Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.09% higher at 17,805.50, signaling that Dalal Street was headed for a positive start on Tuesday.

Japanese shares were trading higher, tracking Wall Street overnight, boosted by investor optimism ahead of the US CPI inflation data. The Nikkei 225 index was up 0.56% and the Topix rose 0.59%. Chinese markets were lower with the CSI 300 falling 0.32% and the Hang Seng down 0.24%.

Indian rupee fell 22 paise to 82.72 against the US dollar on Monday.

India’s headline retail inflation rate jumped to a three-month high of 6.52% in January from December’s one-year low of 5.72%, data from the Ministry of Statistics and Programme Implementation showed. The rise in headline inflation in January was led by food components, whose inflation shot up to 5.94% from 4.19% in December. On the whole, the food index of the CPI rose 0.3% month-on-month in January, while the overall general index of the CPI was up 0.5% from December.

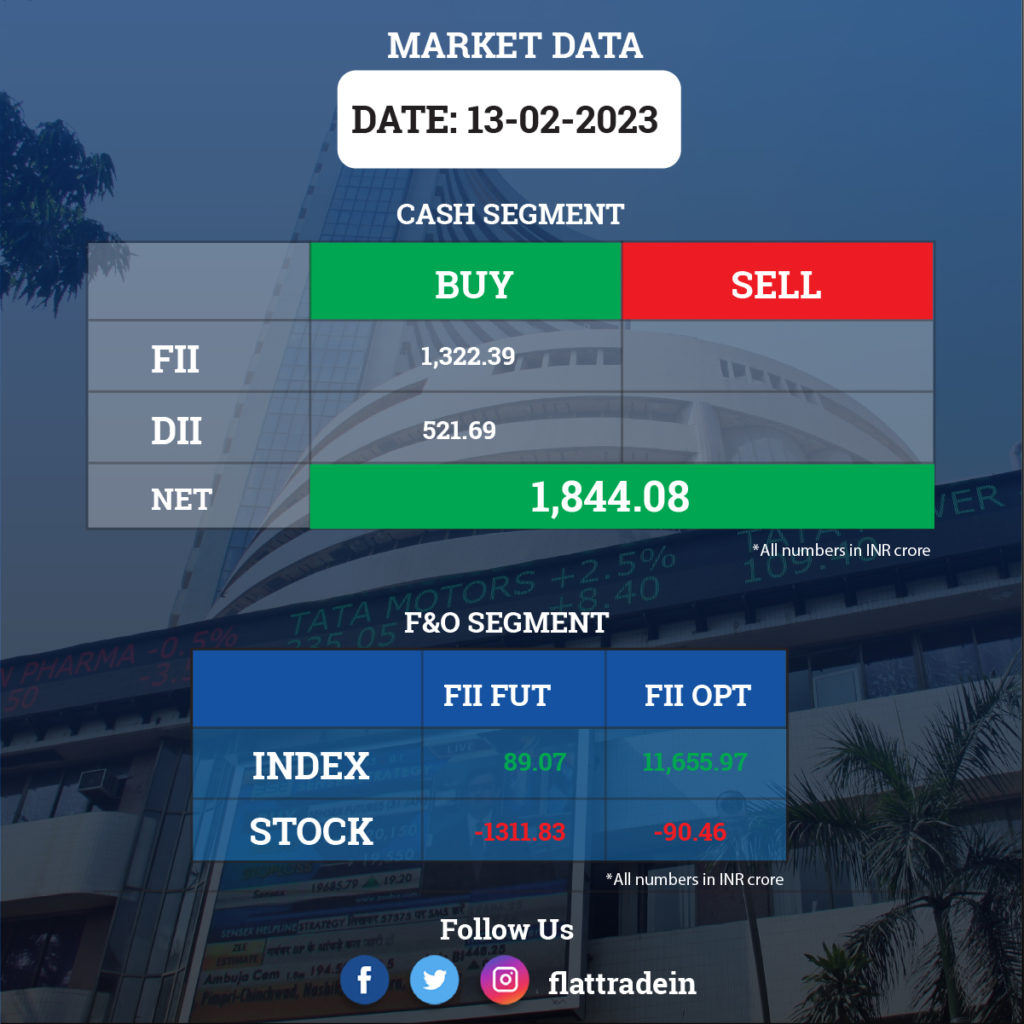

FII/DII Trading Data

Upcoming Results

Adani Enterprises, Grasim Industries, ONGC, Apollo Hospitals Enterprises, Eicher Motors, Aster DM Healthcare, Bata India, Bharat Forge, Biocon, Bosch, CESC, GMR Airports Infrastructure, Indiabulls Housing Finance, Ipca Laboratories, NBCC (India), NMDC, PI Industries, PNC Infratech, Prestige Estates Projects, Radico Khaitan, Siemens, Spencers Retail, SpiceJet, Swan Energy, and Torrent Power will report quarterly earnings on February 14.

Stocks in News Today

Steel Authority of India (SAIL): The steel production company has registered a 64.5% YoY decline in net profit at Rs 542 crore for the quarter ended December FY23. Revenue for the quarter at Rs 25,042 crore fell by 0.8% compared to the same period last year. At the operating level, EBITDA for the quarter dropped by 39% YoY to Rs 2,078.5 crore with its margin down by 517 bps.

FSN E-Commerce Ventures (Nykaa): The retailer has recorded a 71% year-on-year decline in consolidated profit at Rs 8.2 crore for the quarter ended December FY23, impacted by weak operating margin performance. Revenue from operations grew by 33.2% YoY to Rs 1,463 crore with strong gross merchandise value growth of 37% YoY. EBITDA rose by 13.3% YoY, but EBITDA margin fell 94 bps to 5.34% for the quarter.

Zee Entertainment Enterprises (ZEEL): The media company has reported a 92% YoY decline in consolidated profit at Rs 24.31 crore for the quarter ended December FY23, weighed by lower sales and exceptional loss of Rs 168.97 crore. Consolidated revenue from operations was at Rs 2,111.2 crore, a decline of 0.07% compared to the year-ago period hit by lower advertisement revenue (down 15.6% YoY). Its subscription revenue growth was strong at 13.2% in the same period. On the operating front, EBITDA fell by 27.5% YoY to Rs 343.8 crore with a margin decline of 615 bps in Q3FY23.

YES Bank: The lender has moved the Supreme Court against the Bombay High Court (HC) order setting aside the lender’s decision to write off additional tier 1 (AT1) bonds worth over Rs 8,400 crore. The HC had given the bank six weeks’ time to challenge the order in the apex court. The hearing of which is likely to start by next week

IRB Infrastructure Developers: The company reported a 94.49% jump in its consolidated net profit to Rs 141.35 crore for the quarter ended December 31, 2022. The company had registered a net profit of Rs 72.68 crore during the year-ago quarter, IRB Infrastructure Developers said. Its total income during October-December 2022 rose to Rs 1,570 crore, from Rs 1,497.78 crore in the year-ago period.

Power Finance Corporation: The public sector company recorded a 7.8% YoY rise in consolidated profit at Rs 3,860 crore for the three-month period ended December 2022. Net interest income for the reported quarter was at Rs 7,218.7 crore, down by 7.1% compared to the year-ago period. The board has declared an interim dividend of Rs 3.50 per share for FY23.

NLC India: The coal mining company has posted a consolidated loss of Rs 406.7 crore for the December FY23 quarter dented by regulatory deferral account balances expenses, against a profit of Rs 231.1 crore in the year-ago period. Consolidated revenue for the quarter was at Rs 3,679 crore jumped 35% over a year-ago period. On the operating front, EBITDA grew by 50.4% YoY to Rs 1,360 crore with a margin expansion of 387 bps for the quarter.

Linde India: The industrial gases company has reported a 62.3% YoY growth in consolidated profit at Rs 110 crore for the quarter ended December FY23, led by operating performance and partly by a low base. In Q3FY22, it had an exceptional loss of Rs 18.97 crore. Revenue for the quarter grew by 8.2% YoY to Rs 697 crore, while on the operating front, EBITDA jumped 13.4 percent YoY to Rs 167.8 crore with a margin expansion of 110 bps YoY.

Castrol India: The automotive and industrial lubricant manufacturing company has clocked a 2.5% year-on-year growth in profit at Rs 193.32 crore for the December FY23 quarter dented by weak operating performance. Revenue for the quarter at Rs 1,176 crore grew by 7.8% YoY. At the operating level, EBITDA fell by 5.8% YoY to Rs 250.6 crore with a margin contraction of 307 bps due to higher input cost.

IndiGo: The company has restored annual increments for more than 4,500 pilots as a financial turnaround helped the airline make a profit in Q3FY23 after three quarters of loss. An email from the airline’s management last week informed pilots of the restoration from April.

Brigade Enterprises: The realty firm has sold housing and commercial properties worth Rs 2,618.5 crore during the first three quarters of 2022-23 fiscal, up 31% from the year-ago period, on better demand and higher price realisation. Its sales bookings stood at Rs 1,994.8 crore in the year-ago period. In volume terms, the sales bookings rose 25% to 39,58,000 square feet during the April-December period of 2022-23 fiscal from 31,68,000 square feet in the corresponding period of the previous fiscal. The average sales realisation grew 5 per cent to Rs 6,616 per square feet from Rs 6,298 per square feet.

Landmark Cars: The company reported a 37% jump in quarterly profit in its first earnings report since going public, driven by the strong demand for premium cars. The company’s consolidated net profit for the three months ended December 2022 rose to Rs 25.9 crore from Rs 18.93 crore a year earlier. It registered a 4.66% increase in revenue from operations to Rs 876 crore.

GMR Power And Urban Infra: The company reported its consolidated net profit at Rs 360.53 crore in the quarter ended December 31, 2022. The company had posted a consolidated net loss of Rs 558.41 crore in the corresponding quarter of previous fiscal. The company’s consolidated income during October-December period increased to Rs 1,503.56 crore from Rs 1,006.93 crore in the year-ago period.

Jaypee Infratech: The company which is undergoing insolvency resolution reported widening of its consolidated net loss to Rs 601.24 crore for the third quarter of this fiscal. Its net loss at stood Rs 540.03 crore in the year-ago period. Total income rose to Rs 312.66 crore in the December quarter of this fiscal from Rs 294.76 crore earlier.

MapmyIndia: The company said it has bought a 20% stake in drone start-up Indrones Solutions for Rs 7 crore, saying the investment will be used to offer high-definition 3D maps. The Delhi-based company further said its investment will help Indrones in offering “industry-leading” drones and solutions to large base of enterprise customers across industry verticals as well as consumers.

Chemplast Sanmar: The company plans to invest about Rs 680 crore for expansion of its Custom Manufactured Chemicals (CMC) Division near Hosur in Tamil Nadu. The company said that the phase-1 of multi-purpose custom manufacturing block is likely to be finished by the second quarter of FY24.