Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.41% higher at 17,106, signalling that Dalal Street was headed for a gap-up start on Tuesday.

Asian stocks were mixed as investors made cautious bets after a slump in recent sessions. Japan’s Nikkei jumped 2.24% and Topix advanced 2.46%. In Chinese markets, Hang Seng fell 0.83% and CSI 300 index was down 0.58%.

Indian rupee closed 53 paise lower to 81.87 against the US dollar on Monday.

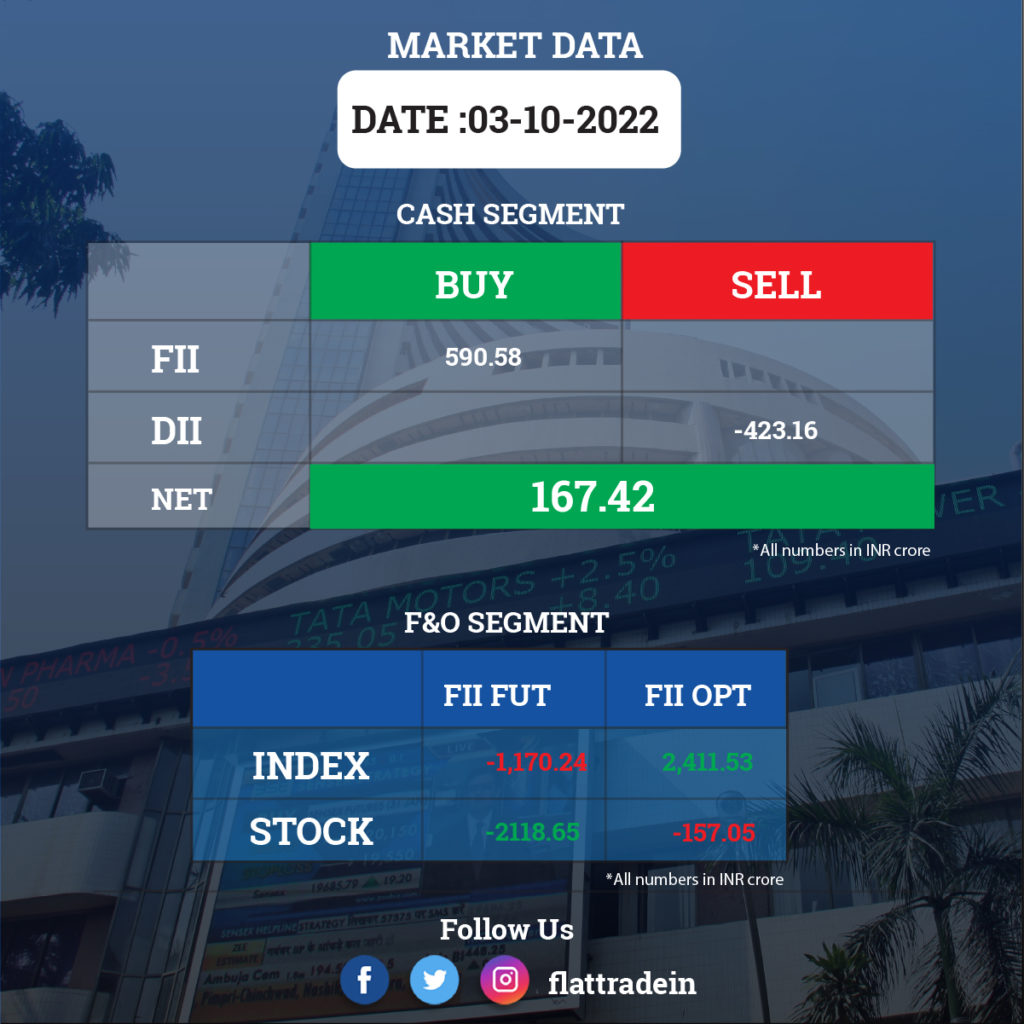

FII/DII Trading Data

Stocks in News Today

Infosys, Wipro and Tech Mahindra: The IT companies have revoked offer letters given to students after delaying their joining by nearly three-four months, businessline reported citing sources. In an email sent to a student by Infosys said that the offer has been revoked for not meeting the company’s academic eligibility criteria, according to businessline report.

Tata Consultancy Services (TCS): The IT major is set to secure a $2 billion deal from Bharat Sanchar Nigam (BSNL) to roll out its 4G and 5G services across the country, Business Standard reported citing sources. However, the final approvals from the publicly-owned telco may take a couple of months, sources in the know said. TCS will develop 4G core and Radio Access Network (RAN) technology for BSNL’s telecom services.

JSW Cement: The company said it has raised Rs 400 crore from MUFG Bank India as its first sustainability-linked loan. The company plans to deploy the fund for capital expenditure to achieve its annual capacity target of 25 million tonne by FY25. Parth Jindal, Managing Director of JSW Cement, said the funding will enable the company to meet its goal of 25 million tonne per annum capacity by FY25 and also forms part of its environmental, social, and governance (ESG) objectives.

Adani Green: The company said that it has formed three new subsidiary companies for its renewable energy business. Adani Green Energy said Adani Renewable Energy Holding Four Limited is its own subsidiary and the newly incorporated entities are its step-down subsidiaries. The three new step-down subsidiaries are Adani Renewable Energy Thirty Six, Adani Renewable Energy Forty Limited and Adani Renewable Energy Forty Seven Limited. The main objective of the new subsidiaries is to generate, develop, transform, distribute, transmit, sale, supply any kind of power or electrical energy using wind energy, solar energy or other renewable sources of energy.

Bharti Airtel: The telcom operator will finalise on 5G tariff in a few days, Business Standard reported citing a company executive. Airtel rolled out its 5G service in eight cities on Saturday and is advancing its capital expenditure plans for a faster roll-out this year and has plans to expand the coverage across India by March 2024.

Tata Steel: The company’s subsidiary, Neelachal Ispat Nigam, has started operations nearly 90 days after it was acquired by a Tata Steel subsidiary for Rs 12,000 crore in a bidding process, a statement said. Tata Steel has plans to invest in the NINL site to build a dedicated 4.5 million tons per annum long products complex over the next few years.

Vedanta: The company’s aluminium production increased by 2% to 5,84,000 tonnes in the second quarter of the ongoing fiscal. The company’s aluminium production in the corresponding quarter of FY22 stood at 5,70,000 tonnes, Vedanta Ltd said in a regulatory filing. The mined metal output at Zinc India during the July-September quarter also went up by 3% to 2,55,000 tonnes over 2,48,000 tonnes in the same period of the previous fiscal. The production of finished steel also went up by 11% to 3,25,000 tonnes, from 2,93,000 tonnes in the year-ago quarter.

Marico: The FMCG firm said that its India business posted low single-digit volume growth in the second quarter of the ongoing fiscal. The company said demand sentiment in India were on similar lines as the preceding quarter during most of the second quarter, with some signs of positivity in September. Marico said that consumption trends should improve in the second half of the fiscal given retail inflation is expected to cool off as a result of government interventions, moderating commodity inflation pressures and reasonably healthy spatial distribution of monsoons.

Dr Reddy’s Laboratories: The company said that Life Insurance Corporation of India has increased its stake to 7.7% in the pharmaceutical firm through the purchase of 33.86 lakh shares from open market over a period of time. Life Insurance Corporation of India (LIC) earlier had a stake of 5.65% in the company, Dr Reddy’s said in a regulatory filing.

Housing Development Finance Corporation: The NBFC said loans assigned in Q2FY23 stood at Rs 9,145 crore, up from Rs 7,132 crore in same period last year and all the loans assigned during the quarter were to HDFC Bank. Gross income from dividend for the second quarter stood at Rs 1,360 crore and the profit on sale of investments was nil for the quarter.

Avenue Supermarts: The D-Mart operator announced standalone revenue for the quarter ended September 2022 at Rs 10,384.66 crore, a rise of 36% from Rs 7,649.64 crore in same period last year. The company’s total number of stores stood at 302 as of September 2022.

Bank stocks: After Indian’s central bank’s raised repo rate by 50 basis points (bps) to 5.9%, several banks, including State Bank of India (SBI), ICICI Bank, Yes Bank and Bank of India have increased their lending rates. With this development, the cost of borrowing and EMIs on various loan products like home loans, gold, vehicle loans, etc. will get costlier.

Britannia Industries: The biscuit maker said it has acquired a controlling stake in Kenya’s Kenafric Biscuits by subscribing to 51% of the equity share capital, while also fully taking over Catalyst Britania Brands. The cost of acquisition was about Rs 9.2 crore.

Bank of Maharashtra: The public sector lender registered 16% growth in total business at the end of the second quarter of this fiscal. Gross advances during the second quarter rose 28.65% Rs 1,48,246 crore. Total deposits grew 7.86%, while CASA deposits rose 12.58%.

Quess Corp: The company has appointed Kamal Pal Hooda as Group CFO (designate) with immediate effect. He will succeed N. Ravi Vishwanath, who will step down from the post in 2023.

Anupam Rasayan: The company’s board has approved a proposal to raise up to Rs 500 crore by way of placement of equity shares to QIBs (Qualified Institutional Buyers) at Rs 725 per share.

Mahindra & Mahindra Financial Services: The company said that the business continued its momentum with disbursement of approximately Rs 4,080 crore in September 2022, an increase of 110% YoY, aided by macro tailwinds. The company said that it has clocked a disbursement of about Rs 21,300 crore that led to a strong gross asset book of approximately Rs 73,900 crore, a 3% growth month-on-month. The collection efficiency was at 98% for September 2022, against collection efficiency of 96% for August 2022.

KEC International: The infrastructure EPC company has secured new orders of Rs 1,407 crore across segments. The transmission and distribution segment received orders from Middle East, while the railways business has bagged an order for signaling & telecommunication works. Its year-to-date order book now stands at Rs 8,400 crore.

Dilip Buildcon: The road construction company through its joint venture RBL-DBL has received letter of acceptance (LOA) for its Surat Metro Rail Project in Gujarat and the order is worth Rs 1,061 crore.

Avenue Supermarts: The D-Mart operator announced standalone revenue for the quarter ended September 2022 at Rs 10,384.66 crore, a rise of 36% from Rs 7,649.64 crore in same period last year. The company’s total number of stores stood at 302 as of September 2022.

Mahindra & Mahindra Financial Services: The company said that the business continued its momentum with disbursement of approximately Rs 4,080 crore in September 2022, an increase of 110% YoY, aided by macro tailwinds. The company said that in the first half of the fiscal it had clocked a disbursement of about Rs 21,300 crore that led to a strong gross asset book of approximately Rs 73,900 crore, a 3% growth month-on-month. The collection efficiency was at 98% for September 2022, against collection efficiency of 96% for August 2022.

South Indian Bank: In an exchange filing, the lender said that gross advances grew by 17% YoY to Rs 67,981 crore for the quarter ended September 2022 and deposit rose 2% YoY to Rs 88,503 crore in the second quarter. CASA deposits rose 14% YoY to Rs 30,574 crore.