Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.34% higher at 18,014.5, signalling a positive start for Dalal Street.

Asian shares were trading higher, tracking Wall Street overnight as tech stock rallied boosting investors’ confidence. The Nikkei 225 index was up 0.07% and the Topix edged 0.07% higher. The Hang Seng gained 0.09%.

Indian rupee rose 13 paise to 81.59 against the US dollar on Wednesday.

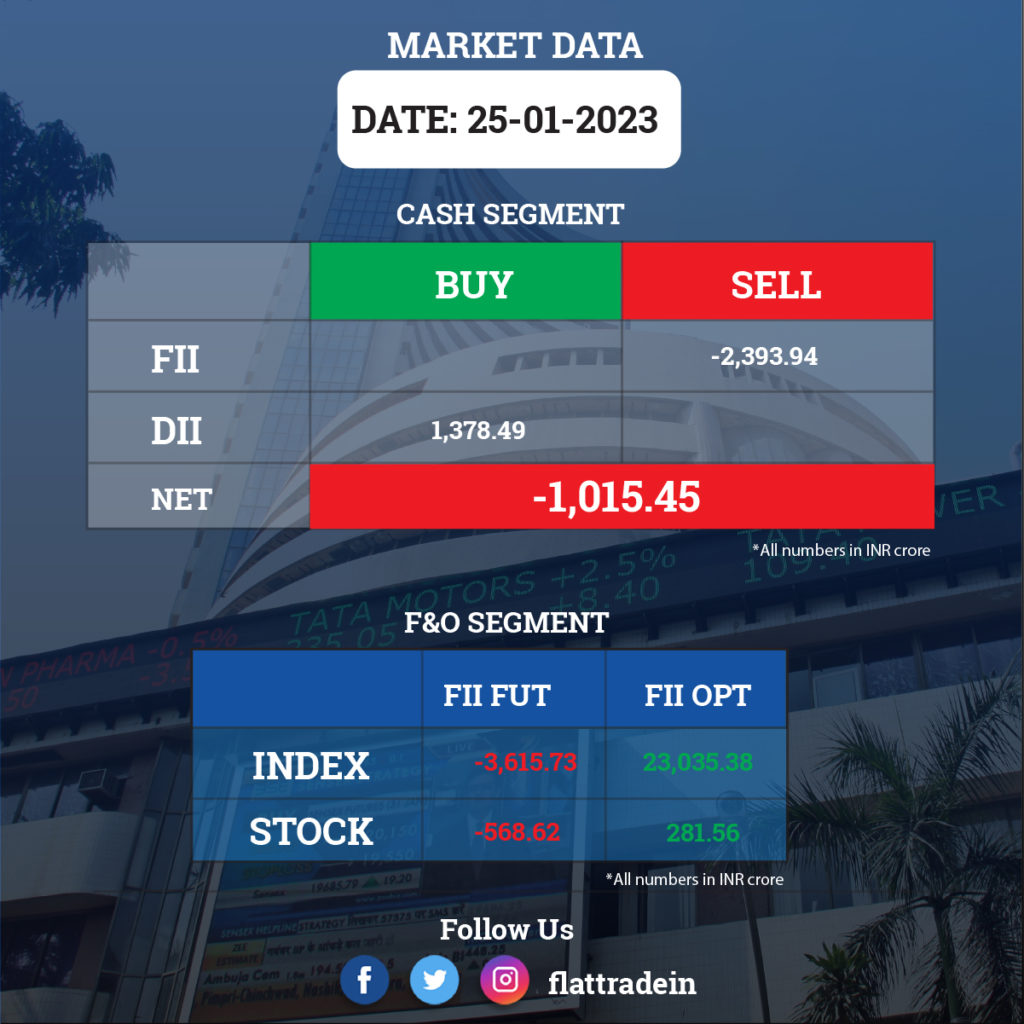

FII/DII Trading Data

Upcoming Results

Bajaj Finance, Vedanta, Aditya Birla Sun Life AMC, CMS Info Systems, Glenmark Life Sciences, Godfrey Phillips India, Sterlite Technologies, Zenotech Laboratories, Aarti Drugs, and AIA Engineering will post their results on January 27.

NTPC, Bharat Electronics, CARE Ratings, DCB Bank, Five-Star Business Finance, Gujarat Ambuja Exports, Heranba Industries, Kajaria Ceramics, Vedant Fashions, Radiant Cash Management Services, and Zen Technologies will report their quarterly earnings on January 28.

Stocks in News Today

Tata Motors: The automaker said its consolidated profit for the quarter stood at Rs 2,958 crore against loss of Rs 1,516 crore in same period last year. Revenue from operations at Rs 88,489 crore for the quarter grew by 22.5% over corresponding period last fiscal, with better realisation at JLR as well as standalone businesses. EBITDA was at Rs 9,853 crore rising 33% YoY, with margin expansion of 90 bps YoY at 11.1% for the quarter. The company remains cautiously optimistic on the demand situation despite global uncertainties.

Dr Reddy’s Laboratories: The pharma company clocked a massive 77% year-on-year growth in consolidated profit at Rs 1,247 crore for quarter ended December FY23, driven by strong US business. Consolidated revenue from operations stood at Rs 6,770 crore for the quarter, up 27.3% over the corresponding period in the last fiscal. Its US business rose 64%, domestic business grew 10% and emerging markets witnessed 14% growth YoY. EBITDA jumped 55% YoY to Rs 1,966 crore and margins improved by 500 bps to 29% during the reported quarter.

Adani Enterprises: The Adani Group company will launch its follow-on public offer of Rs 20,000 crore today. The closing date will be January 31, with a price band of Rs 3,112-3,276 per share. The company has raised close to Rs 6,000 crore from anchor investors. The company has received Rs 2,992.4 crore from anchor investors ahead of the FPO and the remaining amount will be payable by anchor investors later in one or more subsequent calls.

DLF: The real estate developer has registered a 37% year-on-year growth in consolidated profit at Rs 519 crore for quarter ended December FY23. It had an exceptional loss of Rs 224.4 crore in Q3FY22. Revenue from operations fell 3.5% to Rs 1,495 crore for the quarter compared to same period last fiscal. Sales bookings rose 34% YoY to Rs 2,507 crore. EBITDA fell by 8.5% YoY to Rs 477.2 crore and margin declined by 170 bps YoY to 31.9% for the quarter under review.

Ceat: The tyre maker has reported consolidated profit of Rs 35.4 crore for quarter ended December FY23, against loss of Rs 20 crore in same period last year. Consolidated revenue rose 13% YoY to Rs 2,727 crore, led by domestic demand. The company remains cautious about international markets due to recessionary trends. EBITDA soared 77% YoY to Rs 237.6 crore for the quarter and margin rose by more than 300 bps to 8.7% compared to year-ago period.

Amara Raja Batteries: The industrial and automotive battery maker registered a 53% year-on-year growth in consolidated profit at Rs 221.9 crore for quarter ended December FY23, backed by health topline and operating performance. Revenue grew by 11.5% to Rs 2,638 crore compared to year-ago period, driven by healthy volume growth in the automotive sector in both OEM and Aftermarket segments.

SJVN: The company has sold its entire stake in the Bhutanese joint venture company Kholongchhu Hydro Energy (KHEL) as per the directions received from the Government of India. The transaction cost is Rs 354.71 crore. The entire stake of the company was brought by the JV partner Druk Green Power Corporation, Bhutan.

Tata Elxsi: The design and technology services provider has clocked a 29% year-on-year growth in profit at Rs 194.7 crore for quarter ended FY23 despite lower operating margin, supported by revenue and other income. Revenue for the quarter increased by 29% to Rs 817.7 crore compared to same period last fiscal.

LTIMindtree: The IT services provider has partnered with Duck Creek Technologies, and Microsoft to build a cloud migration solution for insurers. The solution will enable insurers to migrate their on-premises core systems to the cloud in a quick and efficient manner.

Patanjali Foods: The posted a 15% YoY rise in net profit for the quarter ended December to Rs 269 crore. Revenue from operations increased by about 26% YoY to Rs 7,927 crore. EBITDA declined 12.4% YoY to Rs 368 crore, while margin contracted a sharp 205 basis points to 4.64%. Raw material costs rose 27% on-year to Rs 6,472 crore, staff expenses increased over 49% to Rs 73 crore, and other expenses soared 50% to Rs 538 crore.

Reliance Capital: The creditors of the company have withdrawn a plea from the National Company Law Appellate Tribunal (NCLAT) challenging the NCLT’s order of maintaining a status quo on the debt resolution process at the distressed financier. The development came after the NCLAT observed that it is not inclined to hear the matter since the final order by NCLT is expected next week.

CG Power and Industrial Solutions: The company’s board has approved the expansion of the manufacturing capacity of transformers at two of its facilities in Madhya Pradesh at a cost of Rs 126 crore, the company said on Wednesday.

Blue Dart Express: The logistics company said its net profit for the quarter ended December 2022 declined 29% YoY to Rs 87 crore. Revenue from operations increased 7% YoY to Rs 1,337 crore.