Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.01% higher at 17,844.5, signalling that Dalal Street was headed for a muted start on Monday.

Asian share markets rose as investor sentiments were boosted by gains made on Wall Street overnight ahead of the US inflation numbers. Japan’s Nikkei 225 index was up 1.13%, Topix rose 0.66%. China’s Hang Seng jumped 2.69% and CSI 300 index gained 1.39%.

The Indian rupee appreciated 13 paise to 79.58 against the US dollar on Friday.

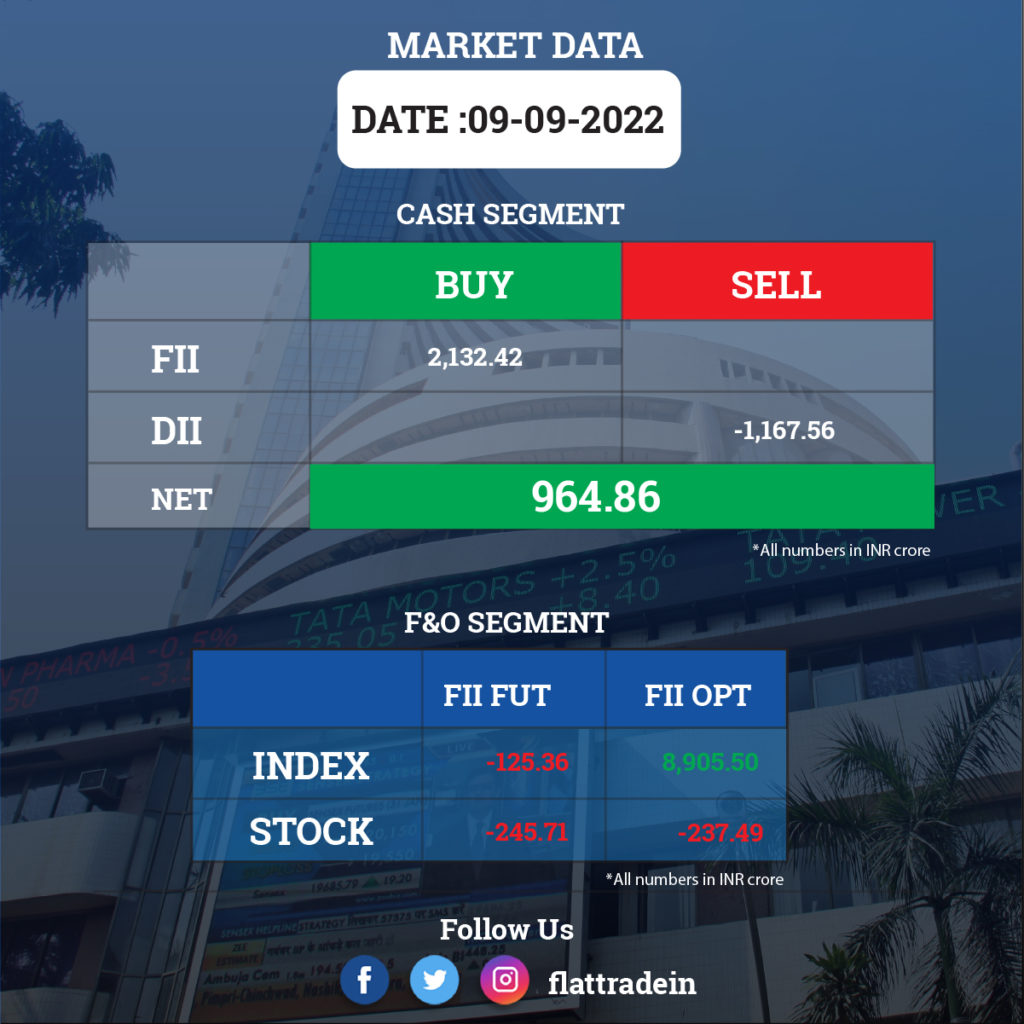

FII/DII Trading Data

Stocks in News Today

Reliance Industries Ltd (RIL): The company’s subsidiary, Reliance Petroleum Retail, said that it has acquired the polyester business of Shubhalakshmi Polyesters (SPL) and Shubhlaxmi Polytex for Rs 1,522 crore and Rs 70 crore, respectively, in cash. The acquisitions are subject to approval by the Competition Commission of India (CCI) and the respective lenders of SPL and Shubhlaxmi Polytex.

Reliance Infrastructure and Adani Transmission: Reliance Infrastructure said that it has filed an arbitration claim of Rs 13,400 crore with respect to a deal to sell its Mumbai power-distribution business to Adani Transmission, Bloomberg reported. Reliance Infrastructure cited a breach in the terms of a December 2017 agreement, and filed its statement of claim before the Mumbai Centre for International Arbitration, according to a stock exchange filing.

Mahindra & Mahindra (M&M): The company is lining up new products and investments as the company is very optimistic about gradual evolution of electric vehicle penetration in the country over the next few years. The automajor expects transition towards electric mobility to happen step wise with fleet and sports utility segments expected to lead the transformation in the domestic market, according to a senior company official.

SpiceJet: The company has appointed Ashish Kumar as its new Chief Financial Officer. Kumar has served as Vice President (Head) – Corporate Finance at Interglobe Enterprises since January 2019. Earlier, he also served as CFO at Interglobe Hotels from 2014 to 2018.

Mahindra Lifespace Developers: The realty firm is looking to acquire a few land parcels this fiscal to build housing projects with sales potential of Rs 3,000-4,000 crore, a top company official said. The company will acquire these land parcels either through outright purchase or by forming Joint Development Agreements (JDAs) with landowners. The company is looking at three cities – Mumbai, Pune and Bengaluru – for business expansion.

Titagarh Wagons: The Italian government and a UAE-based private equity firm have together picked up almost 44% stake in Titagarh Wagons’ fully-owned subsidiary Firema SpA, a top company official said. The company saw a recapitalisation of Euro 20 million through fresh equity infusion, raising the total capital to Euro 33 million, according to sources.

H G Infra Engineering: The company’s subsidiary, H G Ateli Narnaul Highway, has received the completion certificate for its road project in Haryana. With this, the project has been declared fit for commercial operations.

Ujjivan Small Finance Bank: The lender has issued non-convertible debentures of Rs 75 crore and the coupon rate is 11.95%. The redemption date for the NCDs is April 26, 2028.

Gujarat Industries Power and KEC International: The company said that its board of directors had approved the award of an EPC contract worth Rs 244 crore to KEC International. The contract is for a 400/33 KV pooling sub-station, 1,200 MW of solar, wind, and hybrid power, and a renewable energy park of 2,375 MW capacity in Gujarat.

Oberoi Realty: The company has approved scheme of amalgamation of its four subsidiary companies – Oberoi Constructions, Oberoi Mall, Evenstar Hotels and Incline Realty. The company said the move is to create a simplified structure with greater management focus.

IRB InvIT Fund: The fund is set to acquire the Vadodara Kim Expressway HAM project in Gujarat from its sponsors IRB Infrastructure Developers, at an enterprise value of Rs 1,297 crore and equity value of Rs 342 crore. The acquisition is likely to be completed by October 2022.

Oil and Natural Gas Corporation: The state-owned company has signed six contracts for Discovered Small Fields (DSF) in the offshore under DSF-III bid round, with three each for fields in the Arabian Sea and Bay of Bengal. It is planning an investment of $1894.5 million towards development in the six DSF-III blocks. The PSU also signed two contracts for fields under special CBM Bid round-2021 blocks in Jharkhand and Madhya Pradesh, and plans to invest $5.94 million in these two fields.

Anupam Rasayan India: In an exchange filing, the company said that there was a fire incident at its Unit-6 of Sachin GIDC plant in Surat on September 10. According to the filing, four people have died and 20 people have been injured in the fire incident.

Orient Tradelink: Story Mirror Infotech, a literature technology platform, has signed up six book publishing deals with Orient Tradelink. With this deal, Story Mirror expects a revenue of Rs 5 crore in the next few years.