Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.14% lower at 17,375, signalling that Dalal Street was headed for a negative start on Wednesday.

Chinese stocks were trading higher after data showed China’s factory activity for February expanded further. China’s official manufacturing PMI hit 52.6 in February, above the 50-point mark indicating expansion in the sector. The CSI 300 index rose 1.07% and the Hang Seng jumped 2.41%.

Meanwhile, Japanese shares were trading lower marginally with the Nikkei 225 index slipping 0.02% and the Topix falling 0.14%.

India rupee rose 17 paise to 82.66 against the US dollar on Tuesday.

India’s gross domestic product (GDP) growth rate fell for the second straight quarter in the October-December period, coming in at 4.4%, the Ministry of Statistics and Programme Implementation said. The latest quarterly growth number is lower than the 6.3% growth that was recorded in the second quarter of 2022-23, also less than half the 13.2% increase posted in April-June 2022 as the GDP growth rate benefitted from a low base in the early part of the year.

In other news, India’s fiscal deficit for the first 10 months of 2022-23 widened to Rs 11.91 lakh crore, data released on February 28 by the Controller General of Accounts showed. At Rs 11.91 lakh crore, the fiscal deficit for April 2022-January 2023 accounts for 67.8% of the full-year target for 2022-23. The fiscal deficit in the first 10 months of the last financial year was 58.9% of that year’s target. The Centre made an upward revision in its fiscal deficit target for 2022-23 in the 2023 Budget to Rs 17.55 lakh crore from Rs 16.61 lakh crore. However, with the size of India’s economy this year set to exceed the Budget estimate, the fiscal deficit as a percentage of GDP is seen unchanged from the initial target of 6.4 percent.

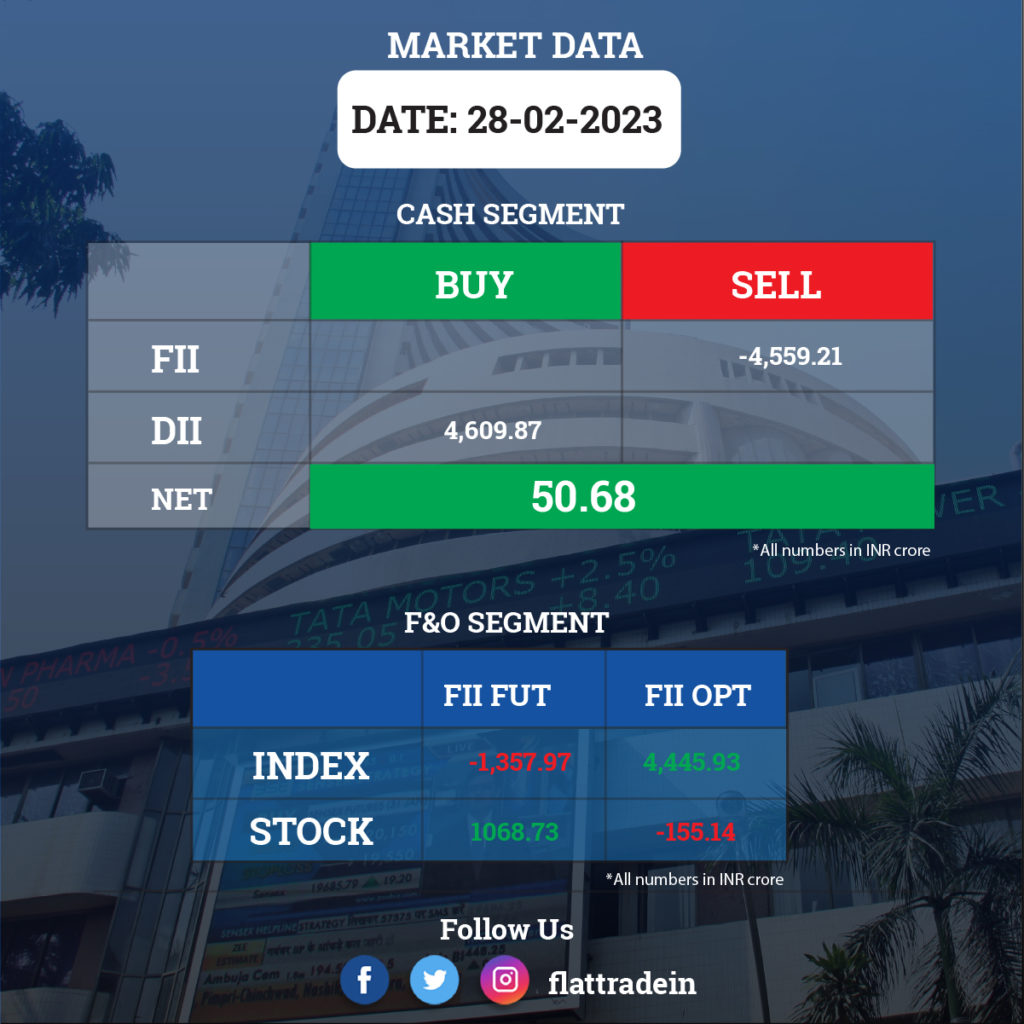

FII/DII Trading Data

Stocks in News Today

Tata Power: The company’s subsidiary, Tata Power Renewable Energy, has approved the allotment of 20 crore compulsorily convertible preference shares at a face value of Rs 100 each, amounting to Rs 2,000 crore on a preferential basis to GreenForest New Energies Bidco. GreenForest is incorporated under the laws of England and Wales. With this, both the tranches of investment of Rs 2,000 crore each in Tata Power Renewable Energy made by GreenForest are completed.

Vodafone Idea (VI): The telecom operator has allotted the balance 4,000 optionally convertible debentures (OCDs) with a face value of Rs 10 lakh each to ATC Telecom Infrastructure. With this, the company has completed the entire transaction of allotment of 16,000 OCDs to ATC. Shareholders of the company had approved the OCDs allotment at the extraordinary general meeting on February 25.

Bharat Electronics (BEL): The state-owned company has signed a frame supply agreement with Thales Reliance Defence Systems (TRDS), Nagpur, for the manufacture and supply of TR modules, radar LRUs (line replaceable units) and micro modules.

Power Grid Corp: The company has been declared as the successful bidder to establish an inter-state transmission system for the “establishment of Khavda pooling station-3 (KPS3) in Khavda RE Park, on a build, own operate and transfer (BOOT) basis. The company has received a Letter of Intent for the said project. The project comprises establishment of a new 765/400kV GIS substation, 765kV D/C transmission line and associated works in Gujarat.

Delhivery: Japan-based Softbank Group is planning to sell its stake worth around Rs 600 crore in Delhivery, the Gurugram-based logistics and supply chain company, via block deals, CNBC Awaaz reported. The block deals to offload the share could be launched on March 1, reports said. Softbank is also considering the option to upsize, if the deal evokes a strong demand. The shares are likely to be offered at a discount of 3-5 percent against the current market price

One 97 Communications (Paytm): The fintech company denied recent media reports regarding selling of shares by SoftBank and Ant Group, and stated that the firm is not part of any negotiation as mentioned in the news report. In a report published by Economic Times, it was said that China’s Ant Group and Japan’s SoftBank were looking to sell their shares in the company through a secondary sale. As per details, Masayoshi Son’s SoftBank and Alibaba’s affiliate Antfin have 13.24% and 25.47% shares in Paytm respectively.

Adani Enterprises: The company’s subsidiary, Mundra Aluminium, is declared as the preferred bidder and subsequently received a Letter of Intent from the Odisha government for the Kutrumali bauxite block in Odisha.

Ambuja Cements: The company has bagged a coal mine in Maharashtra on the second day of the commercial mines auction on Tuesday. While Assam Mineral Development Corporation has emerged as the highest bidder for a coal block in Jharkhand, Shreesatya Mines Private has bagged a coal block in the eastern state. The auction of three other coal blocks was underway.

Aditya Birla Capital: The company has announced its collaboration with National Payments Corporation of India (NPCI) to develop and promote digital payment methods through subsidiaries to its customers. This collaboration marks entry of Aditya Birla Capital into payments space through its operating subsidiaries.

Samvardhana Motherson International: The automotive components manufacturer has announced the completion of the purchase of assets of frame manufacturing and assembly operations of Daimler India Commercial Vehicles (DICV). In September 2022, the company signed a strategic agreement to acquire those assets, and also entered into a long-term agreement with DICV for the supply of the complete frame assembly.

Seamec: The company has entered into a charter party with HAL Offshore for the charter hire of the vessel ‘Seamec Paladin’ for an ONGC contract for a period of 5 years. The charter rate is $35,000 per day for marine activities. The vessel has completed the modification and arrived in India and is getting ready for mobilization for the ONGC contract. The total contract value for 5 years will be approximately $64 million.

Zydus Lifesciences: Zydus has received approval from the United States Food and Drug Administration (USFDA) for Apixaban tablets which block the activity of certain clotting substances in the blood. The drug will be manufactured in the formulation manufacturing facility at Moraiya in Ahmedabad. Apixaban tablets had annual sales of $18,876 million in the United States. Further, the company has also received approval from USFDA for Olmesartan Medoxomil and hydrochlorothiazide tablets, which are used to treat high blood pressure (hypertension). The drug will be manufactured at a formulation manufacturing facility in Ahmedabad SEZ, and had annual sales of $41.7 million in the US.

Hathway Cable: Rajan Gupta has tendered his resignation as Managing Director and Director of the company due to personal reasons. He will be relieved from the services with effect from March 9.

Gradiente Infotainment: The media and entertainment company is in talks with BU Abdullah Group of Companies for a possible collaboration and joint venture in Middle East and African region. These efforts are part of Gradiente’s expansion and diversification plan with projects outlay of Rs 1,800 crore unveiled so far, of which Rs 1,100 crore in media & entertainment business, and business news channel, ‘Gradiente Business’ at a project outlay of Rs 700 crore.

Stovec Industries: The printing solutions provider has recommended dividend of Rs 47 per share for the financial year ended December 2022. The dividend will be paid to the eligible members on or before its due date, if approved by the shareholders at the ensuing Annual General Meeting. The company has reported a 72% year-on-year decline in Q4CY22 profit at Rs 1.66 crore, impacted by weak operating performance. Revenue from operations was at Rs 60.9 crore, a growth of 6.5% YoY.