The benchmark indices closed higher amid a volatile week as markets cheered the Union Budget 2022 which focused on growth.

The Union Budget emphasized on higher capital expenditure and infrastructure spending. The government also gave a push to manufacturing sector, start-ups, green/renewable energy and electric vehicles, boosting market sentiments.

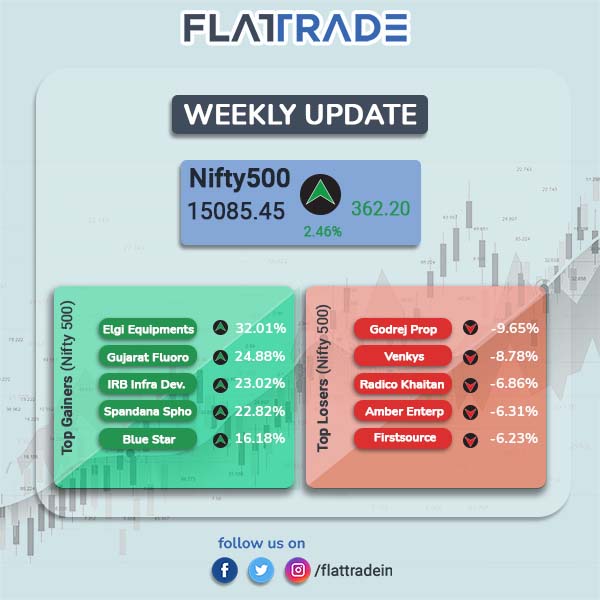

For the week, the Sensex closed 2.53% higher at 58,644.82 and the Nifty closed 2.42% higher 17,516.30.

Among Nifty sector indices, top gainers were Metal [6.7%], Pharma [4.6%], FMCG [3.7%], IT [3.6%] and PSU Bank [3.3%]. All Nifty sector indices closed in green.

Next week, RBI’s policy meeting will be the important event awaited by market participants. The upcoming RBI monetary policy meeting will be held between Feb 7 and Feb 9. The RBI’s commentary on inflation and economic growth will be key factors to watch amid the hawkish stance taken by the US central bank as well as the Bank of England and the European Central Bank increasing benchmark interest rate last week.

Company News

Tata Group Companies

Tata Motors: The company reported a net loss of Rs 1,451 crore in Q3FY22 as against a net loss of Rs 4,415-crore in Q2FY22. For the year-ago quarter, it had posted a net profit of Rs 2,941 crore. The company said that better availability of semiconductors is helping Jaguar Land Rover (JLR) ramp up production. Revenue from operations during the three-month period declined 4 per cent to Rs 72,229 crore as against Rs 75,653 crore in the corresponding period last fiscal.

Titan: The company’s net profit jumped 91 per cent to Rs 1,004 crore in Q3FY22 compared to the year-ago period. Revenue from operations rose 37 per cent YoY to Rs 9,903 crore riding helped by strong consumer demand during the quarter. The total income for the quarter stood at Rs 9,570 crore in the reported quarter from Rs 7324 crore in Q3FY21.

Tata Consumer Products Ltd (TCPL): The company reported a 22.19 per cent jump in its consolidated net profit to Rs 290.07 crore for the third quarter ended December 2021, helped by volume-driven growth in the domestic market. The company had posted a net profit of Rs 237.38 crore in the year-ago period. Its revenue from operations in Q3FY22 rose 4.52 per cent to Rs 3,208.38 crore, from Rs 3,069.56 crore in the year-ago period.

Tata Teleservices (Maharashtra) Ltd: The company said it wouldn’t convert interest on dues owed to the government into equity as the interest amount eligible for conversion is much lesser than expected and calculated by the carrier. Tata Tele’s expected and calculated amount was Rs 850 crore compared with DoT’s calculated amount of Rs 195 crore.

Tata Steel Long Products Limited: The government has approved the sale of 93.7% stake in Neelachal Ispat to Tata Steel Long Products at an enterprise value of Rs 12,100 crore. The transaction was made through an open-market, competitive bidding process towards the enterprise value of the company.

Adani Group Companies

Adani Ports and Special Economic Zone Limited (APSEZ): The company reported a 6.20 per cent decline in consolidated profit at Rs 1,478.76 crore for the third quarter of FY22 as against a consolidated profit of Rs 1,576.53 crore in the corresponding period last earlier. Its consolidated total income rose to Rs 4,422.73 crore in the latest December quarter from Rs 4,274.79 crore in the year-ago period.

Adani Power: The company posted Rs 218.49 crore consolidated net profit for December quarter of FY22 as against a loss of Rs 288.74 crore in the year-ago period. Total income stood at Rs 5,593.58 crore in the quarter compared with Rs 7,099.20 crore in the same period a year ago. The company said that capacity utilization was affected in the quarter due to shortage of domestic coal and high prices of imported coal.

Adani Transmission: The company’s net profit declined 32.45% to Rs 267.03 crore in the quarter ended December 2021 as against Rs 395.31 crore during the same quarter last fiscal. Sales rose 14.02% to Rs 2613.35 crore in the reported quarter ended December 2021 as against Rs 2292.10 crore during the same quarter ended December 2020.

Adani Green Energy: The company posted a nearly 20 per cent rise in its consolidated net profit to Rs 49 crore in the October-December 2021 quarter compared to the year-ago period. The company had reported a consolidated net profit of Rs 41 crore in the quarter ended on December 2020. Total income of the company rose to Rs 1,471 crore in the quarter from Rs 843 crore in the same period a year ago.

Three subsidiaries of the company raised Rs 612.30 by their maiden domestic bond issuance, on private placement basis. The three firms collectively house 930 million of operational solar power projects. The rated, listed, secured, redeemable, non-convertible debentures (NCDs) of face value of Rs 10,00,000 each, in multiple series, have a fixed average annualized coupon rate of 7.83% p.a. and a tenure up to 12 years.

Other Companies

HDFC: The mortgage lender reported a 11% rise in standalone net profit at Rs 3,261 crore in Q3FY22 compared with a standalone net profit of Rs 2,926 crore in the year-ago period. Net interest income rose 5% to Rs 4,284 crore in the reported quarter as against Rs 4,068 crore in Q3FY21.

ITC Ltd: Cigarettes-to-FMCG maker reported a 14.81 per cent year-on-year (YoY) increase in consolidated profit after tax (PAT) at Rs 4,118.80 crore in the December quarter (Q3) led by growth across segments. In the year-ago period, PAT was at Rs 3,587 crore. Its consolidated revenues were Rs 18,366 crore, up 30 per cent from Rs 14,124 crore in the year-ago period. The company attributed the rise to robust recovery across markets aided by increase in mobility and agile supply chain and market servicing.

Indian Oil Corporation (IOC): The company reported a 19 per cent growth in third quarter net profit helped by rise in refining margins. Net profit stood at Rs 5,860.80 crore in October-December 2021, up 19.2 per cent from Rs 4,916.59 crore profit in the same period last fiscal. Revenue from operations rose to Rs 1.98 lakh crore in October-December 2021 from Rs 1.47 lakh crore a year-ago period.

Sun Pharma: The drug company posted an 11.14 per cent increase in its consolidated net profit to Rs 2,058.8 crore for the third quarter of FY22, helped by strong sales across domestic and international markets. It had reported a consolidated net profit of Rs 1,852.4 crore in the same quarter of previous fiscal. Total revenue from operations rose to Rs 9,863 crore in the third quarter as compared to Rs 8,836.7 crore in the same period of previous fiscal.

Bharat Petroleum Corporation (BPCL): The company has reported 48 per cent rise in consolidated net profit of Rs 2,805.09 crore in Q3FY22 from Rs 1,900.63 crore reported in the comparable months of the previous financial year. Revenue from operations during the period under review surged 35 per cent to Rs 117,702.59 crore from Rs 87,292.62 crore in the year-ago period.

Privatisation of second largest oil refiner in India is likely to be postponed to the next fiscal year as no bidder visited the firm’s premises in the last quarter, a senior company official said on Wednesday. The government is selling its entire 52.98 per cent stake in BPCL for which three expressions of interest (EoIs), including one from billionaire Anil Agarwal-led Vedanta Group, have been received earlier.

Hindustan Petroleum Corporation Ltd (HPCL): The company reported a 63 per cent decline in third quarter net profit as it booked inventory losses. Net profit in Q3FY22 stood at Rs 869 crore compared with Rs 2,355 crore for the same period last year. During the period October-December 2021, sales rose to Rs 1,03,080 crore as compared to Rs 77,113 crore for the same period of the previous financial year.

Bharat Dynamics: Shares of the company rose after the company signed a contract worth Rs 3,131.82 crore with Indian Army. As part of the order, the company will manufacture and supply Konkurs – M Anti-Tank Guided Missiles to the Indian Army. After the new order, its order book position stood at Rs 11,400 crore.

GAIL: The company’s standalone net profit rose 121% YoY to Rs 3,287.99 crore. Revenues was up 66.75% to Rs 25769.75 crore in Q3FY22 from Rs 15454.29 crore in the year-ago period.

Lupin: The pharma company’s consolidated net profit jumped 24.47% YoY to Rs 545.52 crore in the third quarter of FY22. The drug maker posted a 3.57% YoY rise in total revenue from operations to Rs 4160.93 crore in Q3FY22.

Bank of India: The lender reported a 90% rise in standalone net profit to Rs 1,027 crore in Q3FY22 from Rs 541 crore in Q3FY21. Total income during the quarter decreased by 8% YoY to Rs 11,211 crore. Net Interest Income (NII) was Rs 3,408 crore in Q3 FY22, 9% lower from Rs 3,739 crore in Q3FY21.

Aditya Birla Fashion and Retail Ltd (ABFRL): The fashion retailer announced that it will set up a platform to venture into the Direct-to-Consumer (D2C) business. The company will set up a new subsidiary towards building a portfolio of new-age, digital brands across categories such as beauty, fashion and other allied lifestyle segments.

Jubilant FoodWorks: The QSR chain operator reported 9.8% growth in net profit at Rs 1,373 crore. Revenue from operations rose by 12.9% YoY to Rs 11,935 crore in Q3 FY22. EBITDA in Q3FY22 was Rs 3,174 crore, up by 13.9% from Rs 2,786 crore in Q3FY21.

Bharti Airtel: The telecom operator announced an agreement to acquire about 25 per cent equity stake in Bengaluru-based technology startup Lavelle Networks. Lavelle Networks specialises in software-defined Wide Area Network solutions and it serves a range of industry segments.

Tech Mahindra: The IT firm’s profit rose 2.2% QoQ to Rs 1368.5 crore from Rs 1338.7 crore in the previous quarter. Revenue stood at Rs 11451 crore in the reported quarter, up 5.25% from Rs 10881.3 in Q2FY22

Dabur India: The FMCG major reported a 2.19 per cent increase in consolidated net profit to Rs 504.35 crore for the third quarter ended December 2021, compared with a consolidated net profit of Rs 493.50 crore in the year-ago quarter. Its revenue from operations rose by 7.8 per cent to Rs 2,941.75 crore during the quarter under review as against Rs 2,728.84 crore in the year-ago period.

Economy News

The Economic Survey 2021-22 was released during the week a day before the Budget session which happened on Feb 1. The economic survey stated that the next fiscal year is well-positioned for the private sector investment to improve and the financial system is in a good position to provide the necessary support for the revival of the country’s economy. The the economic survey in its report expected that there will not be any widespread threat to the economy and any pandemic-related lockdown weighing on the economy. In addition, it expects monsoon to be normal and monetary policy tightening by global central banks will be gradual and orderly.

India is expected to witness GDP growth of 8% to 8.5% in FY23, supported by easing of regulation, strong export growth, higher capital spending and widespread vaccine coverage.

The survey noted that the Indian economy is estimated to grow by 9.2% in real terms in 2021-22, after a contraction of 7.3% in 2020-21.

IHS Markit India Services PMI was at 51.5 in January 2022 lower than 55.5 posted in December 2021. The numbers indicated a slowest rate of expansion in the current six-month sequence of growth. The slow rate was due to inflationary pressures, worsening situation of the pandemic which led to reintroduction of restrictions in January in most parts of India.

Global Markets

In the US, stock markets remained volatile but registered overall gains and closed higher for the second week in a row. The gains were broad-based as midcaps and small-caps advanced. Both value and growth stocks rose which helped the markets to close in positive territory. For the week, the Dow gained 1.05%, the S&P 500 jumped 1.55% and the Nasdaq jumped 2.38%.

Meanwhile, Meta Platforms, the parent company of Facebook, said that its social networking site saw a decline in average daily users and the company gave lower guidance for revenue growth. This resulted in a 26% fall in its stock price and erased a record $232 billion off its market capitalization. However, e-commerce giant Amazon reported a better-than-expected earnings, driven in part by its web services business, which drove the index higher.

In addition, U.S. oil prices rose above $90 per barrel and major oil exporters agreed for modest production increase amid increase in demand. This helped energy shares to advance.

China’s share markets were closed during the week for the Lunar New Year. China’s statistics agency said the country’s Manufacturing Purchasing Managers’ Index for January stood at 50.1. A reading above 50 indicates the economy is expanding and a reading below 50 denotes economy is in contraction.

Stock markets in Japan closed higher for the week as investors’ optimism was boosted after news report said that the Japanese government would further open up its economy to boost economic activity. Nikkei 225 Index rose 2.70% and the broader Topix index jumped 2.86%.