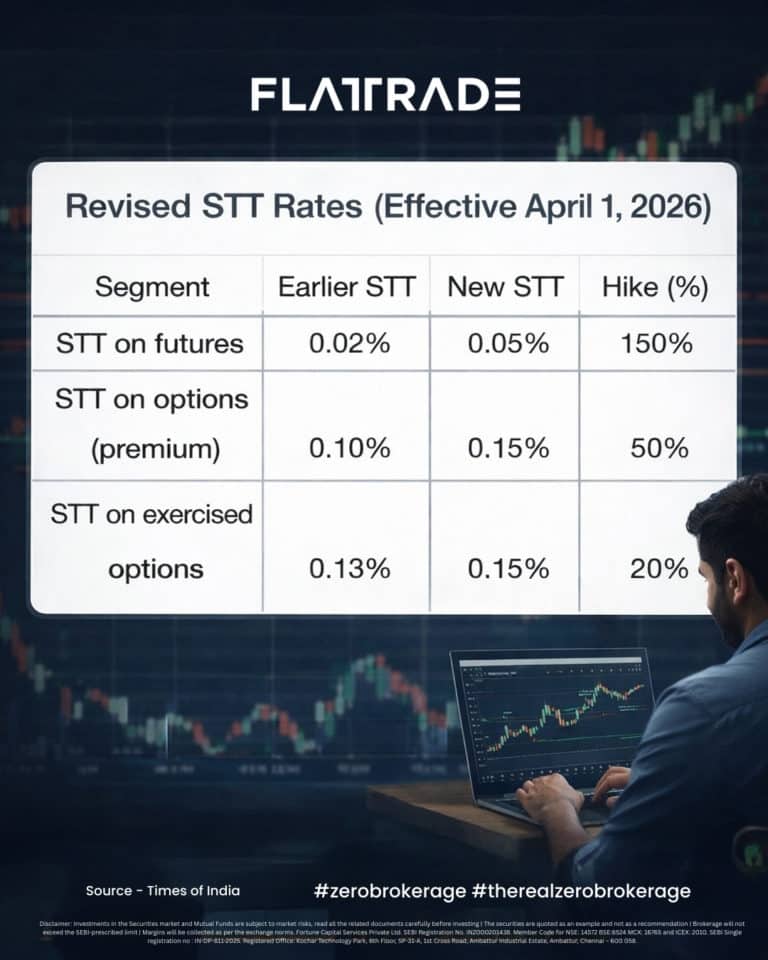

The Union Budget 2026 introduced a revision in Securities Transaction Tax (STT) on equity derivatives. STT on equity futures has been increased from 0.02% to 0.05%, and STT on options premiums has been raised from 0.10% to 0.15%, effective April 1, 2026.

While the per-trade increase may appear small, the impact can add up for active F&O traders. This makes cost efficiency, especially brokerage, more relevant than before.

What Changed in Budget 2026?

Securities Transaction Tax (STT) is a government levy applied to trades executed on recognised stock exchanges across equities and derivatives.

Key changes:

- Futures STT increased by 150%

- Options premium STT increased by 50%

For traders executing frequent trades, this raises total transaction costs and affects net returns.

Why Trading Costs Now Matter More?

Trading costs typically include:

- STT and statutory levies

- Exchange and clearing charges

- Brokerage

Taxes and statutory charges are fixed by regulation. Brokerage, however, varies by platform – and this is where traders can optimise costs.

Even small per-order brokerage adds up meaningfully for high-frequency traders and strategy-based participants.

Example: Brokerage Impact Over Time

Consider two traders executing 200 F&O trades in a month:

- Trader A uses a broker charging ₹20 per order

- Trader B trades with zero brokerage

Trader A pays ₹4,000 in brokerage, while Trader B pays ₹0.

Cost savings like this can help offset rising statutory charges and improve net outcomes over time.

The Role of Real Zero Brokerage

In an environment where regulatory charges are rising and unavoidable, reducing controllable costs becomes important.

Flattrade offers real zero brokerage across segments, including:

- Equity delivery and intraday

- Futures & options

- Currency and commodities

There are no per-order brokerage charges and no percentage-based brokerage layers.

For active traders who frequently enter and exit positions, eliminating brokerage fees helps maintain cost efficiency and strategy viability.

Additional Platform Benefits

Flattrade also provides:

- Advanced trading platforms across mobile, web, and desktop

- Free APIs for Algo and automated trading

- Instant fund transfers and real-time portfolio tracking

- Strong risk management and compliance controls

Adapting to a Higher-Cost Trading Environment

Market regulations and tax structures evolve. The STT revision is part of that evolution. While traders cannot control statutory charges, platform costs can be evaluated and optimised.

Choosing a cost-efficient brokerage structure can make a measurable difference, especially for active market participants.

When costs rise, efficiency matters more.