Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.96% lower at 17,451, signalling that Dalal Street was headed for a gap-down opening on Friday.

Asian shares were trading lower, tracking Wall Street overnight, as investors were concerned over rising interest rates and its impact on the US banking sector. The Nikkei 225 index fell 1.21% and the Topix slumped 1.31%. The Hang Seng tanked 2.45% and the CSI 300 index lost 1%.

Indian rupee rose 8 paise to 81.97 against the US dollar on Thursday.

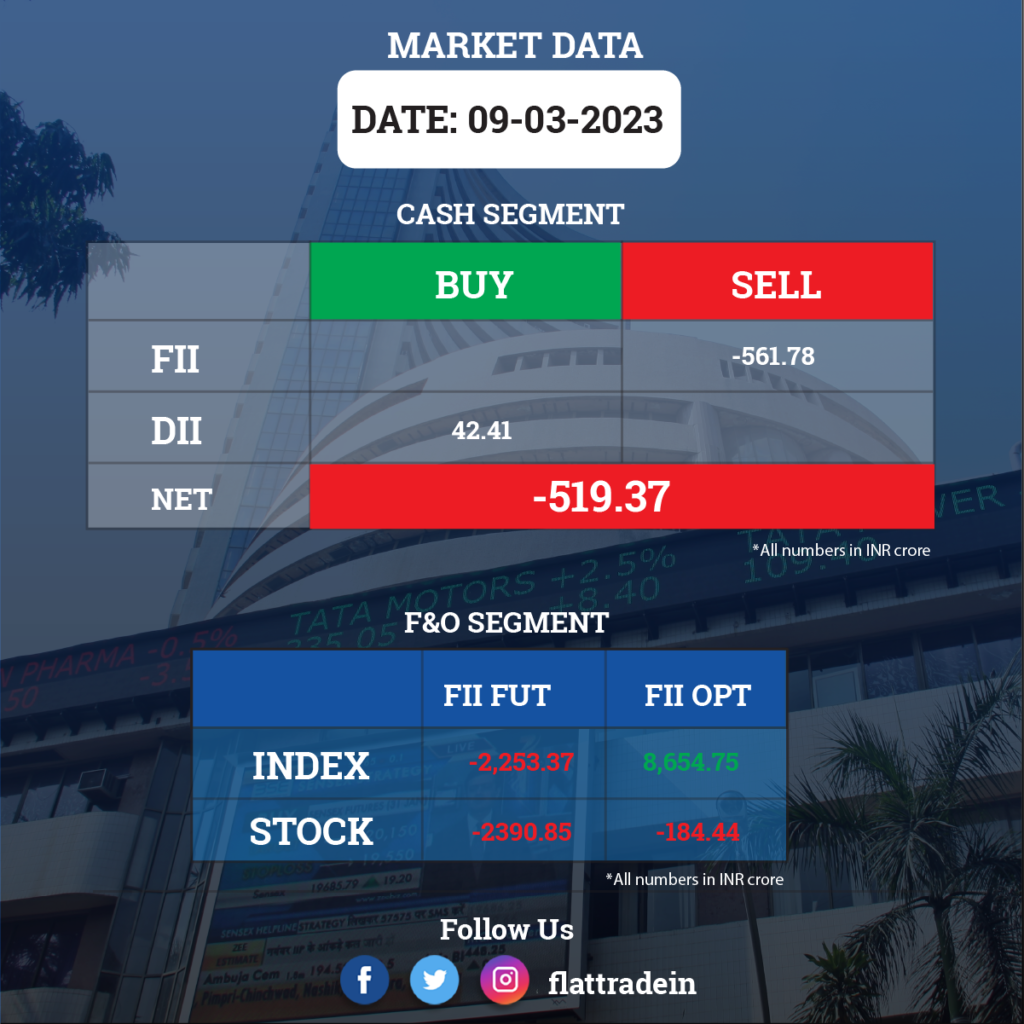

FII/DII Trading Data

Stocks in News Today

Reliance Industries Ltd (RIL): The company’s arm Reliance Polyester has completed the acquisition of polyester business of Shubhalakshmi Polyesters & Shubhlaxmi Polytex. The acquisitions is expected to expand the company’s downstream polyester business.

In other news, Reliance Consumer Products (RCP) has relaunched the 50-year-old iconic beverage brand ‘Campa’. The company bought the brand in August 2022 for Rs 22 crore from Pure Drinks.

Infosys: The IT major has collaborated with mobility specialist ZF to revamp its multi-echelon supply chain with SAP Integrated Business Planning (SAP IBP) and Infosys Cobalt. Infosys leveraged its hybrid agile implementation methodology to replace multiple legacy demand planning tools at ZF Aftermarket, with a unified, global SAP platform. ZF is a global technology company supplying systems for passenger cars, commercial vehicles and industrial technology, enabling the next generation of mobility.

Wipro: The IT firm announced that it has been selected by Menzies Aviation, the world’s largest aviation services company, to transform its air cargo management services. The partnership will help fortify Menzies’ position as the leading cargo handler in the market, enabling the company to grow its services and use of new technologies. It will also accelerate competitiveness while keeping customers, partners, employees, and the environment at the center of this transformation.

NBCC (India): The state-owned project management consultancy and EPC company has received work orders worth Rs 229.81 crore, from Indian Institute of Foreign Trade (IIFT). The company will construct a new campus for IIFT in Kakinada.

Bank of Baroda: The state-owned bank said that its board has approved selling up to 49% stake in wholly-owned subsidiary BoB Financial Solutions Ltd (BFSL).

Dredging Corporation of India: The dredging company has received the annual maintenance dredging contract worth Rs 64 crore from Southern Naval Command Kochi, for FY23. The contract includes annual dredging of 1.5 million cubic metre at Naval Channel, Ernakulam, Kochi.

PNC Infratech: The company is declared as L1 (lowest) bidder for two highway projects of NHAI, with an aggregate bid project cost of Rs 2,004.43 crore. These two highway projects, which come under Bharatmala Pariyojana in Bihar on Hybrid Annuity Mode, are to be constructed in 24 months and operated for 15 years, post construction.

IRB Infrastructure Developers: The road infrastructure developer has reported toll collection at Rs 352 crore for February 2023, a rise of 27% compared to Rs 277.5 crore in the same month last year. Its private InvIT subsidiary IRB Infrastructure Trust recorded 12.7% YoY growth in toll collection at Rs 75.52 crore for February 2023.

Glenmark Life Sciences: The board members of the company are scheduled to meet on March 16 to consider and declare payment of interim dividend, if any, for the financial year 2022-23. The trading window will remain closed from March 10-March 18, 2023 for the interim dividend.

Shriram Finance: Investors Dynasty Acquisition (FPI) and Arkaig Acquisition (FPI) have exited the Shriram Group company by selling their shareholding of 2.49% and 0.67%, respectively, via block trades on March 8.

Zydus Lifesciences: The drugmaker has received final approval from the United States Food and Drug Administration (USFDA) for Erythromycin tablets. These tablets are used to prevent and treat infections in many different parts of the body, including respiratory tract infections, skin infections, diphtheria, intestinal amebiasis, acute pelvic inflammatory disease, legionnaire’s disease, pertussis and syphilis. The drugs will be manufactured at the group’s formulation manufacturing facility in Moraiya, Ahmedabad (India). Erythromycin tablets had annual sales of $25.1 million in the US as per IQVIA MAT data of December 2022.

REC: The company’s board has approved raising up to Rs 1,20,000 crore via debt instruments in FY24. The company will borrow the funds from the market in FY24 under various types of bonds and loans and commercial papers.

Swan Energy: The company through its subsidiary Triumph Offshore Private (TOPL) has signed an agreement to lease out its floating storage regasification vessel to Botas of Turkey, a state-owned natural gas and LNG firm.

Apcotex Industries: The company said that the multi-purpose expansion plant for manufacturing of Synthetic Latex Emulsion Polymers at its plant in Taloja, Maharashtra has been commissioned and commenced commercial production.

IFL Enterprises: The board has approved stock split of 1 equity share of face value of Rs 10 each into 10 equity shares of face value of Rs 1 each along with a bonus share issue of 1 share each for every 4 shares held by shareholders.

Welspun Corp : Its arm Welspun DI Pipes has received the ‘Kitemark’ certificate from BSI UK for a size range of 100 to 1,000 DN against EN 545 & ISO 2531 standards.

EP Biocomposites: The company has ventured into the production of laminated doors, which is an allied product to its current production of FRP Doors. The company has successfully tested the production of this product and is ready for its commercial launch.

PSP Projects: The company has received work orders worth Rs 123.38 crore in institutional, industrial and residential categories, including the order for the construction of the iconic project “360” in Ahmedabad, from Anjney Finebuild, and design & construction of an industrial shed in Ahmedabad, from Adishwaram Innovative LLP. With the above orders, the total order inflow for the current financial year stands at Rs 3,415.97 crore.

Mukand: The company has signed a share purchase agreement for sale of 5.51% equity shares of Mukand Sumi Special Steel to Jamnalal Sons. Mukand Sumi Special Steel is a joint venture of Bajaj Group, and Jamnalal Sons is a promoter group entity of the company. The board of directors of the company had approved the sale of 5.51% stake in Mukand Sumi and share purchase agreement with respect to said transaction in February 2023.

Hind Rectifiers: The rectifier equipment and semi-conductor devices manufacturer has commenced commercial production at new manufacturing plant in Nashik, Maharashtra. The benefits of these new production lines will be availed from 2023-24 onwards.