Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% higher at 18,70.3.5, signalling that Dalal Street was headed for positive start on Wednesday.

Most Asian shares were trading lower after paring gains. The Nikkei 225 index slumped 1.21%, while the Topix index dropped 0.78%. The Hang Seng rose 0.69%, while the CSI 300 index fell 0.37%.

Indian rupee rose 9 paise to 82.6 against the US dollar on Tuesday.

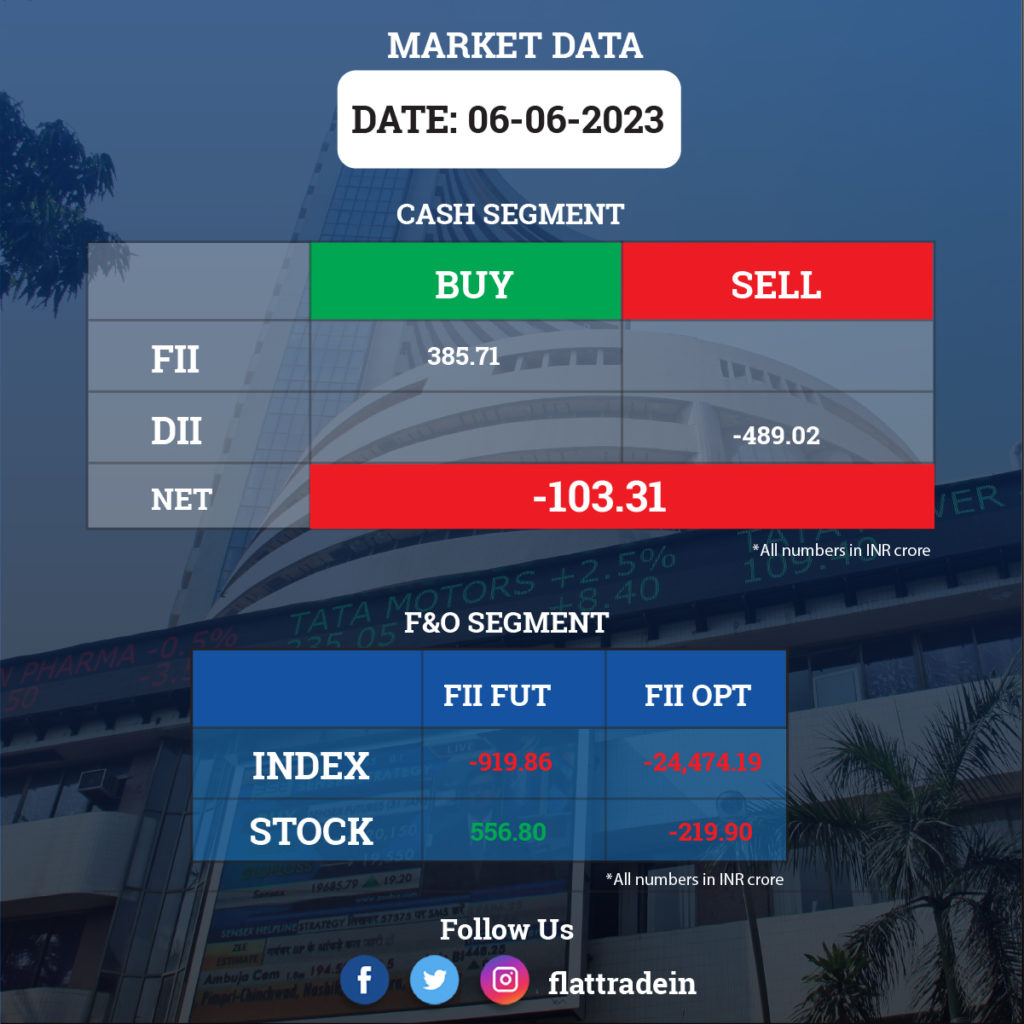

FII/DII Trading Data

Stocks in News Today

Adani Group: Shares of four Adani Group companies will be in focus on Wednesday following upward revision in their circuit limits by stock exchanges. For Adani Power, the circuit limit has been revised to 20% from 5% earlier. For Adani Green Energy, Adani Wilmar and Adani Transmission, the circuit limit has been changed to 10% from 5% earlier. The development has come a week after NSE and BSE removed the securities of Adani Enterprises from the short-term ASM framework.

Meanwhile, Adani Enterprises has revived its investment plan for Mundra Petrochem Ltd, India’s largest polyvinyl chloride (PVC) plant, with initial funding of Rs 14,000-16,000 crore, after a four-month suspension of operations, Livemint reported citing two people directly aware of the development.

Bank of Maharashtra (BoM): The lender’s board has approved QIP issue at issue price of Rs 28.5 apiece, which is at a discount of 4.94% to the floor price of Rs 29.98. An aggregate of Rs 1,000-crore will be allotted to eligible qualified institutional buyers.

Torrent Power: The company has signed memorandum of understanding (MoU) with Government of Maharashtra to develop three pumped storage hydro projects of 5,700 MW capacity in Maharashtra. The projects would entail an investment of about Rs 27,000 crore. Torrent intends to execute these projects over a period of 5 years.

GMR Airports Infrastructure: GMR Hyderabad International Airport (GHIAL), a step-down subsidiary of the company, has divested about 8.18 lakh square feet of warehouse facility at the Hyderabad Airport to ILP Core Ventures I PTE Limited for Rs 188.1 crore. ILP Core is a step-down subsidiary of Indospace Core PTE Limited, India’s largest operator of core logistics and industrial real estate vehicle. The proceeds will be utilized for expansion and other growth opportunities at Hyderabad Airport Land Development portfolio.

Engineers India: The company has secured order worth Rs 5.05 crore from National Aluminium Company for providing consultancy services for updating project report for Pottangi Bauxite Mines. It also won an order worth Rs 15.50 crore from Jindal Steel and Power to supply basic engineering and detail engineering for direct reduced iron plant in Odisha.

G R Infraprojects: The company’s subsidiary — GR Hasapur Badadal Highway — has executed the concession agreement with the National Highways Authority of India (NHAI). The bid project cost is Rs 872.2 crore. The said highway project in Maharashtra is to be executed in Hybrid Annuity Mode under Bharatmala Pariyojana.

Rashtriya Chemicals and Fertilizers: Arbitral Tribunal passed an award of Rs 95 lakh as arbitration cost in favour of company in a case with a contractor regarding recovery of damages and losses for breakdown of two Gas Turbo Generator. It asked contractor to repair and reinstate both the generators at their own cost. Tribunal directed contractor to pay Rs 173.72 crore with 10% interest for additional power expense.

JSW Ispat Special Products: Kiran Menon has resigned as the Chief Financial Officer (CFO) of the sponge iron, steel and ferro alloys manufacturerwith effect from June 6. Menon resigned to pursue opportunities outside the group.

MPS: The company has dissolved its UK unit Highwire Press on June 6. Highwire Press is not a material subsidiary and its dissolution will not affect revenue or business of company.

Valiant Organics: The company’s unit Valiant Laboratories has filed a draft red herring prospectus with SEBI for an initial public offering by the way of fresh issue of up to 1.15 crore equity shares for listing on BSE and NSE

Hardwyn India: The company has allotted 8.72 crore equity shares as fully paid bonus shares to existing shareholders of the company in 1:3 ratio.

Ugro Capital: The board has allotted 2,500 Non-Convertible Debentures with a face value of Rs 1 lakh each through private placement.

Wipro: The IT services firm launched the Wipro Industry Innovation Experience for Financial Services solution on Microsoft Cloud. Microsoft and Wipro will develop new solutions to help financial services clients accelerate growth and deepen client relationships.

Deepak Fertilisers & Petrochemicals Corporation: The company’s subsidiary Performance Chemiserve has raised Rs 900 crore via the issuance of non-convertible debentures (NCDs) on a private placement basis to qualified institutional buyers. NCDs are to be listed on BSE Limited.