Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.05% higher at 19,771, signalling that Dalal Street was headed for falt-to-positive start on Friday.

Japanese markets were trading lower ahead of Bank of Japan’s monetary policy decision. The Nikkei 225 index fell 1.32% and the Topix was down 1.03%. MEanwhile, the Hang Seng was down by 0.46% and the CSI 300 index was marginally higher by 0.05%.

Indian rupee rose 6 paise to 81.94 against the US dollar on Thursday.

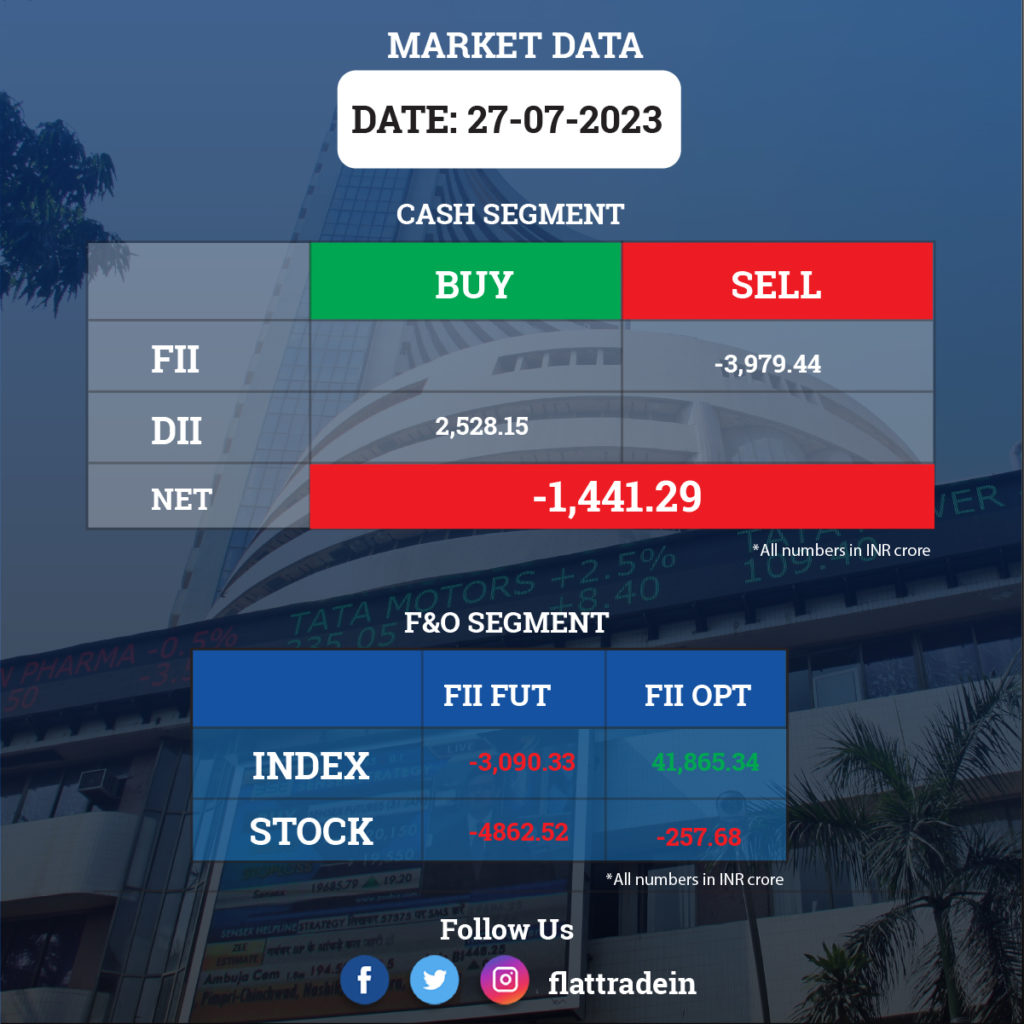

FII/DII Trading Data

Stocks in News Today

Indus Towers: The company registered a rise of 182% in consolidated net profit at Rs 1,348 crore in Q1FY24, from Rs 477 crore in the corresponding period last year. The growth was driven by higher tenancies and record tower additions during the quarter under review. The company’s revenue from operations during the first quarter of current fiscal stood at Rs 7,075 crore, up almost 3%, compared to Rs 6,897 crore in the year-ago period. Ebitda jumped 30.6% to Rs 5,341.2 crore in the June quarter from Rs 4,089.2 crore in the corresponding period in the previous fiscal.

Indian Hotels: The country’s largest hospitality posted a profit of Rs 222 crore for June FY24 quarter, growing 31% YoY, with 17% on-year growth in revenue at Rs 1,516 crore. The company or one of its subsidiaries will purchase 100% equity in Pamodzi Hotels PLC, a listed company in Zambia, from Tata International Singapore PTE Ltd. It will buy 90% of Tata’s stake while acquiring the remaining 10% through the delisting process in Zambia.

Bharat Electronics (BEL): The state-owned aerospace and defence electronics manufacturer reported a 23% YoY rise in net profit at Rs 530.84 crore for the quarter ended June 2023 compared to Rs 431.49 crore in the year-ago period. Revenue from operations stood at Rs 3,446.69 crore in the quarter under review compared to Rs 3,063.58 crore a year ago. Ebitda rose 29% YoY to Rs 664.4 crore.

Blue Dart Express: The logistics company reported its revenue fell 4.31% to Rs 1,237.55 crore in Q1FY24 from Rs 1,293.31 crore in Q1FY23.Its consolidated net profit was down 48.41% YoY to Rs 61.28 crore in Q1FY24 from Rs 118.79 crore in Q1FY23. Ebitda fell 28.64% to Rs 190.67 crore in Q1FY24 as against Rs 267.22 crore in Q1FY23.

RITES: The state-owned company has signed a memorandum of understanding (MoU) with Indian Railway Finance Corp. (IRFC) to explore avenues of mutual collaboration in the railway eco-system and the transport infrastructure sector. Under the MoU, RITES will offer consultancy & advisory services and assist in ascertaining the financial & technical viability of projects, while IRFC will provide financial services to projects/ institutions that have got backward and or forward linkages with the Railways.

Motilal Oswal Financial Services: The company reported strong numbers for the quarter ended June, with consolidated net profit rising multifold times year-on-year to Rs 527 crore. Its consolidated revenue from operations nearly rose two-times to Rs 1,500 crore. Its capital market business reported a strong 63% YoY growth in net profit to Rs 155 crore and the revenue for this segment grew 44% on-year to Rs 879 crore.

JK Lakshmi Cement: The flagship company of JK organisation registered a 30.65% on-year fall in consolidated profit at Rs 79.8 crore for the quarter ended June FY24, impacted by disappointing operating numbers. Revenue from operations grew by 4.6% to Rs 1,730.25 crore compared to year-ago period. The company has acquired 100% of the equity shareholding of Hidrive Developers and Industries for Rs 16.33 crore in cash. It has also agreed to raise up to Rs 2,500 crore through debt to partly finance its ongoing projects and for various growth opportunities.

Rail Vikas Nigam: The government has agreed to exercise the green shoe option in Rail Vikas Nigam’s offer for sale. It will divest an additional 1.96% stake in Rail Vikas Nigam under its green shoe option. The non-retail portion had 273% demand on Day 1.

Lupin: The pharma major received correspondence from the US FDA that it has now addressed the concerns raised in the warning letter for its facilities in Goa and Pithampur unit-2, Indore. This is after the satisfactory evaluation of the corrective actions taken by the company in response to the warning letter. The US FDA issued warning letter to the company in November 2017.

Trident: The textile company registered a 27.8% year-on-year decline in consolidated profit at Rs 93.4 crore for the quarter ended June FY24, impacted by lower topline and operating margin. Revenue from operations for the quarter at Rs 1,493.7 crore declined by 11% compared to corresponding period last fiscal, with fall in yarn, and paper & chemicals businesses.

NDTV: The media company reported a consolidated net loss of Rs 8.1 crore for the quarter ended June 30, compared to a profit of Rs 23.2 crore a year ago. Revenue from operations plunged 35% to Rs 70 crore, while overall expenses was down by 1.6% YoY. Separately, NDTV said NSE, BSE imposed penalty of Rs 6.1 lakh each on it “for alleged non-compliance with the requirements pertaining to the composition of the Board, Audit Committee and the Nomination and Remuneration Committee”.

Ajanta Pharma: The specialty pharmaceutical formulation company has registered a 19% year-on-year growth in profit at Rs 208 crore for the quarter ended June FY23, driven by healthy operating performance. Revenue from operations for the quarter increased by 7% on-year to Rs 1,021 crore, with US sales increasing by 19 percent, India sales growing 14% and Asia reporting 6% sales growth, but Africa sales fell 5% YoY.

Latent View: The data and analytics company said its net profit fell 3.8% to Rs 32.9 crore in Q1FY24 as against Rs 34.2 crore in Q4FY23. Revenue rose 4.7% QoQ to Rs 147.7 crore in Q1FY24 as against Rs 141.1 crore in Q4FY23. Ebitda was up 7% QoQ to Rs 28.1 crore in Q1FY24 as againstRs 30.2 crore in Q4FY23.

Westlife Foodworld: The company said its net profit was up 22.5% at Rs 28.8 crore in Q1FY24 as against Rs 24 crore in Q1FY23. Revenue rose 14.2% to Rs 614.3 crore in Q1FY24 from Rs 537.8 crore in Q1FY23. Ebitda climbed 14.5% to Rs 105.3 crore in Q1FY24 from Rs 92 crore in Q1FY23.

Godawari Power: The company’s consolidated net profit was down 29.4% YoY at Rs 231 crore in Q1FY24 as against Rs 327 crore in Q1FY23. Consolidated revenue fell 20.4% YoY at Rs 1,325.6 crore in Q1FY24 as against Rs 1,666.3 crore in Q1FY23. Ebitda was down 33.8% YoY at Rs 305.2 crore in Q1FY24 as against Rs 460.8 crore in Q1FY23.

Coromandel International: The company’s consolidated net profit fell 1% to Rs 494 YoY during the April-June 2023 quarter. Consolidated revenue from operations was down 0.6% at Rs 5,693.4 crore in Q1FY24 as compared to 5729.1 crore in the year-ago period. The company’s revenue from crop and allied business increased 1.7% YoY to Rs 5,200 crore in the April-June quarter. Its crop fertilizer business fell 17% YoY to Rs 547 crore in Q1FY24.

Laurus Laboratories: The company’s consolidated net profit fell 88.8% year-on-year to Rs 28.40 crore in Q1FY24 from a profit of Rs 252.5 crore in the year-ago period. Revenue from operations came in at Rs 1,181.8 crore, down 23.2% from the Rs 1,539 crore in the year-ago quarter. Its Ebitda stood at Rs 166.8 crore during the quarter, 63.2% lower than Rs 454 crore in the year-ago period. It reported an operating margin of 14.1% for the June quarter, a decline from the 29.5% reported in the same period last year.

Zydus Lifesciences: The pharma company has received the final approval from the United States Food and Drug Administration (USFDA) for plerixafor injection, which is used by patients with certain types of cancer (non-Hodgkin’s lymphoma and multiple myeloma) to prepare them for a stem-cell transplant. The drug will be manufactured at the group’s injectable manufacturing facility in Gujarat’s Ahmedabad. Meanwhile, the company said Zydus Lifesciences and Bayer (South East Asia) PTE Limited have entered into an agreement to amend certain clauses of their joint venture agreement (JVA) to enable participation in tenders of some government institutions / public sector undertakings for some products.

Adani Enterprises: Adani New Industries has raised a trade finance facility of $394 million, or Rs 3,231 crore, from Barclays PLC and Deutsche Bank AG. This is to secure working capital for its integrated solar module manufacturing facility.

Ipca Laboratories: The Competition Commission of India has approved Ipca Laboratories proposal to acquire a controlling stake in Unichem Laboratories. Ipca will acquire one-third of Unichem’s overall shareholding for a cash consideration of Rs 1,034.06 crore. It will make the necessary open offer to public shareholders for a 26% stake in Unichem as per SEBI regulations.

Welspun Enterprises: The company has signed a share purchase agreement with Authum Investment & Infrastructure, Sansaar Housing Finance, and Michigan Engineers to acquire a 50.10% stake in Michigan Engineers for Rs 137.07 crore in cash.

NACL: The company has been approved to foray into specialty materials and intermediates, specialty nutrition, and bioproducts. It has considered an investment of Rs 1,000 crore over the next three years for the business, including expansion of its existing manufacturing and R&D facilities for captive as well as custom development and contract manufacturing opportunities.

Netweb Technologies: The company had a strong stock market bebut on Thursday. The company shares got listed at Rs 946.40 apiece on NSE, a rise of 89% from its issue price of Rs 500 per share. It touched a high of Rs 952 but retreated to close at Rs 910.4 apiece.