You Might Also Enjoy

a

Zomato Limited is one among the leading online Food Service platforms in terms of the worth of food sold as of Dec 31, 2020. In the year 2010, It was incorporated as “DC Foodiebay Online Services Private Limited”. The company’s technology platform provides B2C offerings include food delivery and dining-out services where customers can search and discover restaurants, order food delivery, book a table, and make easy payments & offers for dining out at restaurants while under the B2B segment, it generates revenue from Hyperpure (supply of high-quality ingredients and kitchen products to restaurants) and Zomato Pro, customer loyalty program.

As of December 31, 2020, Zomato has established a strong footprint across 526 cities in India, with 350,174 Active Restaurant Listings. It also has a presence in 23 countries across the globe, 161,637 active delivery partners, and an average monthly food order of 10.7 million customers.

· Among the leading Food Service Delivery platforms.

· Recognized consumer brand equity across India.

· Hyper-local Networks

· Widespread and efficient on-demand hyperlocal delivery network.

· A strong network of 131,233 restaurants and 161,637 delivery partners.

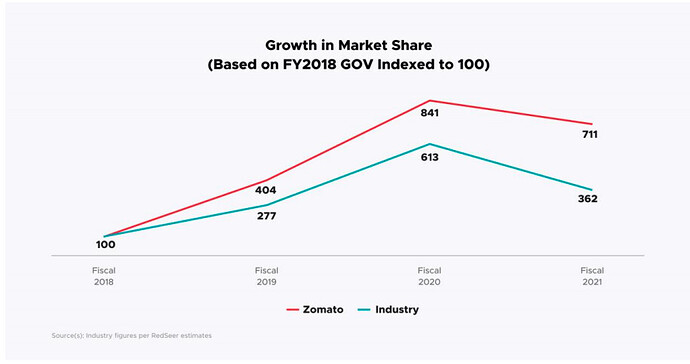

Zomato seems to posses grown 7x since 2018 compared to the 3.6x growth of the overall food delivery industry in the same time period

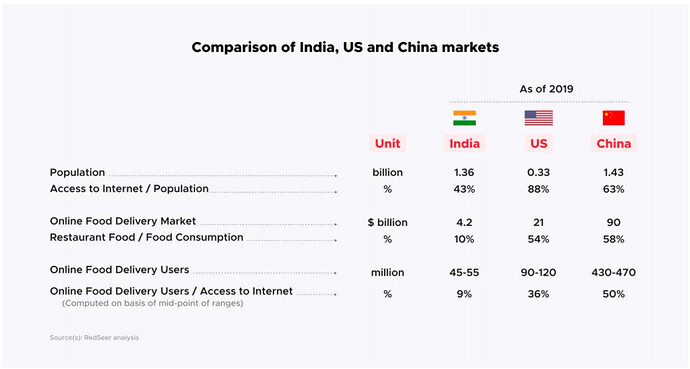

Zomato has been growing at a very fast pace but how much headroom does the company have? This table comparing the total addressable markets in India, US & China may give us some indication

Zomato is a professionally managed company with no real identifiable promoters under the SEBI ICDR Regulations and Companies Act.

|

Particulars |

For the year/period ended (₹ in million) |

||

|

|

31-Mar-21 |

31-Mar-20 |

31-Mar-19 |

|

Total Assets |

87,035.43 |

29,003.82 |

34,134.05 |

|

Total Revenue |

21,184.24 |

27,427.39 |

13,977.17 |

|

Profit After Tax |

(8,164.28) |

(23,856.01) |

(10,105.14) |

· General corporate purposes.

· Funding organic and inorganic growth initiatives.

IPO Opening Date | July 14, 2021 |

IPO Closing Date | July 16, 2021 |

Issue Type | Book Built Issue IPO |

Face Value | ₹1 per equity share |

IPO Price | ₹72 to ₹76 per equity share |

Market Lot | 195 Shares |

Min Order Quantity | 195 Shares |

Listing at | NSE,BSE |

The Zomato IPO market lot size is 195 shares. A retail-individual investor can apply for up to 13 lots (2535 shares or ₹192,660).

|

Application |

Lots |

Shares |

Amount (Cut-off) |

|

Minimum |

1 |

195 |

₹14,820 |

|

Maximum |

13 |

2535 |

₹192,660 |

a