Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.59% higher at 16,782.50, signalling that Dalal Street was headed for a positive start on Thursday.

Asian shares were trading higher as investors’ sentiments were boosted by a possible slowdown in the pace of Federal Reserve monetary tightening. Japan’s Nikkei 225 index rose 0.32% and Topix inched up 0.05%. China’s Hang Seng increased 0.2% and CSI 30 index advanced 0.92%.

As expected by market participants, the U.S. Federal Reserve on Wednesday raised key rates by 75 basis points to 2.25-2.5% and noted some softening in recent data.

Indian rupee fell 12 paise to 79.90 against the US dollar on Wednesday.

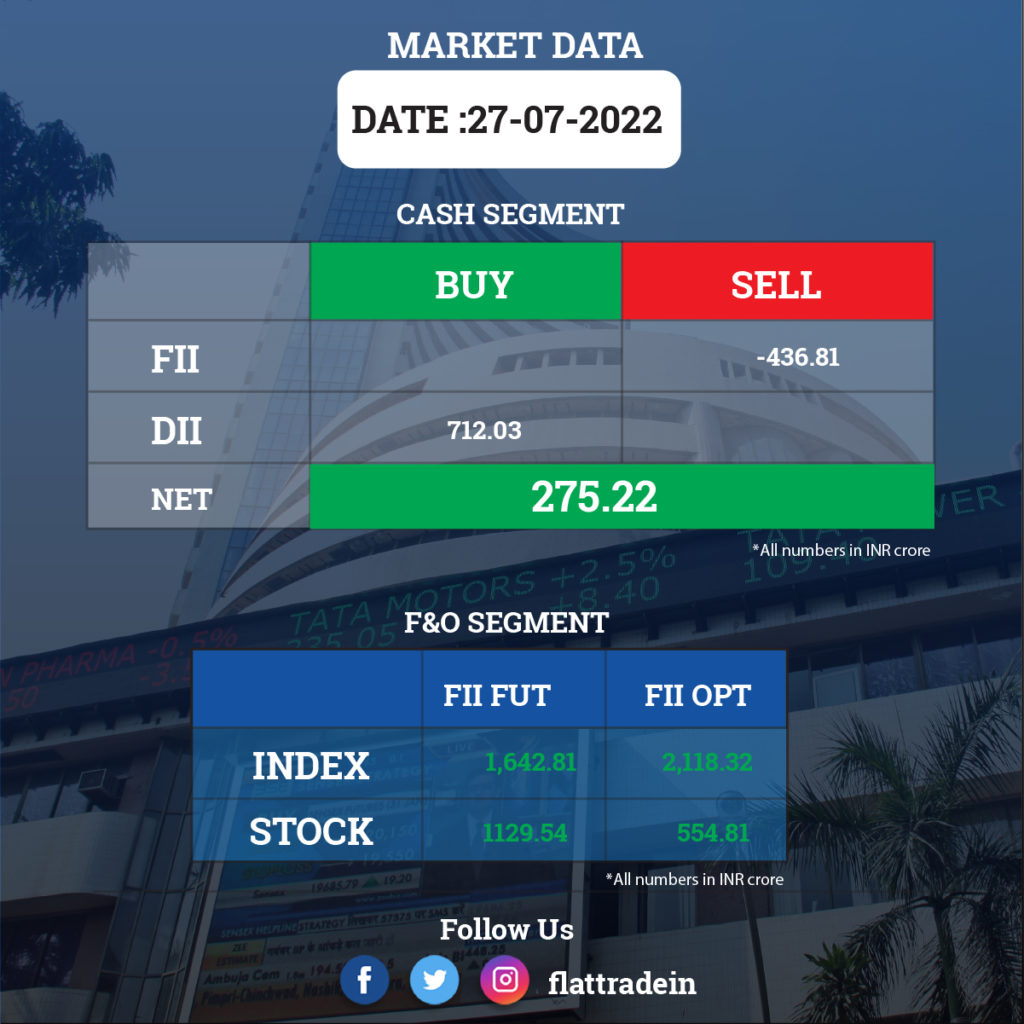

FII/DII Trading Data

Upcoming Results

Dr Reddy’s Laboratories, Shree Cement, Bajaj Finserv, Nestle India, SBI Life Insurance Company, Jubilant FoodWorks, Vedanta, Punjab National Bank, Mahindra & Mahindra Financial Services, PNB Housing Finance, SBI Cards and Payment Services, TVS Motor Company, Shriram Transport Finance, Chalet Hotels, Equitas Small Finance Bank, CMS Info Systems, GHCL, AAVAS Financiers, Intellect Design Arena, Dr Lal PathLabs, Motilal Oswal Financial Services, Nippon Life India Asset Management, NIIT, RITES, Sona BLW Precision Forgings, TTK Prestige, and Westlife Development will report quarterly earnings on July 28.

Stocks in News Today

Tata Motors: The company reported a consolidated net loss of Rs 5,007 crore for the quarter ended June 2022, compared with a loss of Rs 4,451 crore in the same period last fiscal. The company’s consolidated revenue from operations rose 8% to Rs 71,935 crore in Q1FY23 as against Rs 66,406 crore in Q1FY22. The losses were attributed to semiconductor shortage along with a strict lockdown in China.

Bharat Petroleum Corporation Ltd (BPCL): The Union Cabinet gave approval to state-owned oil refiner BPCL to invest an additional USD 1.6 billion in a Brazilian oil block. The block will start production from 2026-27.BPRL, a wholly-owned subsidiary of BPCL, has a 40 per cent stake in the block and Brazil’s national oil company Petrobras is the operator with 60 per cent interest.

Hindustan Aeronautics Ltd (HAL): the company has signed a $100 million contract with US engine-maker Honeywell, for 88 engines to power the indigenous Hindustan Turbo Trainer – 40 (HTT-40). HAL CMD R Madhavan said the company has successfully developed Basic Trainer Aircraft (HTT-40) to address the basic training requirements of the IAF.

Tata Steel: The company said it has inked a pact with a Bengaluru-based startup for drone-based mining solutions for effective mine management. With this collaboration, both the companies will jointly develop and offer sustainable and end-to-end integrated solutions focusing on efficiency, safety, and productivity of open cast mining operations.

United Breweries Ltd (UBL): The company’s revenue from operations climbed 95.88 per cent to Rs 5,196.08 crore during the quarter under review from Rs 2,652.63 crore in the corresponding period of the previous fiscal. Its consolidated net profit jumped five-fold to Rs 162.50 crore in Q1FY23, helped by higher volume. It had posted a net profit of Rs 30.94 crore in the year-ago period.

Biocon: The biotechnology firm reported a 71 per cent increase in consolidated net profit at Rs 144 crore for the quarter ended June 2022 on the back of robust growth across business verticals. It had posted a net profit of Rs 84 crore in the April-June quarter of the previous fiscal. Total revenue rose to Rs 2,217 crore in the first quarter as compared with Rs 1,808 crore in the year-ago period.

MapMyIndia: The company announced the launch of its 360-degree panoramic street view offering called ‘Mappls RealView’. The service will be available on MapmyIndia’s consumer mapping portal Mappls on the web and Mappls App on Android and iOS.

Blue Dart Express: The logistics service provider reported more than three-fold jump in consolidated profit after tax at Rs 118.79 crore in April-June 2022 quarter compared to a consolidated PAT of Rs 31.3 crore in the quarter ended June 2021. The revenue from operations during the reporting quarter was Rs 1,293.3, a 49.3 per cent growth from Rs 866.2 crore in Q1FY22.

Colgate Palmolive India: The toothpaste maker saw its net profit down 7.2 per cent year-on-year to Rs 216.6 crore (excluding exceptional item ) in the April-June quarter and its revenue up 2.5 per cent YoY to Rs 1186.59 crore compared to last year.

Shriram City Union Finance: The company has posted a 61 per cent rise in consolidated net profit during Q1FY23 to Rs 354 crore as compared to Rs 220 crore in the year-ago period. The company’s income from operations during the quarter under review was up by 24 per cent to Rs 2,003 crore as against Rs 1,611 crore during the same period of the previous financial year. The company’s disbursements rose by 82 per cent to Rs 8,726 crore, driven by a rebound in micro, small and medium enterprises (MSME), gold loans and two-wheeler loans.

EIH: The company registered a consolidated profit of Rs 65.86 crore for the quarter ended June 2022 on normalisation of business, against loss of Rs 114.25 crore in same period last year. Revenue grew 314% YoY to Rs 394.3 crore in Q1FY23.

IIFL Finance: The company’s consolidated revenue climbed 27% YoY to Rs 1928.64 crore on Q1FY23 as against Rs 1514.39 crore in the eyar-ago period. Its net profit jumped 24% to Rs 329.69 crore in Q1FY23 from Rs 265.72 crore in the corresponding quarter last fiscal. The company’s EBITDA rose 13% to Rs 1,197.71 crore in the reported quarter from Rs 1062.19 crore in the year-ago period.

Dixon Technologies: The contract manufacturer reported over two-fold jump in its consolidated net profit at Rs 45.43 crore in the April-June quarter of FY23. IT had posted a net profit of Rs 18.16 crore in the same period a year ago. Its revenue from operations was up 52.89 per cent at Rs 2,855.07 crore as against Rs 1,867.29 crore in the corresponding quarter of last fiscal.

Mahindra Lifespace Developers: The company’s consolidated revenue fell 36% to Rs 94.55 crore in Q1FY23 from Rs 148.21 crore in the year-ago period. The net profit stood at Rs 75.7 crore as against a net loss of Rs 14.04 crore in the same period last year. The company’s EBITDA loss was up 32% at Rs 31.96 crore compared to Rs 24.18 crore in the corresponding quarter last fiscal. Meanwhile, the company announced Arun Nanda’s retirement as chairman. Nanda will be succeeded by Ameet Hariani, an independent director on the board since 2017.

Poonawalla Fincorp: The financial services company posted 118 per cent year-on-year (YoY) rise in net profit at Rs 141 crore in Q1FY23 on improvement in net interest margins (NIM). It had posted a consolidated profit of Rs 64.5 crore in Q1FY22. Its gross non-performing assets (GNPAs) fell to 2.19 per cent in Q1FY23 from 5.38 per cent a year-ago period.

Welspun India: The company has reported a 11.6% year-on-year decline in consolidated revenue at Rs 1,957.3 crore for the quarter ended June 2022, impacted by home textile business. Profit fell sharply by 90.4% to Rs 21.36 crore on weak operating performance at home textile business.

VIP Industries: The company posted a consolidated profit of Rs 69.10 crore in Q1FY23 compared to a profit of Rs 2.53 crore in Q1FY22. Revenue grew by 186.4% YoY to Rs 590.61 crore in the quarter under review.

CG Power and Industrial Solutions: The company said its consolidated net profit jumped 138 per cent to Rs 129.93 crore in the April-June quarter in the current fiscal, compared to a consolidated net profit of Rs 54.58 crore in the quarter ended on June 30 2021. Total income rose to Rs 1,674.50 crore in the quarter under review from Rs 1,061.24 crore in the same period a year ago.