Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.32% higher at 17,234, signalling that Dalal Street was headed for positive start on Tuesday.

Asian shares declined on Tuesday, as investors were rattled by SVB contagion. The Nikkei 225 index tanked 1.97% and the Topix plummeted 2.48%. The Hang Seng was down by 1.22% ad the CSI 300 index fell 0.73%.

The Indian rupee fell 8 paise to 82.12 against the US dollar on Monday.

India’s retail inflation based on CPI inched lower to 6.44% in February from 6.52% in January, though it remained above the upper band of the 2%-6% target of the Reserve Bank of India (RBI) for the second consecutive month, data released by the National Statistical Office (NSO) on Monday showed. While food inflation eased marginally to 5.95% in February from the revised level of 6% in January (earlier 5.94%).

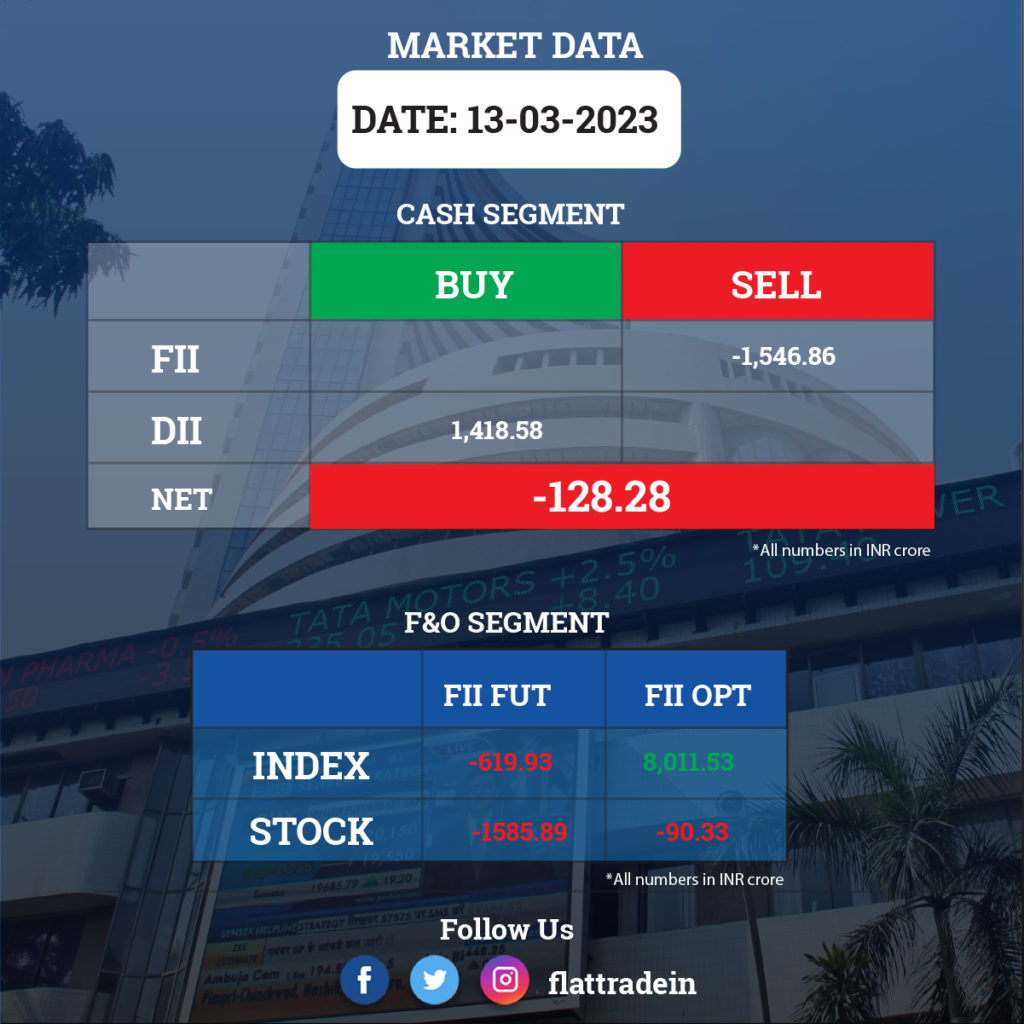

FII/DII Trading Data

Stocks in News Today

GAIL India: The PSU has declared an interim dividend of 40 percent on the paid-up Equity Share Capital, which is Rs 4 per equity share for FY23. The total dividend amount will be Rs 2,630 crore and the record date is March 21, 2023. According to the current shareholding pattern, Government of India (51.52%) will receive a dividend of Rs 1,355 crore, while other shareholders will receive Rs 1,275 crore.

Sona BLW Precision Forgings: Private equity firm Blackstone sold its 20.50% stake in the auto component maker for Rs 4,917 crore through an open market transaction. Blackstone, through its affiliate Singapore VII Topco III Pte Ltd offloaded the shares in Sona BLW. Singapore VII Topco III Pte is a promoter entity in Sona BLW. Monetary Authority of Singapore, Government of Singapore, BNP Paribas Arbitrage, Fidelity Asian Values Plc, Societe Generale, among others were the buyers of the shares.

National Aluminium Company (NALCO): The company’s board has approved a second interim dividend of Rs 2.5 per share for each share of face value Rs 5. The record date for the dividend is March 21, and it will be paid to the shareholders on or before March 31.

PNB Housing Finance: The company has received SEBI’s approval to raise up to Rs 2,500 crore through rights issue of shares. The company intends to utilise the net proceeds to strengthen its capital base.

Embassy Office Parks REIT: The company said it has committed over Rs 300 crore for ongoing green initiatives across its commercial projects across its 43.6 million square feet pan-India portfolio. Embassy REIT said it has recently commissioned the first phase of its 20 MW solar rooftop project. This project aims to generate 30 million units of solar power, offsetting around 25,000 tonnes of CO2 emissions. As part of its 2040 net zero carbon operations goal, Embassy REIT aims to achieve 75% renewable energy usage by 2025.

Tube Investments of India: The company signed a deal with N Govindarajan to incorporate a subsidiary to foray into the contract development and manufacturing operations business. The company will invest Rs 285 crore, and Govindarajan will invest Rs 15 crore in the form of equity and compulsorily convertible preference shares.

NMDC: The company said that additional charge of Chairman and Managing Director has been given to Amitava Mukherjee, Director (Finance), for a period of three months till May 31 as Sumit Deb was relieved from the post.

Jaiprakash Associates (JAL): The company has approached the insolvency appellate tribunal NCLAT against the NCLT order relating to the distribution of Rs 750 crore in the Jaypee Infrastructure (JIL) matter. The amount was deposited with the Supreme Court registry by Jaiprakash Associates, the erstwhile promoter of Jaypee Infratech, which is going through insolvency proceedings since August 2017. As per the NCLAT cause list, the matter between JAL and JIL is scheduled for hearing on Tuesday before a two-member bench of the National Company Law Appellate Tribunal (NCLAT).

Krsnaa Diagnostics: Krsnaa Diagnostics said it has operationalised 100 more Pathology collection centres to provide services of Lab Investigation Facilities under Hinduhridaysamrat Balasaheb Thackeray Chikitsa for BMC Dispensaries and Hospitals in Mumbai. With this, the company has operationalized 300 Pathology collection centres as of date.

Dhanlaxmi Fabrics: The company said that it will be shutting its processing unit at Dombivali for 6-8 months as the 30-year-old factory need to go for a major renovation. The renovation work will start on April 1. However the Weaving Unit of the Company located at Kolhapur will remain in operation, it said.

Tata Chemicals: Fitch Ratings revised the outlook on the company’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to Positive from ‘Stable’ and affirmed the rating at ‘BB+’.

Lupin: The USFDA has completed an inspection of Lupin’s Bioresearch Centre in Pune, India. Lupin Bioresearch Centre conducts BA/BE, PK/PD, In-vitro BE and biosimilar studies. The inspection closed without any observation. The Centre has successfully undergone its seventh consecutive on-site inspection.

Sun TV Network: The company’s board at their meeting held on March 13, inter alia, have declared an interim dividend of Rs 2.50 per equity share for FY23.

Surya Roshni: The company said it has secured an order worth Rs 96.39 crore for supply 3LPE Coated steel pipes from Hindustan Petroleum Corporation Limited for City Gas Distribution (CGD) projects in three geographical areas in the state of Rajasthan, Bihar, Jharkhand and West Bengal. The order is to be executed within nine months.

BL Kashyap and Sons: The company has secured new orders from domestic unrelated clients aggregating to Rs 158 crore. This includes construction of Business Park Campus at Bengaluru worth Rs 89 crore excluding GST and construction of Residential Complex at Bengaluru worth Rs 69 crore excluding GST. These projects are expected to be completed within 24 months approximately from the date of award. The current order book of the company stands at Rs 2,089 crore.

CreditAccess Grameen: The NBFC major announced that it has crossed Rs 20,000 crore milestone of AUM and intends to open 34 additional branches by March 31, 2023. The management is also confident of achieving 24%-25% AUM growth in FY23, 4%-4.2% ROA, and 16%-18% ROE.

Axita Cotton: The company secured contract from Taraspinning Mills, Bangladesh and Khadiza Sadek Spinning Mills, Bangladesh for Indian Raw Cotton that aggregates to $2.72 million.