Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.07% higher at 18,703, signalling that Dalal Street was headed for positive start on Tuesday.

Asian shares pared gains to trade lower. The Nikkei 225 index fell 0.42% and the Topix dropped 0.61%. The Hang Seng lost 0.285 and the CSI 300 index was 0.345 lower.

Indian rupee fell 6 paise to 82.63 against the US dollar on Monday.

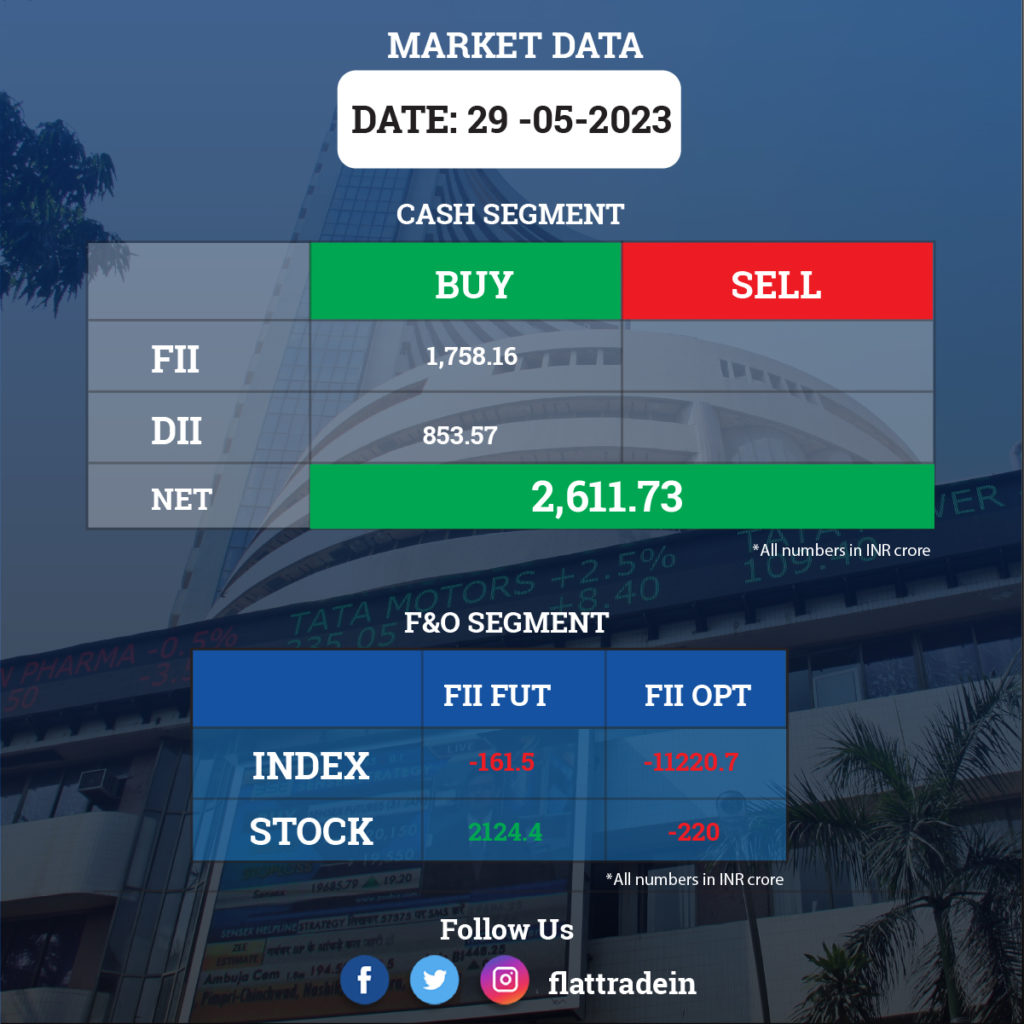

FII/DII Trading Data

Upcoming Results

Adani Ports and Special Economic Zone (APSEZ), Apollo Hospitals Enterprise, Mankind Pharma, Torrent Pharmaceuticals, Patanjali Foods, Prestige Estates Projects, Action Construction Equipment, Aegis Logistics, Astrazeneca Pharma India, Bajaj Healthcare, Birla Tyres, Gujarat Mineral Development Corporation, Graphite India, Greenply Industries, Heranba Industries, Indiabulls Real Estate, Insecticides (India), KRBL, Lemon Tree Hotels, Lumax Auto Technologies, Lux Industries, Marksans Pharma, Mazagon Dock Shipbuilders, Panacea Biotec, PC Jeweller, Peninsula Land, Rashtriya Chemicals & Fertilizers, Reliance Infrastructure, Suzlon Energy, Uflex, Vakrangee, V-Guard Industries, Vivimed Labs, and Welspun Corp will report their quarterly earnings today.

Stocks in News Today

Reliance Industries (RIL): JioCinema, the streaming platform of RIL, and NBC Universal (NBCU) have entered into a multi-year partnership to offer films and TV series in India. Under the partnership, the over-the-top (OTT) platform will stream Comcast NBCUniversal’s production entities and brands. The deal will give JioCinema’s premium subscribers access to popular Hollywood shows.

Adani Transmission: The company’s consolidated revenue was up 12.9% YoY at Rs 3,357.7 crore in Q4FY23. Ebitda was up 27.3% YoY at Rs 1,203.2 crore in Q4FY23. Consolidated net profit was up 85.5% YoY at Rs 439.6 crore in Q4FY23.

Indian Railways Catering and Tourism Corporation (IRCTC): The company’s standalone revenue rose 39.7% YoY to Rs 965 crore in Q4FY23. Ebitda rose 16.5% YoY to Rs 324.6 crore in Q4FY23. Standalone net profit rose 30% YoY to Rs 278.8 crore in Q4FY23. The company reported exceptional gain to the tune of Rs 25.9 crore for the quarter under review, compared to exceptional loss of Rs 4 crore in the year-ago period. The company will pay a final dividend of Rs 2 per share for the fiscal 2023.

Rail Vikas Nigam (RVNL): The state-owned railway company has recorded a 5% year-on-year decline in consolidated profit at Rs 359.2 crore for the quarter ended March FY23. Consolidated revenue from operations dropped 11.1% to Rs 5,720 crore compared to the corresponding period last fiscal. Ebitda was down 8.3% YoY at Rs 374.37 crore in Q4FY23. The board recommended a final dividend of Rs 0.36 per share.

Torrent Power: The power utility has posted a consolidated profit of Rs 449 crore for the quarter ended March FY23, against a loss of Rs 488 crore in the year-ago period. The loss in Q4FY22 was due to a one-time loss of Rs 1,300 crore. Revenue from operations grew by 61.3% to Rs 6,038 crore compared to the corresponding period last fiscal. Ebitda was up 10.1% YoY at Rs 1,090.4 crore in Q4FY23. The company will pay a final dividend of Rs 4 per share for the fiscal 2023, with a total outgo of Rs 192.3 crore.

Sobha: The realty company has reported a massive 242% YoY rise in consolidated profit at Rs 48.6 crore for the March FY23 quarter, helped by healthy topline growth. Revenue from operations surged 70.3% to Rs 1,210 crore compared to the corresponding period last year, with consistently higher sales, the highest-ever collections and healthy customer deliveries. The board recommended a dividend of Rs 3 per share for FY23.

NBCC (India): The public sector enterprise registered a 206% YoY growth in consolidated profit at Rs 108.4 crore for the fourth quarter of FY23, driven by healthy operating performance. Consolidated revenue from operations for the quarter stood at Rs 2,790 crore, 14.3% rise over a year-ago period. The company reported net exception expenses of Rs 4.77 crore during the March quarter, down from 72.9 crore in the year-ago period. The board recommended a final dividend of Rs 0.54 per share.

Jubilant Pharmova: The pharma company has posted a consolidated loss of Rs 97.8 crore for the quarter ended March FY23, against a profit of Rs 59.5 crore in the same period last year. The profitability was impacted by dismal operating numbers with a significant rise in depreciation, higher inventory, and input cost. Revenue from operations grew by 9.7% to Rs 1,661 crore compared to the corresponding period last fiscal.

ISGEC Heavy Engineering: The engineering company has reported consolidated profit at Rs 86.13 crore for the fourth quarter of the last financial year 2022-23, growing 129% over the corresponding period last fiscal. Revenue from operations for the quarter stood at Rs 2,043 crore, up 28% over the year-ago period. The board recommended a dividend of Rs 3 per share for FY23.

KNR Constructions: The company’s consolidated revenue rose 13% YoY at Rs 1,245.3 crore in Q4FY23. Ebitda fell 11.8% YoY at Rs 245.97 crore in Q4FY23. Consolidated net profit was up 5.8% YoY at Rs 147.27 crore in Q4FY23. The company announced a final dividend of Rs 0.25 per share for the fiscal 2023.

Hikal: The company reported a consolidated revenue of Rs 545.3 crore in Q4FY23, up 8.55% YoY. Ebitda was up 44.3% YoY at Rs 88 crore in Q4FY23. Consolidated net profit jumped 73.8% YoY at Rs 36 crore in Q4FY23. The board recommended a final dividend of Rs 0.3 per share for the fiscal 2023.

Jamna Auto Industries: The company’s consolidated revenue was down 1.3% YoY at Rs 347.75 crore in Q4FY23. Ebitda was down 7% YoY at Rs 82 crore in Q4FY23. Consolidated net profit was down 7.7% YoY at Rs 52.5 crore in Q4FY23. The board recommended a final dividend of Rs 1.10 per share.

NOCIL: The company said its consolidated revenue fell 15.1% YoY to Rs 392.72 crore in Q4FY23. Ebitda plunged 55.7% YoY to Rs 49 crore in Q4FY23. Consolidated net profit dropped 58.6% YoY at Rs 28.38 crore in Q4FY23. The company will pay a final dividend of Rs 3 per share.

Campus Activewear: The company said its consolidated revenue slipped 1.3% YoY to Rs 347.75 crore in Q4FY23. Ebitda was down 27.9% YoY at Rs 56.5 crore in Q4FY23. Consolidated net profit was down 0.09% YoY at Rs 22.9 crore in Q4FY23. Sanjay Chabra has been appointed as the chief financial officer of the company, effective June 1, while Piyush Singh has been elevated to the position of chief operating officer.

Speciality Restaurants: The company which operates Mainland China chain of restaurants said its consolidated revenues was up 21.9% YoY at Rs 87.5 crore in Q4FY23. Ebitda rose 64.1% YoY at Rs 13.7 crore in Q4FY23. Consolidated net profit jumped 1794.1% to Rs 55.31 crore in Q4FY23. The company received tax credit of Rs 35.04 crore during the quarter under review. Its board approved a dividend of Rs 2.50 per share.