Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.11% higher at 17,582, signalling that Dalal Street was headed for a positive start on Monday.

Asian markets were trading lower as investors awaited a slew of monetary policy decisions due this week. Japan’s Nikkei 225 index was down 1.11% and Topix fell 0.61%. Hang Seng dropped 1.12%, while CSI 300 inched up 0.14%.

The Indian rupee fell 4 paise to 79.74 against the US dollar on Friday.

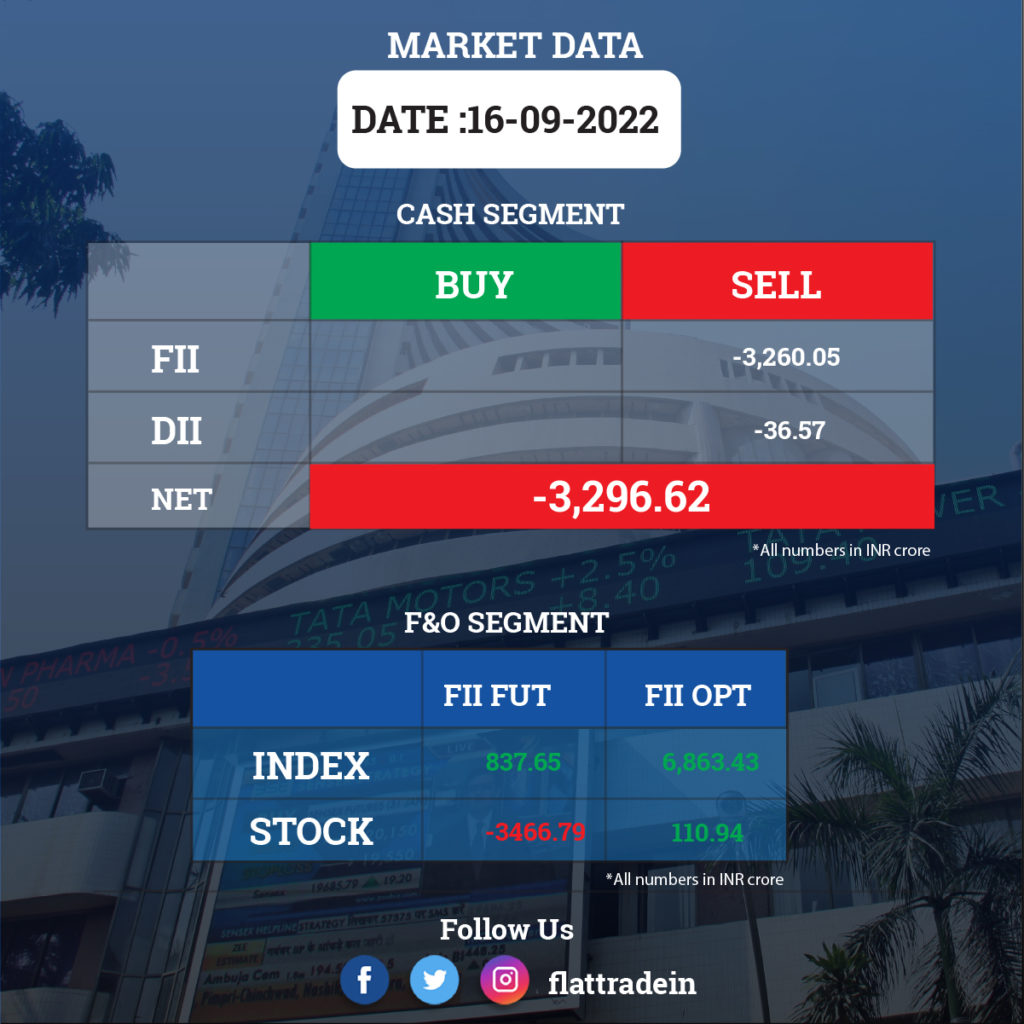

FII/DII Trading Data

Stocks in News Today

Ambuja Cements: The company has called for an extraordinary general meeting (EGM) with its shareholders on October 8. Ambuja Cements will seek shareholders’ approval for the appointment of Gautam Adani and others on the board and a Rs 20,000 cash infusion in the company through preferential allotment of warrants.

HDFC Life Insurance Company: The insurer has received approval from National Company Law Tribunal for merger of Exide Life Insurance Company with itself. The Scheme of Amalgamation is subject to the final approval of the Insurance Regulatory and Development Authority of India (IRDAI), it added. Exide Industries will hold 4.1 per cent stake in HDFC Life.

Adani Power: The company has announced withdrawal of its delisting offer. Its shareholders had approved the delisting of company’s shares on the BSE and NSE in July 2020, and had submitted application for approval for the delisting to the exchanges in January 2021. However, the company has not received in principle approval of the exchanges, due to which it is withdrawing offer for delisting on account of delay and commercial viability.

ONGC: The oil and gas producer wants the government to scrap windfall profit tax levied on domestically produced crude oil and instead use the dividend route to tap into bumper earnings resulting from surge in global energy prices. The firm also favours a floor price for natural gas at $10 per million British thermal unit to help bring deposits in challenging areas to production.

Maruti Suzuki India: The automaker has decided to recall 5002 super carry vehicles manufactured between May 4 and July 30. “The recall is being undertaken for inspection and torquing of a bolt attached to seat belt buckle bracket of co-driver seat,” the company said in a regulatory filing.

Hero MotoCorp: The two-wheeler manufacturer will foray into the electric segment next month with the launch of its first model in the domestic market. In a regulatory filing, the company said that “a new era in mobility is about to begin” alluding to an event under its Vida brand on October 7, 2022. The two-wheeler major has issued invites to its dealers, investors and global distributors for the event to be held in Jaipur, Rajasthan.

Public Sector Banks: The lenders are fast adapting to digital means as they have cleared digital lending of Rs 83,091 crore in the financial year ending March 2022. The Enhanced Access and Service Excellence (EASE) program, driven by Indian Banks’ Association (IBA), also stressed on data analytics, automation, and digitization. Bank of Baroda received the first prize among all PSBs for the best overall performance on PSB Reforms EASE Agenda 4.0. State Bank of India and Canara Bank were ranked second and third respectively.

Indus Towers: Bimal Dayal has tendered his resignation as Managing Director & CEO of the company and as a Director from the Board. Tejinder Kalra, the Chief Operating Officer and Vikas Poddar, the Chief Financial Officer will be jointly responsible for the functioning of the company under the guidance of the board and the Chairman until the vacant position of CEO and MD is filled.

Tata Power: Resurgent Power Ventures has completed the acquisition of South East UP Power Transmission Company (SEUPPTCL). Resurgent Power Ventures is a joint venture based out of Singapore, wherein 26 percent shareholding is held by Tata Power through its wholly owned Singapore based subsidiary.

SAL Steel: The company has entered into an agreement with AIA Engineering to supply ferro chrome to the latter. SAL has entered into a supply agreement for 3 years with AIA Engineering on a non-exclusive basis, while AIA Engineering has also agreed to provide a secured inter corporate deposit of Rs 125 crore to the company which will be used by the company to repay its loan or for working capital requirements.

Granules India: The company’s share buyback offer will open on September 27 and will close on October 11. The company will buy back shares worth up to Rs 250 crore and the price has been fixed at Rs 400 per share.

Inox Wind: The company’s subsidiary, Inox Green Energy Services, is planning for an Initial Public Offering (IPO) by October this year to raise Rs 740 crore to fund its expansion plans. The company will focus on the Indian market initially and plans to tap the overseas market, Inox Wind Chief Executive Officer (CEO) Kailash Lal Tarachandani said.

Mahindra Holidays & Resorts India: The company has increased its shareholding in Rocksport to 23.42%. It has subscribed to balance 3,25,547 equity shares of Rocksport for nearly Rs 8 crore. Rocksport provides outdoor entertainment, adventure programs, educational adventure tours and retail of branded adventure products in India.

Mafatlal Industries: The company’s board has given approval for sub-division of existing equity share from one equity share (face value Rs 10 each) into five shares (face value Rs 2 each). The record date for sub-division of equity shares will be intimated in due course.

Shree Renuka Sugars: In an exchange filing, the company said that the expanded capacity for ethanol production, from 720 KLPD to 1250 KLPD, is expected to go on stream by December 2022.