Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.55% higher at 18,805, signalling that Dalal Street was headed for a positive start on Wednesday.

Most Asian stocks rose after data showed the US consumer prices eased in November ahead of the Federal Reserve’s policy decision due later on Wednesday. The Nikkei 225 index rose 0.67% and the Topix index was up 0.46%. Meanwhile, the Hang Seng index fell 0.27% and the CSi 300 index slipped 0.08%.

Indian rupee fell 27 paise to 82.81 against the US dollar on Wednesday.

The US consumer price index (CPI), a measure of inflation, rose 7.1% in November from a year ago, as against 7.7% in October, according to the Labor Department. On a month-to-month basis, the consumer price index rose just 0.1% in November, down from 0.4% in October.

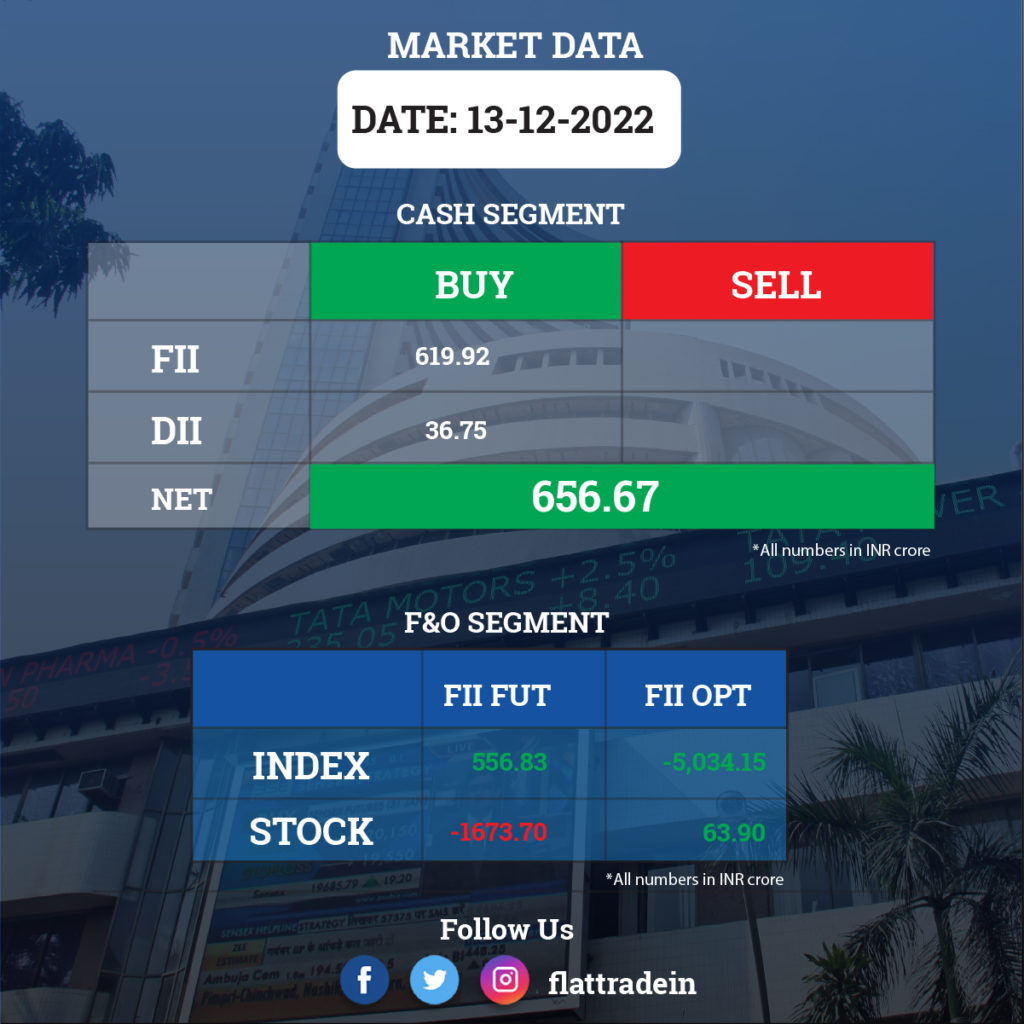

FII/DII Trading Data

Stocks in News Today

Adani Transmission: The company said it has incorporated a wholly-owned subsidiary Adani Cooling Solutions Ltd. According to its regulatory filing, the subsidiary was incorporated with an initial authorised and paid up share capital of Rs 1,00,000 each, for the purpose of carrying on District Cooling System business.

Paytm: The company’s board has approved buyback of shares worth Rs 850 crore. The company would undertake the buyback exercise at a maximum price of Rs 810 per share, nearly 50 per cent premium to Tuesday’s closing price. Until the buyback period is completed, the company said that the management would not participate is any sale of shares.

Axis Bank: The private sector lender received the board approval for allotment of 12,000 non-convertible Basel-III compliant Tier-2 bonds of face value of Rs 1 crore each. The total fund raising would be at a coupon rate of 7.88 per cent per annum payable annually, on a private placement basis.

Ultratech Cement: The cement maker commissioned 1.9 metric tonnes per annum (mtpa) greenfield clinker-backed grinding capacity at Pali Cement Works, Rajasthan. The project is part one of capacity expansion plan announced in December 2020. With this, the company’s total cement capacity in Rajasthan stands at 16.25 mtpa.

SBI: The country’s largest lender raised interest rates by 15-100 basis points (bps) on various maturities on both domestic retail deposits, and bulk deposits. A peak deposit rate of 6.75 per cent was applicable on retail deposits on two buckets – one year to less than two years and two years to less than three years.

YES Bank: Private equity majors Carlyle Group and Advent picked 9.99 per cent stake in the bank and would pump in around Rs 8,896 crore with full conversion of warrants into equity. The investment by the PE funds will be one of the biggest in the banking sector in recent times.

Bank of Baroda: The public sector lender plans to sell its majority stake in Nainital Bank. The board of directors of the bank has approved divestment of its majority shareholding in Nainital Bank (NBL), and authorised issuance of an advertisement inviting Expressions of Interest through a Preliminary Information Memorandum.

Tata Power: The company received shareholders nod to appoint former Union home secretary Rajiv Mehrishi as an independent director on its board. Mehrishi is a retired Indian Administrative Service (IAS) officer of the 1978 batch and has a wide experience of over 42 years.

TVS Motor: The company plans to launch Euro-5 two-wheelers in Turkey, in line with regulations related to Euro-5 emission norms. The company awaits approval from European Union and local authorities, post which the product shall be launched. The management said that the new Euro-5 standard editions would encourage more new-age riders.

Piramal Enterprises: The NBFC’s subsidiary Piramal Capital & Housing Finance (PCHFL)acquired 100 per cent stake in PRL Agastya for Rs 90 crore. Post-acquisition, PRL Agastya will become a wholly-owned subsidiary of PCHFL.

Bayer CropScience: The agrochemical company temporarily discontinued operations at crop protection formulations plant at Himatnagar in Gujarat, with effect from December 12. This is after the directions from the Gujarat Pollution Control Board.

IFB Industries: The manufacturer of white goods has received approval from board of directors for investment of up to Rs 97 crore in equity issue of IFB Refrigeration in one or more tranches.

Patel Engineering: The company said that its board would meet on December 16 to approve fund raise through issue of equity shares on rights basis to existing shareholders of the company.