Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.05% lower at 19,554.50, signalling that Dalal Street was headed for flat-to-negative start on Thursday.

Asian shares were trading higher, tracking Wall Street overnight, as investors were buoyed by easing US inflation. The Nikkei 225 index jumped 1.23%, while the Topix was up 0.91%. China’s CSI 300 index rose 1.07% and the Hang Seng index soared 2.47%.

Indian rupee appreciated by 14 paise to 82.24 against the US dollar on Wednesday.

India’s consumer price index (CPI) inflation rose to 4.81% in June 2023, higher than expectations of 4.58%. But the CPI number was still below RBI’s upper tolerance limit of 6%. The higher inflation was driven by a surge in vegetable prices. The CPI-based inflation stood at 4.31% in May 2023 and 7.01% in June last year. Meanwhile, the consumer food price index (CFPI) jumped to 4.49% in June 2023, compared to 2.43% in May and 7.75% in June of the previous year.

India’s industrial output grew by 5.2% in May 2023, according to data released by the Ministry of Statistics and Programme Implementation. Industrial growth in April was revised to 4.5% from earlier 4.2%, and it stood at 19.7% in May 2022.

The Central Government has restricted the import of unstudded gold and certain gold articles. Importers would require permission from the government to import these gold products. However, restrictions will not apply to imports under the India-UAE free trade agreement.

The US consumer price index fell to 3% in June year-on-year, down from 4% in May. The core CPI dropped to 4.8%, the lowest since 2021.

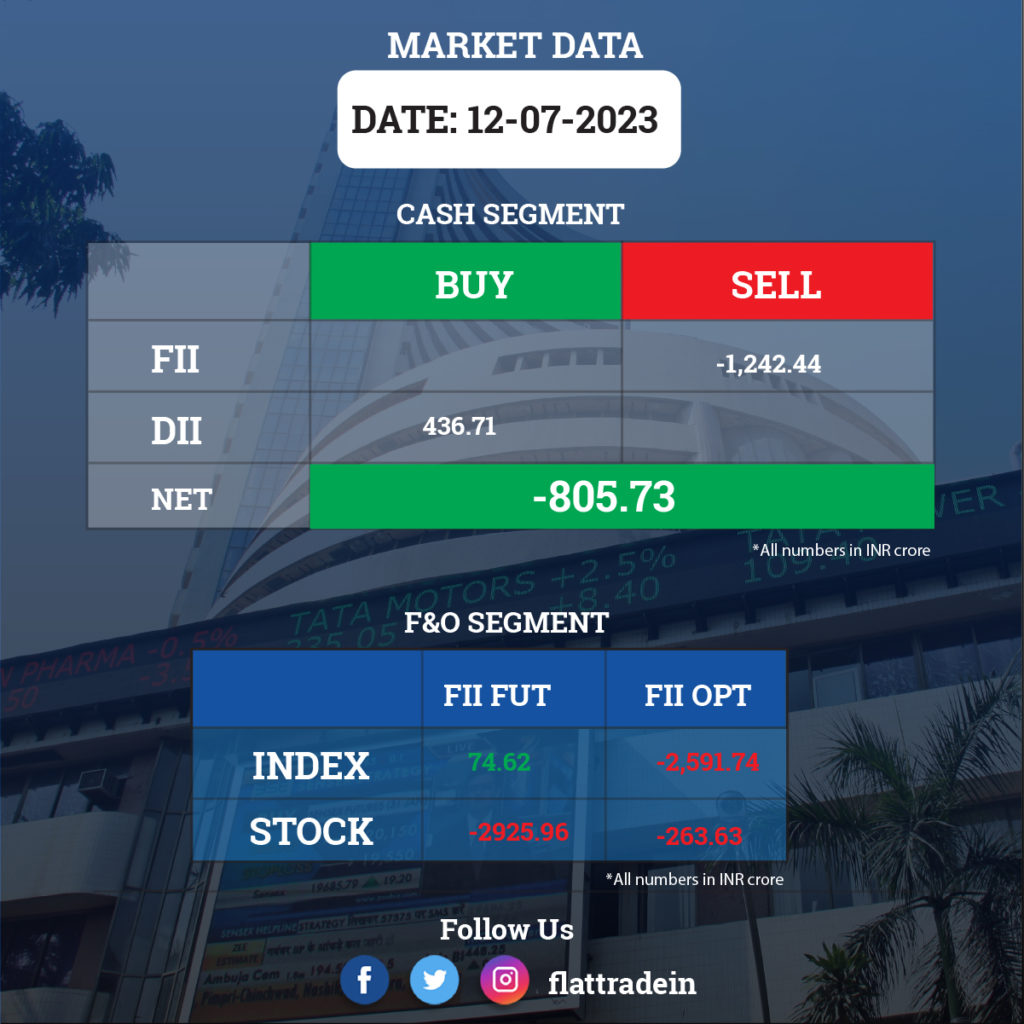

FII/DII Trading Data

Upcoming Results

Wipro, Federal Bank, Aditya Birla Money, Tata Metaliks, Angel One, Sterling and Wilson Renewable Energy, Avantel, Bhansali Engineering Polymers, GI Engineering Solutions, and Unitech.

Stocks in News Today

Tata Consultancy Services (TCS): The company’s net profit was up 16.8% YoY at Rs 11,074 crore and revenue rose 13% YoY at Rs 59,381 crore. In dollar terms, the revenue grew by 4% as against the previous quarter to $7,226 million, the company said in a release. The growth was attributed to strong growth in total contract value (TCV) deal wins despite a tough business environment. The company’s order book at the end of Q1FY24 stood at $10.2 billion, and the book-to-bill ratio stood at 1.4.

HCLTech: The IT services company posted 7.6% YoY growth in net profit in the first quarter of fiscal 2024. Sequentially, however, net profit was down by 11.2% due to ramp-downs in deals and verticals like hi-tech and telecom. Net profit for Q1FY24 stood at Rs 3,534 crore, which was lower than analyst estimates. Consolidated revenue for the quarter grew 12% YoY at Rs 26,296 crore, and in constant currency terms, revenue slipped 1.3% QoQ. HCLTech’s board of directors declared an interim dividend of Rs 10 per equity share for the financial year 2023-24.

Prestige Estates: The company has registered sales of Rs 3,914.7 crore, up 30% annually, in the quarter ended June 30, the company said in a regulatory filing. The collections from the sales stood at Rs 2,740.8 crore, up by 28% year on year (YoY). The sales during this period touched 3.83 million square feet (msf) of development with an average realisation of Rs 10,244 per square foot for apartments, villas and commercial. The average realisation for plots stood at Rs 5,007 per sq ft. The company sold 2,276 units in Q1 FY24 and launched one new project of 3.12 msf. The total completions during the quarter stood at 5.90 msf.

Power Finance Corporation: The company is planning to raise Rs 10,000 crore through non-convertible debentures. The company said it will issue of secured, rated, listed, redeemable NCDs with a face value of Rs 1,000 each aggregate up to Rs 10,000 crore (shelf limit) in one or more tranches.

Hindalco Industries: The country’s largest aluminium major has received board approval for sale of land at Kalwa in Maharashtra. Birla Estates bought the land for Rs 595 crore. Formalities will be completed in 15 months.

SpiceJet: The company’s promoter plans to invest Rs 500 crore to strengthen the airline’s financial position. Ajay Singh, also the CMD of SpiceJet, will infuse capital through equity and or convertible securities on a preferential basis. Funds to be considered equity shares of promoters in the government’s ECLG scheme.

Anand Rathi Wealth: The company reported a consolidated net profit of Rs 53 crore for Q1FY24, up 34% compared to Q1FY23 and revenue of Rs 175 crore, an increase of 33% compared to Q1FY23. The firm added that it continues to expand its client base, adding 395 client families during Q1 FY24.

Patanjali Foods: The company’s promoter — Patanjali Ayurved — is set to launch an offer for sale of 2.53 crore equity shares of Patanjali Foods representing 7% of equity capital. Non-retail investors can bid on July 13, while retail investors on July 14. The floor price of the offer shall be Rs 1,000, compared to prevailing price of Rs 1,228.05 per share. The promoter will have the option to additionally sell up to 2% in case of oversubscription.

Dr. Reddy’s Laboratories: The drugmaker’s license application for its proposed biosimilar rituximab has been accepted by the U.S. Food and Drug Administration, the European Medicines Agency, and the U.K. Medicines and Healthcare Products Regulatory Agency. The biosimilar will be used in the treatment of rheumatoid arthritis, non-Hodgkin’s lymphoma, chronic lymphocytic leukaemia, pemphigus vulgaris, granulomatosis with polyangiitis, and microscopic polyangiitis.

Aurobindo Pharma: The company’s unit, APL Healthcare, has received final approval from the U.S. Food and Drug Administration to manufacture and sell Sevelamer Hydrochloride Tablets in doses of 400 mg and 800 mg. The tablets are equivalent to Renagel Tablets of Genzyme Corporation. Sevelamer Hydrochloride Tablets are used to treat chronic kidney disease. The drug has an estimated market size of around $37 million for the twelve months ending May 2023, according to IQVIA.

Texmaco Rail Engineering: The board members will meet on July 17 to consider raising funds. The funds will be raised via an issue of one or more instruments including equity shares or convertible securities.

DreamFolks Services: Airport services provider and Plaza Premium Group have announced a collaboration to include over 340+ Plaza Premium Lounges in over 70+ major international airports into the DreamFolks global lounge network starting July 24, 2023. With the inclusion of Plaza Premium Lounges, DreamFolks’ global touchpoints will increase to 1,700 plus.

Deep Industries: The company has acquired a 74% equity stake in Breitling Drilling and consequently it becomes a subsidiary of Deep Industries.

Pritika Auto: The company’s board approved raising of capital by its subsidiary — Pritika Engineering Components Limited (PECL) — through preferential issue of up to 82 lakhs equity shares. Promoters and strategic investors will be participating in the issue, the company said.

Subros: The company said in an exchange filing that it may have incremental business opportunities in vehicle AC component manufacturing after the amendment of Central Motor Vehicles Rules, 1989. Government announced that it will mandate AC in the cabins of vehicles of N2 and N3 category, manufactured on or after January 1, 2025.