Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.03% lower at 19743, signalling that Dalal Street was headed for muted start on Wednesday.

Asian shares were trading higher as investor sentiments were boosted after data showed that the US retail inflation in October fell to 3.2% and raised hopes of an end to interest rate hikes. The nikkei 225 index rose 1.97% and the Tpix jumped 0.98%. The Hang Seng soared 2.7% and the CSI 300 index gained 0.87%.

The Indian rupee rose by 2 paise to close at 83.33 against the US dollar on Monday.

India’s consumer price index (CPI)-based inflation eased to 4.87% in October as prices of food items eased, according to data released by the Ministry of Statistics and Programme Implementation on November 13. The retail inflation was 5.02% in September.

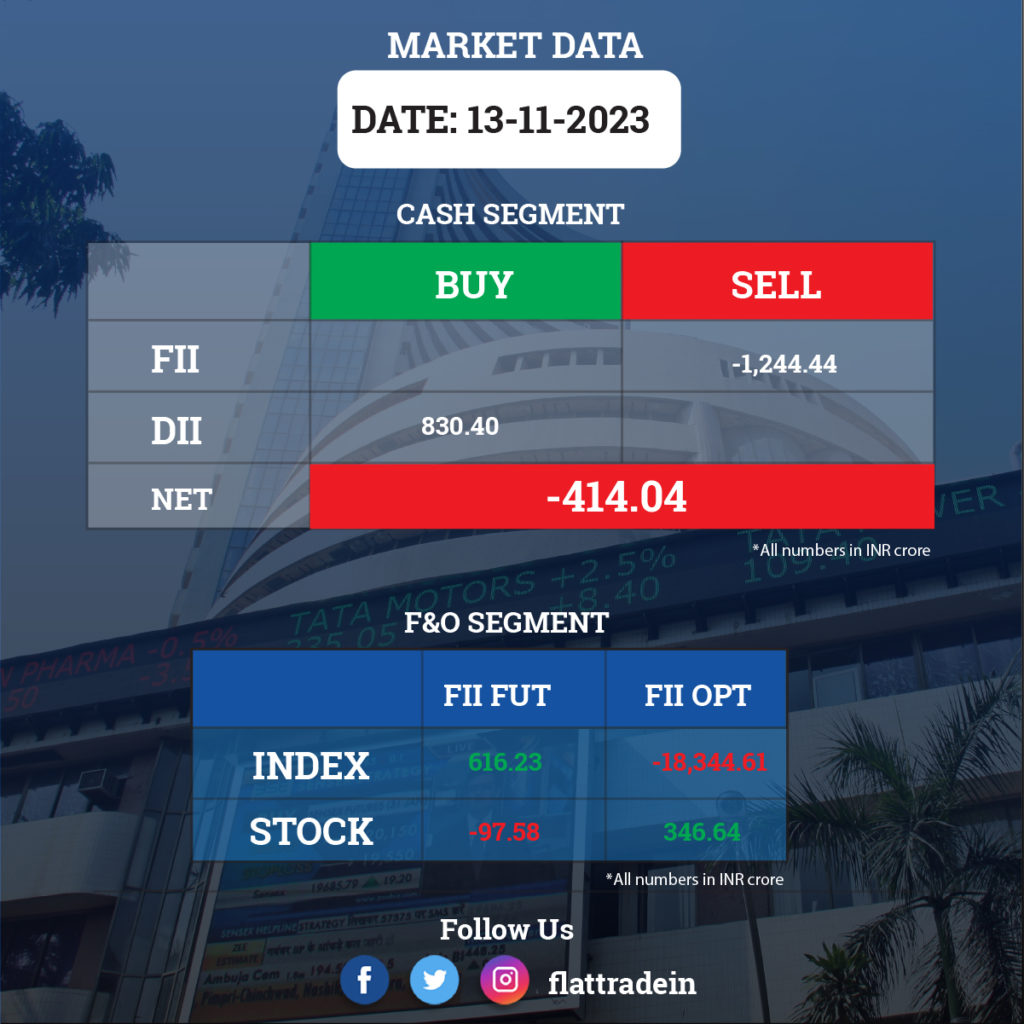

FII/DII Trading Data

Stocks in News Today

Grasim Industries: The company reported a consolidated net profit of Rs 1,164 crore in Q2FY24, up 15% from Rs 1,009 crore in the year-ago period. Revenue from operations in the quarter under review rose 10% to Rs 30,221 crore from Rs 27,486 crore in the corresponding period of the previous year. The company posted an Ebitda of Rs 4,509 crore in Q2FY24, up 19% YoY from Rs 3,783 crore in the previous year period. The total capex outlay for the second quarter stood at Rs 1,650 crore, and Rs 1,269 crore was for the paints business.

Asian Paints: The company has informed that the original installed production capacity of the Khandala plant has been increased to 4,00,000 KL per annum in order to meet the medium-term capacity requirements of the Company. About Rs 385 crores has been invested by the company towards the above increase in installed capacity and the same has been funded through internal accruals. The company had set up a paint manufacturing plant at Khandala, Satara, Maharashtra with an initial installed production capacity of 3,00,000 KL per annum.

Kalyan Jewellers: The jewellery retailer reported a 27.33% YoY growth in consolidated profit after tax at Rs 134.87 crore in Q2FY24 as against a PAT of Rs 105.92 crore in the corresponding period last fiscal. Revenue from operations of the company grew by 27.11% during the quarter under review at Rs 4,414.53 crore, compared to Rs 3,472.91 crores in the same period last fiscal. Total revenue from the company’s Middle East operations in Q2FY24 was at Rs 629 crore, up 5% from Rs 601 crore in the same period last fiscal. The company’s online division, Candere, registered a revenue of Rs 31 crore in Q2FY24 compared to Rs 37 crore in the same period in FY23.

Biocon: The company’s subsidiary, Biocon Biologics Limited (BBL), has announced that MHRA, Medicines and Healthcare products Regulatory Agency in the UK, has granted marketing authorization for YESAFILI, a biosimilar of Aflibercept. In September, YESAFILI received marketing authorization approval from the European Commission (EC) for the European Union (EU). Aflibercept brand sales in the UK stood at $790 million, according to MAT June 2023, IQVIA.

GMM Pfaudler: The company’s promoter, Patel family, will buy a 1% stake in the company. The deal is valued at Rs 1,700 per share and the Patel family will buy 4.49 lakh equity shares from Pfaudler Inc. The transaction will be executed through Millars Machinery, a key entity within the promoter group.

Rail Vikas Nigam (RVNL): The railway company has received a letter of acceptance for construction of Tunnels with, ballast less track, earthwork in formation, construction of important bridges, major bridges, minor bridges, supply of stone ballast, track linking, side drain retaining wall in the Dharakoh Maramjhiri section in connection with the third line from the Central Railway. The project cost is Rs 311.18 crore and it is expected to be executed within 18 months.

Manappuram Finance: The NBFC reported a 37% increase in consolidated net profit of Rs 561 crore in Q2FY24 as against a net profit of Rs 410 crore in the same quarter a year ago. Its total income rose to Rs 2,174 crore in Q2FY24 from Rs 1,714 crore in Q2FY23. Its gross NPA improved to 1.6% in Q2FY24 from 2% in the year-ago period. Net NPAs fell to 1.4% in the quarter under review from 1.8% in the year-ago period. The company’s consolidated gold loan portfolio rose 8.4% YoY to Rs 20,809 crore in Q2FY24. The company declared an interim dividend of Rs 0.85 per equity share with a face value of Rs 2 each.

Wipro: The company’s step-down subsidiary, Designit Tokyo Co., has been voluntarily liquidated with effect from November 13, 2023. Its revenue from operations stood at Rs 3.86 crore of March 31, 2023.

IDFC FIRST Bank: The private sector lender said it has received an in-principle approval from the Pension Fund Regulatory and Development Authority (PFRDA) for the proposed composite scheme of amalgamation of IDFC and IDFC Financial Holding Company into and with IDFC FIRST Bank.

PVR INOX: The multiplex operator said that it has opened six screen multiplex Maison INOX at Jio World Centre, Mumbai, and 4 screen multiplex at Utkal Kanika Galleria Mall, Bhubaneswar, Odisha. With this launch, PVR INOX now operates the largest multiplex network with 1,711 screens across 359 properties in 114 cities (India and Sri Lanka).

PTC Industries: The company and Safran Aircraft Engines, the French global leader in aero engines, have signed a multi-year contract to develop industrial cooperation for LEAP engine casting parts. PTC Industries will produce titanium-casting parts for Safran aircraft engines.