Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.31% lower at 17,520, signalling that Dalal Street was headed for negative start on Wednesday.

Most Asian shares were trading lower, tracking the US markets overnight. The Nikkei 225 index tanked 1.31% and the Topix plunged 1.54%. The Hang Seng dropped 0.66%, while the CSI 300 index rose 0.31%.

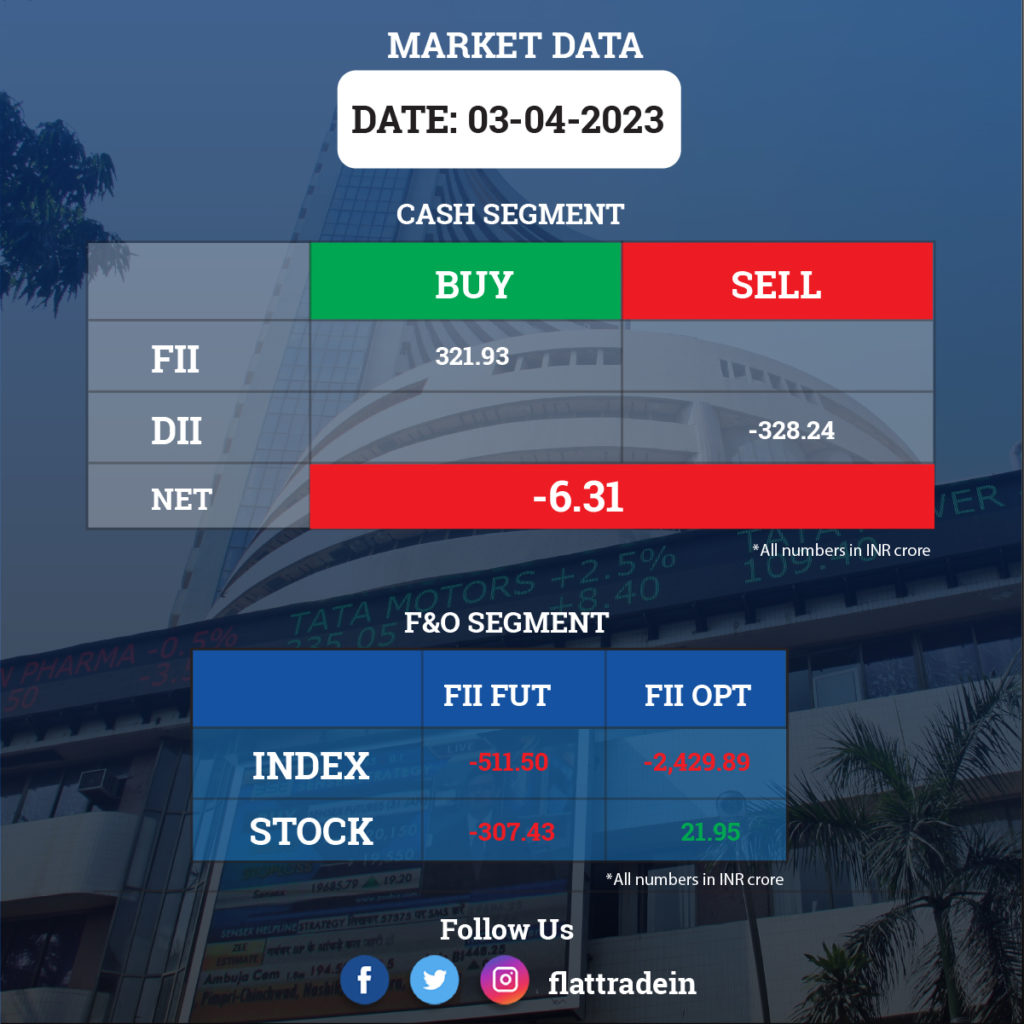

FII/DII Trading Data

Stocks in News Today

HDFC Bank: India’s largest private sector bank said its CASA increased 11.3% to Rs 8.36 lakh crore as on March 31, 2023, with the CASA ratio at 44%. Total deposits increased 20.8% to Rs 18.84 lakh crore. The bank recorded 16.9% YoY rise in gross advances at Rs 16.01 lakh crore.

Oil companies: The Centre has slashed windfall tax on domestically produced crude oil to nil from Rs 3,500 a tonne, effective from April 4. It has also reduced the levy on diesel to 50 paise per litre from Rs 1. The move means crude oil, aviation turbine fuel (ATF), and petrol will not attract windfall tax.

IndusInd Bank: The private sector lender clocked net advances at Rs 2.89 lakh crore for the quarter ended March FY23, up 21% YoY and 6% QoQ, while deposits grew by 12% year-on-year and 3% sequentially to Rs 3.36 lakh crore. The retail deposits stood at Rs 1.43 lakh crore as of March 2023, up from Rs 1.37 lakh crore as of December 2022.

HCL Technologies: Investment bank and brokerage JP Morgan placed Indian IT services provider on “negative catalyst watch” ahead of the earnings season, citing the highest near-term risks for the company. “We remain cautious on the IT sector as we see downside risks to earnings and multiples from the weak fourth quarter prints and FY24 guidance,” the brokerage said in a note.

Marico: The FMCG major said its consolidated revenue in the March FY23 quarter grew in the low single digits on a year-on-year basis. India business witnessed some improvement in YoY volume growth and stayed in the mid-single digit zone, while the international business maintained its stellar growth trajectory as it posted mid-teen constant currency growth. Parachute Coconut Oil posted a strong high single-digit volume growth, aided by stable consumer pricing while copra prices remained steady through the quarter. Value Added Hair Oils touched double-digit value growth.

Britannia Industries: The board approved an interim dividend of Rs 72 for each share for the current fiscal. The record date for the dividend has been fixed at April 13, 2023.

Cyient: The company’s board has appointed Karthik Natarajan as executive director and CEO. It has also appointed Krishna Bodanapu as executive vice chairman and managing director, and Prabhakar Atla as chief financial officer.

NBCC (India): The company has received a work order worth Rs 448.02 crore, for the construction of 88.58-km border and road in Mizoram along the Indo-Bangladesh Border, from the Government of India.

RailTel Corporation of India: The company has received a work order worth Rs 76.10 crore from Bihar State Electronics Development Corporation for the implementation and management of an electronic knowledge network in academic/administrative buildings of government engineering colleges and polytechnic institutes in Bihar. Another order worth Rs 38.95 crore is from National Informatics Centre Services for installation, testing and commissioning of 4 Mbps lease line connectivity for 19 sites.

M&M Financial Services: In March 2023, the company estimates overall disbursement at Rs 5,600 crore, delivering a 42% YoY growth. The Q4FY2023 disbursements at Rs 13,750 crore registered a growth of 50% YoY. FY2023 disbursement was approximately Rs 49,500 crore registering a YoY growth of 80 percent. Healthy disbursement trends during FY23 have led to business assets at Rs 82,300 crore, a growth of 7% over December 2022 and 27% over March 2022. The collection efficiency was at 105% for March 2023, and in Q4FY23 it was at 99% against 100% for Q4FY22).

Federal Bank: The private sector lender said in an exchange filing that total deposits stood at Rs 2.13 lakh crore for the Q4FY23 quarter, rising 17.4% over Q4FY22. Total deposits excluding Interbank deposits and certificates of deposit jumped 13.3% YoY to Rs 2.01 lakh crore. Gross advances grew by 20.2% YoY to Rs 1.77 lakh crore. Retail credit increased by 18.6% and wholesale credit book rose by 22.2%.

Lemon Tree Hotels: The company signed a new property in Greater Bengaluru—Peninsula Suites. The property will be managed by Carnation Hotels, a wholly-owned subsidiary and the management arm of the company.

Dhampur Sugar Mills: The company’s board has approved an interim dividend of Rs 5 per share and special dividend of 10% on successful commissioning of new distillery project.

Bajaj Finance: The NBFC major said that its core AUM rose 29% to Rs 247,350 crore. The company booked highest ever new loans of 29.6 million in FY23. Total deposits increased 45% YoY to Rs 44,650 crore and consolidated net liquidity surplus stood at Rs 11,850 crore for the quarter ended March 2023.

Vedanta: The mining announced that total aluminium production remained flat at 574 kilo tonnes. Gross oil and gas production declined 11% to 12.3 million barrels. Saleable ore production from Karnataka increased 12% to 1.6 million tonnes.

Hindustan Zinc: The company said mined metal production increased 2% to 301 kilotonnes, driven by higher ore production and improved mined metal grades. Refined metal production was at highest-ever of 269 kilotonnes with a growth of 3%. Integrated zinc production increased 2% YoY to 215 kilotonnes.

Mahindra & Mahindra Financial Services: The NBFC announced that its overall disbursement of loans increased 50% to Rs 13,750 crore. Its collection efficiency stood at 99%, compared to 100% in the year-ago period.

South Indian Bank: The bank has reported a 16.65% YoY growth in gross advances at Rs 72,107 crore, while total deposits grew by 2.82% YoY to Rs 91,652 crore. The bank said CASA deposits rose 2.07% to Rs 30,215 crore and CASA ratio fell to 32.97% from 33.21%.

Suryoday Small Finance Bank: Total deposits of the lender increased 34% YoY to Rs 5,165 crore. CASA ratio stood at 17.1%, compared to 20.2% in the year-ago period. Gross advances rose 21% to 6,115 crore. Gross NPA ratio improved to 3% in the quarter ended March 2023 from 11.8% in the year-ago period..

Bandhan Bank: The bank said its advances rose 9.8% YoY to Rs 1.09 lakh crore for Q4FY23. Deposits stood at 12.2% higher at Rs 1.08 lakh crore in the quarter ended March 2023.

Nazara Tech: Company’s subsidiary Nodwin Gaming has acquired 51 per cent stake in Singapore-based firm Branded Pte. for a cash consideration of up to $1.3 million. Branded Pte Ltd. is a private limited company, incorporated in Singapore engaged in Gaming & Sports Entertainment IP business.

HG Infra: It has received a Letter of Acceptance dated from Rail Vikas Nigam for a project with bid cost of Rs. 466.11 crore. The project is expected to be completed within 30 months and commencement of work must begin within 42 days from the date of receipt of Letter of Acceptance.

Indigo Paints: The company will acquire 51% stake in construction chemical firm Apple Chemie India Pvt. Ltd. by a combination of primary capital infusion and secondary share purchase transaction with the promoters. Indigo Paints also has an option to acquire additional stake in Apple Chemie at the end of 3 years.