Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.06% lower at 19,830, signalling that Dalal Street was headed for a flat-to-negative opening on Thursday.

Asian markets were mixed as Tokyo stocks opened lower, while Chinese markets rose. Japan’s Nikkei 225 index fell 1.14% and the Topix dropped 0.69%. China’s CSI 300 rose 0.2% and the Hang Seng climbed 0.57%.

Indian rupee depreciated by 6 paise to close at Rs 82.10 against the US dollar on Wednesday.

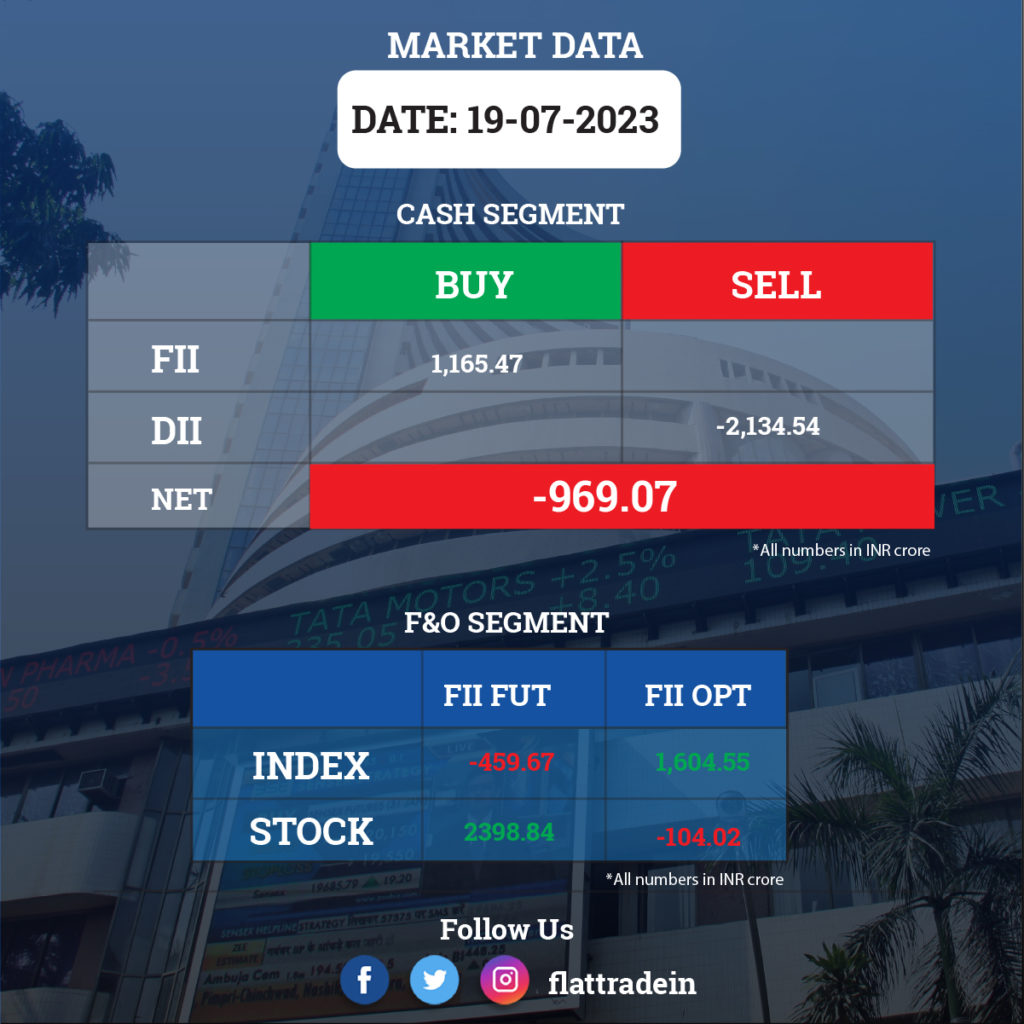

FII/DII Trading Data

Upcoming Results

Infosys, Hindustan Unilever, Union Bank of India, United Spirits, Coforge, CSB Bank, Dalmia Bharat, Havells India, IndiaMART InterMESH, ICICI Securities, 360 ONE WAM, Mphasis, Nelco, Persistent Systems, Quick Heal Technologies, Reliance Industrial Infrastructure, Shalby, South Indian Bank, Tanla Platforms, Zensar Technologies, DB Corp., HMT, Kirloskar Pneumatic, Rajnish Wellness will report their quarterly earnings.

Stocks in News Today

Shree Cement: The company, in a regulatory filing, said that the Ministry of Corporate Affairs (MCA) has issued an inspection order against company. The development comes after media reports claimed that the company is under the scanner for alleged tax evasion worth Rs 23,000 crore. The inspection will be conducted under Section 206(5) of the Companies Act, 2013.

Tata Communications: The company’s consolidated revenue was up 11% YoY at Rs 4,771.36 crore in Q1FY24 as against Rs 4,310.52 crore in Q1FY23. The company’s net profit was down 30% YoY to Rs 381.75 crore in Q1FY24 as against Rs 544.82 crore in Q1FY23. Ebitda stood at Rs 1,024.04 crore in Q1FY23 compared with Rs 1,077.03 crore in Q1FY23.

Olectra Greentech: The company has awarded a contract for the construction of a greenfield electric vehicle manufacturing facility on 150 acres of land in Hyderabad to Megha Engineering & Infrastructures. The construction of the greenfield EV manufacturing facility will be completed within 12 months from the date of approval of the shareholders.

Hatsun Agro Product: The company’s total revenue from operations rose 7% YoY to Rs 2,150.63 crore in Q1FY24 from Rs 2,014.61 crore in Q1FY23. Net profit jumped 54% YoY to Rs 80.15 crore in Q1FY24 from Rs 51.95 crore in Q1FY23. Ebitda gained 34% YoY to Rs 237.88 crore in the reported quarter as against Rs 178.15 crore in the same period last fiscal.

Reliance Industries (RIL): Reliance Strategic Investments has appointed Isha Ambani and Anshuman Thakur as non-executive directors. It also appointed Hitesh Kumar Sethia as managing director and chief executive officer for three years.

Federal Bank: The private sector lender launched its qualified institutional placement (QIP) issue on July 19. The floor price has been set at Rs 132.59 per share for the QIP.

Dr Reddy’s Laboratories: The United States Food & Drug Administration (USFDA) completed a pre-approval inspection (PAI) and a routine GMP inspection at the company’s API manufacturing facility at Srikakulam in Andhra Pradesh. The inspection was conducted during July 10-19. The inspection closed with zero observations and a classification of no action indicated (NAI).

Mastek: The digital engineering and cloud transformation partner signed a definitive agreement to acquire US-based BizAnalytica for an upfront payment of $16.72 million (Rs 137.24 crore) and earn out up to $24 million (Rs 196.99 crore). The strategic acquisition will bolster Mastek’s global data cloud services and generative AI capabilities and grant access to a talented pool of qualified data architects and scientists.

Krsnaa Diagnostics: National Health Mission of Rajasthan has cancelled the letter of acceptance given to Krsnaa Diagnostics for providing laboratory services under the free diagnostics initiative on HUB and SPOKE Model under NHM in Rajasthan. The company said there were requirements for the provision of submitting additional performance security, and there are disagreements over providing this additional performance security due to certain technicalities. The cancellation of the letter of acceptance does not in any way impact its existing business operations, the company said .

LIC: Sat Pal Bhanoo has been appointed as Managing Director of LIC India. Bhanoo works as an additional zonal manager at the Zonal Office, LIC of India, Bhopal.

Finolex Industries: The company’s consolidated revenue from operations slipped 1% to Rs 1,179.17 crore in Q1FY24 from Rs 1,189.81 crore in Q1FY23. Net profit gained 16% YoY to Rs 115.33 crore in Q1FY24 as against Rs 99.22 crore in Q1FY23. Ebitda rose 21% to Rs 152.47 crore in Q1FY24 as against Rs 125.91 crore in Q1FY23.

Can Fin Homes: The lender said its revenue jumped 35% YoY to Rs 818.09 crore in Q1FY24 from Rs 606.49 crore in Q1FY23. Net Interest Income gained 14% YoY to Rs 285.08 crore in Q1FY24 as against Rs 250.39 crore in Q1FY23. Its net profit rose 13% YoY to Rs 183.45 crore in Q1FY24 as against Rs 162.21 crore in Q1FY23. Net NPA stood at 0.34% in Q1FY24 as against 0.26% in Q1FY23.

L&T Finance Holdings: The company’s interest income rose 5.76% YoY to Rs 3,116.49 crore Q1FY24 from Rs 2,946.59 crore in the year-ago period. Its net profit soared 102.56% YoY to Rs 530.93 crore in Q1FY24 from Rs 262.1 crore in Q1FY23.

Alok Industries: The company said its consolidated revenue from operations fell 28% YoY to Rs 1,410.25 crore in Q1FY24 from Rs 1,971.52 crore in Q1FY23. Its net loss rose to Rs 226.14 crore in Q1FY24 from Rs 141.58 crore in Q1FY23. Ebitda fell 74% YoY to Rs 12.31 crore in Q1FY24 from Rs 46.9 crore in Q1FY23. Meanwhile, the company appointed Ram Rakesh Gaur as chief executive officer and Vinod Sureka as joint chief financial officer.

Sun Pharmaceutical Industries: Krensavage Asset Management opposed Sun Pharmaceutical’s bid to take Taro private on account of its low offer value. Shareholders could receive $45 per share on liquidation, compared with Sun Pharmaceutical’s offer of $38 apiece, it said. Krensavage Asset Management is the largest minority shareholder of Taro Pharmaceutical Industries.

TTK Prestige: The company resumed manufacturing operations at the Roorkee plant after flooding on July 18. It estimated a loss of movables of about Rs 40 lakh. The entire area is under red alert for the next two days.

Transformers and Rectifiers: Gujarat Energy Transmission Corporation has decided to stop dealing with Transformers and Rectifiers for a period of three years. The ‘Stop Deal’ notice is on the ground that the company had allegedly submitted a forged Material Dispatch Clearance Certificate for certain transformers supplied. The company has conducted inspection tests and is taking steps to defend its position against this allegation.

PNC Infratech: The company signed a concession agreement with the National Highways Authority of India for three Hybrid Annuity Mode projects worth Rs 3,264.43 crore.

Genus Power Infrastructures: The company has incorporated a wholly-owned step-down subsidiary, Genus Chhattisgarh PKG-1 SPV, to execute the Advanced Metering Infrastructure Service Provider contract.

Vishnu Chemicals: The company’s unit, Vishnu Barium, has acquired a 100% stake in Ramadas Minerals for Rs 26 crore. Ramadas conducts business in the beneficiation of Baryte ores and had a turnover of Rs 2.12 crore in FY23.