Benchmark indices Sensex and Nifty 50 gained up to 20 percent throughout the year.

Nifty Midcap and Nifty Smallcap indices outperformed benchmark indices as they soared up to 50 percent in 2023

The top sectoral leader for 2023 emerged to be the Nifty Realty index as it skyrocketed over 80 percent.

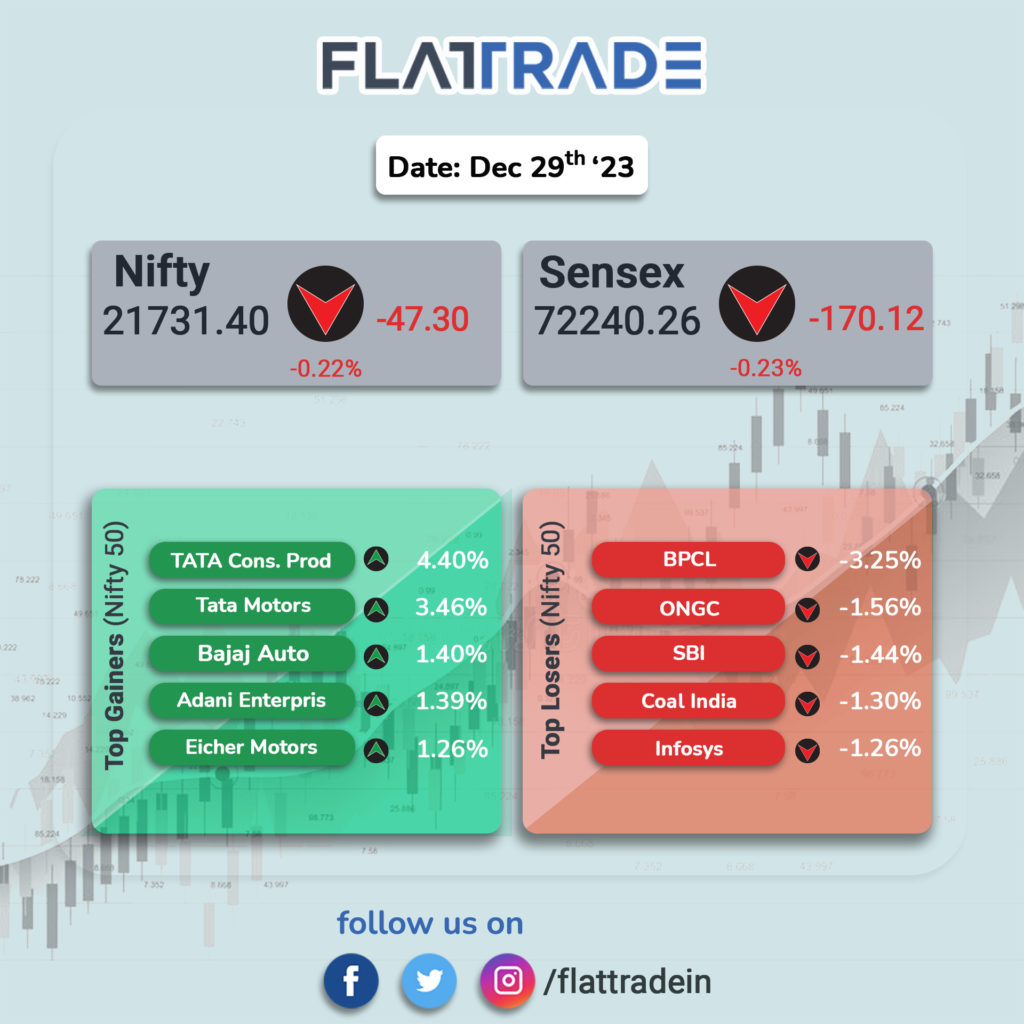

STOCKS TODAY

Tata Motors: Shares of Tata Motors surged 4 percent to Rs 783 in afternoon trade, becoming the first Nifty company to see its share price double in 2023, closing out the last trading session on a high. The bullish momentum comes on the back of a robust JLR outlook, a gradual shift to electric vehicles, and demand for SUVs as disposable incomes increase.

Kotak Mahindra Bank: Shares of Kotak Mahindra Bank fell on December 29, a day after the lender received a show-cause-cum-demand order from the assistant commissioner of central goods and service tax (GST) and excise. It levied a cumulative Rs 57.20 lakh towards central goods and services tax (CGST), accompanied by applicable interest and a penalty of Rs 5.1 lakh

Shakti Pumps (India): zoomed more than 8 percent intraday on December 29 after the company received a fresh order from the Haryana Renewable Energy Department (HAREDA).”The company has received a second work order under the KUSUM‐3 scheme from Haryana Renewable Energy Department (HAREDA) for 6,408 pumps.”

Vodafone Idea: shares have more than doubled investors’ wealth over the past six months, gaining 116.78 percent. In comparison. The surge in the stock price is a result of a supposed equity infusion by the promoters of the embattled telco. An unfettered rally in the share price of Vodafone Idea (Vi) in the last six months has stalled the much-anticipated fund infusion in the cash-strapped telecom company.

Techno Electric & Engineering Company: Shares of Techno Electric & Engineering Company touched a 52-week high, rising nearly 4 percent in the early trade on December 29 after the company bagged orders worth Rs 1,750 crore. The company has received a transmission order of Rs 709 crore.

Innova Captab: The stock was quoting Rs 542 in the afternoon at a premium of 21 percent to the issue price of Rs 448. Innova is an Indian pharmaceutical company involved in research and development, manufacturing, drug distribution, marketing, and exports.