Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.20% higher at 18,413.50, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were trading higher as investors gauged the Federal Reserve’s interest rate hike plans. Japan’s Nikkei 225 index was up 0.10% and the Topix was 0.34% higher. The Hang Seng index rose 2.53% and the CSI 300 increased 0.34%.

Indian rupee fell 47 paise to 81.26 against the US dollar on Monday.

India’s retail inflation, which is measured by the Consumer Price Index (CPI), fell to a three-month low of 6.77% in October 2022, down from 7.41% in September 2022. However, the CPI reading was above the Reserve Bank of India’s (RBI) upper margin of 6%. The overall food inflation, which accounts for nearly half the CPI basket, came in at 7.01% in October as against 8.60% in the preceding month.

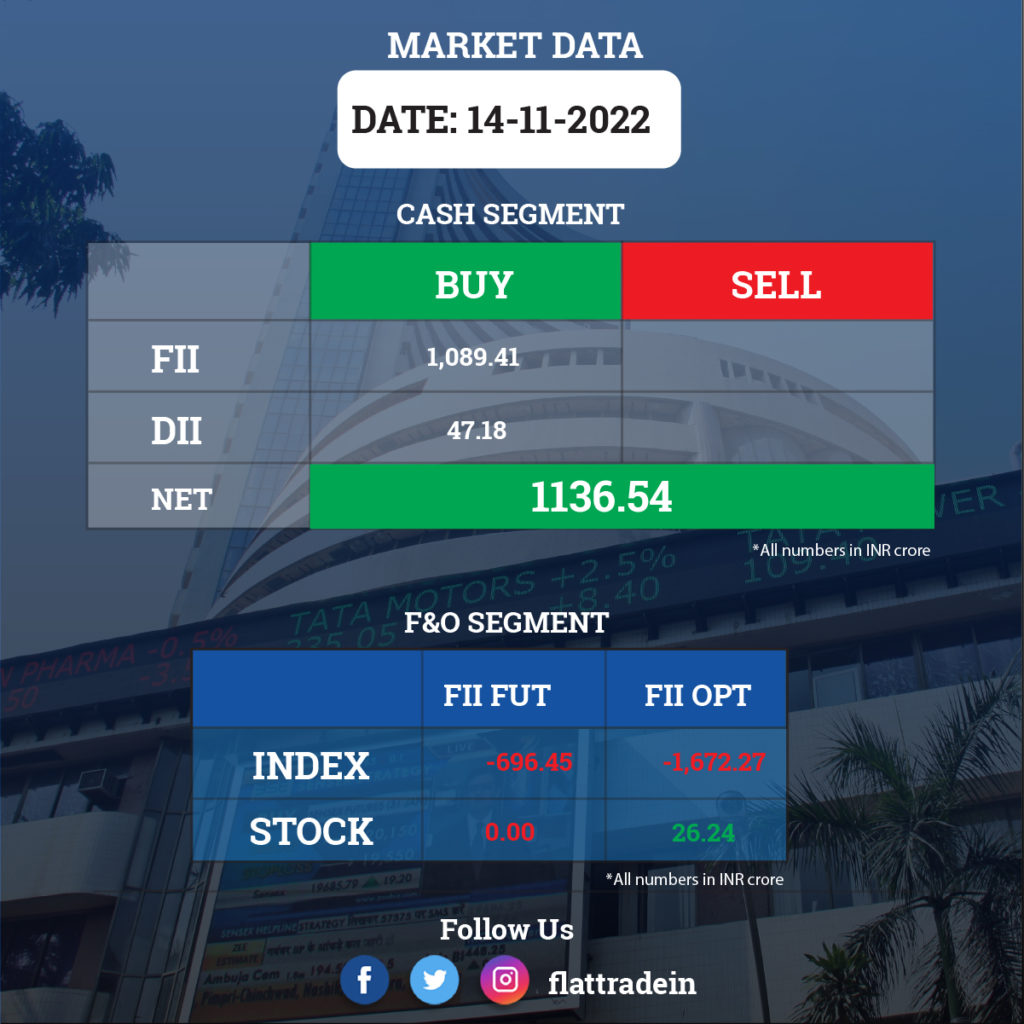

FII/DII Trading Data

Upcoming Results

Rajesh Exports, Advance Syntex, Bhanderi Infracon, Constronics Infra, Hanman Fit, MRC Agrotech, NINtec Systems, Riddhi Steel and Tube, Shahlon Silk Industries, and SSPN Finance will report quarterly results on November 15.

Stocks in News Today

Biocon: The biotechnology company’s consolidated profit fell by 48.8% year-on-year to Rs 81.8 crore for quarter ended September FY23 impacted by lower operating margin. Revenue from operations for the quarter grew by 26.4% to Rs 2,320 crore, while EBITDA increased by 5.7% to Rs 471 crore. The company has received board approval for fund raising via NCDs up to $250 million and commercial paper up to $275 million on private placement basis.

NMDC: The state-run iron ore producer registered a 62% year-on-year decline in profit at Rs 885.7 crore for quarter ended September FY23, due to weak operating income. Revenue from operations for the quarter at Rs 3,328 crore declined 51% and EBITDA fell 73% to Rs 851.2 crore compared to year-ago period.

Mindtree: The IT services company said L&T Infotech and itself started operating as a merged entity from November 14, 2022. Both Mumbai and Bengaluru Benches of the National Company Law Tribunal (NCLT) have approved, via two separate orders, the scheme of amalgamation and arrangement between the two companies. L&T Infotech said Debashis Chatterjee is appointed MD & CEO of L&T Infotech and Vinit Teredesai replaced Anil Rander as CFO.

IRCTC: The company posted a strong 42.5% surge in net profit at Rs 226.03 crore for the quarter ended September 2022 as against Rs 158.57 crore in the corresponding quarter a year ago. Total income soared 97.5% YoY to Rs 831.80 crore.

Catering, which is the second-largest revenue contributor, saw its sales rise 368% on-year to Rs 334 crore in the reported quarter as against Rs 71.4 crore in the same quarter last year. Sales from ticket booking business rose 13% YoY to Rs 300 crore from Rs 265 crore in Q2FY22.

SpiceJet: The low-cost airline reported its highest-ever quarterly loss in Q2FY23 owing to record high fuel prices, limited capacity and rupee depreciation. The airline’s consolidated loss widened by 46% to Rs 833.2 crore year-on-year (YoY).

Indiabulls Housing Finance: The private lender posted a net profit of Rs 289.4 crore in Q2FY23 as against Rs 286.3 crore in the same quarter of FY22. The consolidated income from operations was almost flat at Rs 2,229.7 crore in Q2FY23 from Rs 2,232.7 crore a year ago. Net NPA rose to 1.7% from 1.53% and declined from 1.71% in June 2022. The company’s capital adequacy ratio improved to 34% at end of September 2022 from 31.2% a year ago.

Hinduja Global Solutions: The company reported a 599% sequential growth in consolidated profit at Rs 239 crore for quarter ended September FY23, aided by higher other income and tax write-back. Revenue from operations grew by 1.6% QoQ to Rs 1,167.5 crore in Q2FY23.

Apollo Tyres: The tyre maker reported 12% year-on-year growth in consolidated profit at Rs 194.5 crore for the quarter ended September FY23, supported by higher top line. Revenue from operations grew by 17% YoY to Rs 5,956 crore and EBITDA rose 11.6% to Rs 712 crore, though margin contracted 60 bps due to higher input cost.

NBCC India: The public sector undertaking reported a massive 34% year-on-year increase in consolidated profit at Rs 95.5 crore for quarter ended September FY23 led by healthy operating performance. Revenue from operations for the quarter grew by 8% to Rs 2,029.7 crore and EBITDA surged 74% to Rs 88.4 crore compared to same period last year. The company secured total business of Rs 332 crore in October.

CESC: The power utility company reported a 9% year-on-year decline in consolidated profit at Rs 305 crore for quarter ended September FY23, impacted by weak operating performance. Revenue grew by 12% YoY to Rs 3,913 crore, but EBIDTA fell 46.4% to Rs 490 crore on higher input cost.

Greaves Cotton: The engineering company recorded a consolidated profit at Rs 28.9 crore for quarter ended September FY23 against a loss of Rs 23.3 crore in same period last year. Revenue for the quarter grew by 87% to Rs 698.8 crore compared to year-ago period with electric mobility business recording highest ever quarterly revenues at Rs 318 crore. EBITDA for the quarter stood at Rs 42.86 crore against EBITDA loss of Rs 10.2 crore in corresponding period last fiscal.

Aarti Industries: The speciality chemicals manufacturer has recorded a 17% year-on-year decline in consolidated profit at Rs 124.5 crore for September FY23 quarter on sharp drop in operating profit margin. Revenue for the quarter grew by 34% YoY to Rs 1,685 crore and EBIDTA rises 4.7% to Rs 267 crore, but margin fell more than 4 percentage points on higher input cost.

Nagarjuna Fertilizers and Chemicals: The company posted a consolidated loss of Rs 182.7 crore for quarter ended September FY23, a rise from Rs 142.36 crore in same period last year, impacted by higher input cost. Revenue from operations for the quarter at Rs 2,070 crore increased by 198% compared to year-ago period.

Balkrishna Industries: The tyre maker recorded 2.2% year-on-year decline in consolidated profit at Rs 382.3 crore for quarter ended September FY23 due to higher input cost, and freight & forwarding expenses. Revenue for the quarter rose 28.2% YoY to Rs 2,657.5 crore, but EBITDA declined 20.7% YoY to Rs 426.2 crore compared to corresponding period last fiscal.

Dilip Buildcon: The infrastructure developer reported a profit of Rs 13 crore for quarter ended September FY23 as against loss of Rs 444.6 crore in same period last year, aided by strong operating performance. Revenue from operations grew by 17% YoY to Rs 2,596 crore and EBIDTA surged nearly 7-fold to Rs 352 crore YoY.