The Reserve Bank of India (RBI) as usual holds its Monetary Policy Committee (MPC) meetings after regular intervals of two months constituting Six meetings within one year.

The purpose of the meeting is to assess and formulate the monetary policy stance, focusing on inflation control and economic growth.

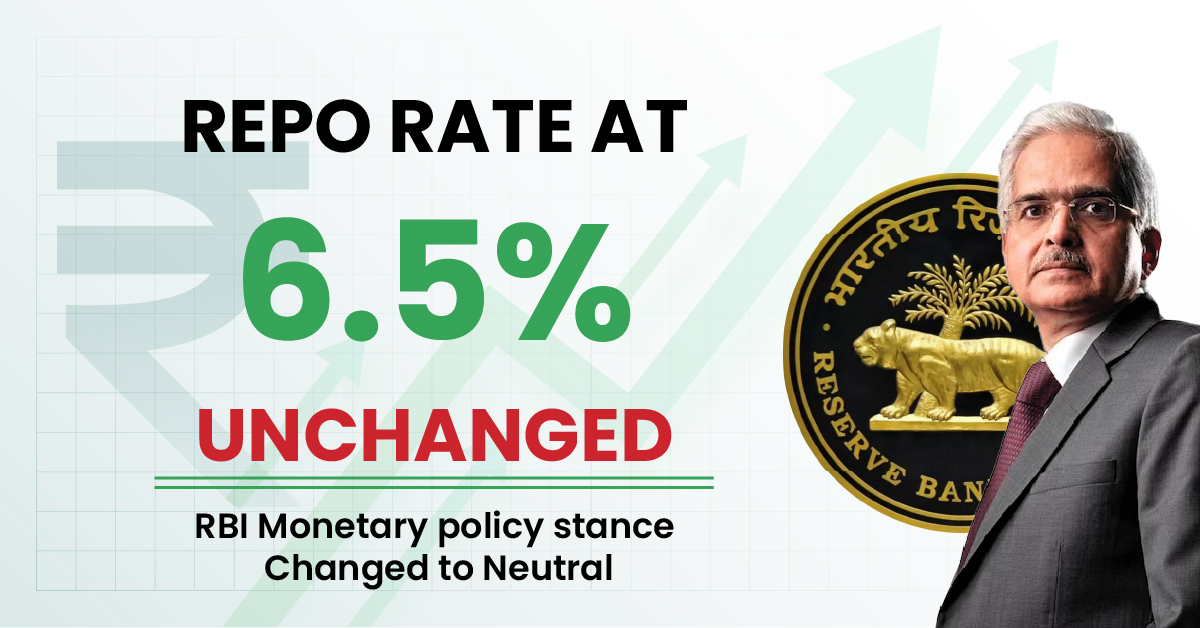

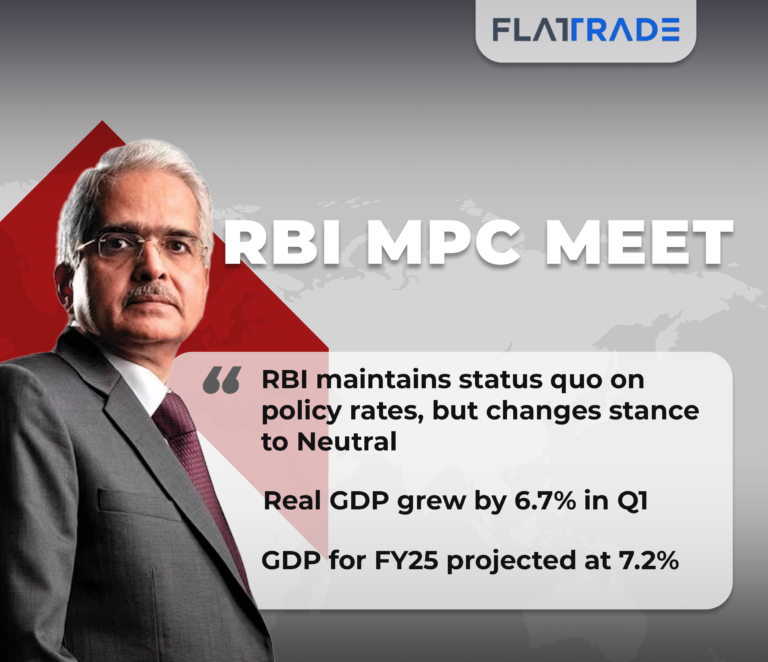

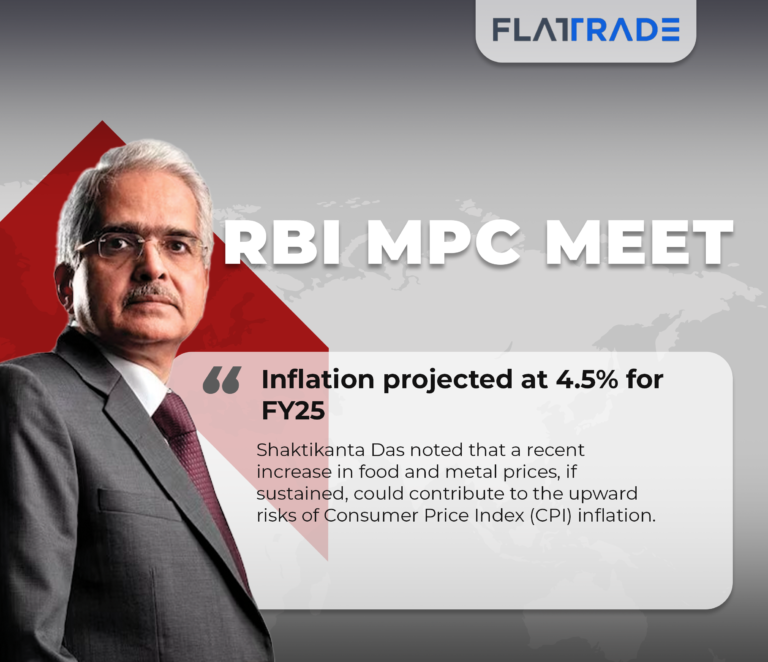

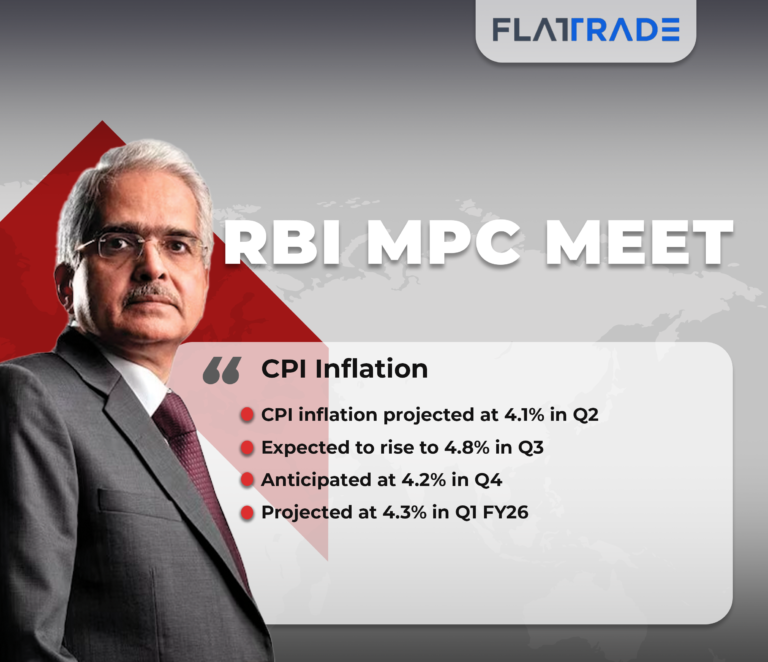

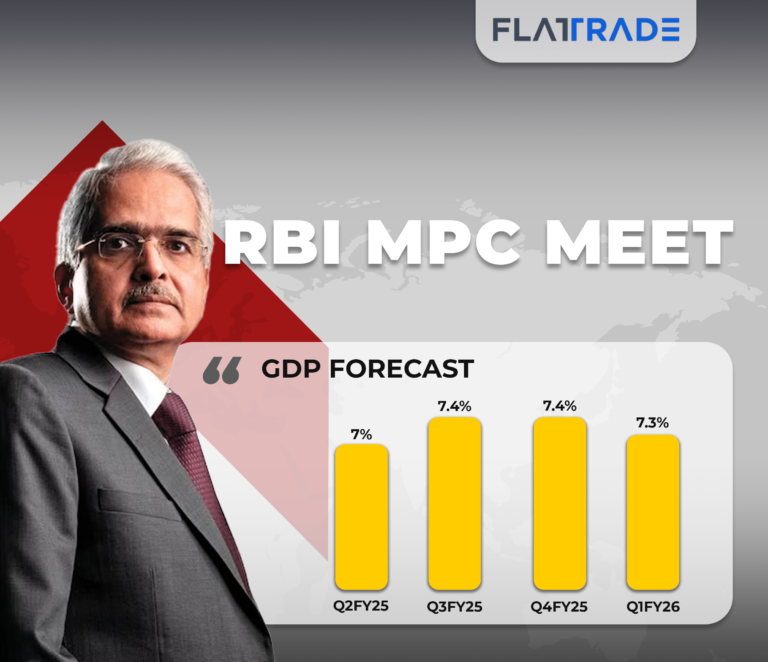

The Reserve Bank of India (RBI) on October 9 announced the fourth bi-monthly monetary policy for the year FY25 in which the repo rate is maintained at 6.5% by the RBI Monetary Policy Committee but the stance changed to ‘Neutral’ from the earlier stance of ‘withdrawal of accommodation’.

Repurchase option rate (REPO RATE)

The repo rate is defined as the rate or percentage at which the Reserve Bank of India (RBI) advances funds to other banks against securities such as government bonds. It is one of the main instruments in the implementation of the monetary policy aimed at controlling inflation strangulation and liquidity breakdown in the country.

Key points of Repo rates

Purpose: To control the volume of money in the system and consequently, manage the rate of interest in the economy.

Impact on the Economy: Since the low repo rate makes the cost of borrowing in banks lower, money will be borrowed out and be lent out hence spending is fostered. On the other hand, a high repo rate will lead to less borrowing of money leading to a drop in inflation rates.

How Often Changes: The repo rate is one of the numerous items reviewed by the Reserve Bank of India during its monetary policy committee (MPC) Meeting which occurs every two months.

Monetary Policy Stance

The monetary policy stance is one of the measures that refers to how the Reserve Bank of India (RBI) tends to the economy by intervening in the rates and liquidity levels.

There are three broadly classified Monetary Policy Stances into which the various policies are segregated.

1. Accommodative Stance

Definition: The purpose of an accommodative stance is to boost economic activity by considering lower interest rates. It creates a wider scope for investment as people will borrow relatively more.

Context: Usually undertaken in times of recession or in situations where inflation is already controlled and lowered. The RBI can cut policy rates to spark demand and aid recovery.

Key Indicators: High unemployment level, low level of consumer spending, or low level of business activity.

Implications: Easier credit to be qualified for, help with financing of small enterprises as well as help with consumer consumption.

2. Withdrawal of Accommodation

Definition: This is a stance that depicts a future constraining dynamics perspective. This means that after some period of accommodation, the RBI might be able to hike up interest to contain rising inflation.

Context: This is mostly done when the inflation is more than what has been targeted or when the economy is about to boil over.

Key Indicators: Increase inflations, increase consumer prices, and an increased drive to the economy.

Implications: Raising the cost of borrowings to dampen investment activities and consumer aggregate spending to stabilize economic activities and control inflation.

3. Neutral Stance

Definition: A neutral position denotes a moderation by the RBI, suggesting that it is not actively easing or tightening policy.

Context: Used in case the macroeconomic environment is considered neither too dynamic nor too unfavorable, with inflation and growth being at tolerable levels. The RBI would likely opt to let things be and watch the developments in the situation, making no particularly important interventions.

Key Indicators: No more than moderate inflation has been observed along with stable growth indicators, which means no new risks are seen at the moment.

Implications: This still means that at some point in the future, the RBI can and should be ready to act in response to the changes in the economic environment without being tied in either direction on the monetary policy – easing or tightening.

Repurchase option rate (REPO RATE)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The repo rate is defined as the rate or percentage at which the Reserve Bank of India (RBI) advances funds to other banks against securities such as government bonds. It is one of the main instruments in the implementation of the monetary policy aimed at controlling inflation strangulation and liquidity breakdown in the country.

Key points of Repo rates

Purpose: To control the volume of money in the system and consequently, manage the rate of interest in the economy.

Impact on the Economy: Since the low repo rate makes the cost of borrowing in banks lower, money will be borrowed out and be lent out hence spending is fostered. On the other hand, a high repo rate will lead to less borrowing of money leading to a drop in inflation rates.

How Often Changes: The repo rate is one of the numerous items reviewed by the Reserve Bank of India during its monetary policy committee (MPC) Meeting which occurs every two months.

Monetary Policy Stance

The monetary policy stance is one of the measures that refers to how the Reserve Bank of India (RBI) tends to the economy by intervening in the rates and liquidity levels.

There are three broadly classified Monetary Policy Stances into which the various policies are segregated.

1. Accommodative Stance

Definition: The purpose of an accommodative stance is to boost economic activity by considering lower interest rates. It creates a wider scope for investment as people will borrow relatively more.

Context: Usually undertaken in times of recession or in situations where inflation is already controlled and lowered. The RBI can cut policy rates to spark demand and aid recovery.

Key Indicators: High unemployment level, low level of consumer spending, or low level of business activity.

Implications: Easier credit to be qualified for, help with financing of small enterprises as well as help with consumer consumption.

2. Withdrawal of Accommodation

Definition: This is a stance that depicts a future constraining dynamics perspective. This means that after some period of accommodation, the RBI might be able to hike up interest to contain rising inflation.

Context: This is mostly done when the inflation is more than what has been targeted or when the economy is about to boil over.

Key Indicators: Increase inflations, increase consumer prices, and an increased drive to the economy.

Implications: Raising the cost of borrowings to dampen investment activities and consumer aggregate spending to stabilize economic activities and control inflation.

3. Neutral Stance

Definition: A neutral position denotes a moderation by the RBI, suggesting that it is not actively easing or tightening policy.

Context: Used in case the macroeconomic environment is considered neither too dynamic nor too unfavorable, with inflation and growth being at tolerable levels. The RBI would likely opt to let things be and watch the developments in the situation, making no particularly important interventions.

Key Indicators: No more than moderate inflation has been observed along with stable growth indicators, which means no new risks are seen at the moment.

Implications: This still means that at some point in the future, the RBI can and should be ready to act in response to the changes in the economic environment without being tied in either direction on the monetary policy – easing or tightening.

Bottom Line

The RBI’s decisions have far-reaching effects on the economic sector. The constant repo rate and a Neutral stance demonstrate that the RBI believes that the present economic situation needs no intervention and the RBI is ready to act in case of any changes in the ongoing economy.