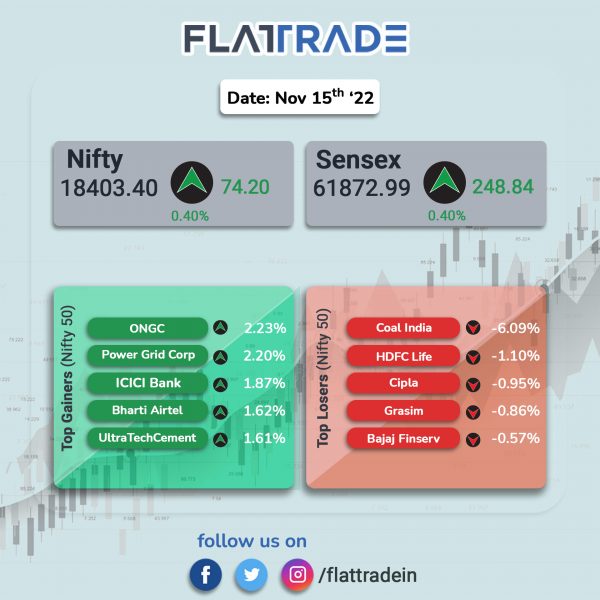

Benchmark equity indices closed higher in a volatile session as Banks, Oil & Gas and Auto stocks gained. The Sensex rose 0.40% and the Nifty advanced 0.41%.

In broader markets, Nifty Midcap 100 and BSE Smallcap indices were flat.

Top gainers among Nifty sectoral indices were Oil & Gas [0.73%], Bank [0.70%], Private Bank [0.67%], Auto [0.64%] and Financial Services [0.59%]. Top losers were Media [-0.2%] and Realty [-0.11%].

Indian rupee rose 17 paise to 81.10 against the US dollar on Tuesday.

On the economic front, India’s trade deficit rose to $26.91 billion in October 2022 compared to $25.7 billion in September. Exports contracted by 16.6% to $29.8 billion y-o-y. Imports rose by 5.7% to $56.7 billion y-o-y. On a month-on month, exports fell by 16% in October, while imports declined by 7.3%.

Stock in News Today

Tech Mahindra: The IT services company said it is in the final stages of framing its moonlighting policy, which may allow employees to take up side gigs, The Economic Times reported. The policy is expected to be rolled out this month, the report added. Tech Mahindra’s global chief people officer, Harshvendra Soin, told ET that the company is looking at allowing employees to take up a side hustle for a short period, mainly, during the weekend.

GMR Airports Infrastructure: The company said its consolidated revenue was up 10% YoY at Rs 1,588 crore in Q2FY23. Its net loss stood at Rs 195 crore in Q2FY23 from Rs 112.9 crore in the year-ago period. Ebitda rose 10% to Rs 472.7 crore in the quarter under review.

Sobha Ltd: The realtor said its consolidated net profit fell 73.5% at Rs 15.9 crore in Q2FY23 from Rs 60.2 crore in Q2FY22. Consolidated revenue from operations fell 14.43% to Rs 667.3 crore in the reported quarter from Rs 779.9 crore in the year-ago period. Ebitda down by 35% at Rs 115.5 crore vs Rs 179.5 crore.

Radico Khaitan: The liquor manufacturer said the standalone net profit tumbled 25.2% YoY to Rs 51.8 crore in Q2FY23 as against Rs 69.3 crore recorded in Q2FY22. Net revenue from operations rose 8.6% to Rs 761.4 crore in quarter ended September 2022 from Rs 701.3 crore posted in Q2FY22. EBITDA dropped 19.3% to Rs 89.6 crore in Q2FY23 as against Rs 111 crore posted in Q2FY22. EBITDA margin reduced to 11.8% in Q2FY23 from 15.8% in Q2FY22.

Eros International Media: The company reported a net loss of Rs 34.55 crore in the quarter ended September 2022 as against net loss of Rs 12.99 crore during the previous quarter ended September 2021. Sales rose 250.92% to Rs 222.87 crore in the quarter ended September 2022 as against Rs 63.51 crore during the previous quarter ended September 2021.

Fusion Micro Finance: The financial services company made a weak stock market debut with its shares falling to a low of Rs 321.10 on the NSE compared to its issue price of Rs 368 per share. It opened at Rs 359.50 on the NSE and closed at Rs 323.40 per share.

Globus Spirits: The company’s profit after tax declined 57.9% YoY and 40.7% QoQ to Rs 22.10 crore in Q2FY23 due to higher operational costs. Revenue from operations was up 25.7% YoY and down 3.7% QoQ at Rs 480 crore. Its EBITDA fell 47.4% YoY to Rs 47 crore in the reported quarter.