Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.03% lower at 19,797.50, signalling that Dalal Street was headed for muted start on Wednesday.

Tokyo stocks opened higher on Wednesday, tracking Wall Street gains on account of solid earnings from US banks. The Nikkei 225 index was up 0.97% and the Topix gained 0.92%. Meanwhile, Chinese markets were trading lower as investors’ optimism was dampened by worries over the country’s economic growth. The CSI 300 index fell 0.29% and the Hang Seng tanked 1.34%.

Indian rupee strengthened by 3 paise to 82.03 against the US dollar on Tuesday.

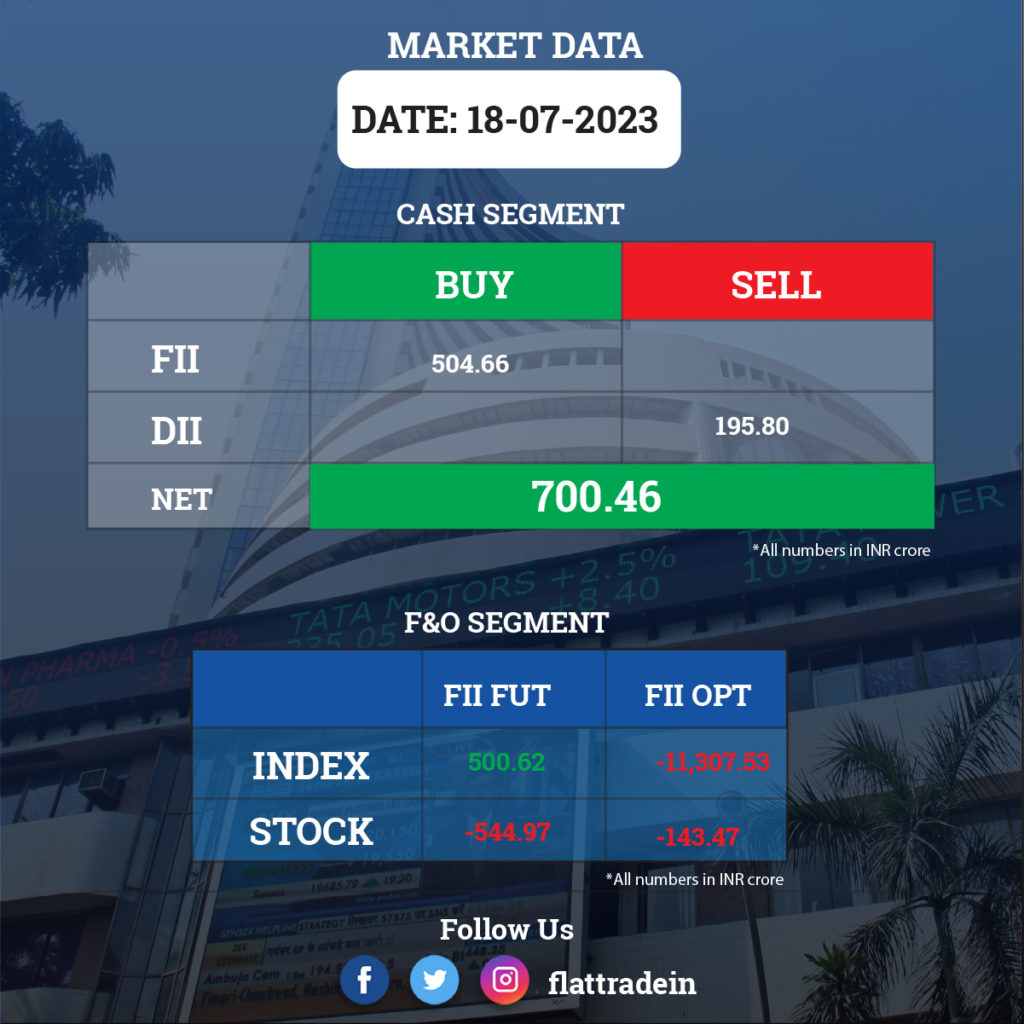

FII/DII Trading Data

Upcoming Results

Tata Coffee, Tata Communications, L&T Finance Holdings, TRF, Alok Industries, Can Fin Homes, Century Textiles & Industries, Finolex Industries, Hatsun Agro Product, Jubilant Pharmova, Bank of Maharashtra, Mastek, Newgen Software Technologies, and Shemaroo Entertainment, and Goodluck India in focus.

Stocks in News Today

State Bank of India (SBI): The country’s largest public sector lender has received an approval from its competent authority to set up a new trustee company as its wholly owned subsidiary for managing Corporate Debt Market Development Fund. SBI Funds Management is identified as the investment manager-cum-sponsor of the said fund.

IndusInd Bank: The private sector lender has registered a 32.5% year-on-year rise in standalone profit at Rs 2,123.6 crore for the quarter ended June FY24 as provisions and contingencies dropped 20.7% YoY to Rs 991.6 crore. Net interest income grew by 18% YoY to Rs 4,867.1 crore for the quarter, with net interest margin expanding to 4.29% from 4.21% in the same period. Its net NPA stood at 0.58% in the reported quarter as against 0.59% in the preceding quarter.

ICICI Lombard General Insurance: The company’s revenue was up 14% YoY at Rs 4,538 crore in Q1FY24 as against Rs 3,978 crore in Q1FY23. Its net profit was up 12% to Rs 390 crore as against Rs 349 crore in the year-ago period. Ebitda rose 5% to Rs 331 crore in the reported quarter from Rs 317 crore in the year-ago period.

L&T Technology Services (LTTS): The company has recorded a 13% year-on-year growth in profit at Rs 311 crore for the quarter ended June FY24 and revenue from operations grew by 15% YoY to Rs 2,301.4 crore for the reported quarter. Revenue in dollar terms for the quarter grew by 9.1% YoY to $280 million. Moreover, the company has won a $50 million contract from a global technology company to enable new opportunities for digital media platforms and the contract is for a period of five years.

Network18 Media and Investments: The company said its total revenue from operations jumped to Rs 3238.94 crore in Q1FY24 from Rs 1339.89 crore in Q1FY23. Its net profit declined 26% to Rs 29.17 crore in Q1FY24 as against Rs 39.46 crore in Q1FY23. Ebitda loss stood at Rs 84.42 crore in the reported quarter compared to Rs 46.20 crore in the year-ago period.

TV18 Broadcast: The company’s total revenue from operations nearly doubled to Rs 3176.03 crore in Q1FY24 from Rs 1,265.05 crore in Q1FY23. Its net profit advanced 52% YoY to Rs 91.20 crore in Q1FY24 from Rs 60.02 crore in Q1FY23. Ebitda loss stood at Rs 54.40 crore in the reported quarter as against Rs 57.75 crore in the year-ago period.

Hero MotoCorp: The automaker has introduced the Xtreme 200S 4-Valve, and it is likely to be priced at Rs 1,41,250 ex-showroom Delhi.

CIE Automotive India: The automotive components manufacturer has recorded nearly 60% year-on-year growth in consolidated profit at Rs 301.68 crore for the quarter ended June 2023 (Q2CY23), backed by higher other income, and strong operating income. Revenue for the quarter grew by 4.7% YoY to Rs 2,320.34 crore. Ebitda rose 21% to Rs 370.43 crore as against Rs 305.76 crore in the year-ago period.

Himadri Speciality Chemical: The speciality chemical company has registered a 123.2% year-on-year growth in consolidated profit at Rs 86.15 crore for the quarter ended June FY24 on lower input cost and other expenses. Revenue dropped 9.1% to Rs 950.91 crore compared to the year-ago period. Ebitda also nearly doubled to Rs 134.01 crore from Rs 71.6 crore in the same quarter last fiscal. Further, the company has agreed to acquire 100% equity shares of Combe Projects for about Rs 3 lakh.

Oil and Natural Gas Corporation (ONGC): The company bought an additional 0.0035% stake in subsidiary Petronet MHB Ltd. for Rs 2.09 lakh, increasing its overall stake to 49.999% from 49.996%.

Mazagon Dock Shipbuilders: Sanjeev Singhal, who is currently Director (Finance), has been given an additional charge of Chairman & MD of the shipbuilding company for a further period of six months with effect from August 1.

B.L. Kashyap and Sons: The company won a new order of Rs 369 crore from DLF Home Developers for civil structure and waterproofing works for DLF The Arbour, Sector 63 in Gurugram. The contract includes a free supply of steel. With this, the company’s total order book as of date stands at Rs 3,086 crore. The said order is expected to be executed within 33 months.

Avanti Feeds: The shrimp exporter has incorporated a new subsidiary, Avanti Pet Care, in Hyderabad, Telangana. The new subsidiary will be involved in manufacturing and trading of pet food and pet care products.

Bank of India: The lender has appointed Yusuf H. Roopwalla as Chief Technology Officer for a period of three years. Roopwalla was earlier associated with Standard Chartered Bank.

Ramkrishna Forgings: The company has started commercial production of 13,700 TPA of R A Shaft-Press Line and 10,100 TPA of 5″ Upsetter at its plant in Kharswan from July 18. This will enhance the output of the company by 23,800 tonnes per year, which will result in a total production capacity of 2,10,900 tonnes per year.

63 Moons Technologies: The company’s unit, Ticker Ltd., has incorporated its wholly-owned subsidiary, Ticker Data Ltd. Ticker will subscribe to the share capital of Rs 10 lakh of Ticker Data.

DB Realty: The company’s subsidiaries have inked share purchase agreements to acquire a stake in Siddhivinayak Realties. The company’s unit Horizontal Ventures will buy a 9.32% stake for Rs 62.09 crore, N.A. Estates will purchase a 10.45% stake for Rs 69.59 crore, and Vanita Infrastructure will acquire a 10.22% stake for Rs 68.07 crore.

HealthCare Global Enterprises: The company has signed a partnership transfer agreement to acquire the entire stake of Ajay Mehta, partner of HCG NCHRI LLP, in accordance with the acquisition of the entire equity share capital of Nagpur Cancer Hospital and Research Institute.

Hinduja Global Solutions (HGS): The company said that HGS Colombia will ramp up to more than 300 employees by the end of 2023 from the current number of more than 150. Hinduja has inaugurated its multilingual customer experience (CX) hub in Barranquilla, Colombia.