Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.17% lower at 18,033.50, signalling that Dalal Street was headed for a negative-to-flat start on Friday.

Asian shares were trading higher on Friday as investors awaited US jobs data due later in the day that would give a hint about the Federal Reserve’s monetary policy. The Nikkei 225 index rose 0.55% and the Topix gained 0.31%. The Hang Seng index advanced 0.17% and the CSI 300 index was up 0.12%.

Indian rupee rose 25 paise to 82.55 against the US dollar on Thursday.

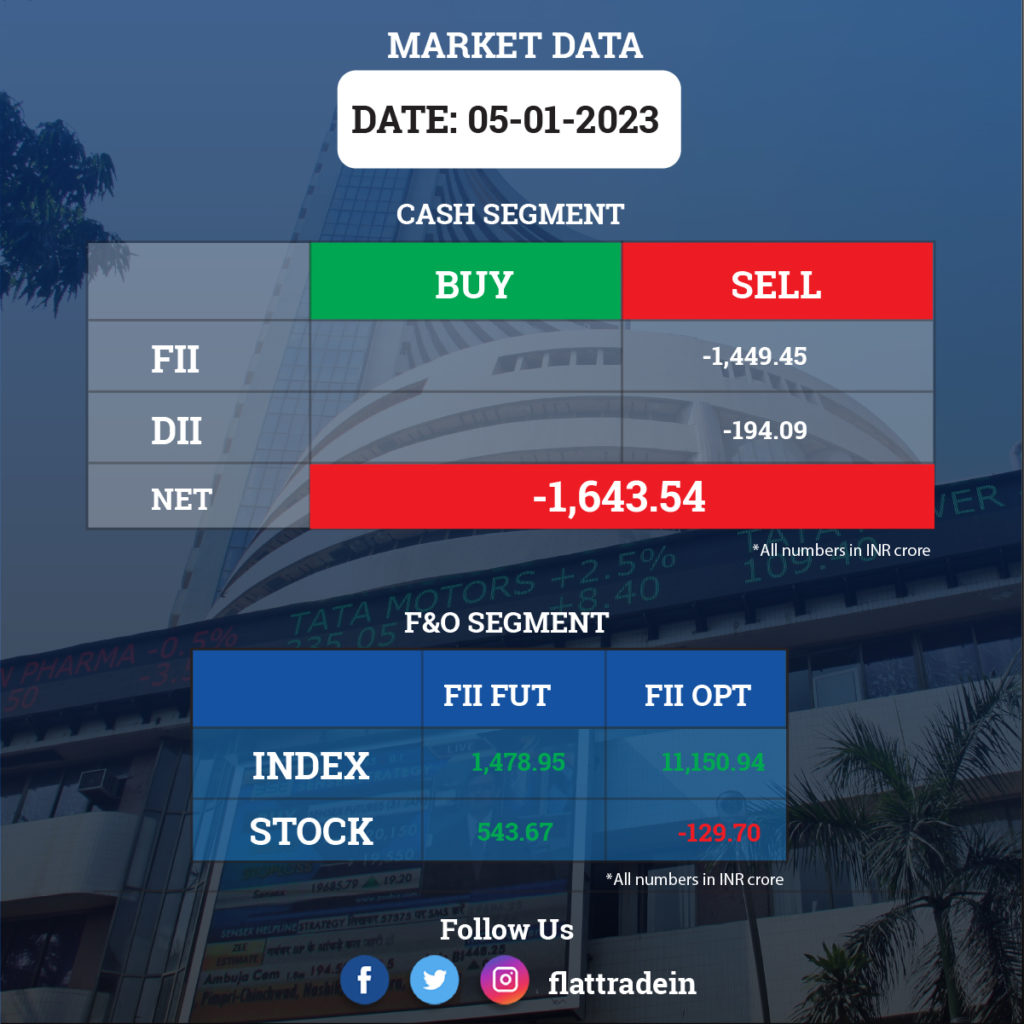

FII/DII Trading Data

Stocks in News Today

Reliance Jio: The company has signed a partnership with British football club Manchester City to become its official mobile communications network partner in India. Man City’s OTT platform CITY+ will be integrated into the JioTV platform and provide exclusive content to Indian viewers, the company said. The content will also include match highlights, live Manchester City Women’s team and Elite Development squad fixtures, matchday content and City Studio’s documentaries.

Larsen & Toubro (L&T): The company’s subsidiary, L&T Realty Developers, has inked a pact to sell entire stake of 99% in Think Tower Developers. The entire stake is being sold to Pratik Harshad Kalsariya, who does not belong to the promoter group. Think Tower Developers has not commenced commercial operation and hence has zero revenue and net worth.

IDBI Bank: The Securities and Exchange Board of India has given its approval for reclassification of the government’s shareholding in the bank as ‘public’ after its disinvestment. The government and state-run Life Insurance Corporation of India (LIC) will sell 60.72% stake in IDBI Bank as part of the disinvestment, and after the stake sale, government’s shareholding will be reduced to 15%. The consent has been given on the condition that the government’s voting rights in the lender should not exceed 15% of the total voting rights of the bank.

Bajaj Finserv: The company’s subsidiary Bajaj Allianz General Insurance’s gross direct premium underwritten stood at Rs 1,209 crore in December. For the nine months ended December 2022, the gross direct premium underwritten was at Rs 11,609 crore.

Rail Vikas Nigam: The company in a joint venture with ISC Projects has received letter of award for supply and commissioning of ballastless track for Surat Metro Rail Project under Phase-1. The order is worth Rs 166.26 crore.

Ambuja Cements: The cement company has incorporated a wholly owned subsidiary – Ambuja Resources. The subsidiary will enter into manufacturing of cement & allied product, alternate fuel and power generation.

RHI Magnesita: The company has received approval from the exchanges for acquisition of refractory business of Dalmia Bharat Refractories for Rs 1,708 crore. In November 2022, RHI received approval from board of directors for allotment of 2.7 crore equity shares at an issue price of Rs 632.50 per share to Dalmia Bharat Refractories in exchange of 8.24 crore shares (100% equity) of Dalmia OCL, from Dalmia Bharat Refractories. With this, Dalmia OCL will become a wholly owned subsidiary of RHI.

Godrej Agrovet: The company will be setting up an edible oil processing plant in Khammam district in Telangana, at an investment of Rs 250 crore. The facility to process palm oil will have a capacity of 30 tonnes per hour expandable to 60 TPH. This would be the single largest private investment in the Khammam district.

Mukand: The company has completed the transfer of 45.94 acres of the land at Kalwe/ Dighe facility in Thane, Maharashtra by executing Deeds of Conveyance in favour of the purchaser – AGP DC Infra Two Private Limited. The entire consideration of Rs 796.46 crore is received by the company.

Vishwaraj Sugar Industries: The sugar manufacturer has approved raising of funds via issue of equity shares to the existing members of the company on rights basis. The fund raising via rights issue will be up to Rs 150 crore.

Aster DM Healthcare: Sreenath Pocha Reddy, Group Chief Financial Officer and key managerial personnel of the company has tendered his resignation due to personal reasons. He will be relieved from the said service with effect from January 6, 2023.

MTAR Technologies: Nippon Life India Trustee bought 30,011 equity shares or 0.097% stake in the company via open market transactions. With this, its shareholding in the company increased to 7.0155%, up from 6.9179% earlier.

Kewal Kiran Clothing: The company has announced strategic partnership with Board of Control for Cricket in India (BCCI) as the Indian Cricket Team’s ‘official partner’. This alliance will see KKCL’s flagship brand ‘KILLER’ displayed on the right upper chest of the Team India jersey. With this partnership, KKCL plans to reach out to the millions of cricket fans that are spread across the country and overseas.

Dharmaj Crop Guard: The agrochemical company has approved resignation of Vishal Domadia from the post of Chief Financial officer, and and appointment of Vinay Joshi as Chief Financial officer. Now Vishal Domadia will be as Chief Executive officer of the company with effect from January 6, while Deepak Prusty has resigned as Internal Auditor of the company.

Equitas Small Finance Bank: The bank’s gross advances rose 27% YoY to Rs 24,923 crore as on December, according to its exchange filing. The total deposits increased by 31% YoY to Rs 23,393 crore. Disbursements jumped 68% higher on year to Rs 4,797 crore as on December 31.

Force Motors: The company produced 2,326 units of vehicles in the month of December, 2022. Further, its domestic sales stood at 1,861 units and exports stood at 430 units.

Clara Industries: Credent Asset Management Services has bought 15,000 shares in the industrial packaging solutions provider via open market transactions at an average price of Rs 201.76 per share. Maven India Fund has purchased 13,500 shares in the company at an average price of Rs 200.8 per share.

VLS Finance: The board has approved to buy back shares worth Rs 70 crore at Rs 200 per share via open market route. The maximum buyback price of Rs 200 per equity share is at a premium of about 26% over the closing price on January 4.