Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.32% higher at 17,435.5, signalling that Dalal Street was headed for a positive start on Tuesday.

Japanese shares market rebounded with the Nikkei 225 index rising 1.02% and the Topix rose 1.15%. Chinese stocks were trading lower due to subdued sentiments. Hang Seng fell 1.65% and CSI 300 index was down 0.68%.

The Indian rupee fell 10 paise to 79.96 against the US dollar on Monday.

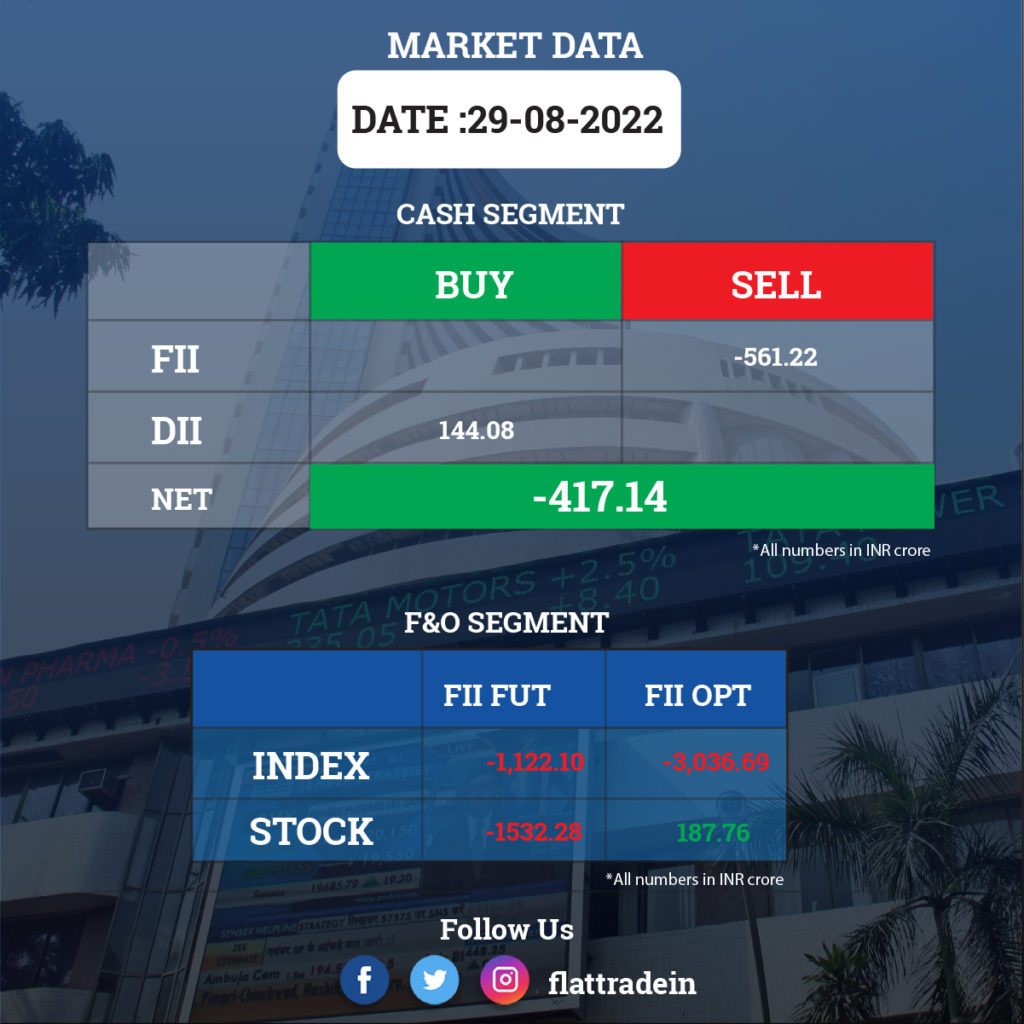

FII/DII Trading Data

Stocks in News Today

Reliance Industries Ltd (RIL): The company’s Chairman and Managing Director, Mukesh Ambani, announced investment plans to the tune of Rs 3.5 trillion at the 45th annual general meeting of the company. Ambani said investment plans include Rs 2 trillion on rapid rollout of 5G, Rs 75,000 crore in expanding oil-to-chemicals capacities across value chains and Rs 75,000 crore in new energy business, as announced last year, with potential to double the commitment based on scalability of evolving models.

Adani Enterprises and NDTV: Adani Group and NDTV’s promoter entity RRPR Holding have approached the market regulator, SEBI, seeking clarity regarding the conversion of warrants into shares, which is an important factor in the hostile takeover bid. RRPR Holding have claimed that the deal cannot go ahead without Sebi’s nod.

Bharat Petroleum Corporation (BPCL): The oil refiner plans to scale up its renewable energy portfolio to 10 GW by 2040, which is also the year the company aims to become net-zero carbon emitter, chairman Arun Kumar Singh said. Addressing the company’s annual shareholders’ meeting, Singh said BPCL is diversifying and expanding into adjacent and alternate businesses, which will not only provide additional revenue streams but also offer a hedge against any decline in the oil and gas business.

Vodafone Idea (VIL): The debt-ridden telecom operator’s 5G services launch will depend on several factors such as use cases, customer demand, competitive dynamics etc., a senior official of the company said. While addressing the 27th annual general meeting, VI Managing Director and CEO Ravinder Takker said that the promoters of the company have invested Rs 4,940 crore and the company is in active discussion with investors for raising funds.

ICRA: The company’s board approved the appointment of Venkatesh Viswanathan as a Group Chief Financial Officer and key managerial personnel. His appointment is effective from August 30, 2022, and the company also designated him as Chief Investor Relations Officer. Meanwhile, Amit Kumar Gupta has stepped down as Chief Financial Officer.

Orient Cement: Franklin Templeton Mutual Fund sold 1.52 lakh equity shares or 0.07% stake in the cement company on August 26. With this, the mutual fund house has reduced its stake in the said company to 3.12%, down from 3.2% earlier.

Krishna Institute of Medical Sciences: The company has entered into a definitive agreement to acquire a majority stake of 51% in SPANV Medisearch Lifesciences, Nagpur. SPANV is running a multi-speciality hospital – Kingsway Hospitals, having over 300+ beds. Existing promoters and shareholders will continue to hold the balance 49% stake. Post-acquisition, the hospital will be renamed ‘KIMS Kingsway Hospitals’.

Ugro Capital: The company said the Board of Directors has made an allotment of 50,000 non-convertible debentures having a face value of Rs 10,000 each, through private placement. The tenure of instrument is 24 months from the date of allotment and the coupon rate is 10.35 percent per annum.

BC Power Controls: The company has received board approval for the issuance of 1.1 crore equity shares, on a preferential basis, to the promoter group category at a price of Rs 5.65 per share. The total fundraising was Rs 6.21 crore.

Thyrocare Technologies: Fundsmith Emerging Equities Trust Plc sold 3,20,000 shares on BSE and 2,68,707 shares on NSE, amounting to a 1.1 per cent stake in the company, as per the bulk deal data available with the exchanges. The toal amount through the open market transaction was Rs 36 crore.

India Grid Trust: The company appointed Harsh Shah as the Chief Executive Officer for a term of five years starting August 30.