Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.45% lower at 18,410.50, signalling that Dalal Street was headed for a negative start on Wednesday.

Most Asian shares were trading lower as the Russia-Ukraine war intensified. The Nikkei 225 index fell 0.125 and the Topix was down 0.09%. The Hang Seng was down 0.29%, while the CSI 300 index inched up 0.05%.

Indian rupee rose 17 paise to 81.10 against the US dollar on Tuesday.

Bikaji Foods International will make its debut on the Indian bourses on November 16. The issue price has been fixed at Rs 300 per share.

Global Health, the operator of hospitals chain Medanta, will also list its equity shares on the BSE and NSE on November 16. The final issue price is Rs 336 per share.

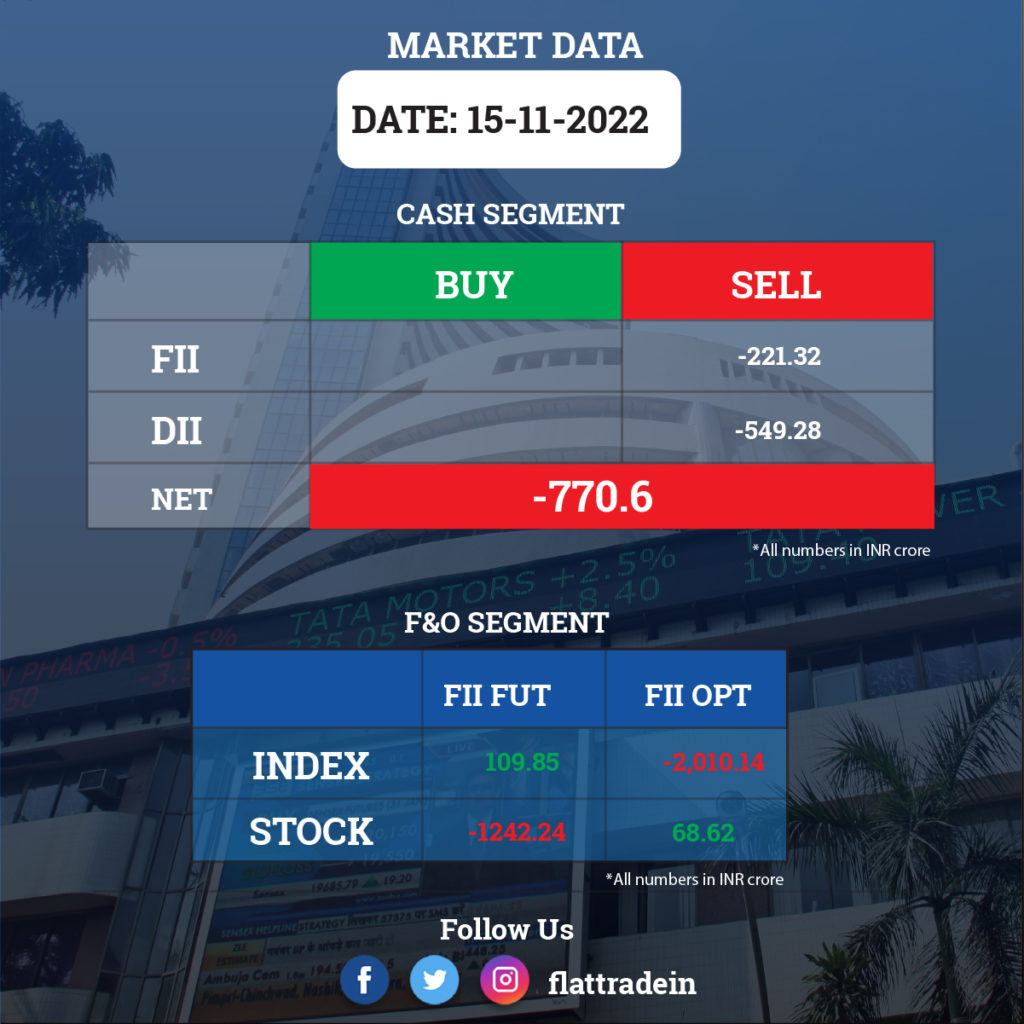

FII/DII Trading Data

Stocks in News Today

HDFC: The mortgage lender will raise up to Rs 5,500 crore by issuing bonds on private placement basis to shore up its resources on Wednesday. The secured redeemable non-convertible debentures (NCDs) issue will have a base size of Rs 4,000 crore with an option to retain oversubscription of up to Rs 1,500 crore.

Tata Consultancy Services: The company has been selected by TAP Air Portugal, the flag carrier airline of Portugal, to accelerate its digital transformation and drive innovation. The company will establish an Airline Digital Center in Portugal, staffed with consultants with deep domain knowledge of the airline industry, solution architects and technology experts.

Tata Motors: The Tata group-owned Jaguar Land Rover is looking for partners to improve semiconductor supplies, as it looks to ramp up sales volume in the second half of the current financial year. The automaker noted that despite strong demand and a record order book, sales during the second quarter continued to be constrained by the global chip shortage.

Paytm: Shares of the the fintech company is likely to be in focus this week, as the one-year lock-in period for the company’s stock expires. With this, investors will be able sell their shares that haven’t yet been allowed onto the market.

IIFL Wealth Management: The company has completed its acquisition of a 91% equity stake in MAVM Angels Network. With this acquisition, MANPL has become a subsidiary of the company. In July this year, the company had executed a share purchase and shareholders’ agreement with MAVM Angels Network (MANPL) and its shareholders to acquire a 91% stake.

Bharat Electronics: The Navratna defence PSU has signed a slew of MoU. It has signed an MoU with Yantra India (YIL), a defence PSU for cooperation in the areas of ammunition hardware and military-grade components. The company also signed an MoU with US-based Profense LLC for cooperation in the manufacturing and marketing of light weapons. It also signed an MoU with SVC Tech Ventures LLP for cooperation in the manufacturing and marketing of heavy-duty blast doors, and with Defence PSU Hindustan Shipyard to carry out joint development, manufacturing and product upgrades of identified products and systems.