Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.25 per cent lower at 17,699, signalling that Dalal Street was headed for a negative start on Monday.

Most Asian shares were trading lower amid concerns that most major central banks are committed to raising interest rates to tame inflation. Japan’s Nikkei 225 index fell 0.43% and the Topix index dropped 0.18%. China’s Hang Seng rose 0.19% and the CSI 300 index advanced 0.64%.

The Indian rupee fell 10 paise to 79.78 against the US dollar on Friday.

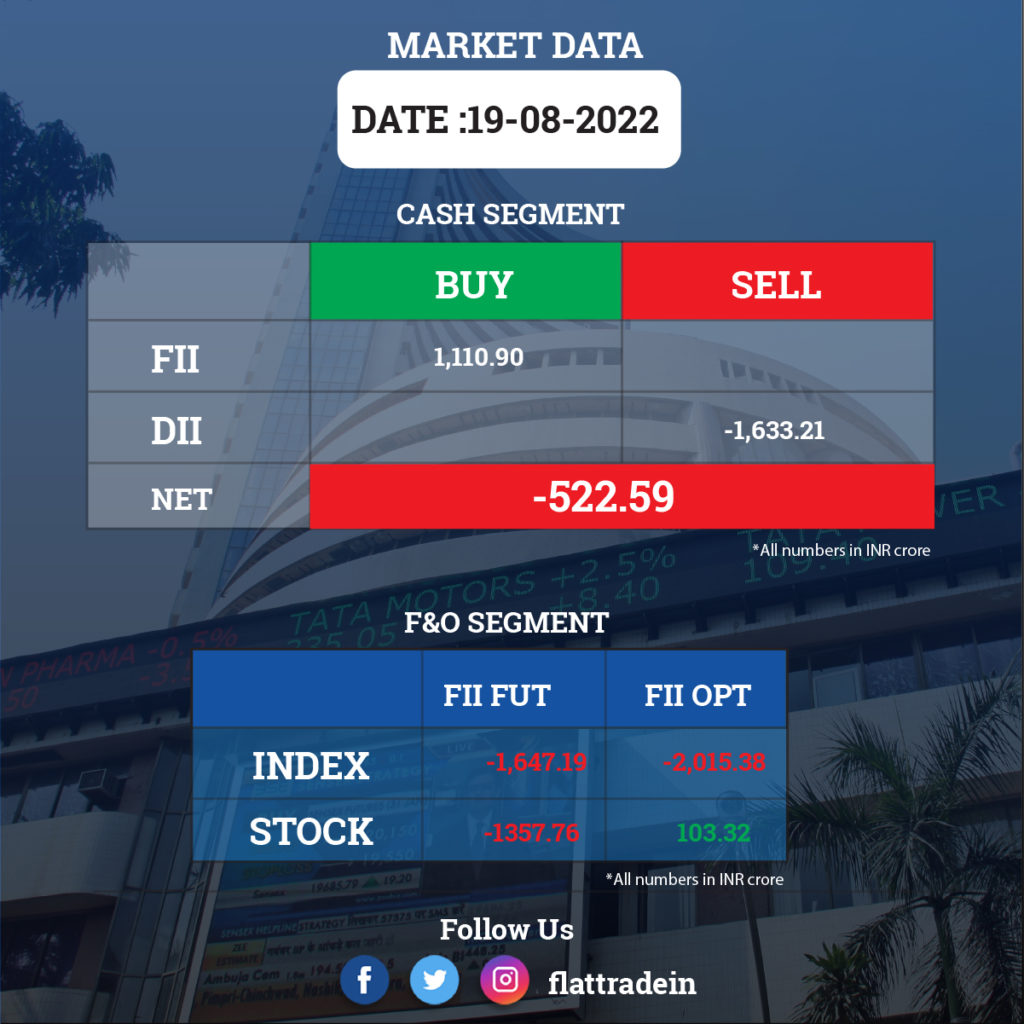

FII/DII Trading Data

Stocks in News Today

Adani Group: The group is likely to launch an open offer worth Rs 31,000 crore to acquire 26% stake each in Swiss firm Holcim’s two Indian listed entities Ambuja Cements and ACC, from public shareholders. Markets regulator Sebi granted approval for the open offer this week. In two separate regulatory filings, Ambuja Cements and ACC have submitted their letter of offers for the open offer launched by the Adani family group’s Mauritius-based firm Endeavour Trade and Investment.

One97 Communications (Paytm): Shareholders of the company have approved the re-appointment of Vijay Shekhar Sharma as managing director and chief executive officer of the company for another five years. About 99.67% voted in favour of Sharma’s re-appointment, while only 0.33% voted against the resolution.

Larsen & Toubro (L&T): The engineering behemoth commissioned a new green hydrogen plant at Hazira in Gujarat. The development comes five months after the company inked a joint venture with Indian Oil Corporation (IOC) and ReNew Power for the production of green hydrogen. L&T and IOC had also inked a separate joint venture for the production of electrolysers.

Adani Power: The company will acquire DB Power at an enterprise value of Rs 7,017 crore. The company owns and operates a running 2×600 MW thermal power plant at District Janjgir Champa in Chhattisgarh. With this acquisition, Adani Power will expand its offerings and operations in the thermal power sector in the state.

State Bank of India (SBI): The company has sold the non-performing loan account of KSK Mahanadi Power Company to Aditya Birla ARC for Rs 1,622 crore, taking a haircut of almost 58 per cent against the total outstanding. KSK Mahanadi Power Company had total loan outstanding of Rs 3,815.04 crore towards State Bank of India (SBI) as of April 2022.

Ashok Leyland: The bus and truck maker has unveiled the AVTR 4825 tipper equipped with a H6 engine aimed at serving the construction and mining segments, the company said. AVTR is the company’s first modular truck platform that offers a range of trucks in the 19-55 tonne gross vehicle of weight (GVW) portfolio and has a slew of cabin and load body options for customers based on their requirements.

Oil and Natural Gas Corporation (ONGC): The state-owned company is preparing for a record third interim chairman as no full-time head of India’s most profitable company has yet been selected in 17 months since the post fell vacant. Alka Mittal, Director for Human Resources, was given an additional charge as chairman and will superannuate at month-end. The next senior-most director, Rajesh Kumar Srivastava, Director (Exploration), is likely to be named as interim head.

Central Bank of India: The public sector lender under the RBI’s prompt corrective action (PCA) framework, may see an exit from restrictions soon following an improvement in its financial health. The bank has made a representation to the Reserve Bank of India (RBI) based on the improvement in financial parameters on a sustained basis for the past five quarters.

In other news, Central Bank of India has signed a pact with Protium Finance and lncred Financial Services to offer loans to MSME borrowers.

Wockhardt: The drug firm said it has tied up with various partners to roll out products in the US market with its Illinois-based manufacturing plant all set to relieve all workers in a phased manner as part of business restructuring in the US market. The company said it has engaged multiple US Food and Drug Administration (USFDA) approved manufacturing partners in the US market, after thorough due diligence and inspection of their facilities.

Computer Age Management Services (CAMS): The promoter entity divested a 3.79 per cent stake in the IT services company, garnering Rs 428 crore through an open market transaction. Great Terrain Investment offloaded a total of 18.55 lakh shares, amounting to a 3.79 per cent stake in the company, as per bulk deal data available with BSE.

Tejas Networks: The company has acquired the remaining 93,571 equity shares in Saankhya Labs at a price of Rs 454.19 a share by paying Rs 4.25 crore through secondary purchase. With this, Tejas has acquired 64.4% stake in Saankhya, for Rs 283.94 crore, on a fully diluted basis.

JSW Steel: The company has entered into a 50-50 joint venture agreement with National Steel Holding (NSHL) for establishing scrap shredding facilities in India. NSHL is engaged in metal recycling, collection and processing business in Auckland, New Zealand. With this, the company plans to reduce its carbon footprint by achieving 42% reduction in CO2 emissions intensity by FY30 from the base year of 2005.