Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.63% lower at 17,031, signalling that Dalal Street was headed for a negative start on Monday.

Asian shares were trading lower as concerns over hawkish monetary policy rose after strong US labor market data. Japan’s Nikkei 225 index fell 0.71% and Topix dropped 0.82%. Hang Seng slumped 2.32% and CSI 300 index was down 1.01%.

Indian rupee fell 44 paise to 82.32 against the US dollar on Friday.

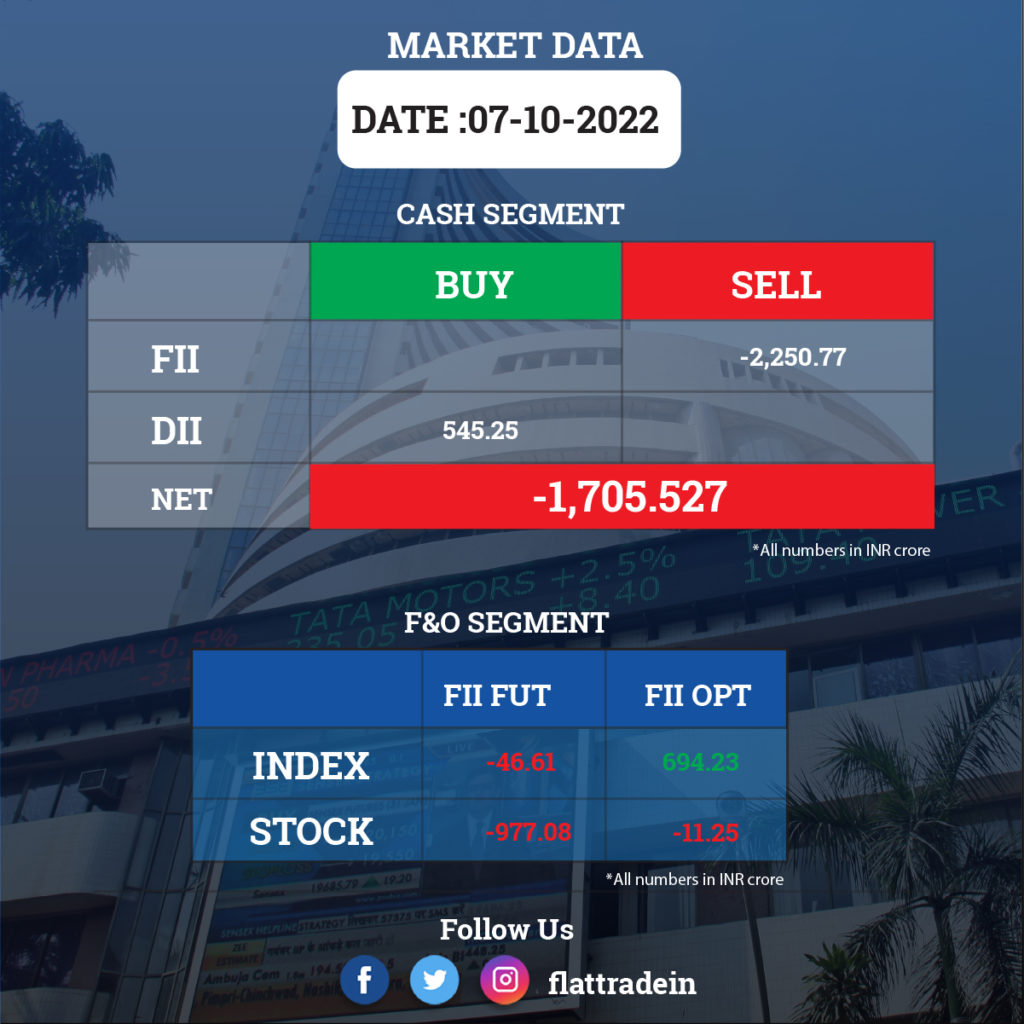

FII/DII Trading Data (7-10-2022)

Stocks in News Today

Tata Motors: The company said Jaguar Land Rover sold 88,121 vehicles in the quarter ended September FY23, up 11.8% over the previous quarter but a decline of 4.9% from the year-ago period. Retail sales were higher in China, up 38% compared to first quarter, a rise of 27% in North America and 14% gain in overseas market. However, retail sales were lower in the UK (down 7 percent) and Europe (down 10 percent). In the first half of FY23, the company saw a 23.2 percent decline in sales volume at 1.66 lakh vehicles YoY. Its total order book in Q2FY23 has grown by 5,000 vehicles to 2.05 lakh vehicles from the previous quarter, the company said.

Ambuja Cements: The company said it has received shareholders’ approval for all proposals in its EGM, including a resolution to raise Rs 20,000 crore from an Adani group firm and appointment of Gautam Adani and others on the board of the company. The Extraordinary General Meeting (EGM) has passed the special resolution proposing to raise Rs 20,000 crore by issuing securities on a preferential basis to Harmonia Trade and Investment, part of Adani Group, with 91.37% votes, Ambuja Cements said in a regulatory update.

HDFC: The mortgage lender will issue secured redeemable non-convertible debentures worth Rs 1,000 crore and option to retain oversubscription of Rs 11,000 crore on October 11, 2022, with a coupon rate of 8.07%.

Tata Power: The company made an announcement at Invest Rajasthan summit that it plans to develop about 10,000 MW of renewable energy capacity, mainly solar energy, in the next five years in Rajasthan, according to PTI reported.

ICICI Prudential Life Insurance: The company’s new business premium of the insurer grew 13.9% YoY to Rs 7,359 crore in the first half of the current fiscal, according to its exchang filing. Its annualised premium equivalent rose 10.1% to Rs 3,519 crore. Retail weighted received premium inched up by 1% to RS 2,613 crore.

IDBI Bank: The government of India has engaged KPMG India as the transaction adviser and Link Legal as the legal adviser for providing advisory services and managing the transaction of stake sale in IDBI Bank as the government and LIC plan to sell more than 30% stake each in IDBI Bank. The government has a 45.48% stake and LIC a 49.24% shareholding in the bank.

FMCG firms: Companies like Hindustan Unilever (HUL) and Godrej Consumer Products (GCPL) have cut prices of some soap brands by up to 15% amid fall in palm oil and other raw materials prices. HUL has reduced prices of its offerings under popular soap brands Lifebuoy and Lux by 5-11% in the western region. GCPL has also reduced prices of soaps by 13-15%.

HCLTech: The IT company plans to hire 1,300 people in Mexico over the next two years and the decision is expected to strengthen its current employee base of 2,400 people in that country. HCLTech outlined its expansion plans in Mexico at its 14-year anniversary celebration at Guadalajara in Mexico. The IT firm will also be opening its sixth technology center in Guadalajara.

Power Grid Corporation of India: The company’s subsidiary POWERGRID Bhind Guna Transmission has successfully commissioned the transmission system in Madhya Pradesh. The subsidiary secured an order to establish transmission system for intra-state transmission work associated with the construction of a 400kV substation near Guna and a 220kV substation near Bhind on build, own, operate and maintain basis.

Star Health and Allied Insurance Company: The company registered gross direct premium of Rs 5,655.1 crore for the quarter ended September FY23, a 12% growth over a year-ago period, with health-retail segment registering 21% YoY growth at Rs 4,306.4 crore.

Allcargo Group: The logistics firm is bullish on its business prospects and expects to grow at an average 15 per cent annually, mainly driven by organic growth, its Chairman Shashi Kiran Shetty said. The group aims to achieve Rs 25,000-30,000 crore revenue by 2026 with as much as Rs 20,000-25,000-crore sales coming from its international supply-chain business, and Rs 2,700-3,500 crore from its express and contract logistics segment.

Navkar Corporation: The company has approved the transfer of movable assets, including trailers and dwarf containers, to Adani Logistics. The transaction cost is Rs 173.97 crore. The company will utilise the amount for the expansion of business and the purchase of new trailers for its new inland container depot at Morbi.

Sundaram Clayton: The company has sold 8.56 lakh shares in TVS Training and Services, an associate company. With this, its shareholding in has been reduced from 30.53% to 21.07%. These shares were sold for Rs 1.24 crore.

Suzlon Energy: The board has approved the appointment of Vinod R Tanti as the chairman & managing director of the company with immediate effect for three years up to October 6, 2025. The board also appointed Girish R Tanti, an executive director, as the executive vice chairman.

Shriram City Union Finance: The company has issued NCDs worth Rs 150 crore on private placement basis on a coupon of 8.30%.

DB Realty: The company has acquired entire equity shares of DB Man Realty, a subsidiary in which the company and its nominees already held 91% stake. The company has also acquired entire equity shares of Spacecon Realty, a subsidiary in which the company and its nominee already held 74% stake. Both units have now become wholly owned subsidiary of the company.