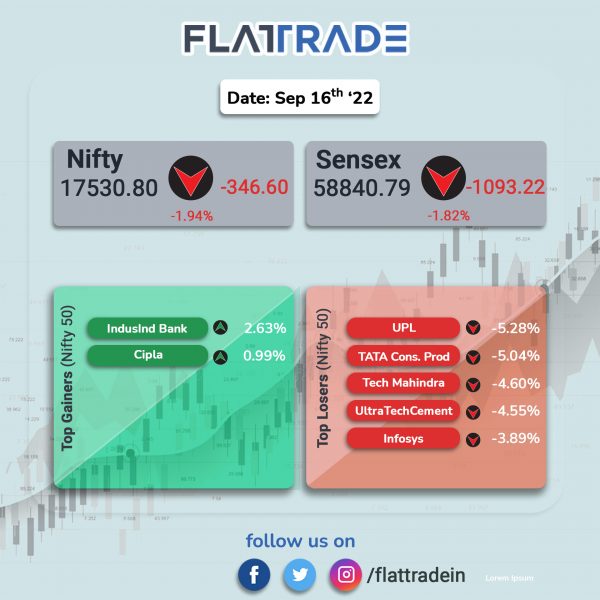

Benchmark indices fell nearly 2% dragged by losses in technology and auto stocks amid intense selling by investor due to concerns over a global recession. The Sensex tanked 1.82% and the Nifty 50 index slumped 1.94%.

Broader markets underperformed headline indices. The Nifty MidCap 100 index plunged 2.84% and the BSE SmallCap tanked 2.38%.

Top Nifty sectoral index losers were Media [-4.07%], Realty [-3.27%], IT [-3.71%], Auto [-2.71%] and PSU Bank [-2.35%]. All Nifty sectoral indices closed in the red.

The Indian rupee fell 4 paise to 79.74 against the US dollar on Friday.

Stock in News Today

Vedanta: Shares of the company tanked 8.66% in intraday trade on the NSE after the company said it would not be undertaking the business of manufacturing semi-conductors. “We reiterate that the proposed business of manufacturing semiconductors is not under Vedanta Limited and it will be undertaken by the ultimate holding company of Vedanta Limited, Volcan Investments Limited,” the company informed the exchanges.

Tata Power: The company’s subsidiary, Tata Power Solar Systems Limited (TPSSL), received a ‘Letter of Award’ (LoA) of Rs 612 crore for setting up a 100 MW groundmounted solar project for SJVN Limited (SJVN). The project is located at the Raghanesda solar park plot C, Gujarat. The LoA was awarded through tariff-based competitive bidding and the project will be commissioned within 11 months from the date of receiving of LoA.

Adani Enterprises: The company surpassed insurance giant Life Insurance Corporation of India (LIC) and FMCG company ITC to become most valuable stock in terms of market capitalisation after a strong rally in the Gautam Adani’s Group company.

Meanwhile, Adani Group‘s Chairperson Gautam Adani surpassed Amazon’s Jeff Bezos to become the world’s second richest person. He is now only behind Tesla CEO Elon Musk, the world’s richest man with a networth of $273.5 billion, according to Forbes’ real time data, LiveMint reported.

Further, Switzerland’s Holcim has closed the sale of Ambuja Cement and ACC, Ambuja’s subsidiary, to the Adani Group, resulting in cash proceeds of $6.4 billion.

IndusInd Bank: Shares of the lender rose 2.63%, in an otherwise weak market, on hopes of bright outlook and potential loan growth across various segments. In other news, the private sector lender has approved the reappointment of Sumant Kathpalia as the managing directorate and chief executive officer for three more years subject to the RBI’s approval, according to its exchange filing.

SBI Cards and Payment Services (SBI Card): The bank has raised Rs 500 crore by issuing bonds on a private placement basis. The company allotted 5,000 fixed rate, unsecured, taxable and redeemable bonds in the nature of non-convertible debentures of Rs 10 lakh each aggregating to Rs 500 crore. The tenure of the bonds is three years with a coupon rate of 7.39% per annum and is set to mature on September 15, 2025.

Arfin India: The company has entered into a service agreement with Tata International Ltd and Tata International Singapore for supply of aluminum scraps and other materials in Indian Market. The service agreement will be effective from September 2022 and it is estimated to cover a volume of around 10,000 MT to 15,000 MT that will facilitate the easy availability of inventories for the company.

Tata Metaliks: Shares of the company jumped 7.25% on Friday, a day after the company announced Ductile Iron Pine Plant 2 inauguration. The Rs 600 crore expansion project will take the company’s Ductile Iron Pipe plant capacity to over 4 lakh tonnes per annum in two phases.

Fairchem Organics: Fairfax India Holdings is looking to sell its majority stake in speciality chemicals manufacturer Fairchem Organics, Mint news reported citing three sources aware of the matter. The transaction may value the publicly listed company at a 25-30% premium to its market capitalization and Fairfax has hired Bank of America (BofA) as an adviser for the deal, one of the three sources said.

Jammu & Kashmir Bank: The lender’s proposal to raise capital by issuing shares to staff members under the employee stock option plan was rejected by the shareholders in the annual general meeting held in late August. Shareholders also rejected the proposal to re-appoint Mohmad Ishaq Wani. Meanwhile, the proposal to raise tier I equity capital of Rs 500 crore by issuing shares in one or more tranches through a rights issue, preferential allotment, private placement of a qualified institutional placement (QIP) was passed with requisite majority, the bank said.

Godrej Properties: The company has announced that it has achieved a record sales worth Rs 1,210 crore through the launch of two new projects, Godrej Ascend at Kolshet Road, Thane and Godrej Horizon located at Dadar-Wadala, Mumbai. The company company said it has cumulatively sold more than 700 homes accounting for an area of over 8.08 lakh square feet from both projects that was launched in Q1FY23.

NMDC: Brokerage firm Kotak Securities has upgraded the company’s stock to an ‘add’ from a ‘reduce’ with a target price of Rs 140, up 11.5% from the stock’s September 15 closing price. The brokerage firm cited that recovery in domestic demand, upside in seaborne iron ore prices and potential rollback of export duty hike as positives for the company.

Stove Kraft: The company has announced the resignation of Elangovan S, Company Secretary and Compliance Officer of the Company, effective September 15, 2022. The Company is in the process of identifying a suitable candidate for filling the position of Company Secretary, according to its exchange filing.

Happiest Minds Technologies: The IT company has commissioned a 183kWp Solar Plant at its Smiles 2 Campus at Madivala, Bengaluru. It aims to achieve carbon neutrality in its operations by 2030 and aspires to be known for its high levels of ESG standards. The solar power plant deployed by EcoSoch Solar will generate 256 MWh of electricity per year and is estimated to reduce 210 MT of carbon emissions annually and 5200 MT over its lifecycle.

Zydus Lifesciences: The pharma company’s US subsidiary, Zydus Pharmaceuticals (USA), has received tentative nod from the US FDA to market Sugammadex injection.

The drug is indicated for reversal of neuromuscular blockade induced by rocuronium bromide and vecuronium bromide in adults undergoing surgery. The drug had an annual sales of $772 million in the US, according to IQVIA.

One97 Communications (Paytm): Shares of the company tanked after a PTI news reported that Enforcement Directorate (ED) has blocked funds worth over Rs 46 crore in payment gateways, including Paytm, Razorpay, Cashfree and Easebuzz under the anti-money laundering law. The development comes after the probing agency conducted raids this week against Chinese-controlled loan apps and investment tokens.