Indian shares end lower after four weeks of gains; metal stocks plunge

The blue-chip Nifty 50 index and benchmark S&P BSE Sensex closed lower for the week ended June 14, after gaining for four weeks, following the U.S. Fed’s hawkish outlook on interest rates dragged on equities. On Friday, the indices closed almost flat, struggling for direction.

For the week, Sensex closed 0.25% down at 52344.45, while Nifty slipped 0.73% to 15683.35. The Bank Nifty fell 1.4% to 34558.

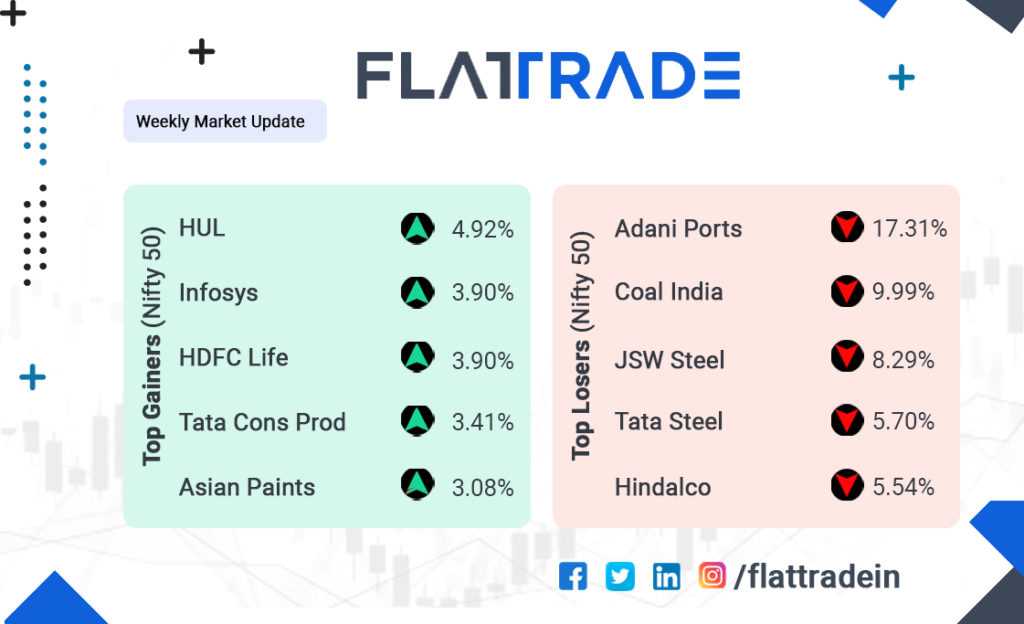

JSW Steel fell 3.7% on Friday dragging the Nifty 50 down, with the Nifty metal index closing 0.91% lower. The index declined 6.62% for the week. Other metal/mining stocks which dropped during the week were Vedanta, SAIL, Jindal Steel and Coal India. On a weekly basis, Adani Ports was the biggest loser, plunging 17.31%.

The drop in various company share prices of metal sector come amid reports that China planned to release metal reserves of copper, aluminium and zinc to arrest the recent spike in prices. On the London Metal Exchange, copper dropped 6%, aluminium lost 2% and zinc fell 3.1%, this week. Going forward, there is likely to be some headwind for the metal stocks in the coming weeks.

Meanwhile, oil prices continued to advance for the fourth week on fuel demand recovery optimism, with the Brent crude rising 0.85% to USD 73.22 and WTI crude 0.88% up to USD 71.41.

Gold prices fell for the week as the US dollar strengthened, after the Federal Reserve hinted at rising the interest rates earlier than anticipated. The Indian Rupee continued to decline against the greenback.

There were a few economic data released during the week. The government came out with inflation numbers, where, the annual rate of inflation, based on monthly WPI, was 12.94% for the month of May as compared to -3.37% in the year ago period. The high rate of inflation is due to low base effect and rise in prices of crude petroleum, mineral oils viz. petrol, diesel, naphtha, furnace oil etc. and manufactured products as compared to the corresponding month of the previous year. Meanwhile, consumer price index rose to 6.30% in May, according to government data. Food inflation advanced to 5.01%.

Separately, exports in May 2021 were USD 32.27 Billion, as compared to USD 19.05 Billion in May 2020, exhibiting a positive growth of 69.35%. In Rupee terms, exports were Rs. 2,36,426.16 crore in May 2021, as compared to Rs. 1,44,166.01 crore in May 2020, registering a positive growth of 64%, according to government data. Meanwhile, imports in May 2021 were USD 38.55 Billion (Rs. 2,82,453.56 Crore), which is an increase of 73.64% in Dollar terms and 68.15% in Rupee terms over imports of USD 22.20 Billion (Rs 1,67,977.68 Crore) in May 2020.