Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.92% higher at 18,719, signalling that Dalal Street was headed for positive start on Monday.

Japanese shares were trading higher as investor sentiments were boosted following the deal between President Joe Biden and House Speaker Kevin McCarthy on the US debt ceiling. The Nikkei 225 index rose 1.32% and the Topix index gained 0.96%. Meanwhile, the Hang Seng fell 0.02% and the CSI 300 index was down by 0.45%.

Indian rupee appreciated by 17 paise to close at 82.57 against the US dollar on Friday.

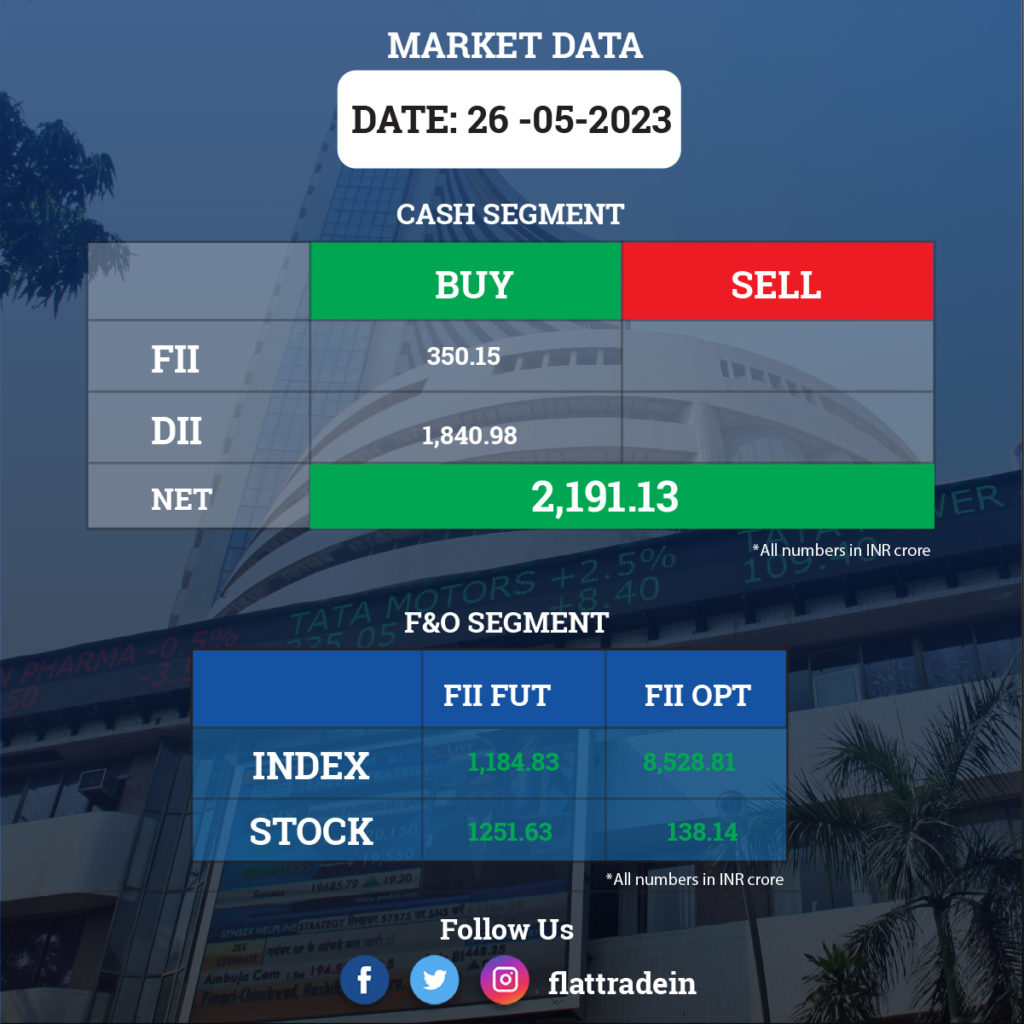

FII/DII Trading Data

Upcoming Results

Adani Transmission, Ipca Laboratories, Indian Railway Catering and Tourism Corporation (IRCTC), Allcargo Logistics, Ansal Housing, Bajaj Hindusthan Sugar, Campus Activewear, Force Motors, HeidelbergCement India, Hikal, ITI, Jubilant Pharmova, KNR Constructions, Natco Pharma, NBCC (India), NHPC, The New India Assurance Company, Rail Vikas Nigam, Shriram Properties, Sobha, Speciality Restaurants, TCNS Clothing, Torrent Power, Vadilal Industries, Vijaya Diagnostic Centre, Goodyear India, Lakshmi Mills Company, SML Isuzu, and Zee Media Corporation will report their quarterly earnings today.

Stocks in News Today

ONGC: The state-owned enterprise said its consolidated revenue was up 5.2% YoY at Rs 1,64,066.72 crore in Q4FY23. EBITDA was down 14.05% YoY at Rs 20,996.73 crore in Q4FY23. Consolidated net profit was down 52.73% YoY at Rs 5,701.46 crore in Q4FY23. On standalone basis, the company incurred a loss of Rs 247.70 crore (estimated Rs 10,598.08 crore profit), compared with Rs 8,859.54 crore a year ago, on account of provisions to the tune of Rs 9,235.11 made towards disputed taxes. The company declared a dividend of Rs 0.5 per share for the fiscal 2023.

Reliance Industries (RIL): The company’s FMCG arm, Reliance Consumer Product, has partnered with US-based General Mills to launch international corn chips snacks brand Alan’s Bugles in India.

Sun Pharmaceutical Industries: The pharma company has issued a letter to the board of Taro Pharmaceutical Industries, Israel, with a proposal of non-binding indication of interest to acquire the remaining shares in Taro through a reverse triangular merger. The transaction will take place in cash, at a price of $38 per share, which is at a premium of 31.2% over Taro’s closing price on May 25.

Lupin: The pharma firm said its Canada subsidiary, Lupin Pharma Canada, received an approval from Health Canada to market a generic version of Spiriva (tiotropium bromide inhalation powder) in Canada. Tiotropium Bromide is indicated for the treatment of airflow obstruction in patients with chronic obstructive pulmonary disease (COPD), including chronic bronchitis and/or emphysema.

Bharat Heavy Electricals (BHEL): The state-owned company registered a 33% YoY decline in consolidated profit at Rs 611 crore in the March FY23 quarter, due to weak topline growth. Consolidated revenue grew by 2.05% on-year to Rs 8,227 crore. Ebitda was down 14.39% YoY at Rs 986.15 crore in Q4FY23. The board recommended a final dividend of Rs 0.40 per share for fiscal 2023.

HDFC: Market regulator SEBI has granted final approval for the proposed change in control of HDFC Capital Advisers in its capacity of an investment manager of the HCARE Funds and investment manager cum sponsor of HDFC Build Tech Fund.

Chambal Fertilisers and Chemicals: The company’s consolidated revenue was up 8.81% YoY at Rs 3,598.67 crore in Q4FY23. Ebitda was down 69.17% YoY at Rs 111.44 crore in Q4FY23. Consolidated net profit was down 61.45% YoY at Rs 93.98 crore in Q4FY23. The board recommended a final dividend of Rs 3 per share.

PNC Infratech: The company’s consolidated revenue was up 3.54% YoY at Rs 2,304.85 crore in Q4FY23. Ebitda was down 14.52% YoY at Rs 410.61 crore in Q4FY23. Consolidated net profit was down 40.94% YoY at Rs 145.98 crore in Q4FY23. The board recommended a dividend of Rs 0.50 per share for fiscal 2023.

Maharashtra Seamless: The company’s consolidated revenues was up 14.31% YoY at Rs 1,632.86 crore in Q4FY23. Ebitda was up 85% YoY at Rs 321.42 crore in q4FY23. Consolidated net profit was down 5.94% YoY at Rs 372.69 crore in Q4FY23. The board recommended a dividend of Rs 5 for the fiscal 2023. It elevated Anuj Kumar Jaiswal as chief financial officer, effective June 1, in place of Sarat Kumar Mohanty.

Karnataka Bank: The lender’s standalone net interest income (NII) was up 31.01% YoY at Rs 860.05 crore in Q4FY23. Standalone net profit was up 171.38% at Rs 353.75 crore in Q4FY23. Net NPA ratio stood at 1.7% in Q4FY23 as against 1.66% in the preceding quarters. Meanwhile, tax expense came down to Rs 78.75 crore, compared with Rs 153.86 crore. The board recommended a dividend of Rs 5 per share for fiscal 2023.

Sunteck Realty: The real estate firm said its consolidated revenue was down 68.51% YoY at Rs 48.88 crore in Q4FY23. Ebitda loss stood at Rs 9.1 crore as against an Ebitda of Rs 5.89 crore in the year-ago period. Consolidated net loss widened to Rs 27.94 crore as against a net loss of Rs 4.31 crore in the year-ago period. The company declared final dividend of Rs 1.50 per share for fiscal 2023 and its board approved raising Rs 2,250 crore through debt and equity.

Ion Exchange (India): The company’s consolidated revenue was up 30.45% YoY at Rs 647.48 crore in Q4FY23. Ebitda was up 11.97% YoY at Rs 106.37 crore in Q4FY23. Consolidated net profit was down 2.42% YoY at Rs 81.19 crore in Q4FY23. The board has declared a dividend of Rs 12.50 per share.

City Union Bank: The lender’s standalone net interest income (NII) was up 2.71% YoY at Rs 514.26 crore in Q4FY23. Its standalone net profit was up 4.35% YoY at Rs 218.04 crore in Q4FY23. Net NPA ratio stood at 2.36% in the quarter under review as against 2.67% in the preceding quarter. The board recommended a dividend of Rs 1 per share.

Indigo Paints: The company’s consolidated revenue was up 12.86% YoY at Rs 325.47 crore in Q4FY23. Ebitda was up 34.43% YoY at Rs 71.73 crore in Q4FY23. Consolidated net profit was up 40.73% YoY at Rs 48.68 crore in Q4FY23. The company recommended a final dividend of Rs 3.50 per share.

Shree Renuka Sugars: The company’s consolidated revenue was up 7.16% YoY at Rs 2,328.50 crore in Q4FY23. Ebitda was down 11.26% YoY at Rs 256.8 crore in Q4FY23. Consolidate net profit was down 71.92% YoY at Rs 44.6 crore in Q4FY23. The board noted the signing of non-binding term sheet for acquisition of 100% share in an Uttar Pradesh-based sugar manufacturing company.

Central Bank of India (CBI): RBI imposed a penalty of Rs 84.50 lakh on Central Bank of India for failing to report certain accounts as fraud and recovering SMS alert charges from customers on flat basis.

Godrej Properties: The company increased stake in Wonder City Buildcon to 100% from 74%, acquiring 2.9 crore shares (26% of overall shareholding) for Rs 45.13 lakh.

RITES, Power Finance Corporation (PFC): RITES and PFC have signed an MoU to explore avenues of mutual collaboration for consultancy works in transport and logistics, energy, water and sanitation, communication, social and commercial infrastructure.

GAIL, Axis Bank: GAIL (India) has partnered with Axis Bank to digitise bank guarantees under Society for Worldwide Interbank Financial Telecommunication

Dalmia Cement: The company’s subsidiary Dalmia Cement (North East) has approved capital expenditure of Rs 3,642 crore for a new clinkerisation unit of 3.6 MTPA at Umrangso and a new cement grinding unit of 2.4 MTPA at the Lanka facility. The said capex will be funded via a mix of debt, equity and internal accruals and the proposed capacity is expected to be added by FY25-26.

NCC: The construction company has registered a consolidated profit of Rs 190.86 crore in Q4FY23, down 21.2% from year-ago period. Revenue for the quarter grew by 42.3% YoY to Rs 4,949 crore. Ebitda jumped 72.26% YoY to Rs 464.61 crore in Q4Fy23. Consolidated net profit was down 13.21% YoY at Rs 202.97 crore. The company made provision to the tune of Rs 14.37 crore for obligation on sale of investment. Sanjay Pusarla has been appointed chief financial officer, effective June 1, in place of K Krishna Rao. The board approved a dividend of Rs 2.20 per share.

Engineers India: The engineering consultancy and EPC company registered a massive 140.3% on-year growth in consolidated profit at Rs 190.2 crore for the fourth quarter of FY23, driven by healthy operating performance. Revenue from operations for the quarter at Rs 880 crore increased by 7.6% over a year-ago period.

Clean Science and Technology: Asha Ashok Boob, Nilima Krishnakumar Boob and Asha Ashok Sikchi, the promoters of the company, will sell up to 3.5% equity in the open market during the May 29-June 30 period. The company is complying with minimum public shareholding norms. The promoters hold a 78.5% stake in the company.