Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% higher at 17,517, signalling that Dalal Street may open marginally higher.

Japanese markets were trading higher, tracking gains in Wall Street overnight after Corporate America posted strong results. The Nikkei 225 index was up 0.72% and the Topix index gained 0.41%. Meanwhile, Chinese markets were trading lower as CSI 300 index was down 0.51% and Hang Seng fell 0.7%.

Indian rupee ended at 82.36 against the US dollar on Tuesday.

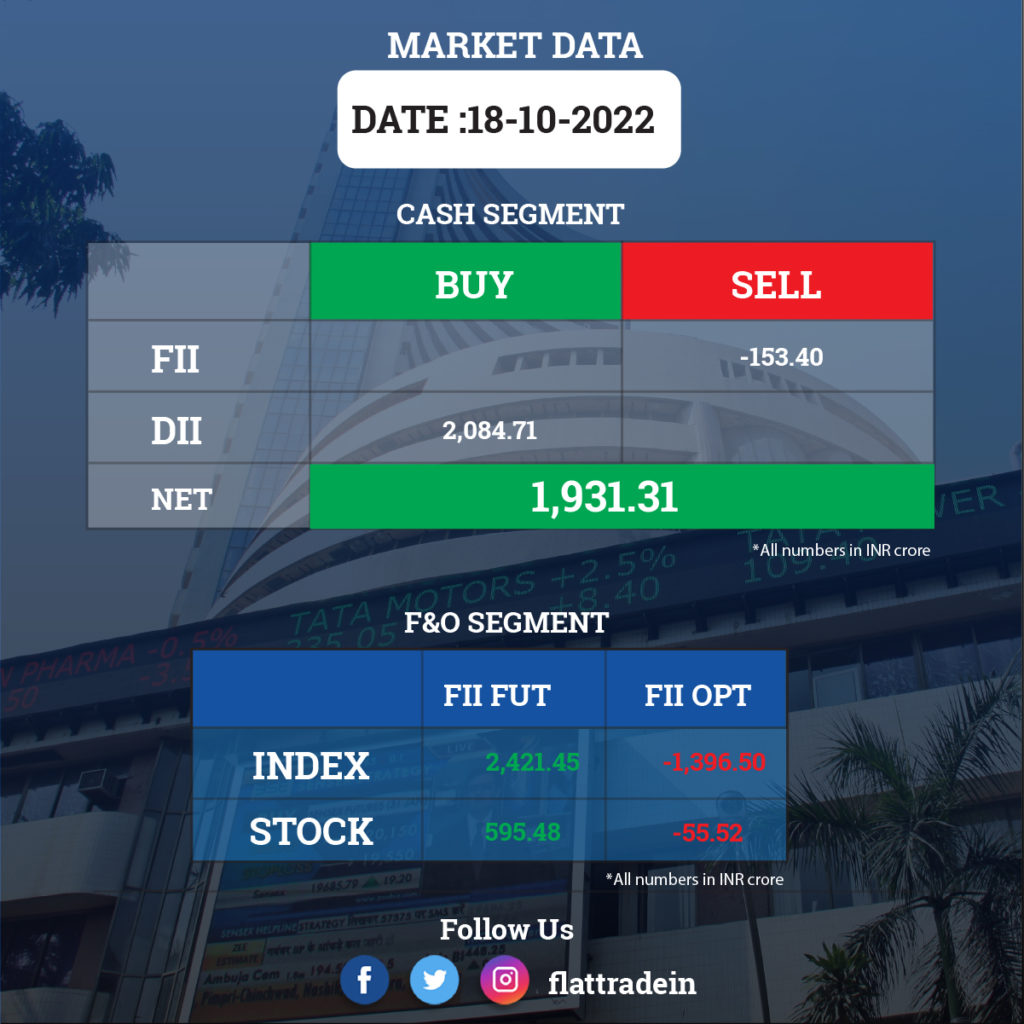

FII/DII Trading Data

Upcoming Results

IndusInd Bank, UltraTech Cement, HDFC Asset Management Company, Nestle India, 5paisa Capital, AU Small Finance Bank, CG Power and Industrial Solutions, Havells India, Home First Finance Company India, Inox Leisure, Metro Brands, Max Financial Services, Nippon Life India Asset Management, Navin Fluorine International, Persistent Systems, Shoppers Stop, and Syngene International will report their results on October 19.

Stocks in News Today

L&T Technology Services (LTTS): The IT company posted a 22.7% growth in consolidated net profit to Rs 282.4 crore for the second quarter ended September 2022. The company had reported a net profit of Rs 230 crore in the same period a year ago. The consolidated revenue from operations grew 24% to Rs 1,995 crore from Rs 1,607.7 crore in the September 2021 quarter. The IT firm won over $60 million plus deals. Revenue in dollar terms increased by 13.6% YoY to $247.1 million and revenue growth in constant currency was 18% YoY. The company also achieved annualised revenue run-rate of $1 billion in constant currency terms.

ICICI Lombard General Insurance Company: The company reported a 32.2% year-on-year growth in profit after tax at Rs 590.5 crore for Q2FY23. It had posted a PAT of Rs 447 crore in the year-ago period. Net premium earned jumped 18% to Rs 3,836.55 crore compared to the corresponding period last fiscal. The company has declared an interim dividend of Rs 4.50 per share for the financial year ended March 2023.

Tech Mahindra: The IT services company announced that it will be hiring 3,000 people in Gujarat over the next five years. It signed a Memorandum of Understanding (MoU) with the Government of Gujarat under its IT/ITeS (IT enabled services) policy on Tuesday. The collaboration is expected to drive technology-led transformation across industries including digital engineering, the company said.

Reliance Jio: The private telecom operator has surpassed state-run BSNL in August to become the largest fixed-line service provider in the country, according to a Trai report released on Tuesday. According to Trai’s subscriber report for August, Jio’s wireline subscriber base reached 73.52 lakh while that of BSNL was at 71.32 lakh. The wireline subscribers in the country grew to 2.59 crore in August from 2.56 crore in July. The growth was dominated by the private sector, with Jio adding 2.62 lakh new customers, Bharti Airtel 1.19 lakh, Vodafone Idea (Vi) 4,202 and Tata Teleservices 3,769. State-run telecom firms BSNL and MTNL lost 15,734 and 13,395 wireline customers, respectively, in August.

Tata Motors: The commercial vehicles manufacturer said it has received an order for 200 electric buses which will be deployed in Jammu and Srinagar. The auto major won the tender of 200 electric buses floated by Jammu Smart City. The automaker will supply 150 units of 9-metre and 50 units of 12-metre Starbus electric buses, it added. As part of the contract, Tata Motors will operate and maintain the buses for a period of 12 years.

Adani Enterprises: Adani Defence & Aerospace, a subsidiary of Adani Group, has decided to acquire Air Works for an enterprise value of Rs 400 crore. Adani Defence Systems & Technologies has signed definitive agreements for the acquisition of Air Works, the biggest and highly diversified independent MRO with the largest pan-India network presence across 27 cities.

ITC: The FMCG company has entered into an agreement to acquire additional 1000 compulsorily convertible preference shares of Mother Sparsh. With this acquisition, the company’s shareholding in Mother Sparsh will increase to 22%.

Network 18 Media and Investments: Network18 reported a 12 percent year-on-year rise in its consolidated operating revenue for the quarter ended September 2022 driven by its entertainment vertical. Consolidated operating revenue for Q2FY23 was Rs 1,549 crore and that for Q2FY22 was Rs 1,387 crore, according to a statement released by the company. Revenue growth continued to be impeded by macro factors, impacting profitability, the statement said. The network’s consolidated operating EBITDA decreased by 87 percent YoY to Rs 32 crore in Q2FY23 from Rs 253 crore in Q2FY22.

TV18 Broadcast: The company reported a 95.55% decline in its consolidated net profit to Rs 10.28 crore for the second quarter ended September 30, 2022. The company had posted a net profit of Rs 231.40 crore for the July-September period of the previous fiscal, TV18 Broadcast said in a regulatory filing. However, its consolidated revenue from operations rose by 12.65% to Rs 1,473.43 crore compared to Rs 1,307.90 crore in the corresponding quarter a year ago. Total expenses were at Rs 1,485.95 crore, up 34.59% from Rs 1,104 crore in the year-ago period.

Mahindra CIE Automotive: The auto ancillary company has recorded a 3 percent year-on-year growth in consolidated profit at Rs 171.4 crore for the quarter ended September FY23 supported by topline and other income, but dented by higher tax cost. Revenue grew by 30 percent to Rs 2,723 crore compared to the corresponding period last fiscal.

HFCL: The telecom equipment manufacturer posted a consolidated net profit of Rs 84.31 crore for the quarter ended September 30, 2022, according to its exchange filing. It had posted a net profit of Rs 85.94 crore in the same period a year ago. Its consolidated revenue from operations declined by about 6% to Rs 1,051 crore compared to Rs 1,122 crore in the year-ago period.

Samvardhana Motherson International: Sojitz Corporation divested 2.83% stake in auto component major for Rs 825 crore through an open market transaction. According to the bulk deal data available with the BSE, Sojitz Corporation offloaded 12,80,00,000 shares, amounting to 2.83% stake in the company. The shares were disposed of at an average price of Rs 64.53 apiece, taking the transaction value to Rs 825.98 crore.

Tinplate Company of India: The company posted a loss of Rs 35.1 crore for Q2FY23, against a profit of Rs 75 crore in the year-ago period impacted by an increase in inventories and other expenses and lower topline. Revenue declined nearly 2 percent YoY to Rs 959.55 crore for the quarter ended September FY23.

Suven Life Sciences: The board approved the upcoming rights issue opening date as October 31 (Monday) and November 10 (Thursday) as closing date.

KPI Green Energy: The renewable energy player posted a jump of over 72% in its consolidated net profit to Rs 21.15 crore in the September quarter helped by higher revenues. The consolidated net profit of the company was Rs 12.25 crore in the year-ago period. Its consolidated revenue from operations rose to Rs 159.84 crore, as agaisnt Rs 57.43 crore in the same period last year.

Prestige Estates Projects: The company recorded quarterly sales of Rs 3,511 crore, up 66% YoY and 17% QOQ. Its collections stood at Rs 2,603 crore during Q2FY23, up 68% YoY and 21% QOQ, according to its exchange filing.