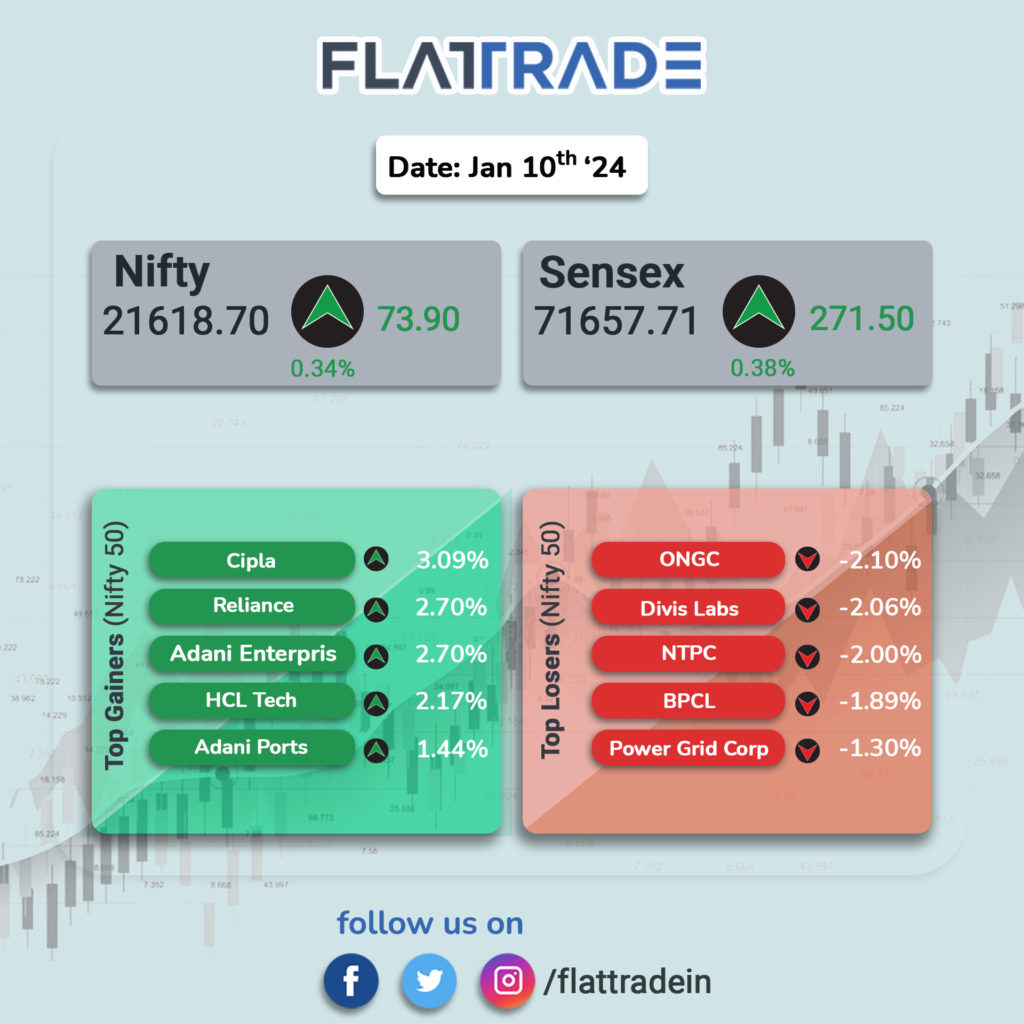

The Sensex closed 271.50 points, or 0.38 percent higher and the Nifty gained 73.90 points or 0.34 percent.

Among sectors, healthcare, information technology, and metal were up 0.4 percent each, while the oil & gas index was down 0.5 percent

Top gainers on the Nifty included Cipla, Reliance Industries, Adani Enterprises, HCL Technologies, and Adani Ports, and the losers were ONGC, Divis Labs, BPCL, NTPC, and Power Grid Corporation.

BSE Midcap and Smallcap indices ended marginally higher.

The rupee depreciated 4 paise to 83.17 against the US dollar.

STOCKS TODAY

KIOCL: Shares of KIOCL fell 3 percent at open on the NSE today, a day after the company suspended operations of its pellet plant unit in Mangalore due to the non-availability of iron-ore fines. Over the last year, stocks for KIOCL gained over 70 percent.

Pondy Oxides and Chemicals: The stock rose 10 percent and hit a 52-week high after the company signed a MoU with the Tamil Nadu government to set up a recycling and manufacturing plant.

Manappuram Finance: Shares of the company went down by 4.84 percent after the market regulator SEBI put on hold the public offer of subsidiary firm Asirvad Micro Finance. Asirvad Mirco Finance had filed DRHP with SEBI in October to raise Rs 1,500 crore.

Spicejet: Shares of Spicejet gained 5.21 percent ahead of the company’s annual general meeting. The airline plans to raise Rs 2,250 crore to aid its expansion and revitalization.

Vedanta: Shares of Vedanta gained 2.32 percent even after Moody’s Investor Service downgraded the company’s corporate family rating (CFR) and senior unsecured bonds.

Network 18: Shares of Network 18 Media and Investments surged 20 percent and got locked in the upper circuit after a Rs 155.50-crore bulk deal. Around 1.3 crore shares, or 1.3 percent equity, changed hands.

Tanla Platforms: Tanla Platform shares gained 10.82 percent with high volumes after the company said its board will meet later in January to approve Q3 results and interim dividends