Market Opening - An Overview

GIFT Nifty Futures on the NSE IX traded marginally higher by 0.02% at 19609, signalling that Dalal Street was headed for muted start on Friday.

Asian shares were mixed as investors awaited the US payrolls data for clues related to interest rate outlook. The Nikkei 225 fell 0.25% and the Topix was up 0.2%. The Hang Seng jumped 2.12%.

The Indian rupee ended at 83.25 against the US dollar on Thursday as against its previous close of 83.24.

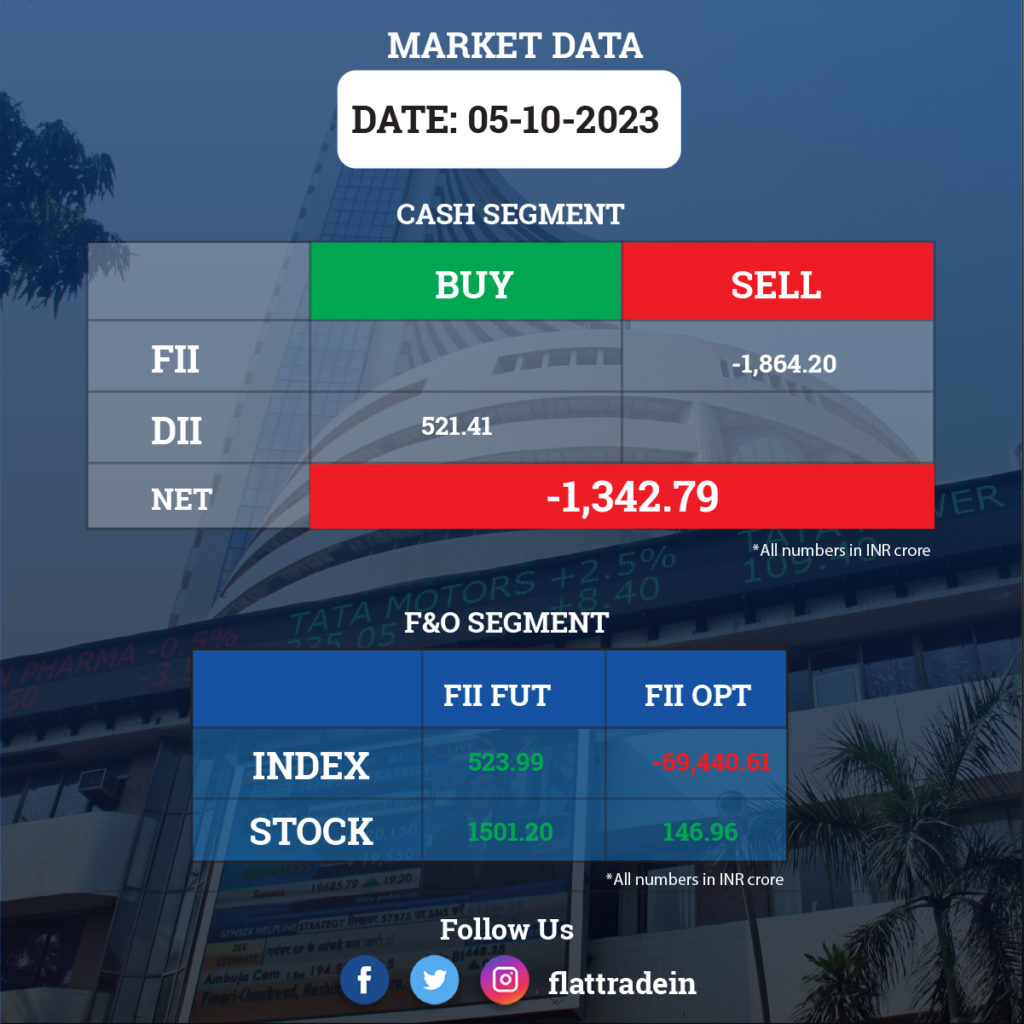

FII/DII Trading Data

Stocks in News Today

Tata Motors: The company said wholesales in Q2FY24 were 96,817 units, up 29% YoY and wholesales for the first half of FY24 were 190,070 units, up 29% YoY. Retail sales in Q2FY24 were 106,561, up 21% YOY and retail sales in H1 FY24 were 208,555 units, up 25% YoY. Order book remained strong at 168,000 units, reducing in line with the fulfilment of client orders, with demand for most profitable Range Rover, Range Rover Sport and Defender models accounting for 77% of the orders. JLR presently expects positive free cash flow of around £300 million in Q2FY24.

InterGlobe Aviation (IndiGo): The airline said that it is introducing fuel charge on domestic and international routes, effective October 6 to offset rising Aviation Turbine Fuel (ATF) prices. The fuel charge would be in the range of Rs 300 to Rs 1000 based on the distance and route.

Sun Pharma: The drugmaker has decided to acquire a 37.76% stake in Ezerx Health Tech Private Limited for Rs 29 crore. Ezerx is engaged in the business of production, marketing and distribution of non-invasive diagnostic and ancillary medical device.

Adani Wilmar: The company said it has delivered strong volume growth in double-digits, on the back of large opportunity in packaged staple foods and strong execution. Rural sales have been growing at a faster rate due to higher focus on increasing the rural distribution network. While the volume growth was strong, the sales value decline on a YoY basis is reflective of the sharp fall in global edible oil prices.

Bharat Heavy Electricals Limited (BHEL): The company said that it has received two awards in arbitration proceedings against Jaiprakash Power Ventures in two different cases. Separately, BHEL has paid a final dividend of Rs 88 crore for the year 2022-23 to the Government of India.

Godrej Consumer: The company said witnessed weak macros and adverse weather conditions during the quarter in India. Its organic business delivered steady performance with mid-single digit volume growth. Overall, Home Care volumes grew in mid-single digit while Personal Care grew in low-single digit. Its Indonesia business continued to deliver improving performance, with double-digit volume and value growth.

L&T: The company announced the voluntary liquidation of its joint venture L&T Hydrocarbon Caspian (Azerbaijan), which has been approved by the Azerbaijani government. Consequently, L&T Hydrocarbon Caspian has ceased to be a Joint Venture of the company.

Tata Steel: The company’s subsidiary, Tinplate Company of India, has received a penalty of Rs 39.87 crore for non-payment of an earlier tax demand order of Rs 13.31 crore for FY17. The demand order is presently pending appeal before the Commissioner of Commercial Taxes.

Lupin: The pharma major has received approval from the United States Food and Drug Administration (US FDA) for marketing Tolvaptan Tablets which is a generic equivalent of Jynarque Tablets of Otsuka Pharmaceutical Co., Ltd. The product will be manufactured at Lupin’s Nagpur facility in India. Tolvaptan Tablets had estimated annual sales of $287 million in the US.

Mankind Pharma: The company said its manufacturing facility at Namchi Zilla, South Sikkim have been disrupted due to disturbance in power/utility supply because of flash floods in river Teesta. The company added that there is no major disruption expected in supply chain as the manufacturing of the products have been diverted to other plants.

SJVN: The government will offer up to 1.81 lakh shares with a face value of Rs 10 each to eligible employees at Rs 70.10 apiece via offer-for-sale. The offer shall remain open from October 6 to October 10.

Manappuram Finance: The company’s unit, Asirvad Micro Finance, filed its draft red herring prospectus with SEBI for a fresh issue of equity shares totalling up to Rs 1,500 crore. The company also plans to raise up to Rs 300 crore in a pre-IPO round.

Lemon Tree Hotels: The hospitality chain said it has opened a 669-room hotel in Mumbai under the Aurika Hotels & Resorts brand. The comapny said this is the third property under the company’s upscale brand Aurika. The hotel features Mirasa – the all-day dining restaurant, Ariva – the bar, a Tea Lounge, a speciality restaurant, and extensive banquet facilities, including the ballroom and multiple boardrooms.

Laxmi Organic Industries: The company’s board has approved the floor price for its QIP at Rs 283.27 per share. The issue price will be determined by the company in consultation with the book-running lead managers appointed for the issue.

Archean Chemical Industries: The company informed that it has incorporated a wholly owned subsidiary Idealis Chemicals with an authorized capital of Rs 3 crore.

KPI Green Energy: The company has received new orders for executing solar power projects of 12.10 MW. The company said 3.10 MW capacity will be undertaken by KPI Green Energy and 9 MW capacity by its wholly owned subsidiary Sun Drops Energia Private Limited.

Som Distilleries & Breweries: In an exchange filing, the company’s board has approved the opening of an issue as of October 5, 2023, and has fixed the floor price of Rs 349.24 for the issue.