s Fusion Trade Innovation and Fusion Corporate Channels.

Zydus Lifesciences: European Commission has granted marketing authorization for Nulibry (fosdenopterin) for injection as the first therapy for the treatment of patients with molybdenum cofactor deficiency (MoCD) Type A. MoCD Type A is an ultra-rare and progressive condition known to impact less than 150 patients globally with a median survival of four years.

Hero MotoCorp: The two-wheeler major and oil retailer HPCL has entered into collaboration to establish charging infrastructure for electric vehicles (EVs) in the country. Companies will set-up charging infrastructure for two-wheeled electric vehicles across the country.

Yes Bank: The private lender said that its board has approved the sale of stressed assets worth around Rs 48,000 crore to JC Flowers ARC, which has turned out to be the sole bidder for the portfolio. The US-based asset reconstruction company had in July this year emerged as the base bidder for the proposed sale of the identified stressed loan book of Yes Bank.

Meanwhile, the RBI has approved the appointment of its former deputy governor R Gandhi as non-executive part time chairman of Yes Bank for three years.

Central Bank of India: The RBI has taken the lender out of the prompt corrective action framework. The bank has provided a written commitment that it would comply with the norms of minimum regulatory capital, net NPA and leverage ratio on an ongoing basis and has apprised the RBI of the structural and systemic improvements that it has put in place which would help the bank in continuing to meet these commitments, RBI said in a statement.

NDTV: Promoters of the company Prannoy Roy and Radhika Roy as well as RRPR Holding have each filed a civil appeal in the Supreme Court against the SAT order, dated July 20, 2022, asking them to pay Rs 5 crore as penalty for the alleged non-disclosure of loan agreements entered by them.

Aditya Birla Fashion: The company board has approved allotment of 1.02 crore shares worth Rs 295 crore at Rs 288.75 apiece, and 6.58 crore warrants at Rs 288.75 per warrant amounting to Rs 1,900 crore to Caladium Investment.

Indian Hotels: The hospitality group has signed its second hotel in Dharamshala, Himachal Pradesh under the SeleQtions brand. A franchised hotel in management with Sohum Hotels and Resorts, the operational hotel will be rebranded under the IHCL SeleQtions brand.

SpiceJet: The budget carrier said it has asked 80 of its pilots to go on a three-month leave without pay to rationalise cost. The pilots who have been asked to go on leave without pay are from the airline’s Boeing and Bombardier fleet.

NBCC (India): The state-owned construction company said it has secured the total business of Rs 274.77 crore during August, according to its exchange filing.

Hi-Tech Pipes: The metal products company has announced resignation of RN Maloo as Chief Financial Officer. The company has relieved Maloo from his duties with effect from September 20.

Jai Corp: Pramod Kumar Jaiswal has tendered his resignation as Chief Financial Officer of the plastic products company due to personal reasons. Jaiswal will continue to hold his current position of CFO until October 31, 2022.

Premier Explosives: The company has received order for warheads manufacturing from Israel Aerospace Industries (IAI). The order is valued at around Rs 4.27 crore and ordered items are expected to be delivered by May 2023. The company also received order worth Rs 5.47 crore for production and supply of booster rocket motors, which is expected to be delivered by March 31, 2023.

Rhetan TMT: Clear Water Commodities bought 9.41% stake in the company through open market transactions. It acquired 7.5 lakh shares or about 3.53% stake on September 8, and 12.5 lakh shares or 5.88% stake on September 13.

Lykis: Vijay Kishanlal Kedia has sold 3.9 lakh equity shares or 2.02% stake in the company via open market transactions. With this, his shareholding in the company reduced to 3.95%, down from 5.97% earlier.

Niyogin Fintech: Alchemy India Long Term Fund sold 20.07 lakh shares or 2.13% stake in the company through open market transactions. With this, its shareholding in the company reduced to 0.82%, down from 3.29% earlier.