Market Opening - An Overview

Nifty futures on the Singapore Exchange traded were trading 0.08% lower at 18,656.50, signalling that Dalal Street was headed for a muted start on Thursday.

Most Asian shares were trading lower, tracking a fall on Wall Street, on recession fears. The Nikkei 225 index fell 0.79% and the Topix index was down 0.695. The Hang Seng index advanced 1.69% and the CSI 300 index dropped 0.28%.

Indian rupee fell 13 paise to 82.48 against the US dollar on Wednesday.

Dharmaj Crop Guard, an agrochemical company, will make its stock market debut on Thursday. Its IPO was subscribed 35.5 times and the price band was fixed at Rs 216-237 apiece.

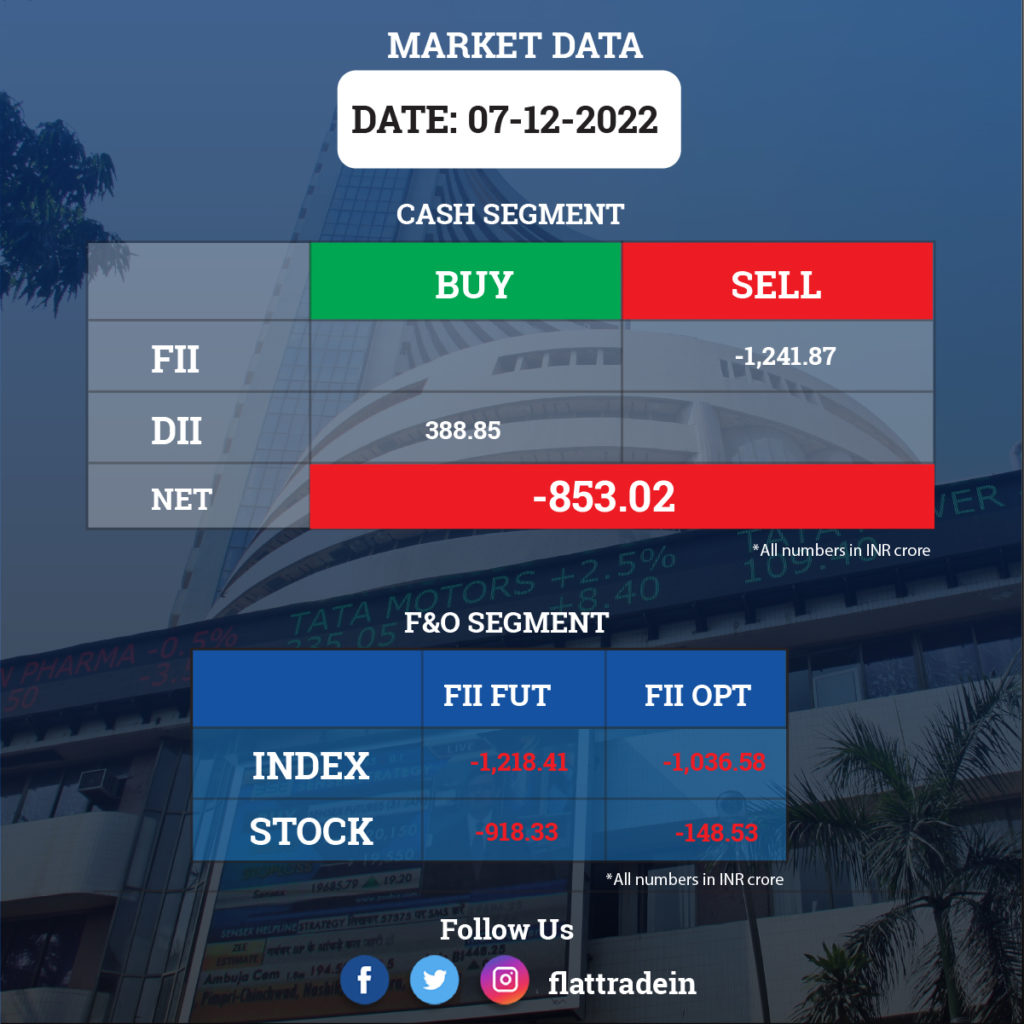

FII/DII Trading Data

Stocks in News Today

Infosys: The IT services company commenced its fourth share buy-back amounting to Rs 9,300 crore. The buy-back will be at a price not greater than Rs 1,850 per equity share having a face value of Rs 5 each through the open market route. The company will be utilising at least 50% of the maximum amount fixed for the buyback i.e. Rs 4,650 crore.

Tech Mahindra: The IT company announced the launch of Cloud BlazeTech, an integrated, sector-agnostic platform, to maximise business value for cloud-powered enterprises globally. The company will continue to invest in cloud services to boost digital transformation for enterprises.

Eicher Motors: The company said its new assembly facility in Brazil has commenced operations. The completely knocked down plant is an important step forward in the company’s plans in Latin America and reiterates the brand’s commitment to the region.

IDFC First Bank: The private lender and NASSCOM Centre of Excellence have partnered to grow the innovation ecosystem and guide startups through a range of banking solutions. A Memorandum of Understanding was signed between the two organisations and IDFC First Bank will be the preferred banking partner for startups in Bengaluru.

Inox Wind: The company allotted 0.01% non-convertible, non-cumulative, participating, redeemable preference shares of Rs 10 each on a private placement basis to Inox Leasing and Finance Limited, the holding company for a cash consideration of Rs 600 crore. The company repaid Gujarat Fluorochemicals Rs 623 crore against advances.

Eveready Industries: The company has appointed Bibek Agarwala as the new CFO w.e.f. February 14, 2023. He will replace Indranil Roy Chowdhury and Bibhu Ranjan Saha, who had earlier been designated as Joint Chief Financial Officers of the company.

Metro Brands: The company completed the 100% acquisition of Cravatex Brands. Cravatex is engaged in the business of importing, trading, selling, marketing, advertising, retailing and distributing footwear, apparel and accessories under various brands including ‘FILA’ and ‘Proline’.

VA Tech Wabag: The company appointed Pankaj Malhan as Deputy MD and Group CEO, effective December 7. The company also re-designated Rajiv Mittal as Chairman and Managing Director effective December 07.

Macrotech Developers: The company has fixed QIP offer floor price at Rs 1,022.75 per share. The company and the selling shareholders may offer a discount of not more than 5% on the floor price. The relevant date for the purpose of the offer is fixed as December 7.

HCLTech: The IT company has teamed up with Intel and Mavenir to Deliver Critical 5G Enterprise Technology Solutions. With this partnership, the companies will work closely on a wide range of projects and activities across enablement, go-to-market and sales acceleration, with the goal of delivering more 5G solutions to CSPs, IoT and enterprise verticals.

IL&FS Transportation: The company will sell its 50% stake in the joint venture Hazaribagh Ranchi Expressway Limited (HREL). It assigned road JV receivables amounting to Rs 40 crore to Roadstar Infra Investment Trust

Lumax Industries: The company will set up a new greenfield project at Chakan, Pune involving a capex of Rs 175 crore for phase 1. The project will service the orders received from OEMs for advanced lighting solutions. The project is expected to be commissioned by Q2FY24 and will be financed by a mix of debt and internal accruals. The company may also avail long-term credit facilities for this project.

Triveni Engineering & Industries: The company’s promoter Dhruv Sawhney is likely to sell a 7.03% stake (about 1.7 crore shares) via block deals on December 8, CNBC Awaaz reported citing sources. The promoter is aiming to sell shares worth Rs 500 crore at Rs 280-Rs 285 per share, which is about 3%-4% discount from its current share price of Rs 294.85 apiece.

Bank of Maharashtra: The state-owned bank said it has raised Rs 348 crore from bonds to fund business growth. The lender raised the funds through private placement of Basel-III compliant tier II bonds. The bond has a face value Rs 1 crore each and carries a coupon rate of 8 per cent, it added. The bonds will be listed on the Wholesale Debt Market segment of the BSE.

Mahindra Logistics: The logistics solutions provider incorporated MLL Global Logistics as wholly-owned subsidiary in the UK on December 6 and it wil carry out the business of logistics, supply chain management including freight forwarding and air charter business across geographies.

PTC India: The power trading solution provider reported 29% dip in consolidated net profit at Rs 138.23 crore for September quarter of FY23 as against a net profit of Rs 195.48 crore in the year-ago period.

Matrimony.com: The company expanded its service offerings by launching a mobile application, unveiling Jodii, ‘for corporates’ that would benefit working professionals. The corporate services would help the employees of select organisations to have unlimited premium access to member profiles.