Why should you invest in Equity Stocks ?

Equity stock investing is not a new Financial instrument. In Fact the oldest stock exchange was started in 1602 by Duch East India company which was dealing in paper stocks and bonds. Bombay stock exchange is the oldest stock exchange in India started in 1875. In India there was 21 regional stock exchanges. All these stock exchanges were dealing in physical shares until the National stock exchange was established in 1996 in an electronic mode of operation.

The new electronic form of operations gave transparency in stock price and the real value discovery of individual stocks started. The cost of investment came down significantly and the turn around time of shares being delivered also came to Trade plus 2 days (T+2) which is being followed today by 2 large stock exchanges BSE and The NSE. The Government of India to protect Investors investments and to make sure the corporate world does not fool the investing community formed the SEBI ( securities exchange board of India) which is governed by the Ministry of Finance.

Many of us have seen the movie “Guru” and a very inspirational movie about Mr.Dhirubhai Ambani, a visionary businessman. There are many inspirational events in the movie but today in this blog we are focusing on “How a common man has seen growth investing in Reliance shares”. Yes as seen in the movies from their 1st Investor meet which was held in a small way to the largest Investor meet which is held in the famous Wankede stadium in Mumbai.

Historically people have made money in stocks and have seen a secured life.

Let's see why we should Invest in equity share?

1. Long term financial growth

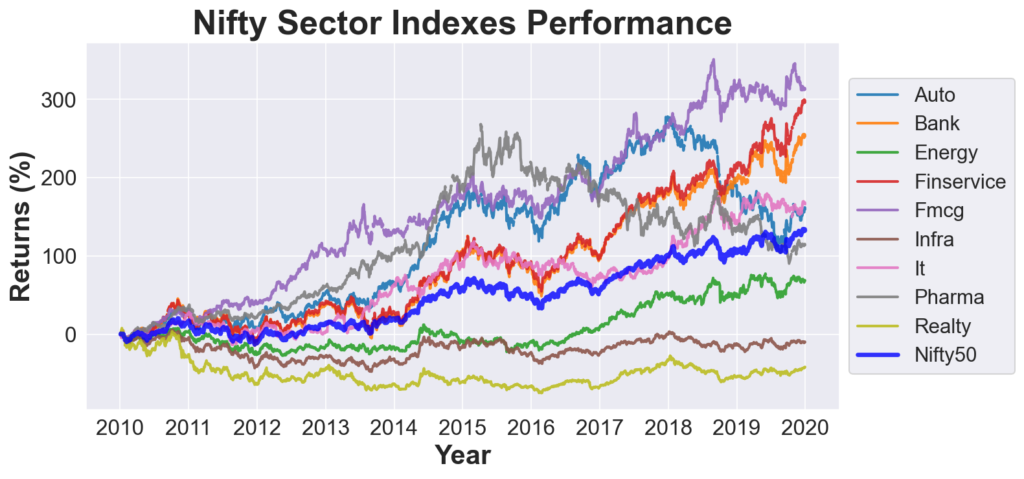

Historically stocks have provided 15% CAGR. As seen in the Image below the returns have been between 150% to 400% return in various sectors. GMCG being the highest among them all. Let’s assume you had invested Rs100 in a FMCG stock in 2010 you would have made around Rs400 by 2020. There are no other financial assets which would have provided you 4X return.

2. Inflation and Investments

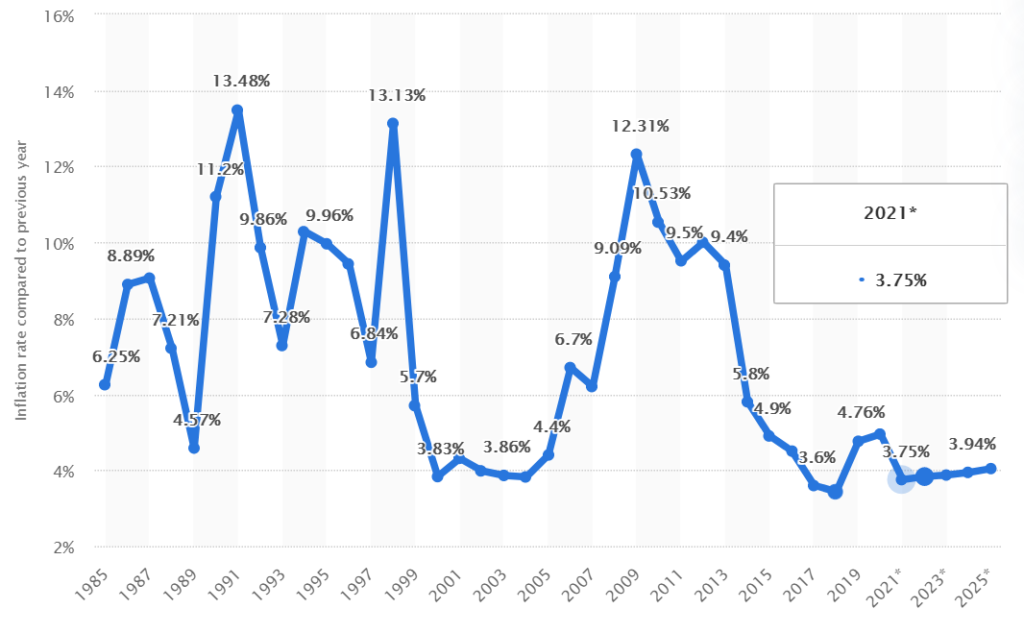

Everything in this earth is perishable including Money. We call it the value of money, Rs 100 in 1950 would have given you a lot of purchasing power. You could have bought some 4 shirts and 4 trousers with Rs 100 then but today we hardly can buy a single shirt with Rs 100. Inflation has decreased the value of Money. In India the current Inflation is 4%. We have seen Inflation as high as 10%.

The rate bank fixed deposit and cost of lending the money put together does not win the real inflation. The only asset that can give absolute return over inflation is Equity stocks.

3. Ease to Invest

Investing in the stock market is simple and easy with low cost. The evolution of discount broking has made the retail investor consider investments in shares. Today the cost of Investing is as low as Rs10. Check out our pricing and use our brokerage calculator to find the cost of your investment in shares.

Equity Investment is the only source of Investment for your long term Financial Freedom. Make calculated decisions as there is an element of risk, though there is Risk in this investment product today we have solutions in the form of Mutual funds, ULIPS and PMS. Even the Government of India has made a wise decision to redirect all pension saving of our civil service employees under the New pension scheme (NPS) which invests largely into Equity stocks. On the other had Government of India has given Income Tax benefits under the 80CCD upto Rs 50000.